Money Market Update

the Fed hints at running QT as long as possible into 2025, not to tighten but to normalize its balance sheet. money markets, meanwhile, debunk tight liquidity as XCCY bases rally alongside the dollar

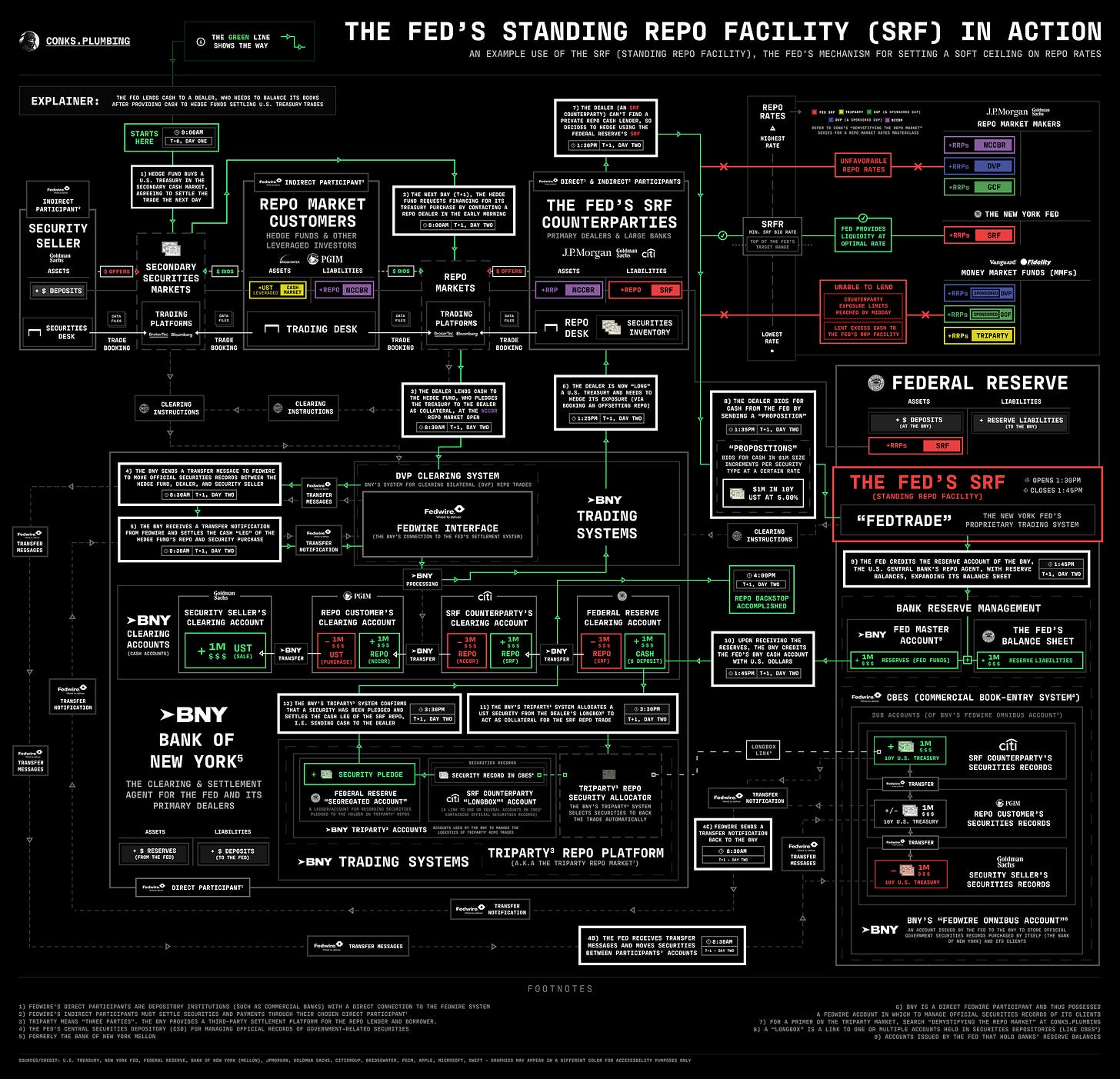

In case you missed it — or you’ve just joined us — the last part of The Fed’s Repo Defensive went live recently.

Next, we explore how private behemoths will implement their own repo backstop alongside the Fed’s emergency facility.

But first, a (gradually improving) money market update...

