The Foreign Exchange Evolution

new competitors have arisen in the world's largest financial market

Monetary giants have banded together to transform the largest, most opaque financial system on the planet: the market for foreign exchange. This has not only reduced the power of dominant players but rewired the global monetary plumbing. The FX Market Evolution™ is here.

In early 2017, shortly after joining forces to create the GFXC (Global Foreign Exchange Committee), monetary authorities and global financial giants unveiled a new prototype for the $7.5 trillion-a-day FX market. Dubbed “The FX Global Code”, this multitude of recommendations set out by central bankers, megabank CEOs, and other high-ranking figures in influential institutions was not only about to transform the largest financial market globally but the future of market structure itself. As these guidelines were starting to enhance the strength of the global foreign exchange system, a new type of participant was rising to prominence, ready to challenge the longstanding status quo of large dealer banks dominating FX markets. It was time for an overdue shift in power.

Ever since the 1980s, from the time when America’s global security alliance drove a decadeslong era of prosperity, large internationally active banks have dominated foreign exchange markets. Independent from their banking operations, these financial giants also built thriving dealer businesses, making the majority of markets in swaps, forwards, and spot FX.

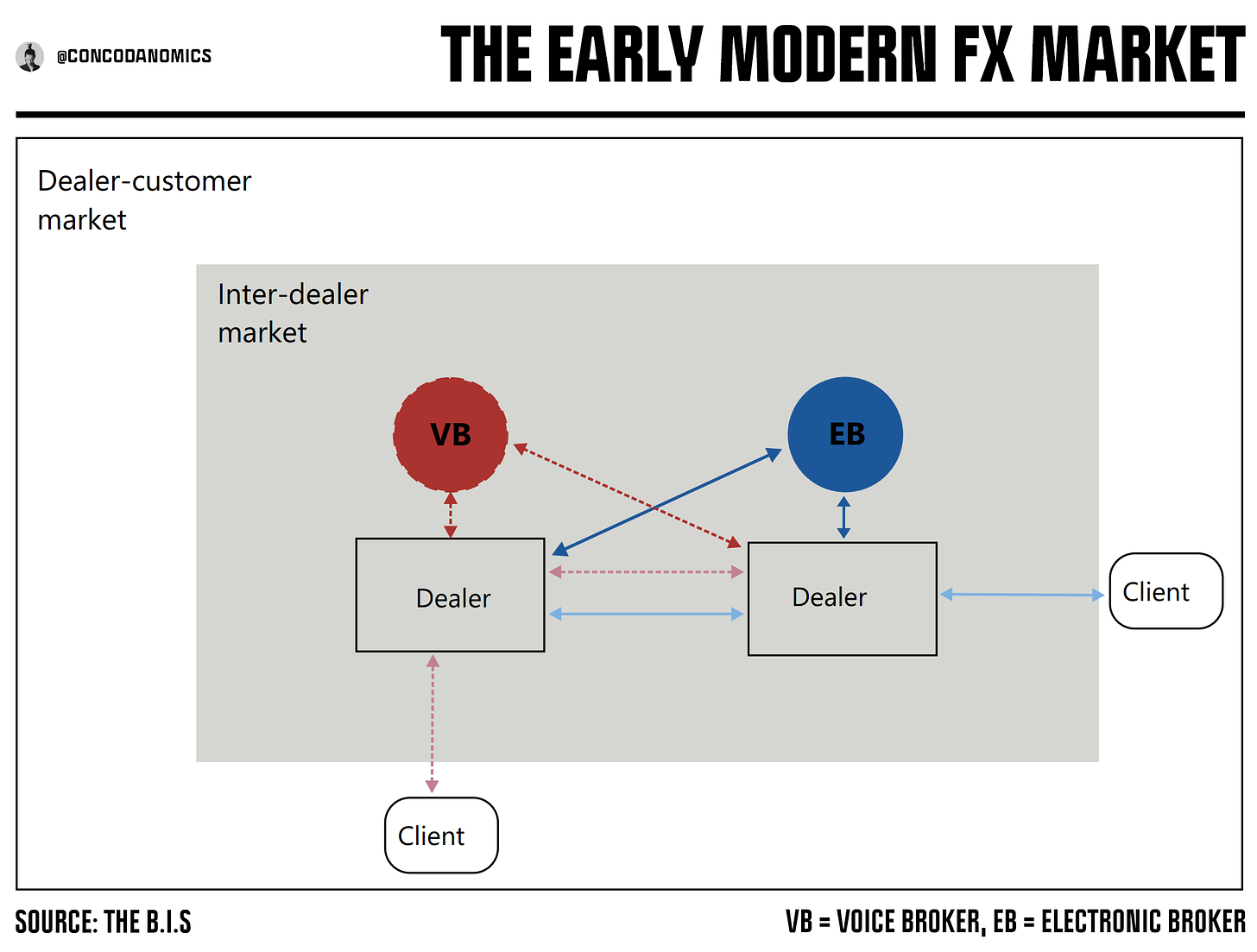

Back in the eighties, the market for immediate (or “spot”) FX delivery — jargon for simply trading one currency for another — was opaque yet still devoid of complexity. As with most other markets, the FX market consisted of only an interdealer (dealer-to-dealer) and dealer-to-customer segment. The interdealer market remained exclusive to the dealer arms of the largest banking corporations, who traded 60% of the volume among themselves. Everyday activities included hedging currency risk, speculating, and offsetting trades they executed with clients in the dealer-to-customer segment.

Year after year, the FX market remained untransparent, inefficient, and costly to transact in. At one stage, every single FX trade was executed via telephone, either directly between dealers or via voice brokers, who’d shout quotes down phone lines hooked to speakers on each dealer’s desk. Then, in the early 1990s, the first of many technological breakthroughs emerged, changing the FX markets forever. Reuters invented the first electronic brokerage system in 1992, forcing the dealer banks to respond by collectively producing a rival system: the Electronic Broking Service (EBS). With two competing systems in place, technological innovation began to flourish. Since EBS and Reuters reported real-time prices to individual dealers and provided data feeds to potential customers, transparency in foreign exchange increased while enabling faster, more efficient trading. The foreign exchange market‘s size and complexity multiplied, eventually forming the multi-trillion dollar currency giant as we know it today:

But with progress came the peak in dealer banks’ power and control over foreign exchange markets. Their increasingly elaborate trading platforms, combined with improved processing and settlement systems, radically lowered transacting costs for a wider group of participants. Subsequently, new players were about to infiltrate opaque areas of FX markets and contest the dominant dealers at their own game. Let’s go back in time and deeper into the monetary plumbing.