The Repo Market Exodus: Part I

trillions of dollars in elaborate repo trades are about to be relocated

Following numerous market upheavals, U.S. officials have enacted their latest agenda to strengthen America’s sovereign debt market, prompting an extensive rewiring of its monetary plumbing. Subsequently, trillions of dollars in highly leveraged trades conducted in the most opaque parts of the repo market, favored by market players, have begun to shift to the more observable regions preferred by monetary leaders. The Repo Market Exodus™ has been initiated.

Upon announcing various deadlines on December 13th, 2023, the U.S. regulatory establishment has enforced rules to fortify not only the U.S. Treasury market but every other market that could threaten its stability. By June 30th, 2026, all trades deemed systemically hazardous in the repo market — the market for cash lending secured primarily against U.S. Treasuries — must be centrally cleared through a CCA (Covered Clearing Agency), the official term for a central counterparty (CCP) or clearinghouse that provides central clearing.

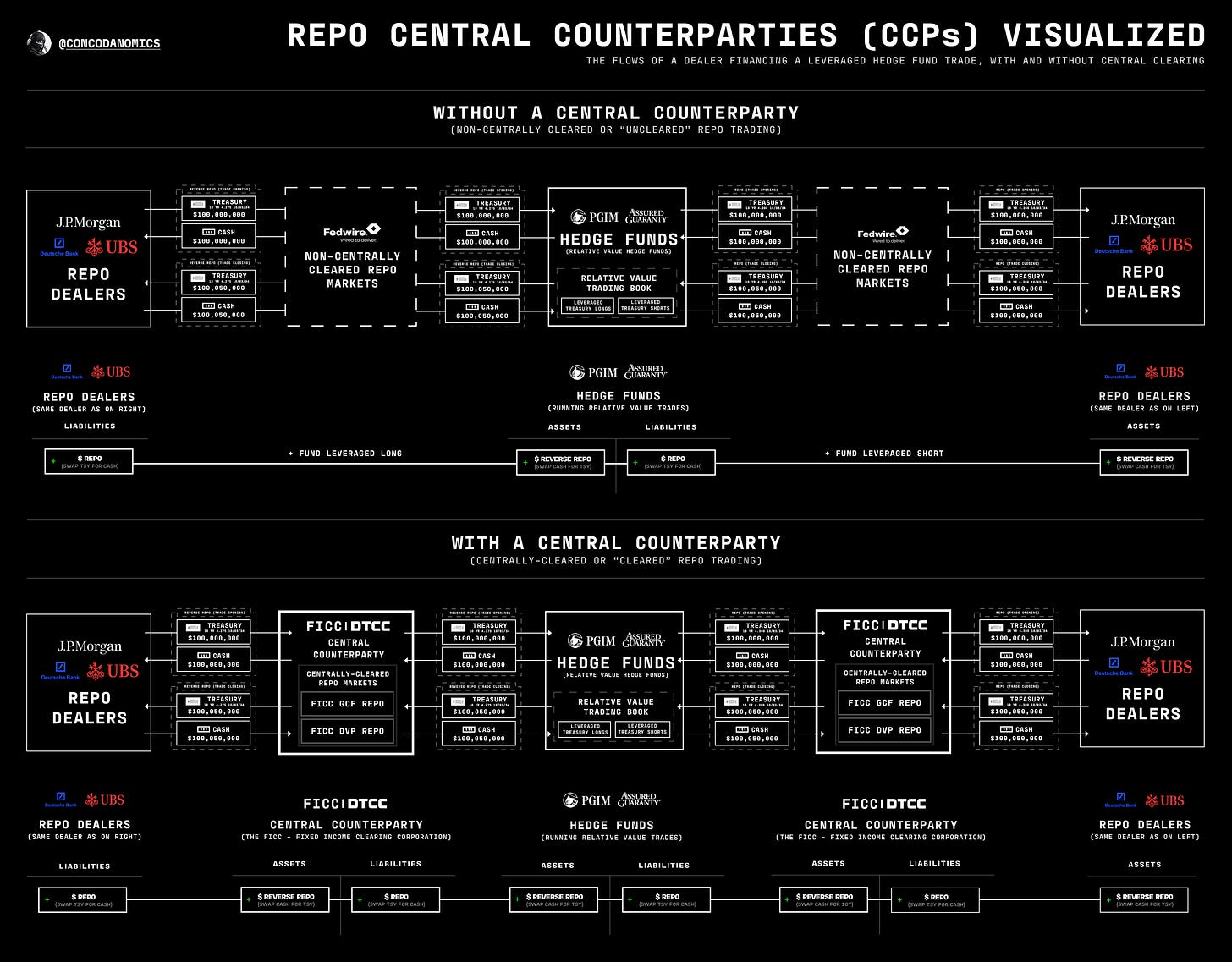

With centrally cleared repo trades, cash and securities are transferred back and forth between participants’ accounts but also via the accounts and risk controls of the FICC (Fixed Income Clearing Corporation), the only active central clearing provider for U.S. repos. As “FICC members” or “direct participants”, dominant broker-dealers and the dealer arms of large banks must post margin (in the form of cash and securities) to the FICC to reduce the risks of their trading activities plus that of their customers, classed as “FICC non-members” or “indirect participants” by U.S. officials. Because the FICC operates all centrally cleared repo markets, only its members have direct access to centrally cleared repo trading. For every other participant — i.e. entities that fail to meet the FICC’s strict member requirements designed to protect itself and other members from frequent defaults, they must earn the trust of their larger counterparts to access centrally cleared repos. These indirect participants include not just money market funds and hedge funds but also thousands of smaller banks and broker-dealers. In the repo market hierarchy, size determines ease of access.

In return for its members posting margin, the FICC not only guarantees trade settlement, absorbing losses from defaulting counterparties, but also removes (“nets”) redundant transactions, reducing costs and saving balance sheet space to increase dealers’ market-making capacity. Still, despite these advantages, most of today’s repo dealings remain “uncleared” — a shorthand for “non-centrally cleared”, where cash and securities move directly between participants’ accounts over Fedwire (the Fed’s securities settlement system) or on the books of the Bank New York Mellon (BNYM), the sole clearing bank for U.S. repos. No central counterparty like the FICC stands between parties to deliver superior risk controls or absorb losses from counterparty defaults.

