Money Market Update

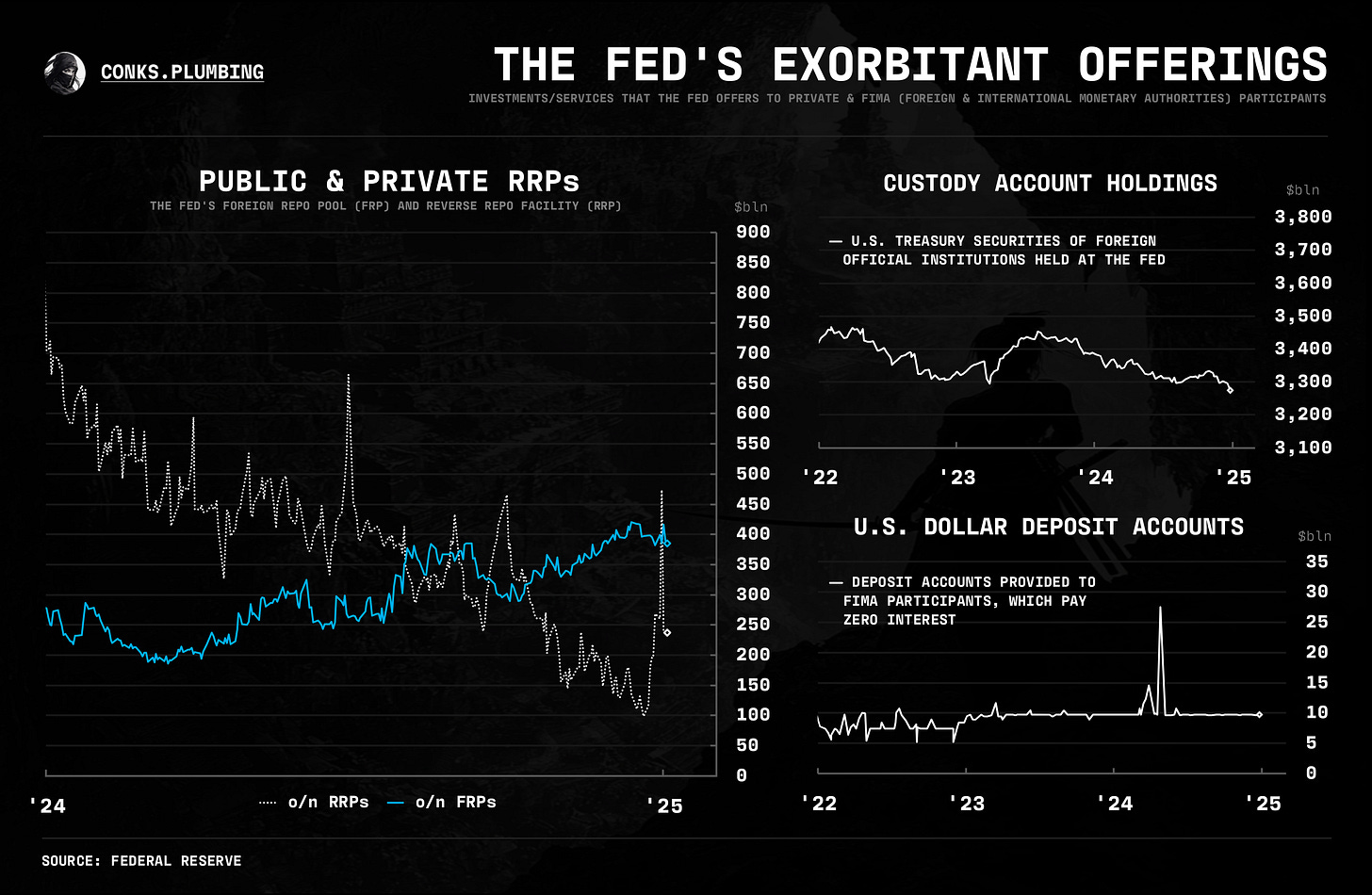

as the Fed announced morning repo operations in late december, the year-end turn went from stormy to calm. now, as 2025 begins, it's the debt ceiling's turn to induce volatility in money markets

In case you missed it — or you’ve just joined us — right as we were about to publish our last piece, the Fed executed steps to calm money market pressures over the year-end turn...

These actions have required us to rethink not one but two articles we were in the process of writing, which happened to be large pieces of work. Thus, we’re releasing some pieces on more timely plumbing topics (a clue below) beforehand.

But first, a gradually improving money market update...