Summary & Brief Commentary

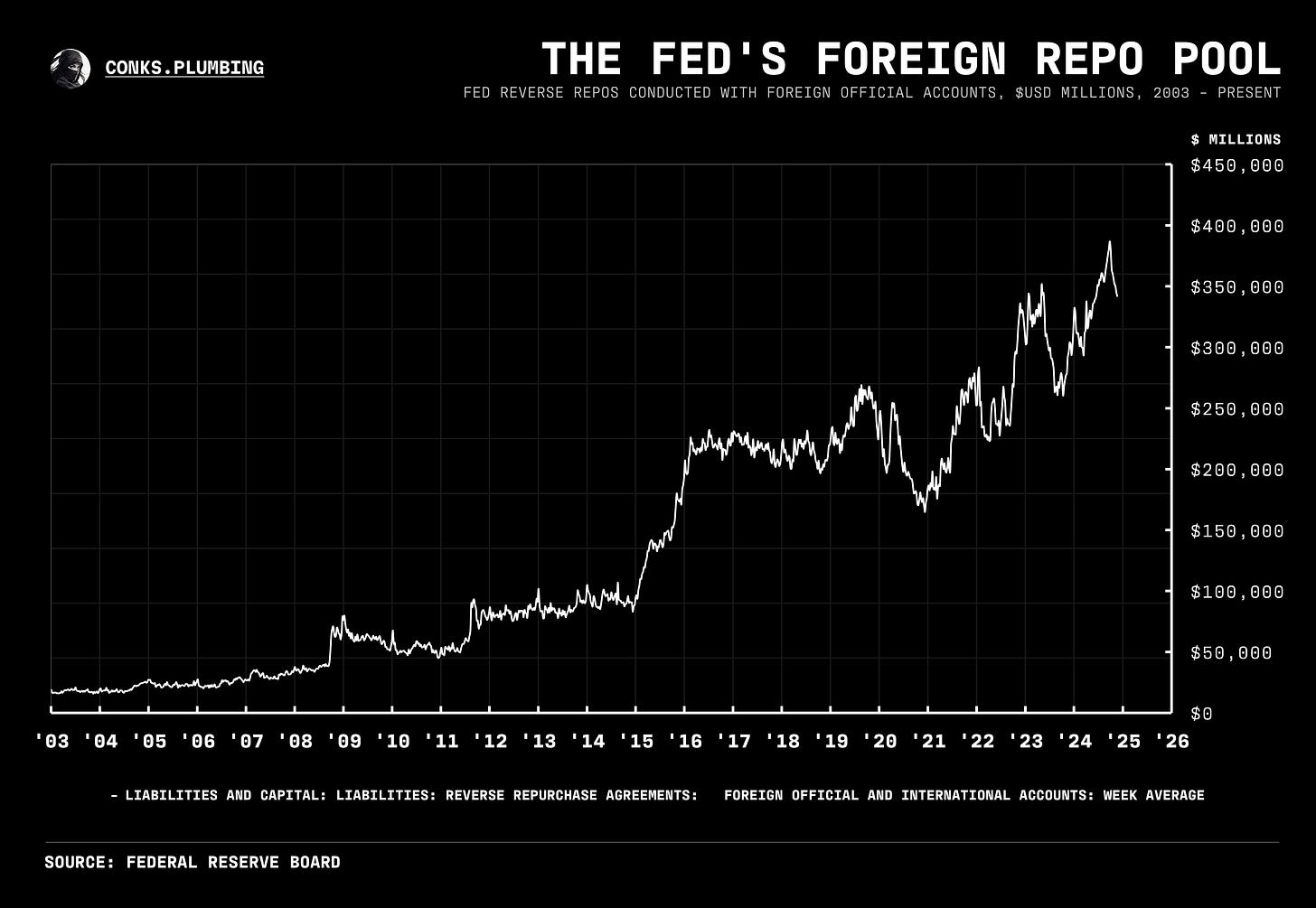

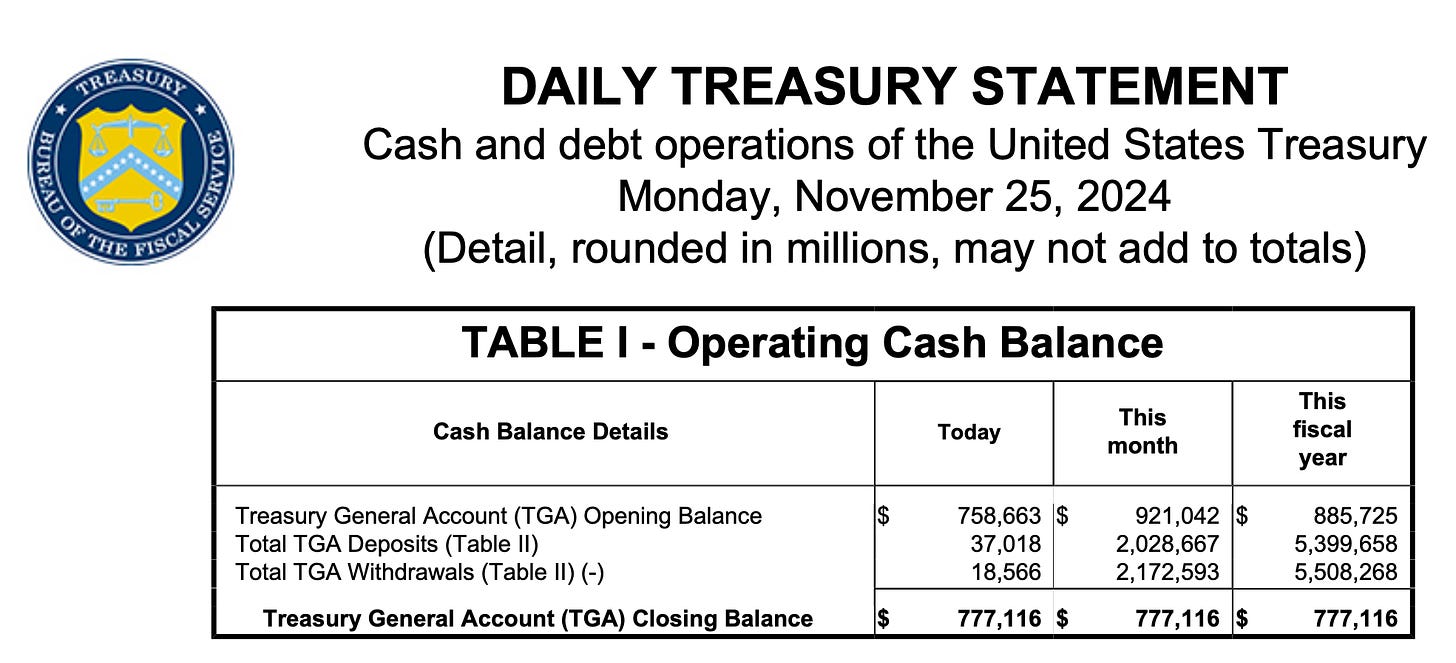

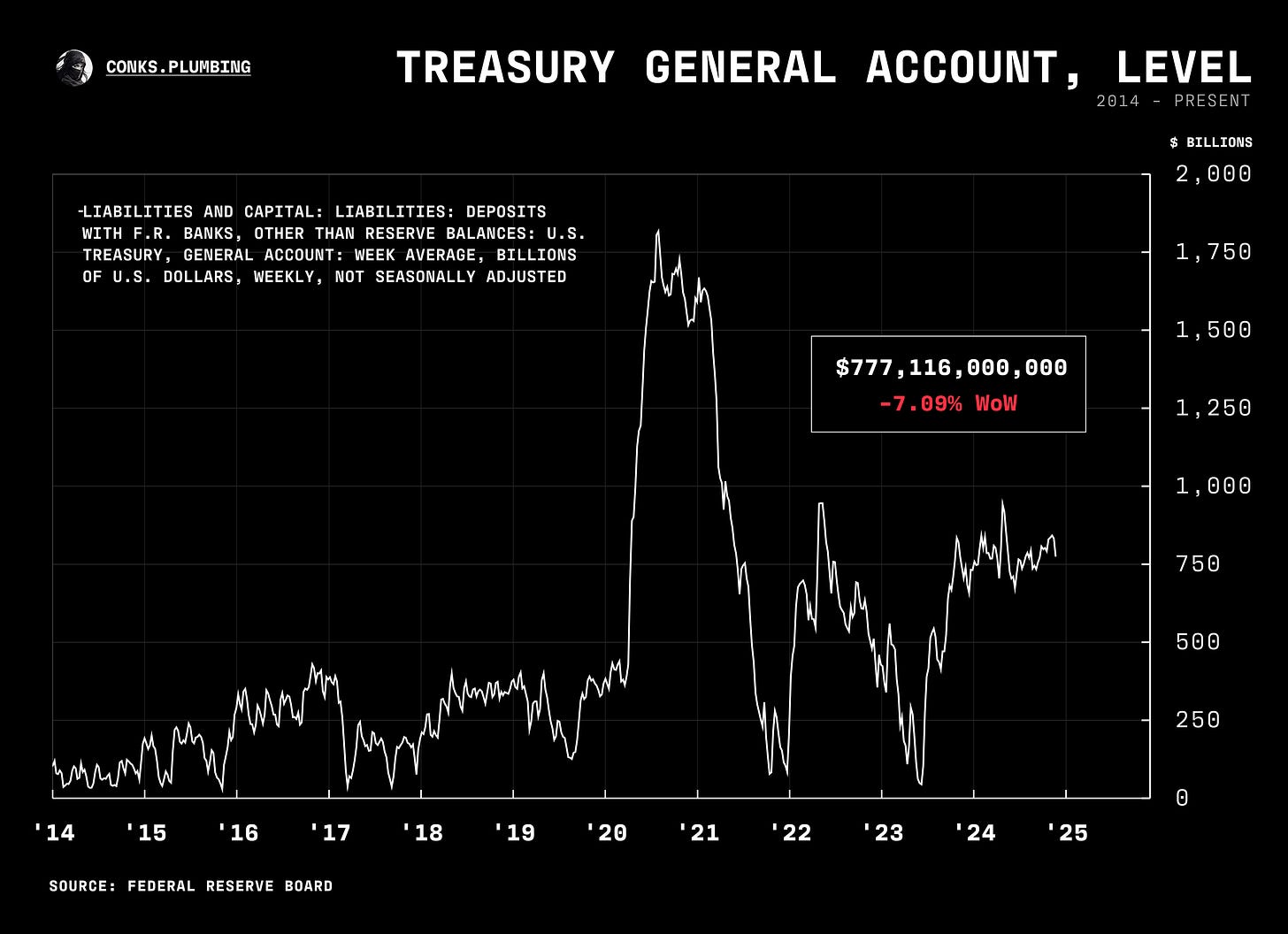

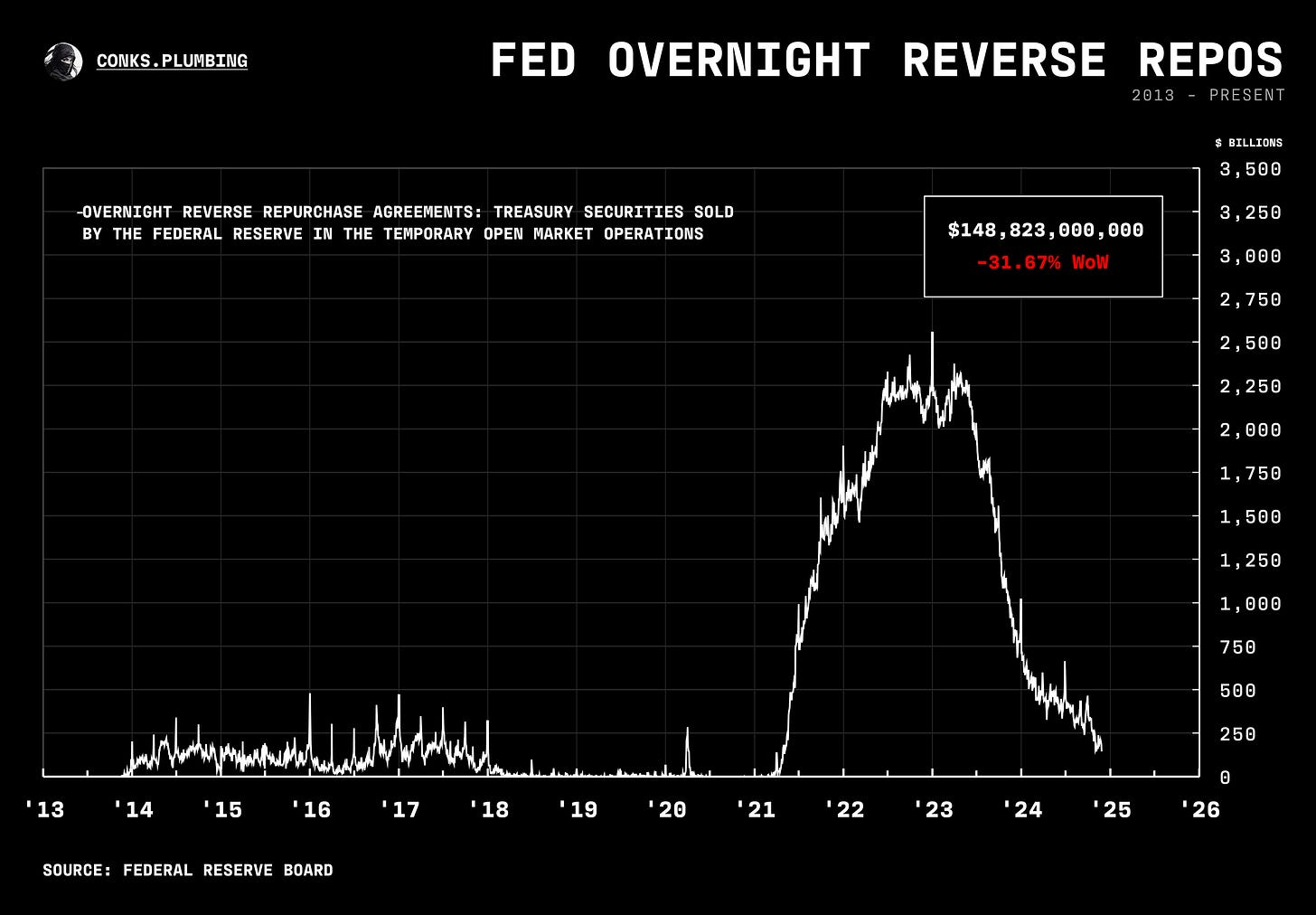

The latest revelation is that the Fed has indicated it will delay the end of QT (quantitative tightening) for as long as possible, reducing its balance sheet as much as possible. Operation “Empty the RRP” has commenced.