The dominance of uncleared repos, however, is coming to an end. The SEC (Securities & Exchange Commission), in a lengthy 400-page release, has laid the foundations for a centrally cleared era in repo markets. After the June 2026 deadline, every repo trade secured against U.S. Treasuries involving a direct participant (i.e. an FICC member), minus a few rare exceptions, must be submitted for central clearing. Direct participants consist of all the largest market makers that facilitate most repo activity. Meanwhile, following the 2008 subprime crisis, U.S. Treasuries have become the go-to collateral to secure repo transactions. Thus, the vast majority of trades in the repo market will ultimately pass through the FICC, with the central clearing giant becoming the dominant “glue” binding most repo participants together.

It’s become evident that monetary leaders’ endgame is to create an ideal balance between liquidity and stability, especially in times of crisis. Repos involving central banks, state and local governments, international financial organizations, and sovereign entities have been excluded from the final ruling, along with transactions where the FICC itself attempts to obtain emergency liquidity — not when it’s novating transactions. What’s more, “inter-affiliate” repos, where both counterparties in a repo trade are associated with the same firm, have likewise been excluded by regulators. According to officials, around 25 to 75% of repos executed by the largest dealers occur between their affiliates, such as their broker-dealer and commercial bank subsidiaries. For instance, JPMorgan’s commercial banking arm will regularly transfer cash to its broker-dealer business to fund market-making activities. When its broker-dealer falls short of liquidity, its bank subsidiary will lend U.S. dollars via repos to finance trades such as FX swaps.

Repos also conducted solely between indirect participants will not require central clearing, such as trades between the thousands of smaller broker-dealers and their institutional customers. Nevertheless, since trades in the Treasury cash market between a direct participant and a registered broker-dealer, government securities dealer, or government securities broker will also require central clearing by the start of 2026, smaller broker-dealers will have to onboard onto central clearing to continue to maintain relationships with their customers and access liquidity, most of which will be provided by larger dealers who must now centrally clear their trades.

But for every other repo transaction, the FICC must eventually stand between participants. That includes all trades in the interdealer markets — which already use FICC’s central clearing — and most trades in the dealer-to-customer markets. In the interdealer segments, any leg of a trade involving systemically important intermediaries must also pass through the FICC’s risk controls. Interdealer brokers (IDBs), which bring dealers together via various trading platforms, are now mandated to centrally clear their activity after regulators have deemed uncleared IDB trading a threat to financial stability. Likewise, in the dealer-to-customer markets, the prominent dealers that hold FICC memberships must enable indirect access to central clearing for a wide variety of customers. The plumbing of the most influential repo trades is therefore about to transform. Let’s dive deeper.