Summary & Brief Commentary

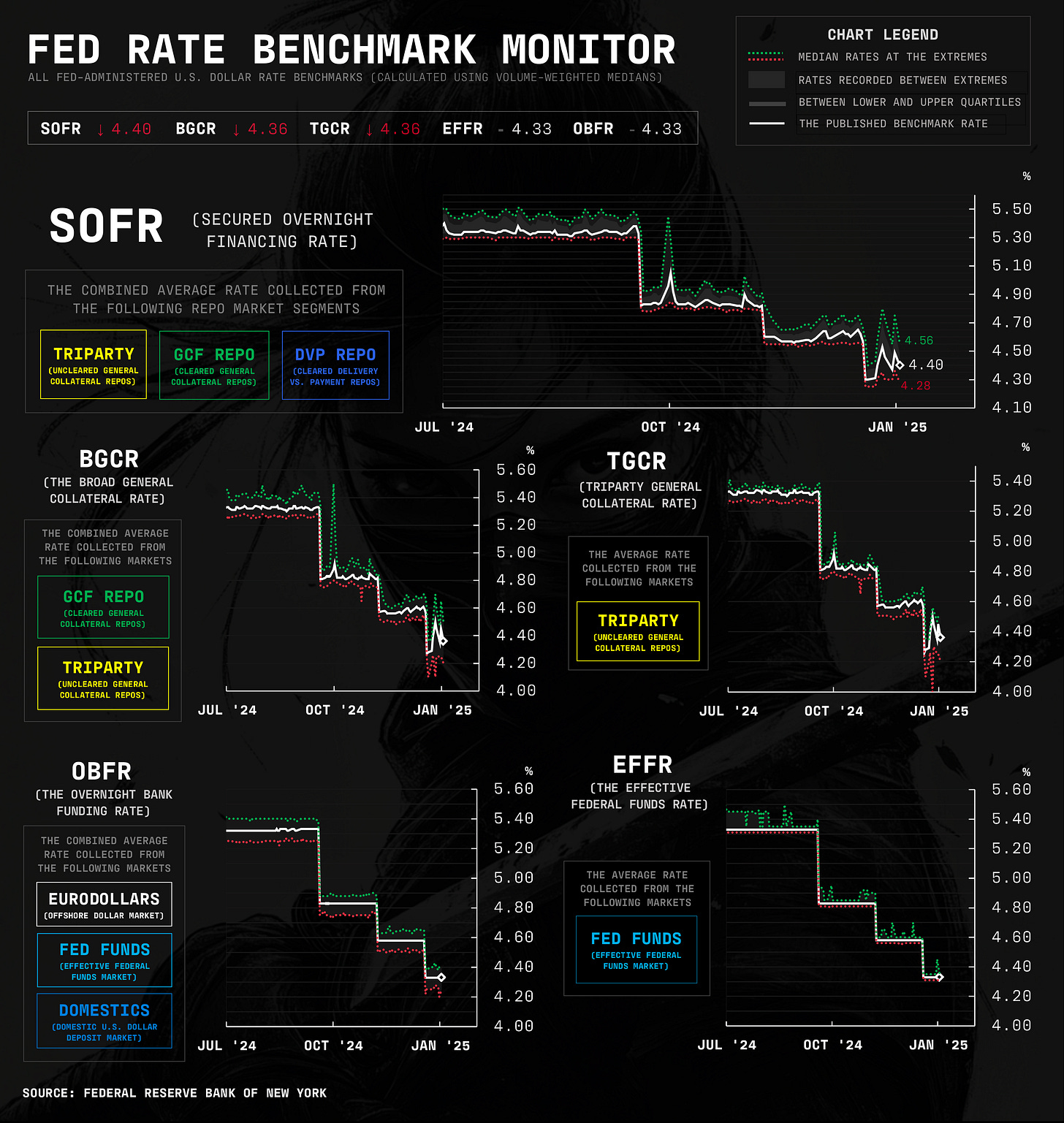

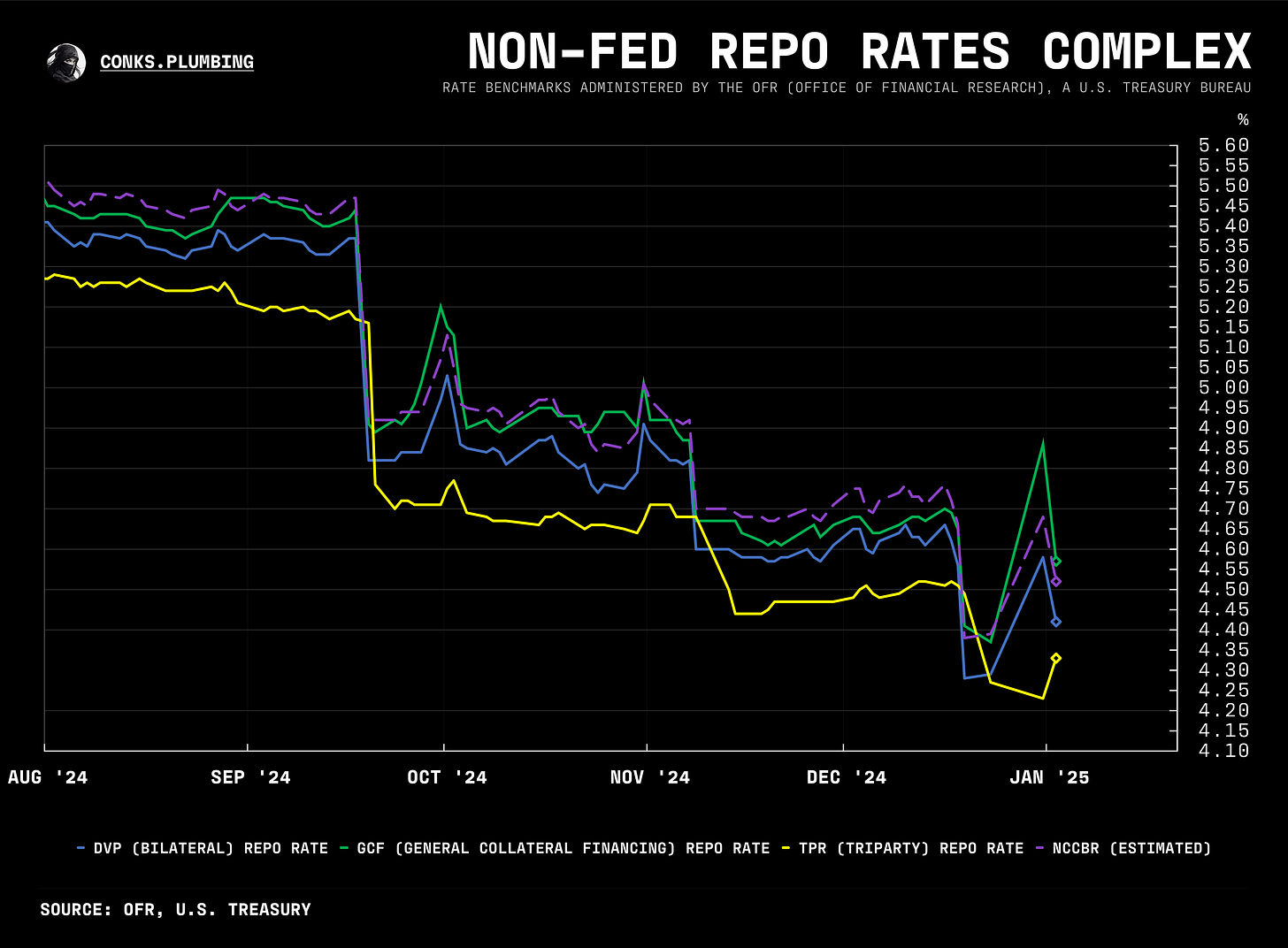

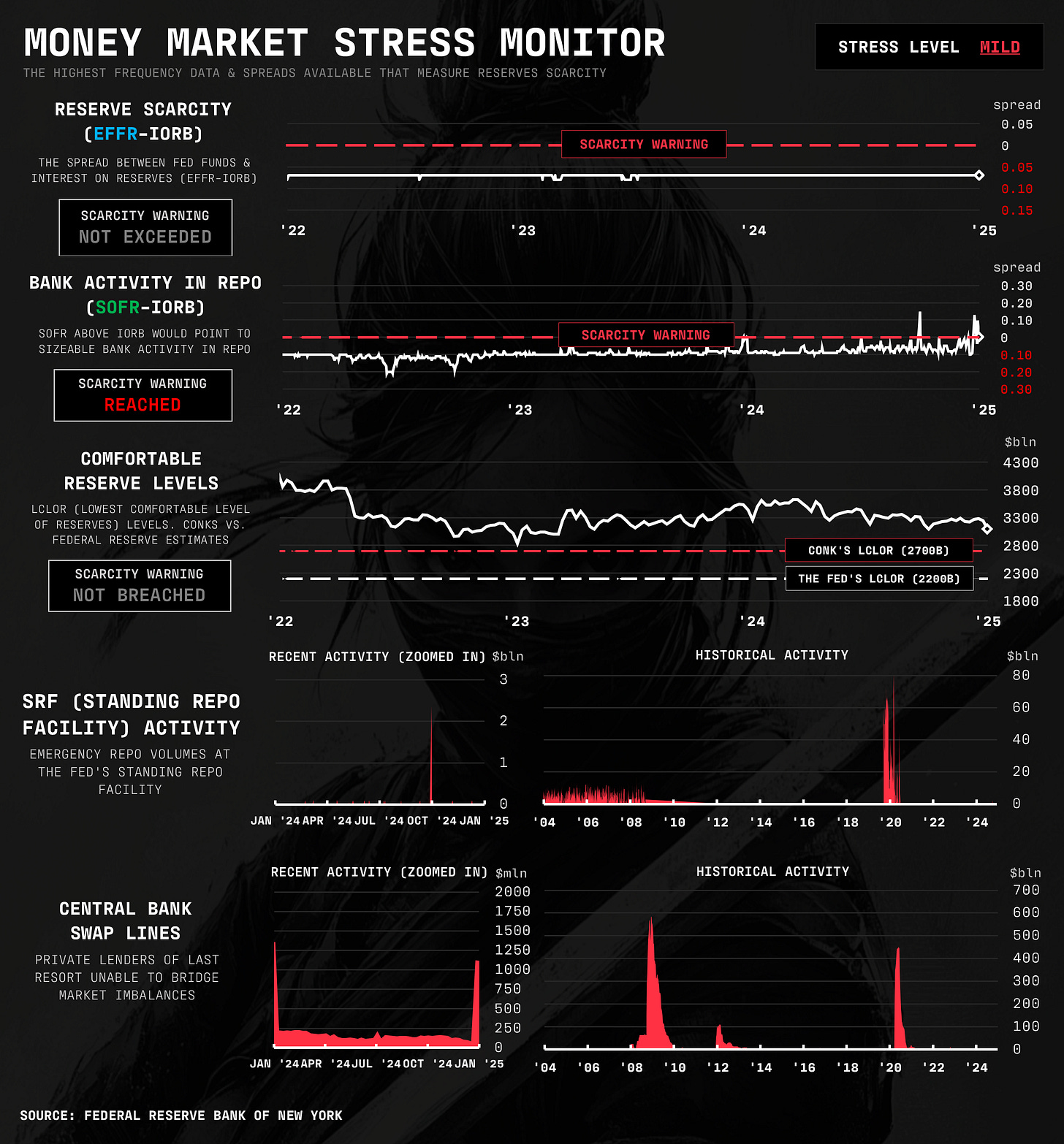

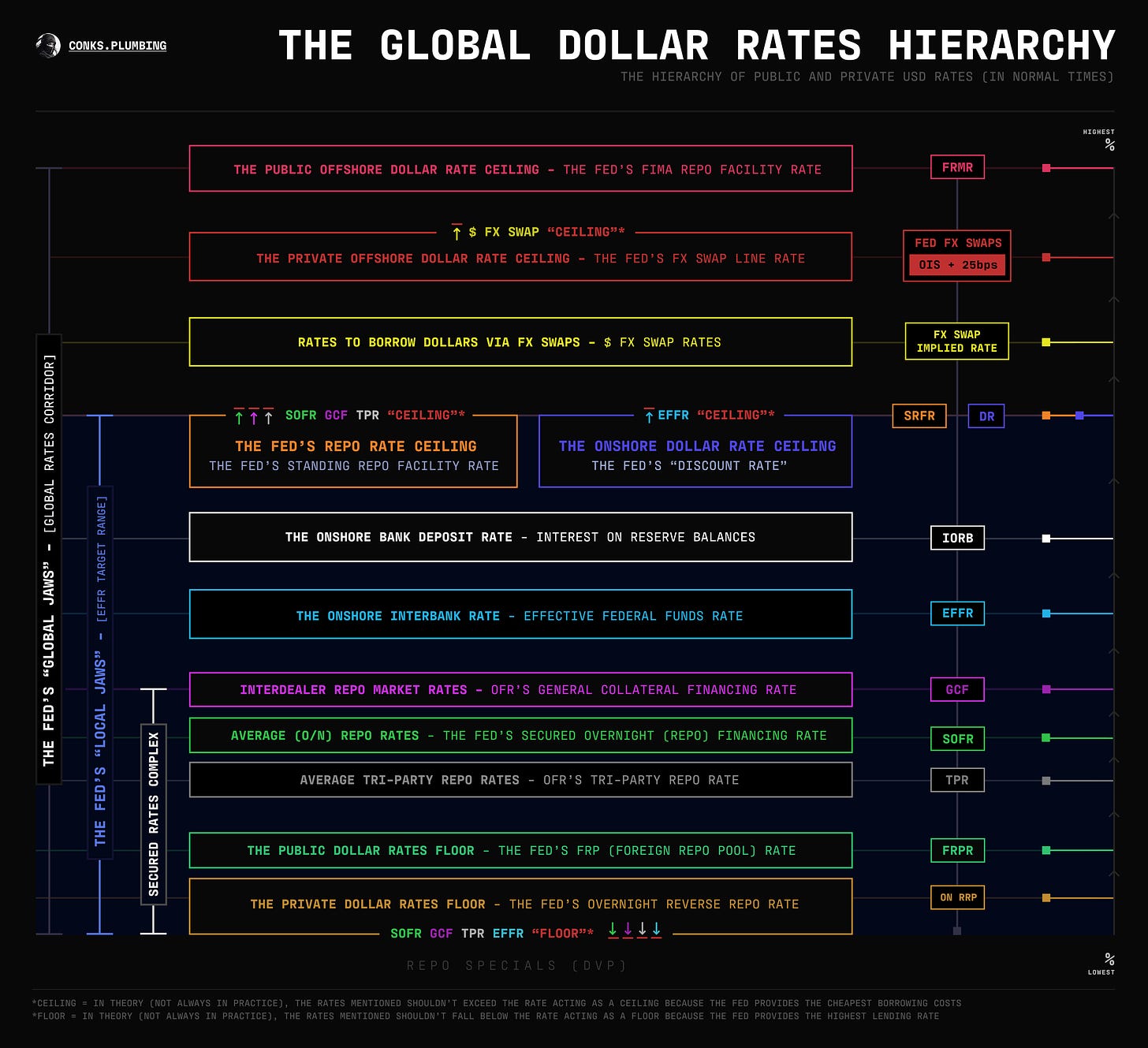

The Fed, along with the usual afternoon program, announced morning SRF (Standing Repo Facility) operations over year-end — a sign that the Fed’s Repo Defensive is now in motion. In talks with participants, central bank officials’ willingness to hold morning operations prompted traders to negotiate repos at lower rates.

The stigma of using the SRF, however, persisted and became evident as hundreds of billions in repos traded above the Fed’s minimum SRF bid — the cheapest rate available — yet nobody tapped the facility at year-end.