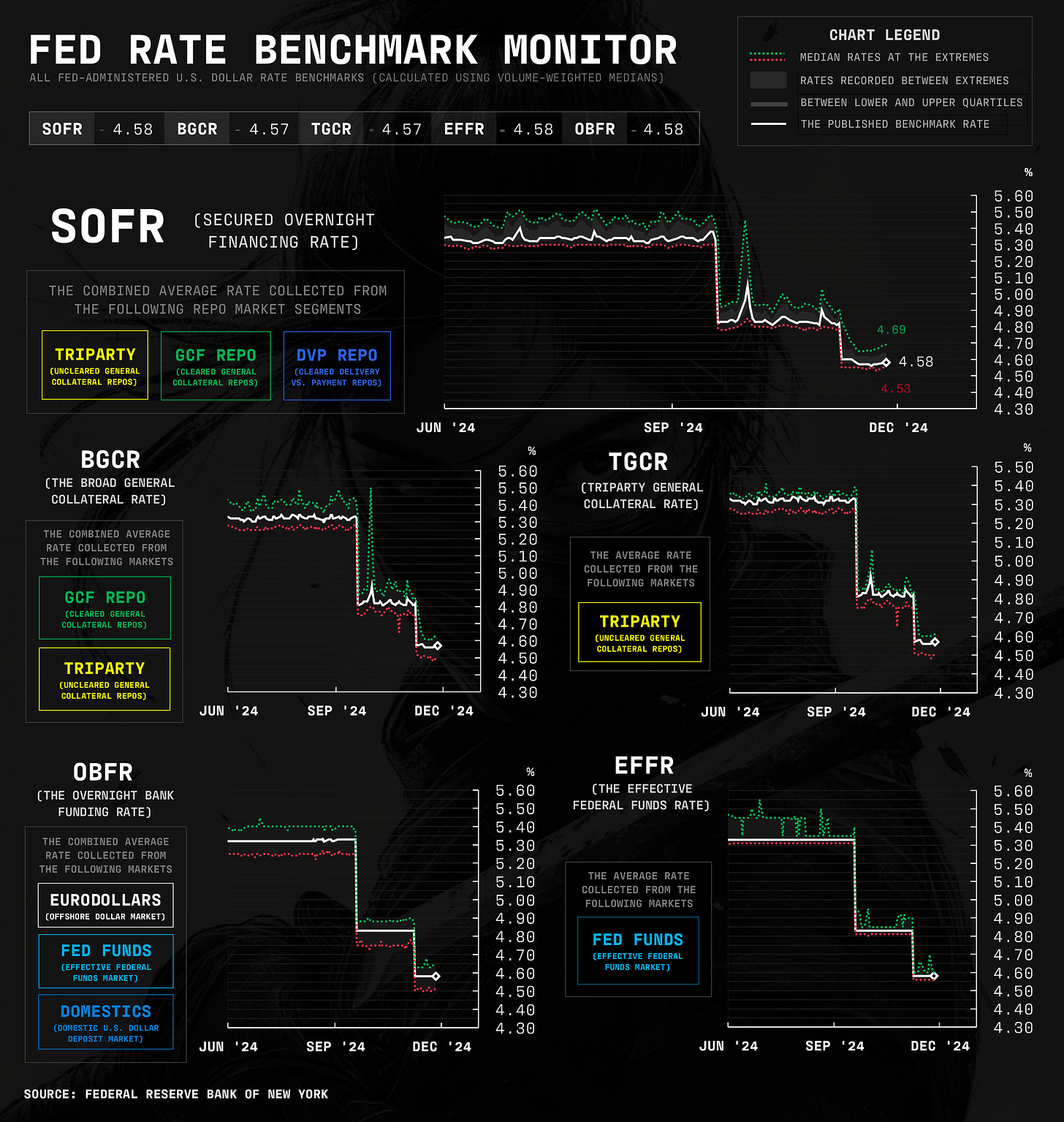

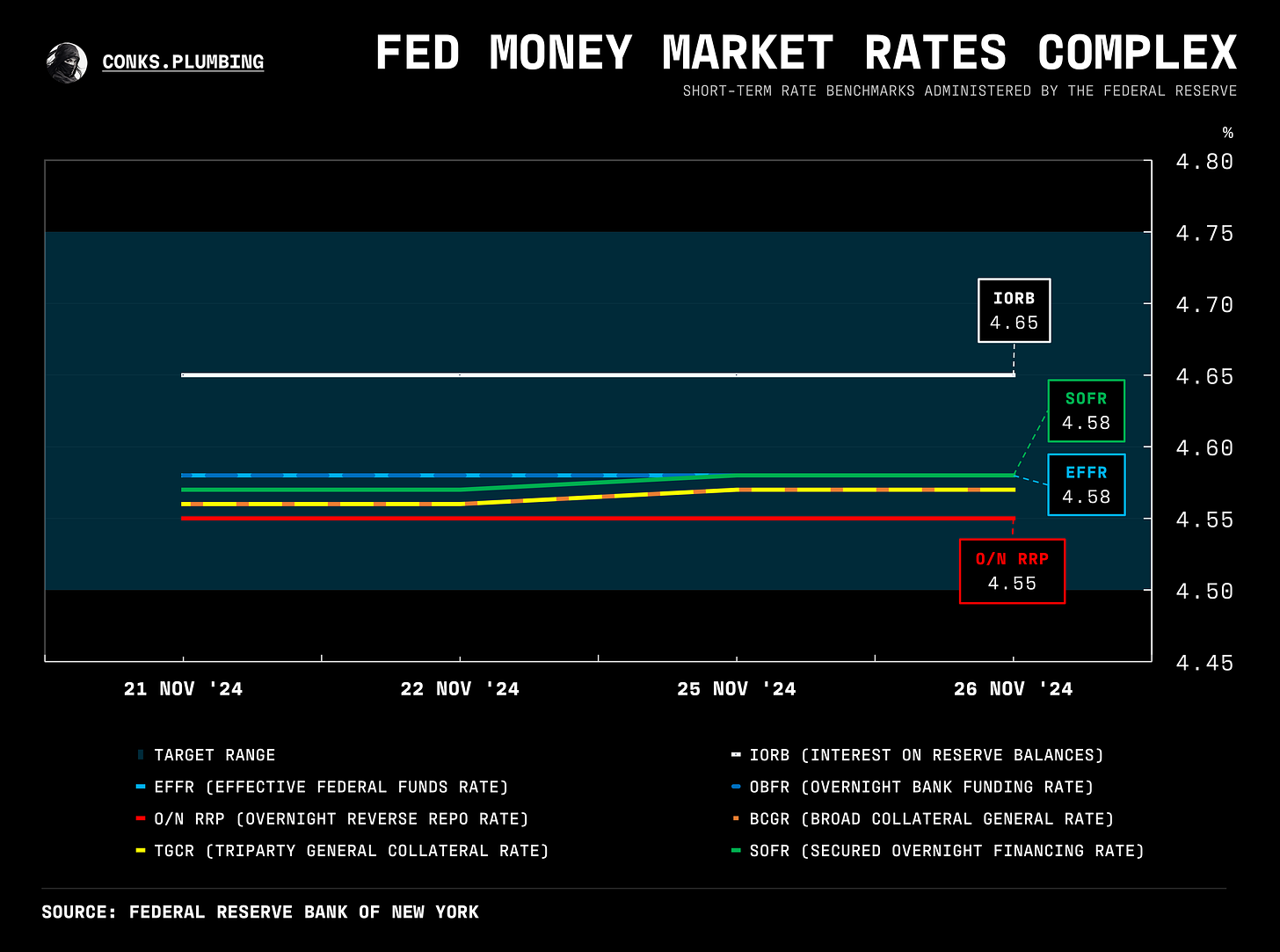

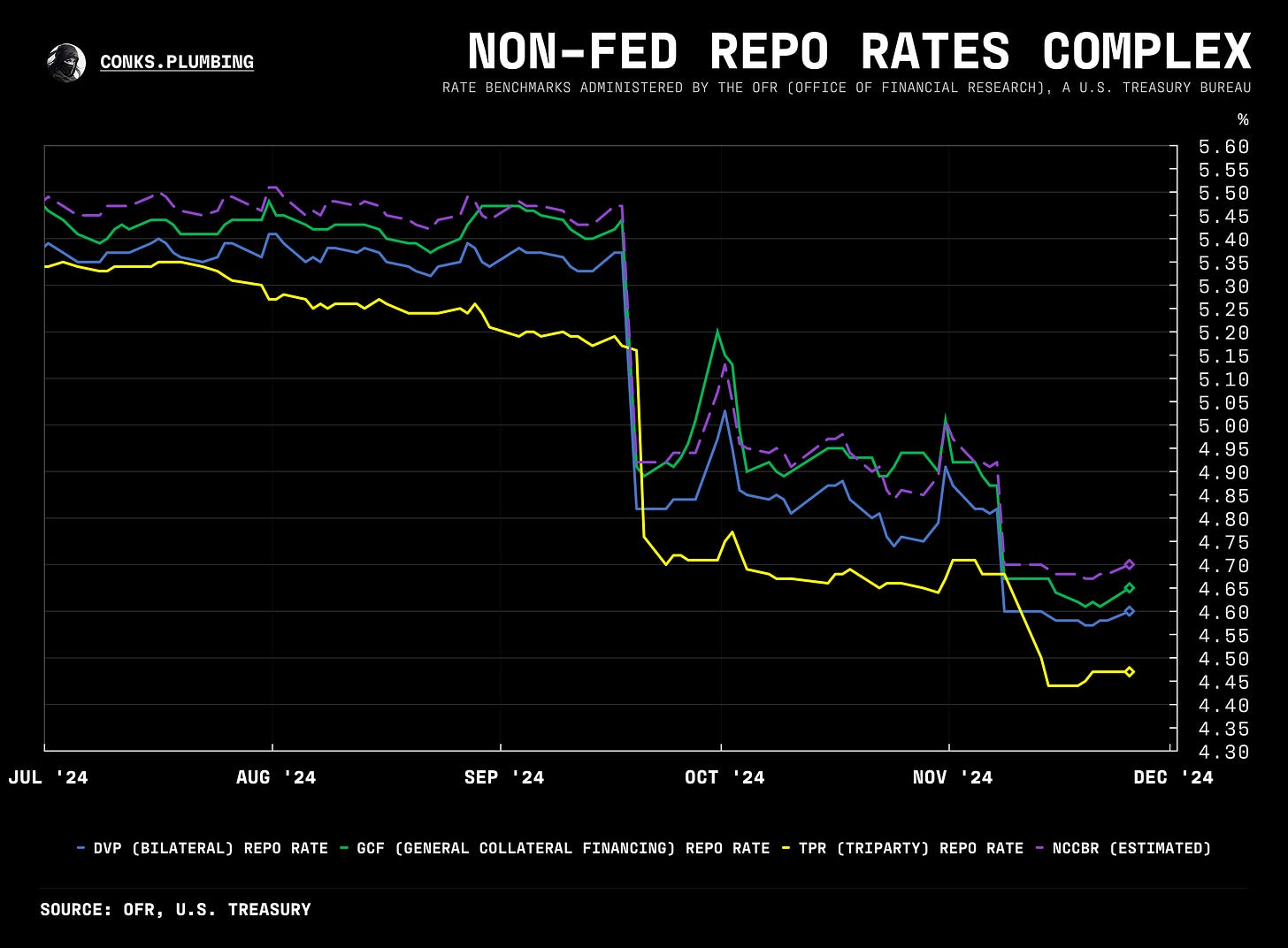

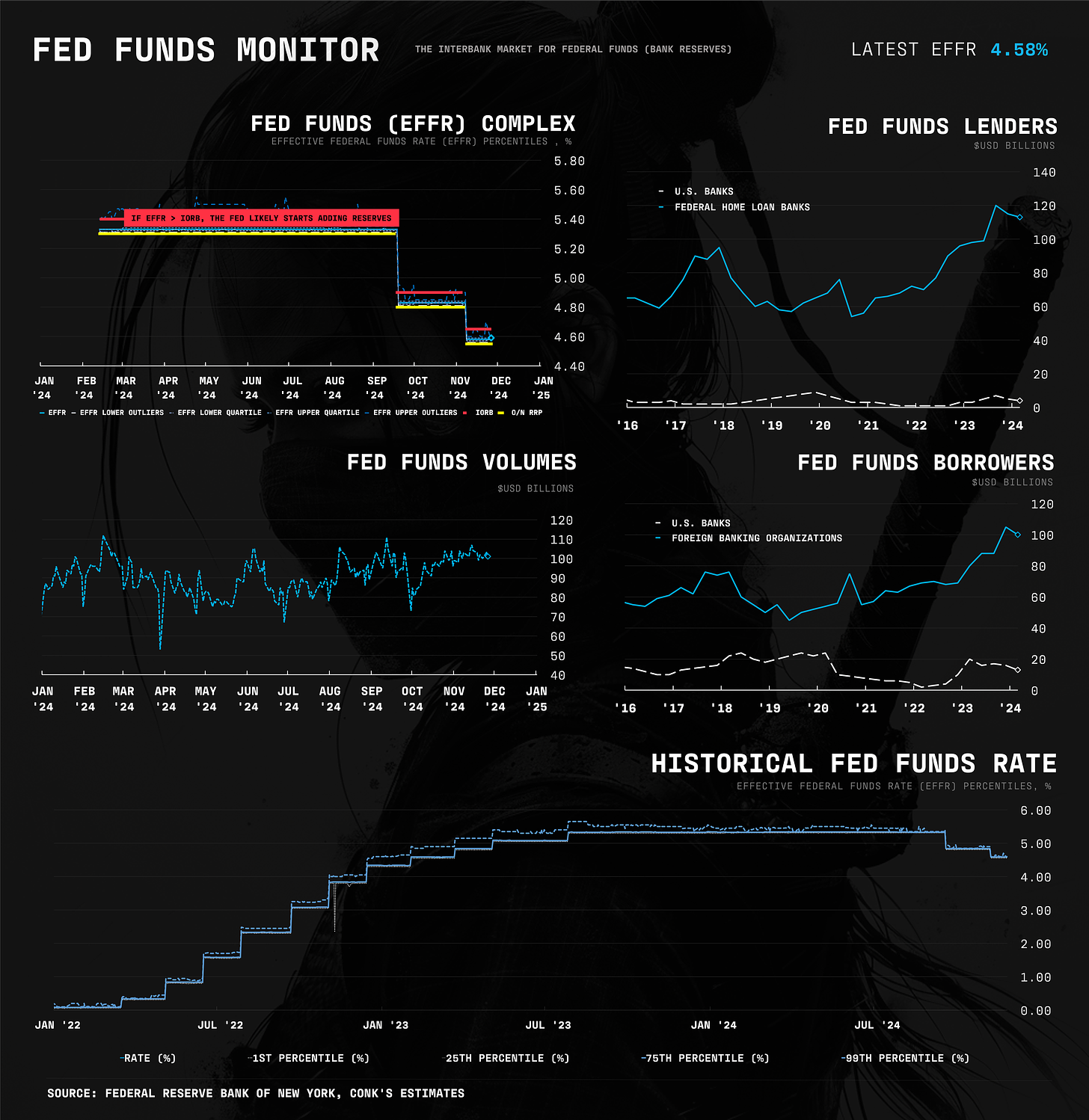

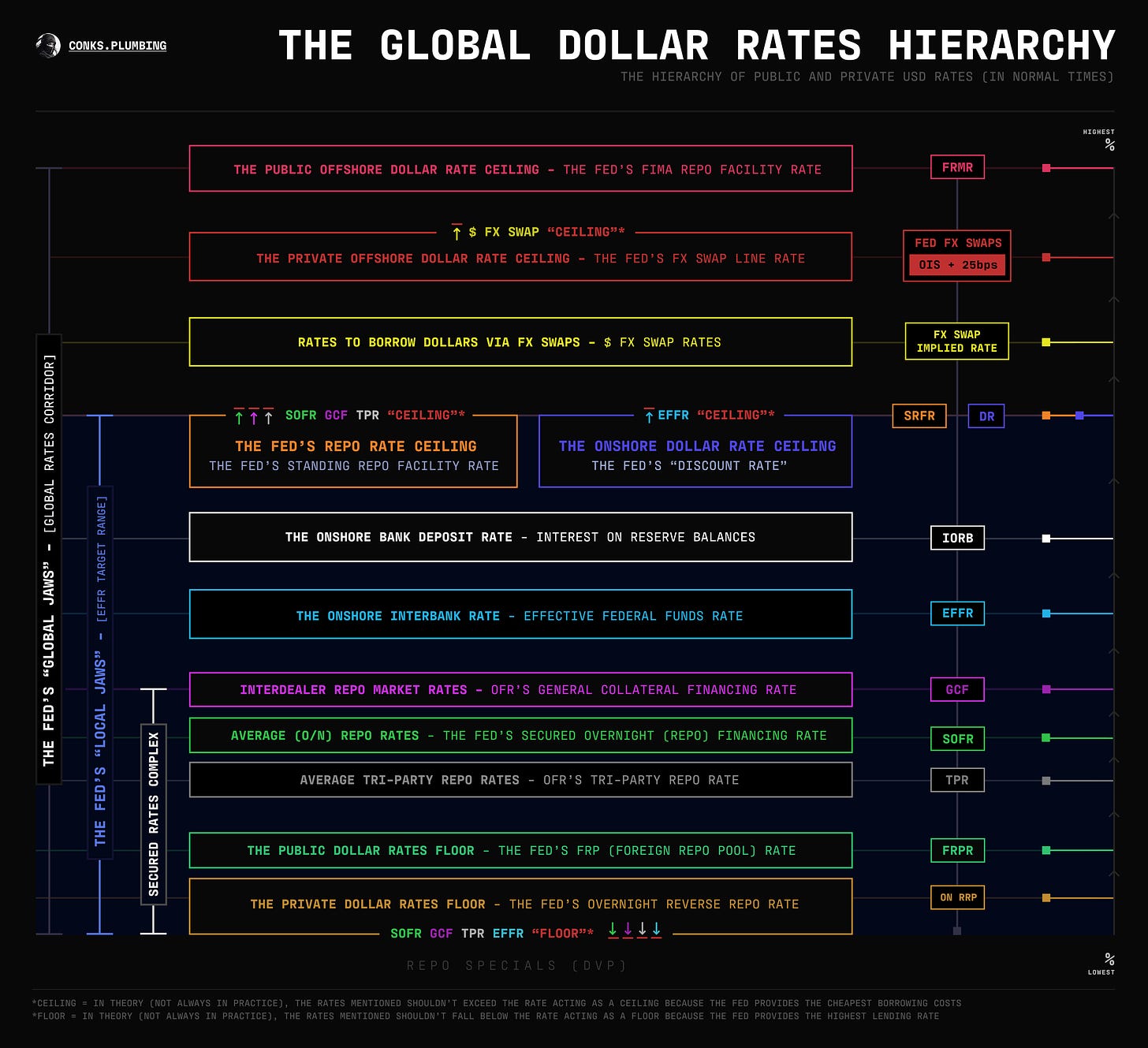

In the latest FOMC minutes, Fed officials hinted at a technical adjustment to the o/n RRP rate by lowering it 5bps. This change would clear the last few hundred billion dollars from its RRP facility while pushing down repo rates (SOFR) and the Fed Funds rate (EFFR) within its target range. Per friend Brian Gierke at CME, the announcement pushed volumes in related STIR futures (SR1-ZQ) to all-time highs.

