As financial markets have experienced widely unforeseen turmoil, dollar funding markets have remained surprisingly subdued. Out of the numerous events that triggered the unwinding of leveraged positions across various asset classes, the so-called reversal of the Yen carry trade has been touted as the major causality. Yet the $/¥ (dollar-yen) cross-currency basis1 — a sharp widening2 of which implies severe market stress — has barely dipped, while other cross-currency bases have traded flat, signaling stability. Onshore money market rates for repos and Fed Funds continue to trade in their semi-zombified state. Compared to volatile FX and equities, money markets have been living in a parallel universe.

That is except for the most perplexing move in a repo rate benchmark since the repocalypse in September 2019. This time, instead of all major repo averages3 exploding through the upper limit of the Fed’s target range, just one has breached the U.S. central bank’s lower boundaries.

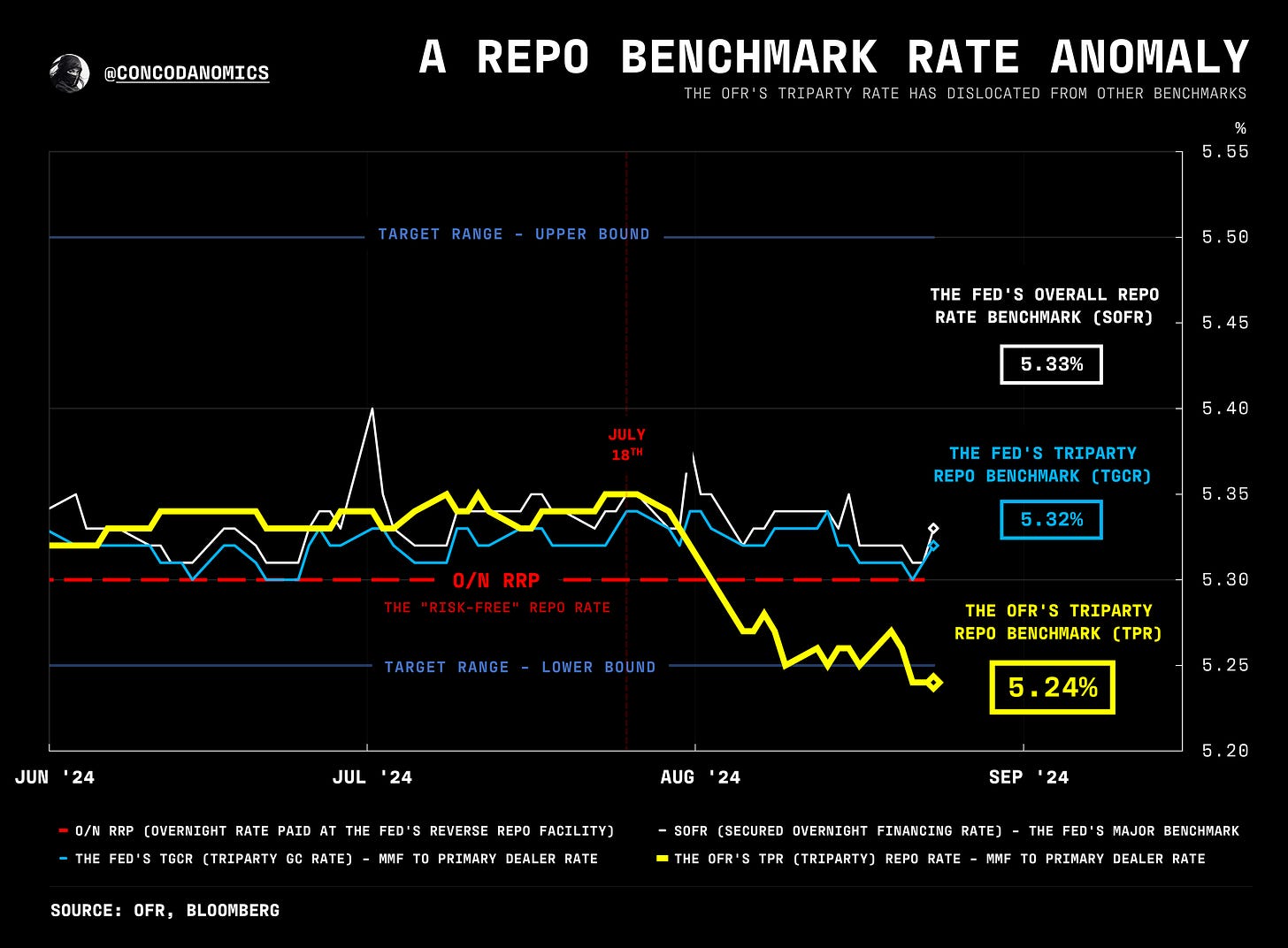

Since July 18th, the two prominent benchmarks for measuring triparty repo rates — the cost at which the Fed’s primary dealers borrow dollars via repos from cash investors — have dislocated. The Federal Reserve’s average triparty measure, TGCR4, has printed in its normal tight range. Yet the TPR5 rate, the triparty benchmark published by the OFR6 (The Office of Financial Research), has descended rapidly (as shown below in yellow).

The OFR’s triparty rate has fallen so far so fast that, initially, it appeared someone large had been willing to lend cash below the Fed’s risk-free repo rate. Why a major cash lender, the only entity with enough size to suppress a benchmark, would lend at inferior yields to what they’d receive at the Fed’s RRP remained a mystery.