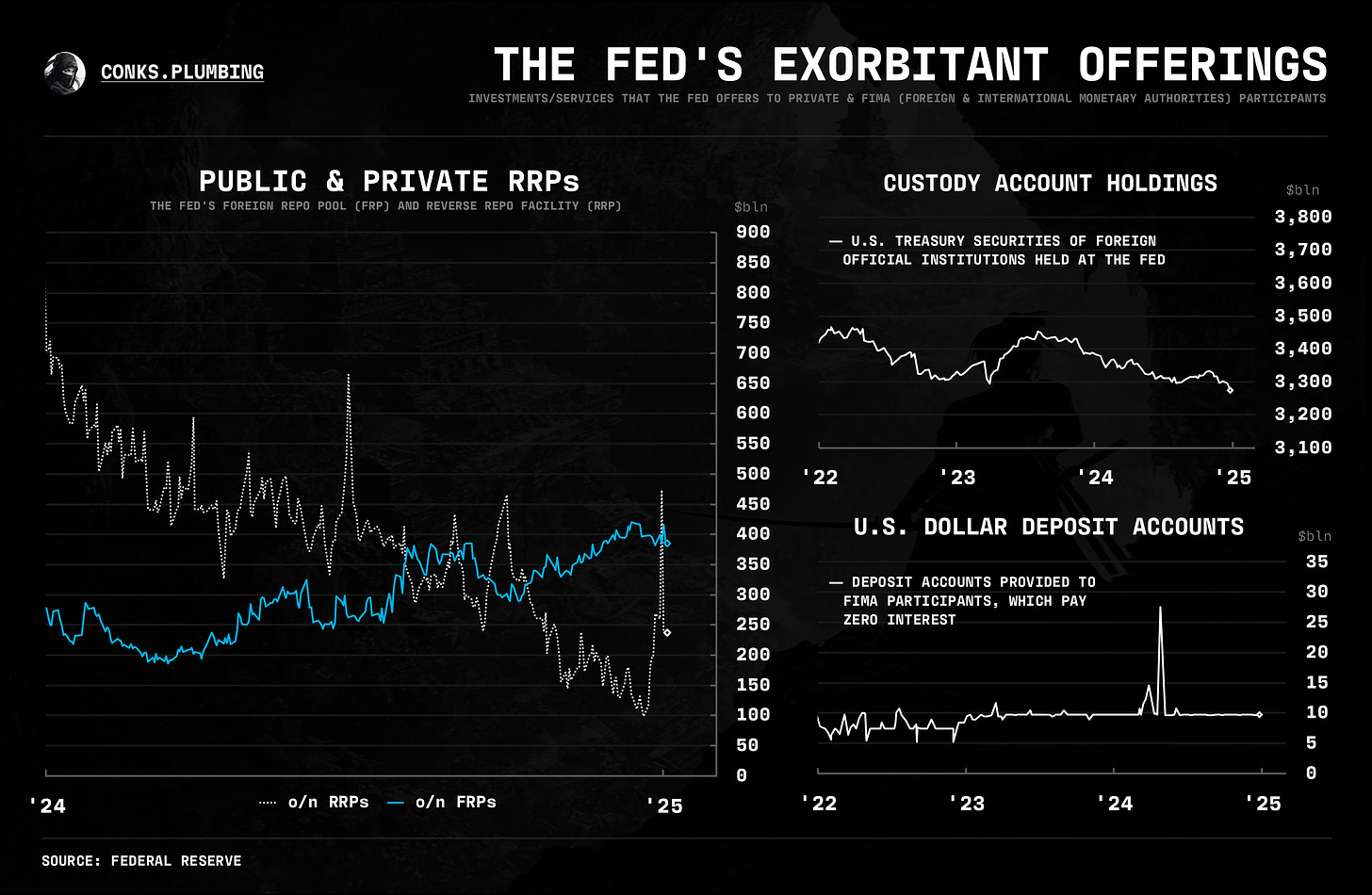

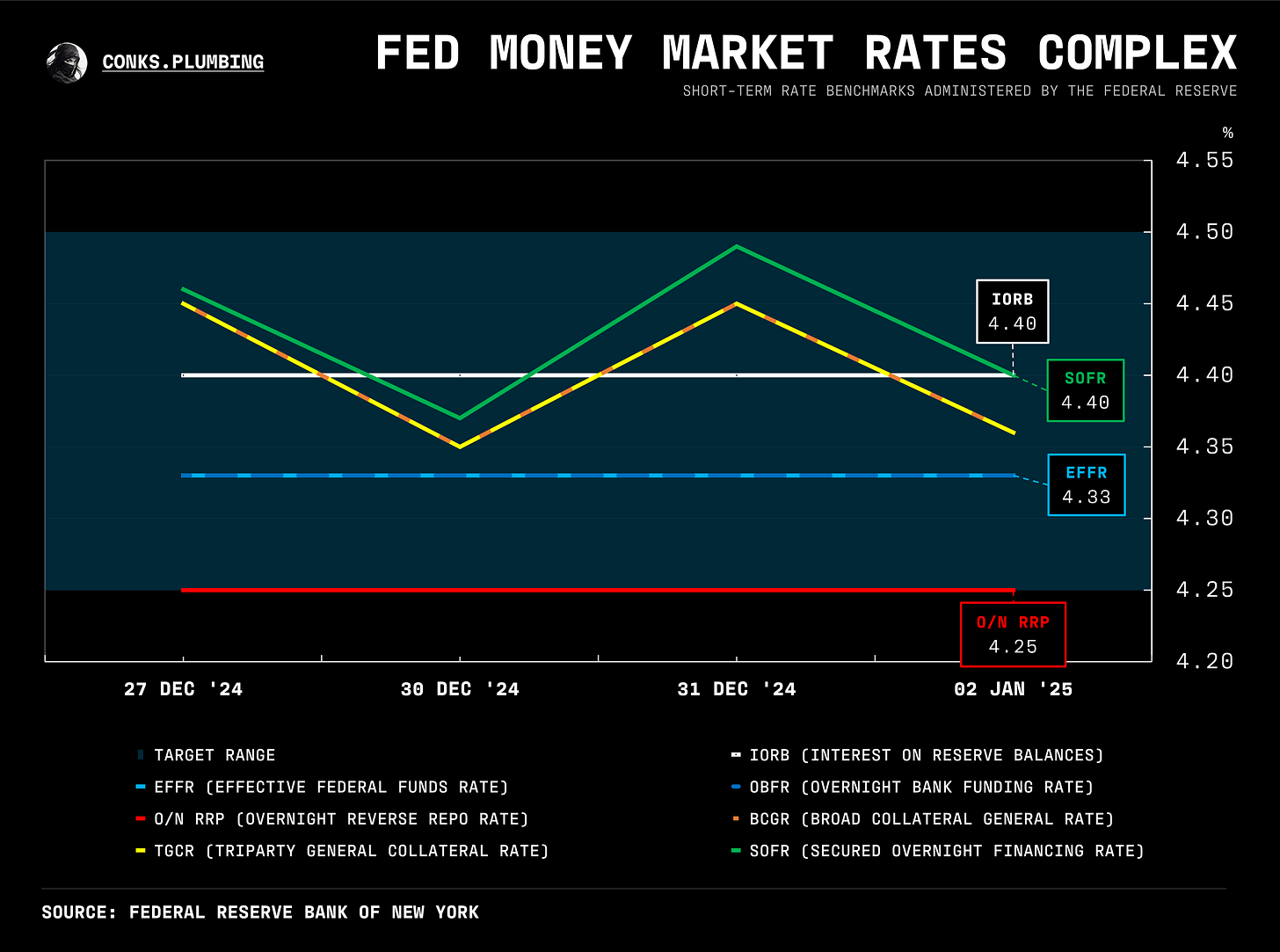

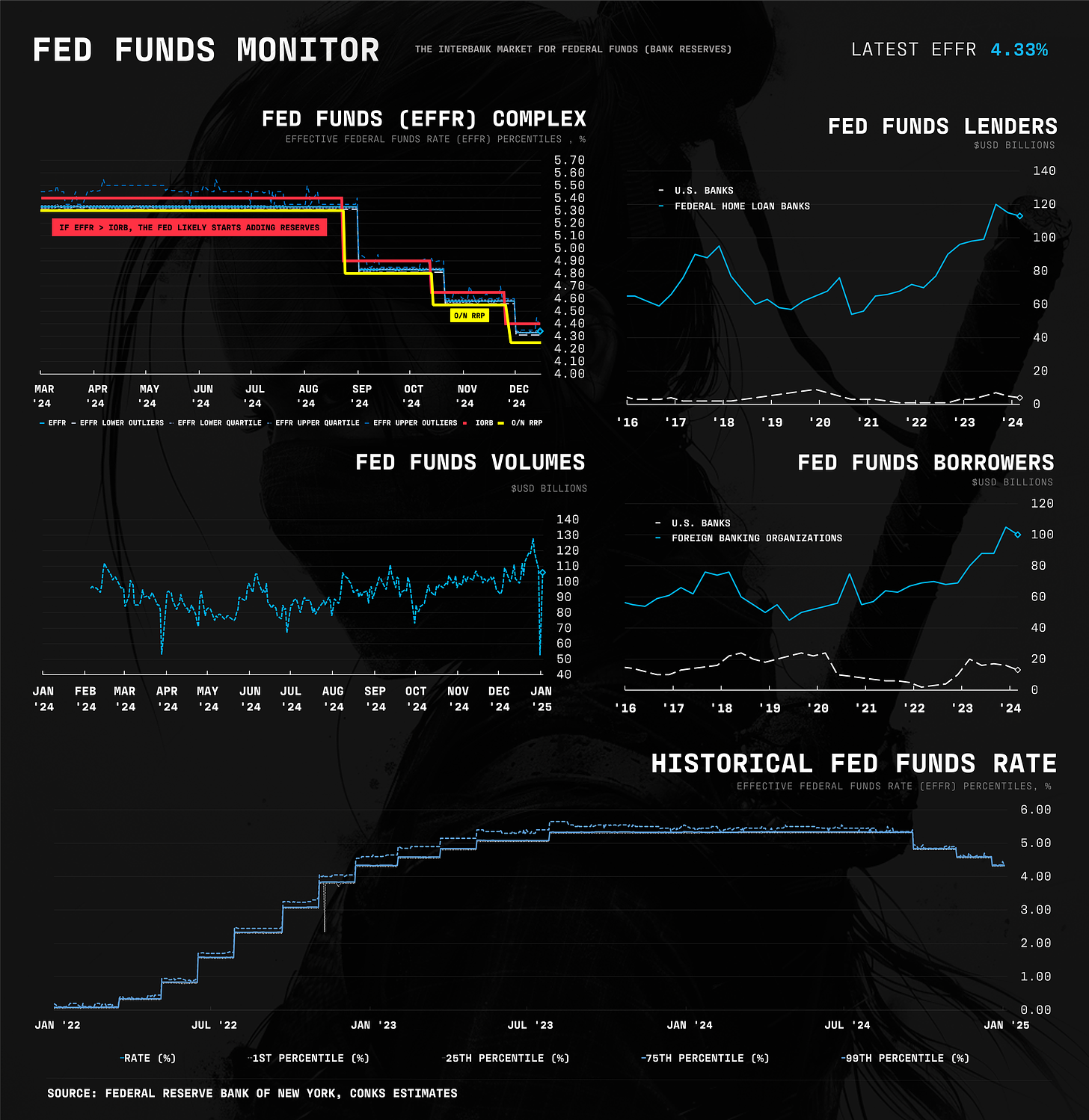

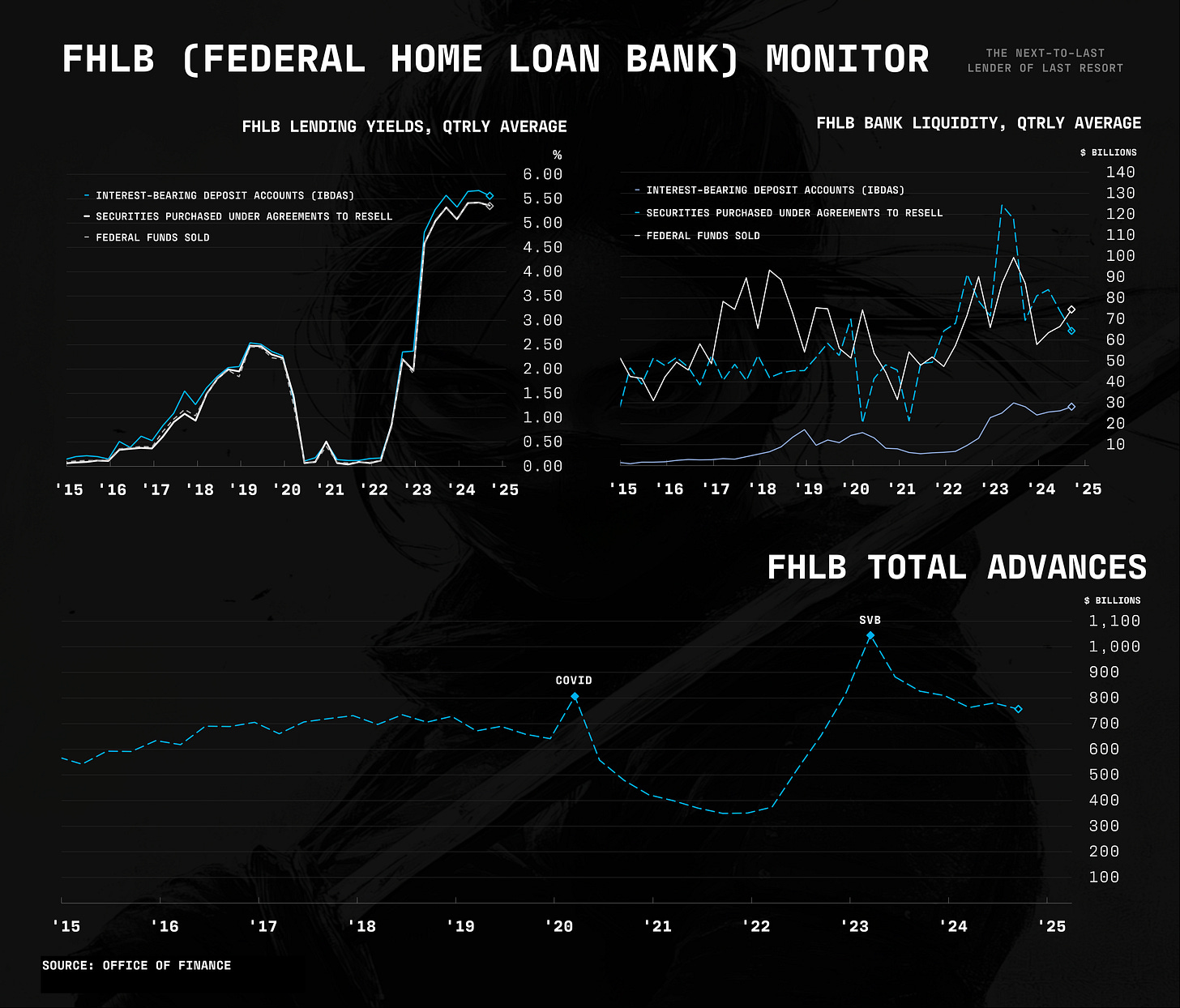

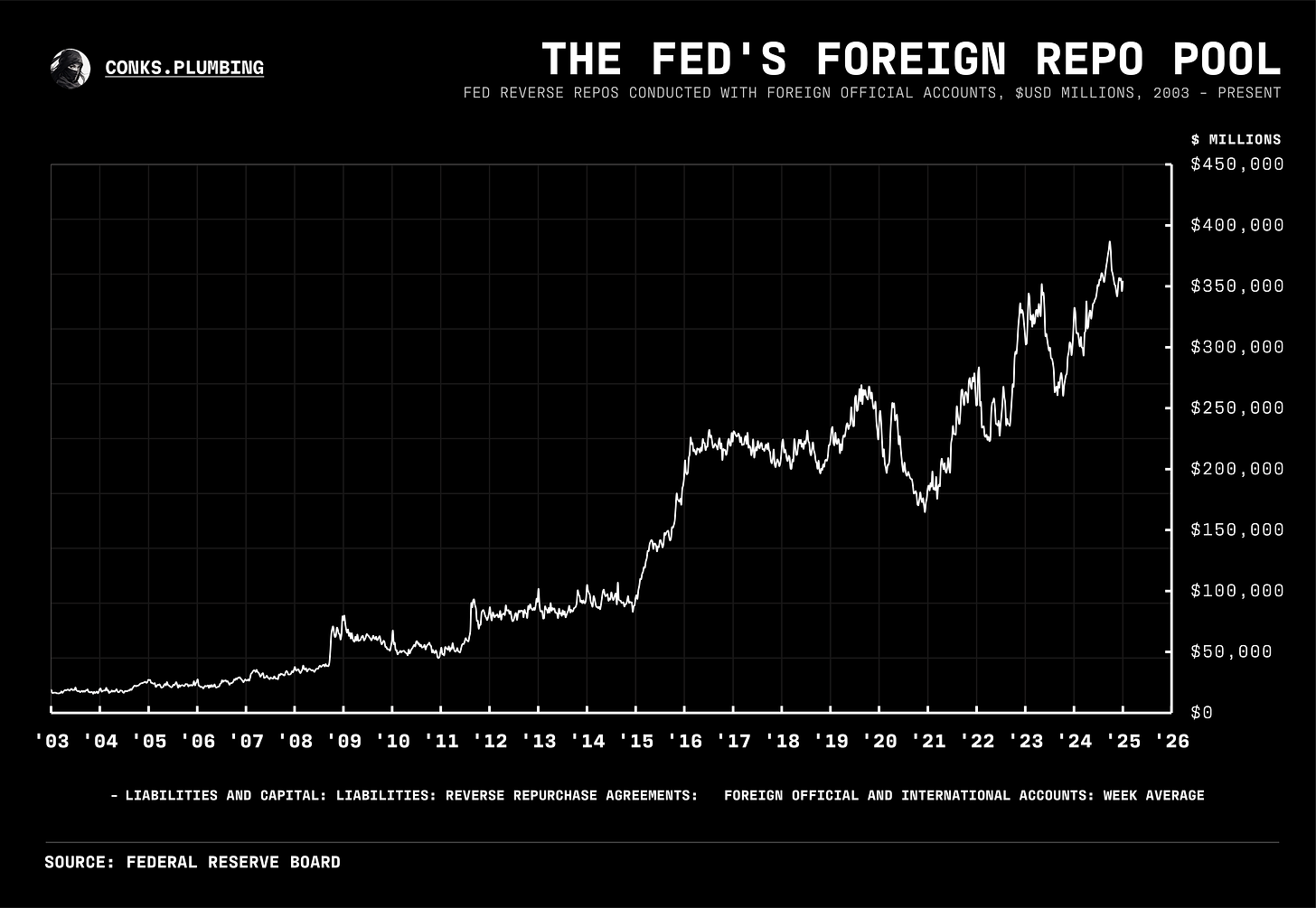