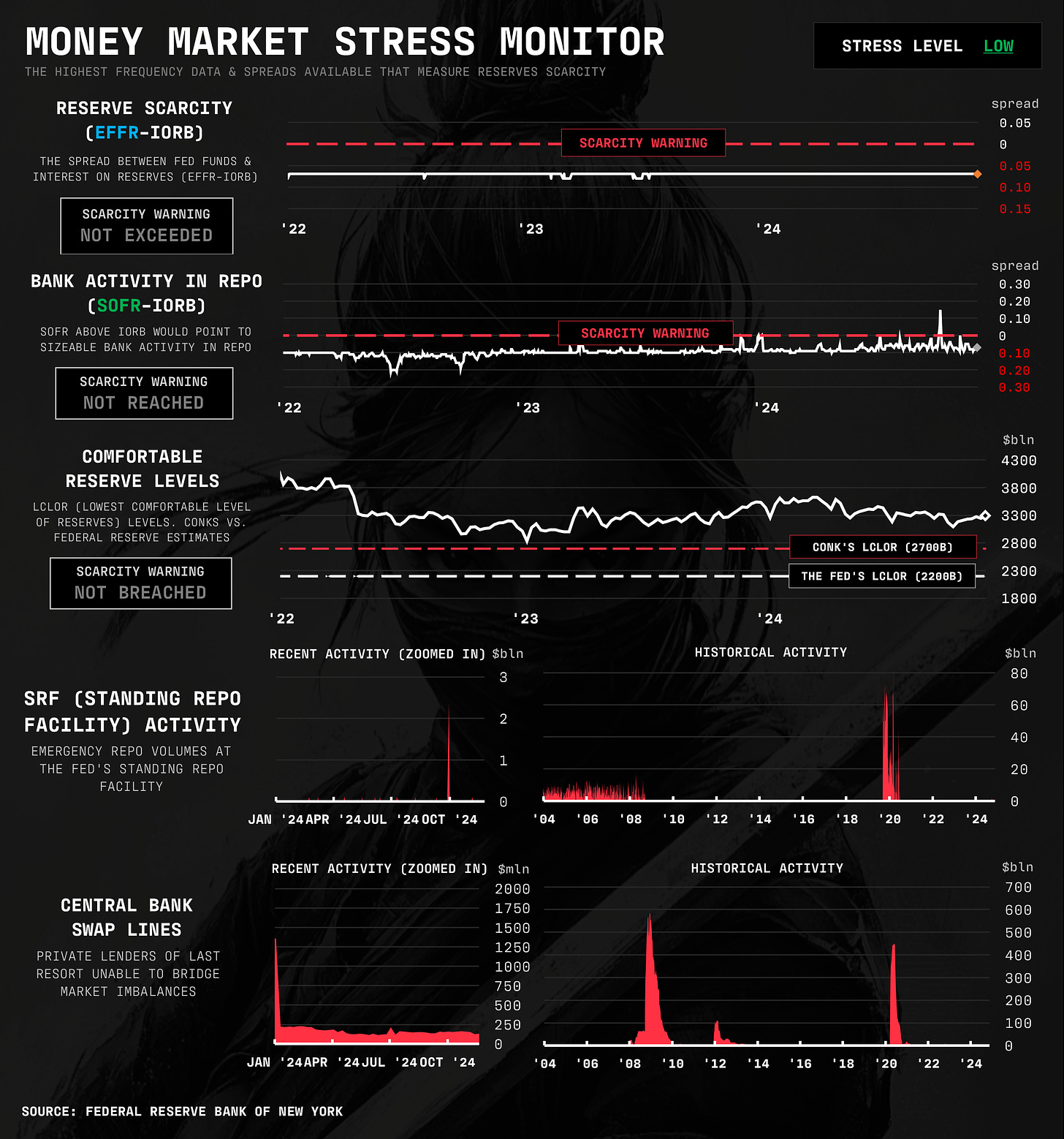

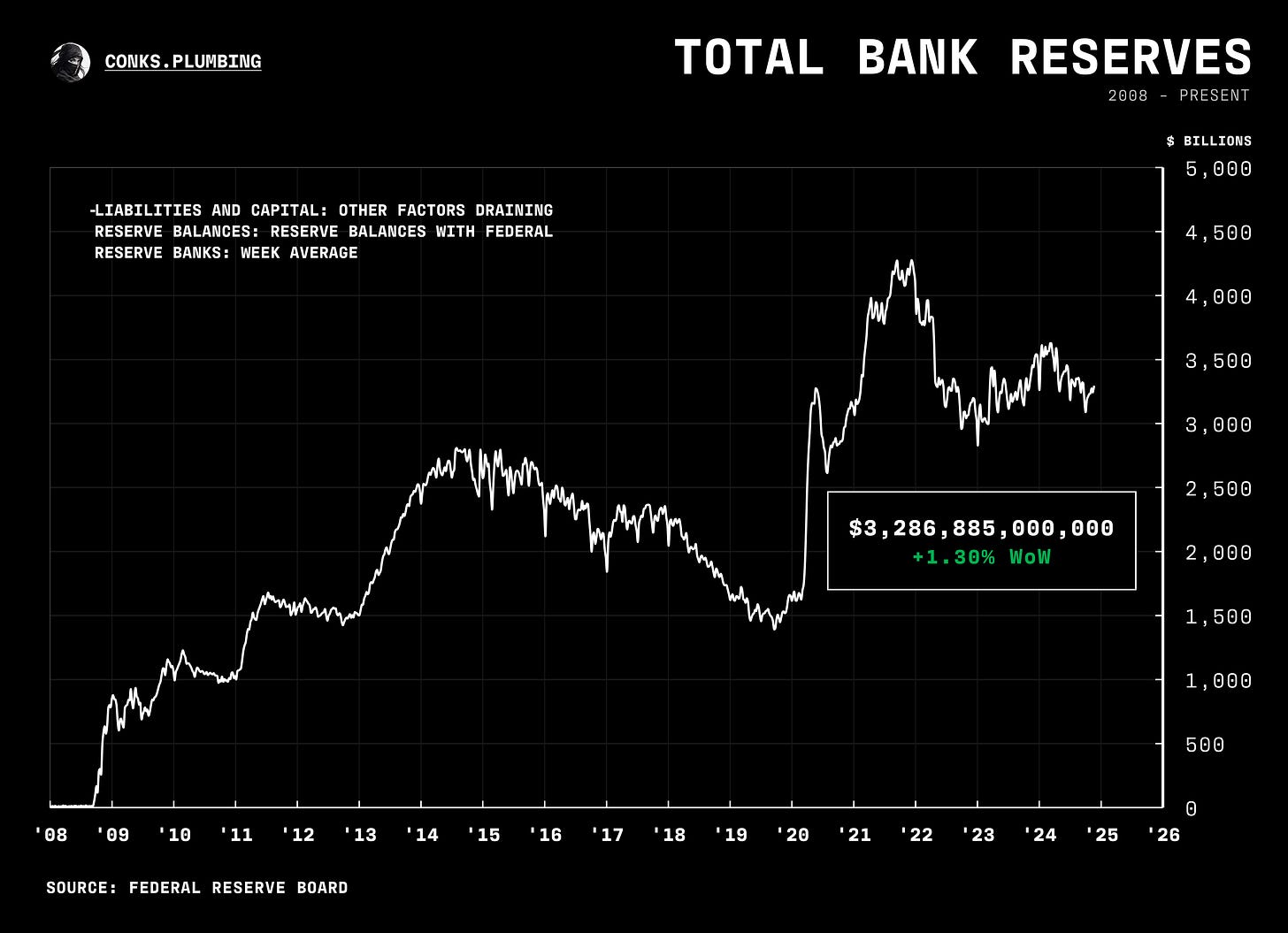

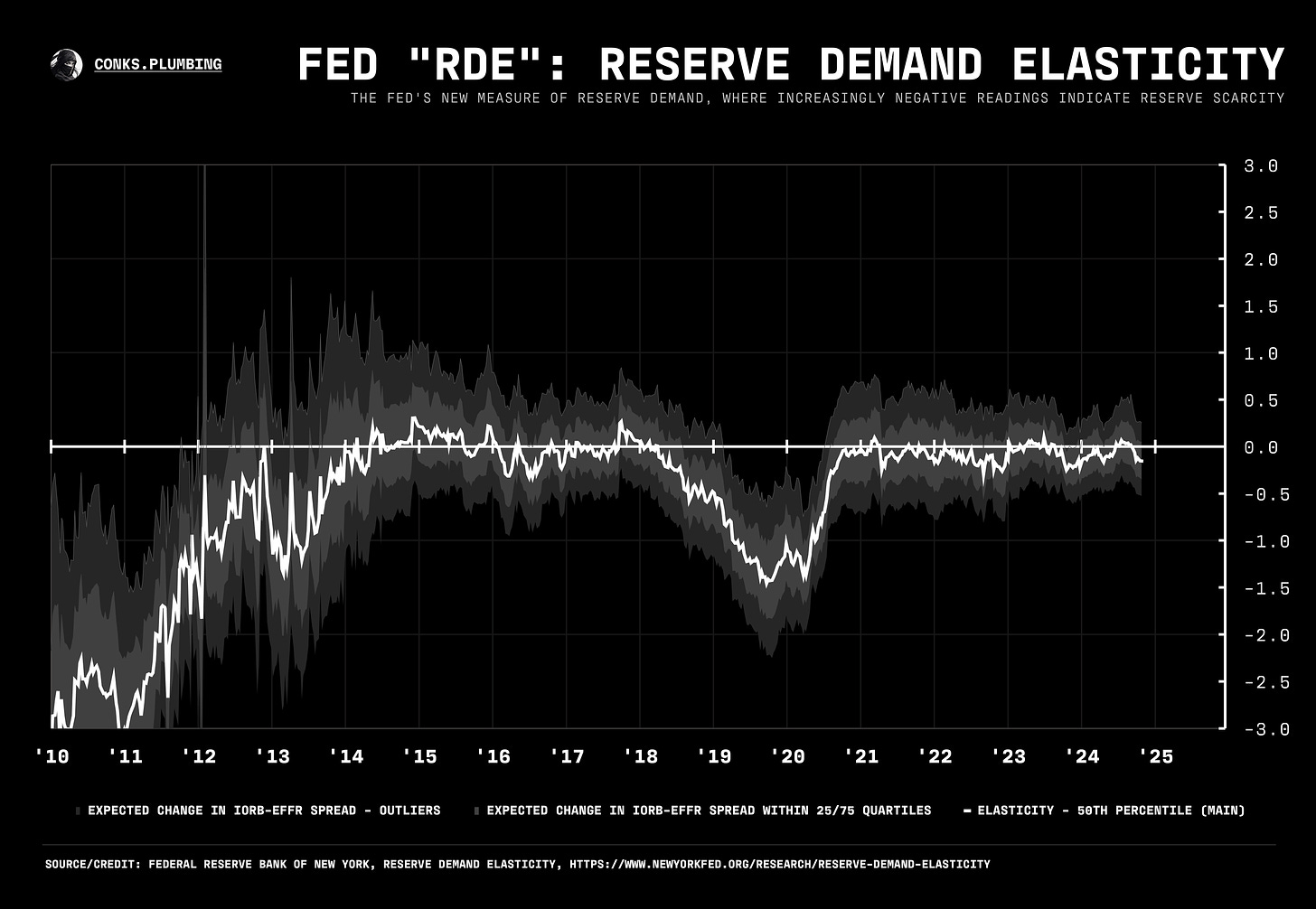

U.S. central bank leaders have implied that EFFR has to rise just below IORB before QT ends. As we’ve often said, the psychological effect of the Fed ending its balance sheet reduction is stronger than the actual mechanical easing. A rare overlap between risk assets and money markets will develop where frontrunning the end of QT (by observing the IORB-EFFR spread narrowing) may cause buying pressure in risk assets.

Speaking of risk assets, bank stocks have rallied so much that this will impact funding pressures moving into year-end. Dominant market makers will likely pull back aggressively from repo at year-end to avoid higher G-SIB surcharges — as we covered in The Great Flattening. Put simply, if their stock prices rally, banks must hold more capital — unless they unwind the size of their repo or derivatives holdings to compensate.

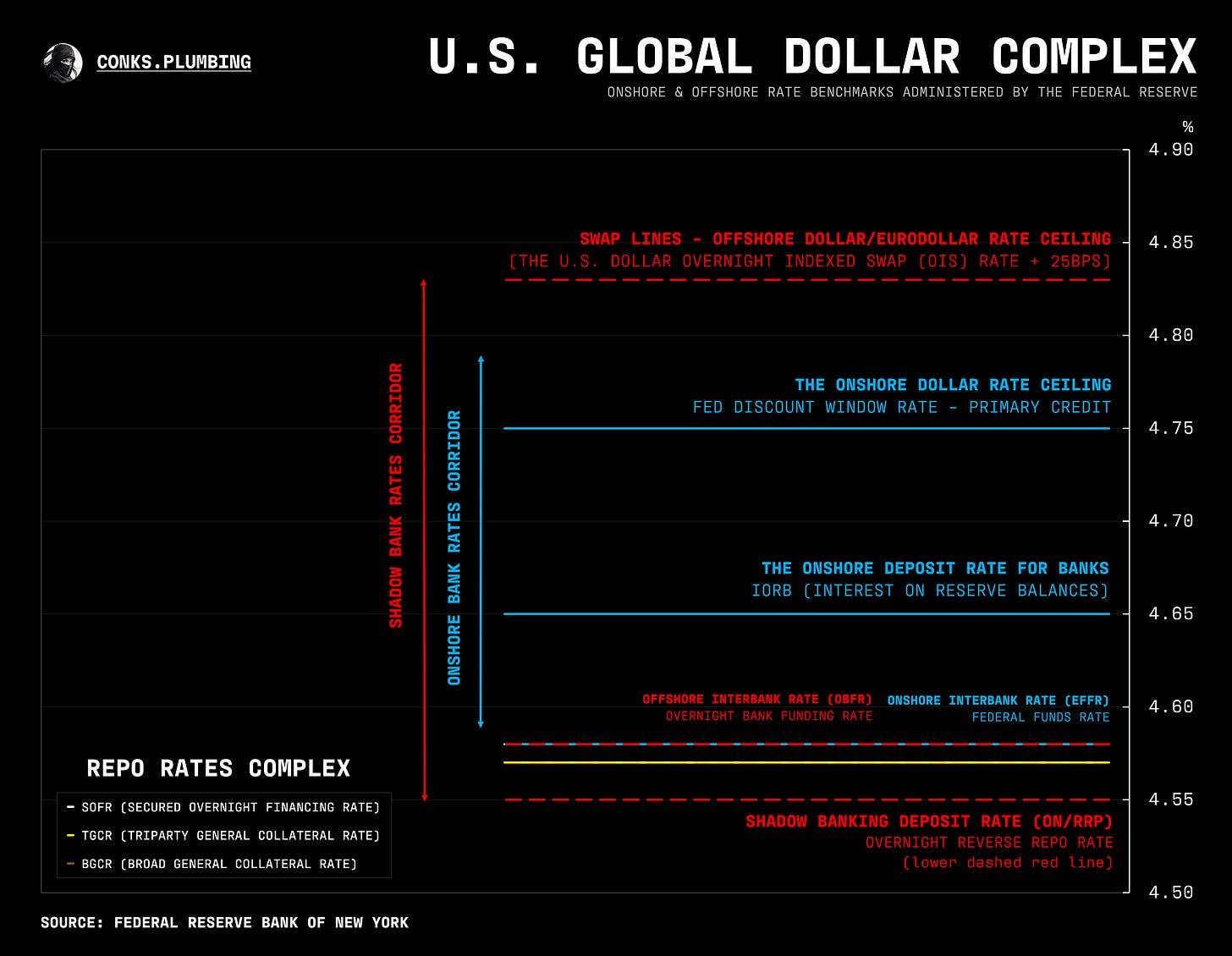

Meanwhile, in XCCY land, EURUSD and GBPUSD XCCY bases have continued to rally despite U.S. dollar strength, revealing no shortage of dollar liquidity — as fellow basis enthusiast,

, pointed out.Also aiding liquidity, the share of Treasury bill issuance will likely remain above 20%, with members of TBAC raising their target from 15-20% to around 20%. This percentage should slowly increase after Trump’s victory. Moreover, duration issuance won’t increase dramatically either until late 2025. All in all, a positive for risk assets in the long term.

Dealer balance sheets have cleared somewhat with a steeper curve, but funding pressures should persist with significant U.S. Treasury settlements. Expect tighter short-end swap spreads.

Many X (formerly Twitter) accounts also circulated a “scary” chart of 10-year Euro swap spreads, which turned negative for the first time since (not 2007 but) forever. Of course, little causation exists between U.S. risk assets and EUR swap spreads. We’d attribute this plunge to ECB QT, Trump's victory, and associated trades. Heavy hedging from European firms paired with bank treasurers' reluctance to nibble on duration has also pushed this spread considerably wider.

