The Treasury Market Basis Trade

a dubious yet vital mechanism is binding U.S. bond markets together

A risky, elaborate trade, one infamous for blowing up everytime, is once again growing in popularity inside the world’s most systemic bond market. When turmoil inevitably re-emerges, only the Federal Reserve’s volatility suppressor will come to the rescue. The Treasury Market Unwind™ is looming.

In early 2018, a string of events formed an exploit in America’s sovereign debt market. Following a large issuance of U.S. Treasuries, a fall in foreign demand, and regulatory reforms, asset managers — pension funds, mutual funds, and insurance companies — began to shift out of cash bonds and into long positions of their associated Treasury futures. This reallocation was so intense that prices of Treasury futures and of those in the underlying cash market began to diverge. Noticing this deviation and subsequent arbitrage opportunity, hedge funds increasingly took the opposite side of asset managers’ positions. The Treasury cash-futures “basis trade” was re-emerging.

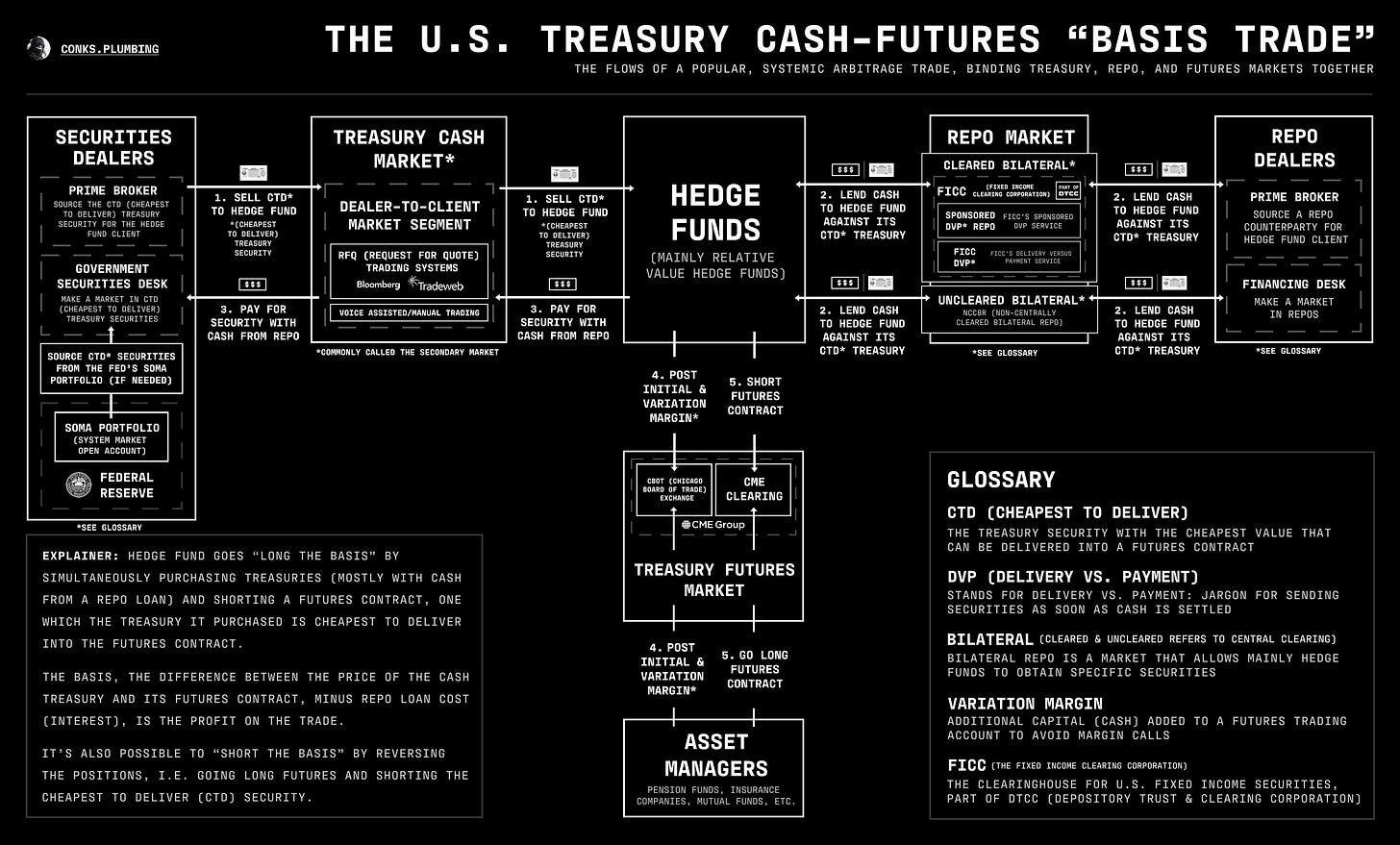

By going “long the basis,” which meant simultaneously shorting Treasury futures and buying the securities underlying these contracts in the cash market, hedge funds — primarily relative-value funds — had high odds of profiting from what was deemed a nearly risk-free arbitrage. Futures prices kept rising markedly above the price of their underlying Treasury securities, allowing traders to buy bonds at a discount to what they’d receive when delivering these securities into futures contracts. The basis, the difference in price between cash and futures (minus financing costs), was the profit.

But although this trade offered nearly risk-free returns, the resulting profits were lackluster. For hedge funds to achieve significant enough returns, they had to employ immense amounts of leverage. To execute these highly leveraged trades, hedge funds called upon the bilateral repo market — the market for cash loans secured against specific securities. By borrowing cash against the Treasuries they would use to deliver into futures contracts, hedge funds only needed to commit a fraction of capital to finance basis trade positions. The amount of leverage hedge fund traders achieved was determined by the repo market they used to finance Treasury purchases.

Hedge funds borrowed in either uncleared, cleared, or sponsored bilateral repo markets, each dominated by leveraged players funding various exotic trades. While cleared and sponsored repo (which is the same as cleared but entities gain access to trading through a third-party sponsor) offered greater transparency and lower counterparty risk, uncleared repo markets delivered superior leverage. Cash lenders in each repo market lent money equal to the value of the Treasury securities the cash borrower (i.e. the hedge fund) pledged, minus a haircut: a percentage the lender subtracted from the security’s value to protect itself against adverse market movements. In the shadowy depths of the uncleared repo market, haircuts fell to as low as 0%, allowing for much higher leverage than cleared and sponsored repo markets.

Subsequently, uncleared bilateral repo — known officially as NCCBR (non-centrally-cleared bilateral repo) — swamped cleared repo in size and activity, with an extra ~$1.4 trillion in outstanding transactions. Soon enough by 2019, hedge funds were regularly borrowing up to a hundred times the capital they committed to Treasury basis trades, achieving in most cases more than 99:1 leverage. For every one dollar of capital, they borrowed a whopping $99 in repo to finance trades.

As 2020 approached, short futures positions had soared by over 100%, with hedge funds making up ~73% of the volume. Billions upon billions of dollars had been allocated to highly leveraged basis trades, on what was perceived to be a low-risk, high-return wager. The trade’s major vulnerabilities were only exposed to the fiercest of black swan events, but as it turned out, the COVID market panic was around the corner. Just as the basis trade was rippling into the mainstream, the Treasury Market Unwind™ had commenced.