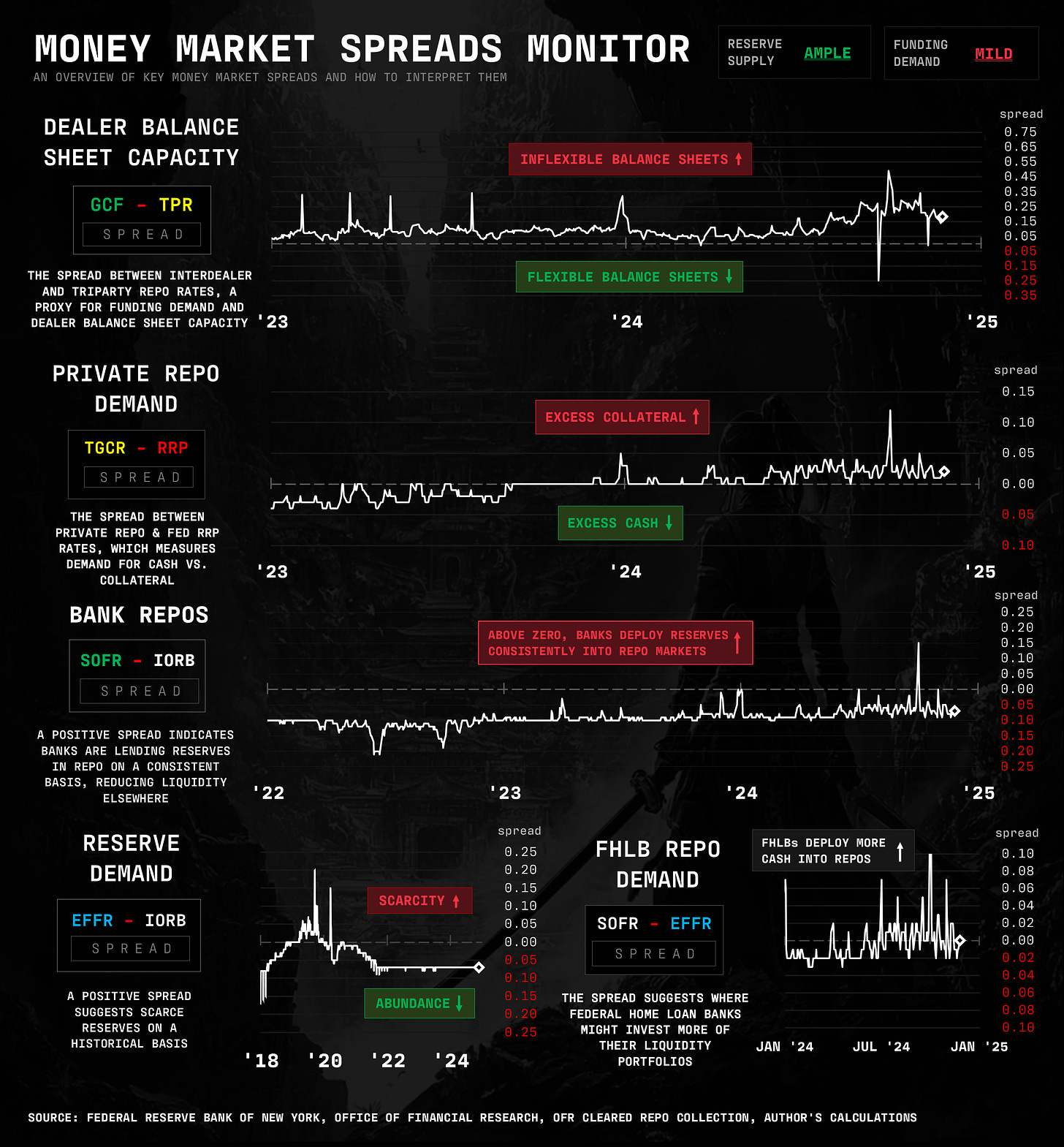

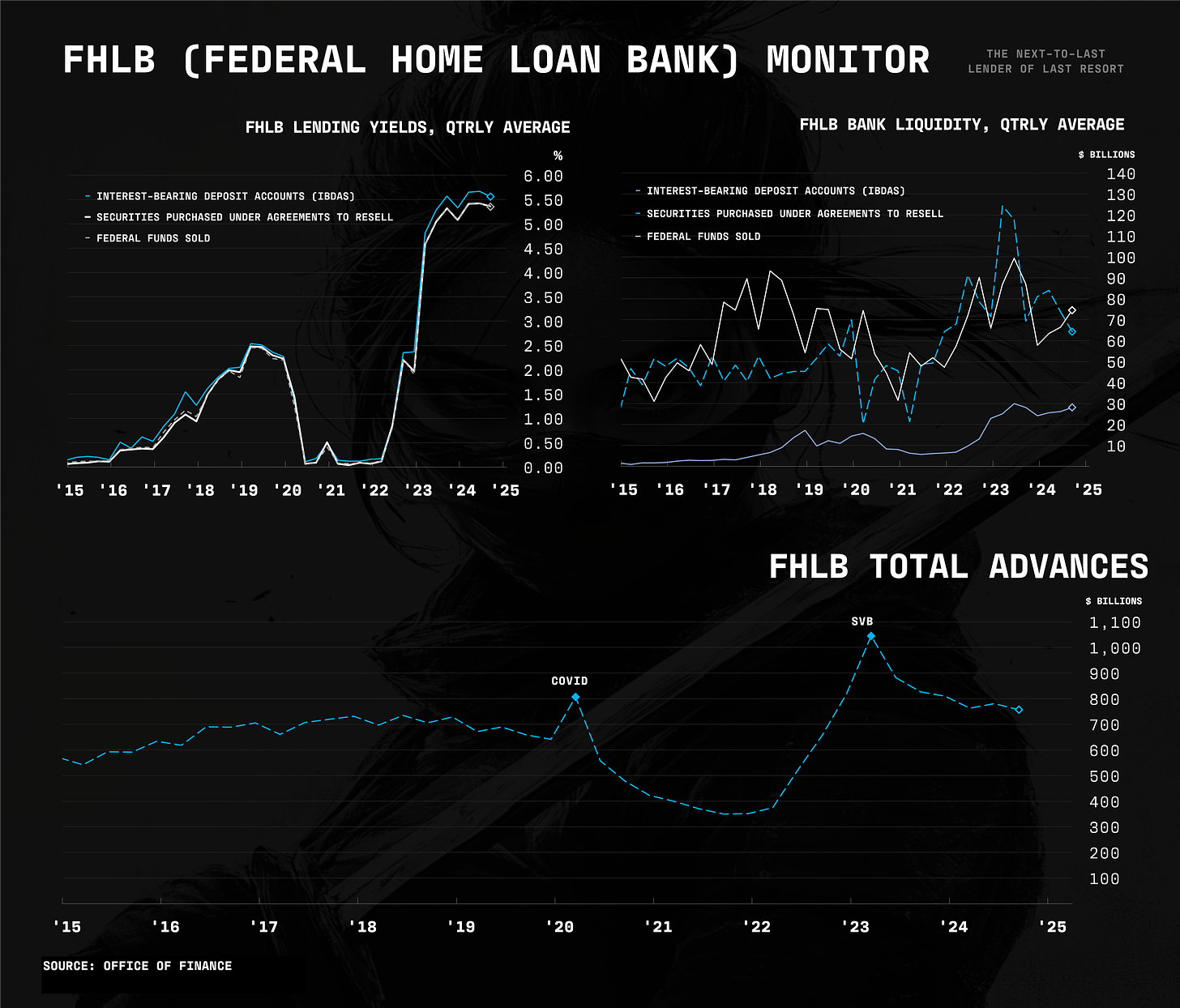

Elsewhere in money markets, the latest FHLB data showed that FHLBs favored lending into the Fed Funds market over repo markets. As our new money market spreads monitor (below) demonstrates, subtracting repo rates from EFFR (Fed Funds) offered higher yields — minus on quarter-ends.

And with that, time for the chartbook (more monitors on the way)…

If you act on anything provided in this newsletter, you agree to the terms in this disclaimer. Everything in this newsletter is for educational and entertainment purposes only and NOT investment advice. Nothing in this newsletter is an offer to sell or to buy any security. The author is not responsible for any financial loss you may incur by acting on any information provided in this newsletter. Before making any investment decisions, talk to a financial advisor.

EFFR, OBFR, SOFR, TGCR, and BGCR are subject to the Terms of Use posted at newyorkfed.org. The New York Fed is not responsible for publication of tri-party data from the Bank of New York Mellon (BNYM) or GCF Repo/Delivery-versus-Payment (DVP) repo data via DTCC Solutions LLC (“Solutions”), an affiliate of The Depository Trust & Clearing Corporation, & OFR, does not sanction or endorse any particular republication, and has no liability for your use.

Hi conks. I read your "Great Flattening" post but I can't understand why Bank stock price rising meaning pull back from repo. There is no comment for bank stock price....

Thank you