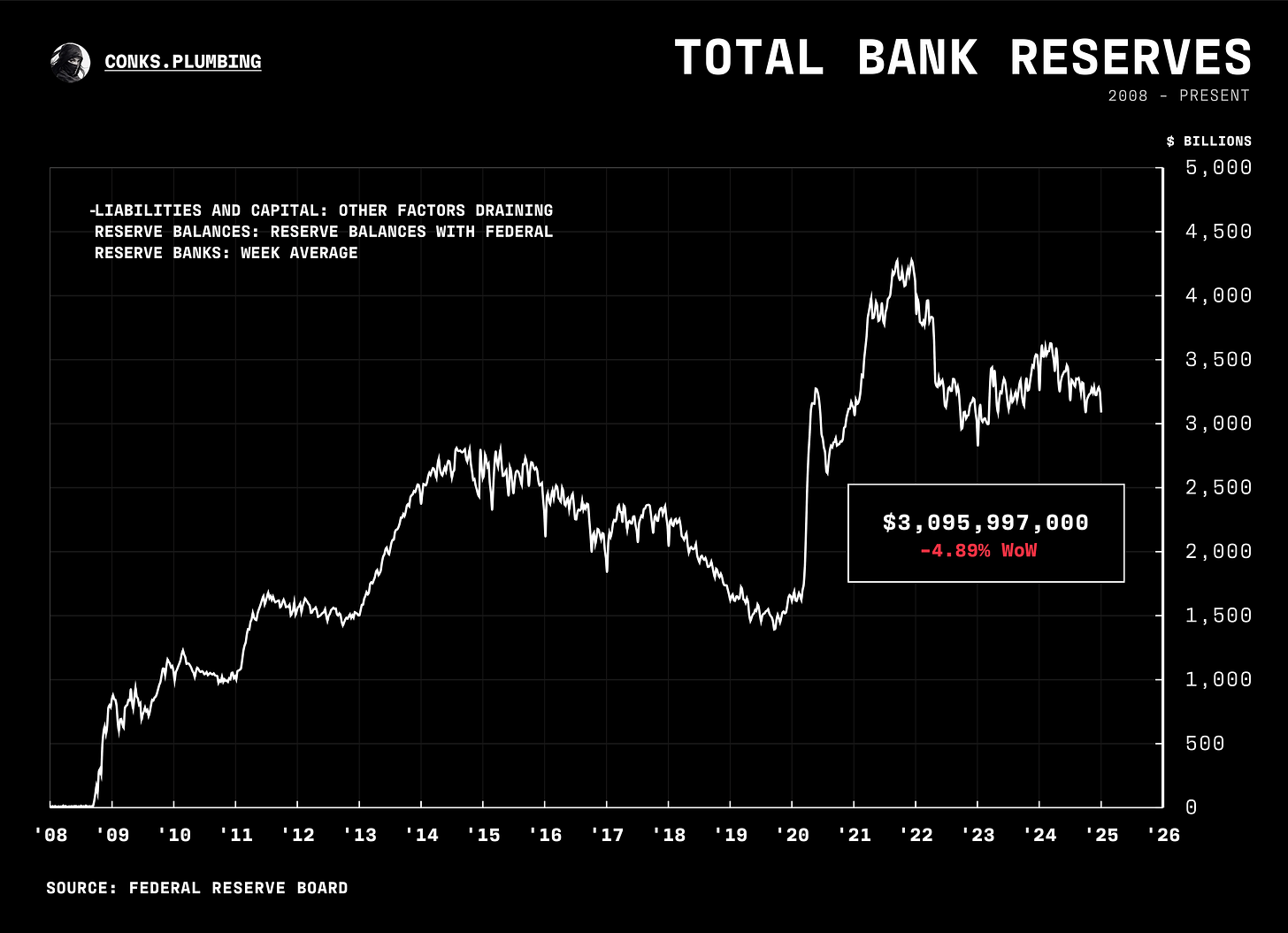

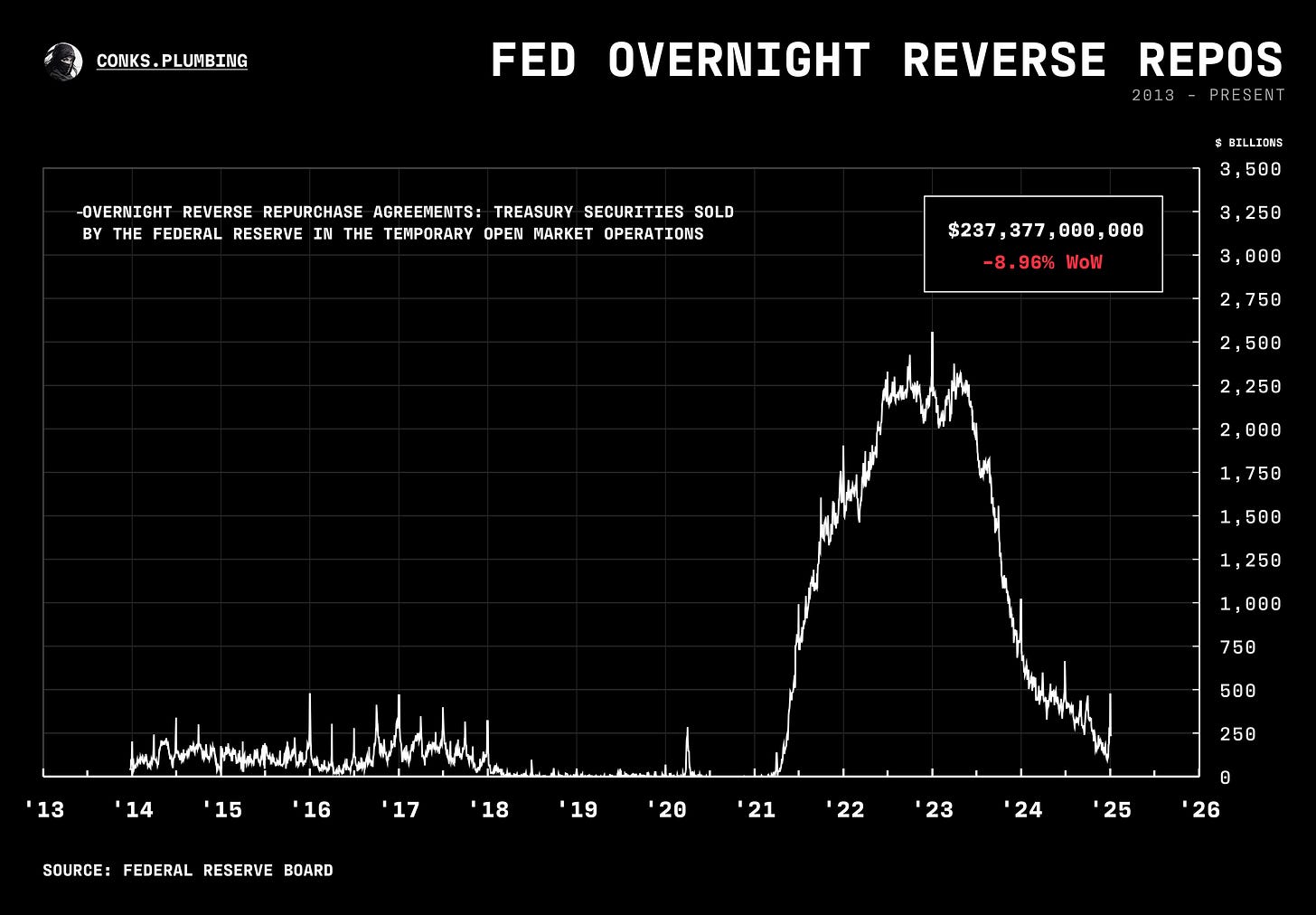

Despite these operations, as anticipated, we saw a spike in FX swaps conducted with the Fed (as JPMorgan’s immense stockpile of reserves couldn’t bridge all imbalances), a massive rise in Fed RRPs (as dealers rejected money funds’ cash balances to tidy their balance sheets), and a subsequent sharp decline in bank reserves (as an increase in Fed RRPs causes a decrease in reserve balances).

These flows will shortly unwind as money funds move out of the RRP and back into private repos, with dealers and banks now willing to offer balance sheet capacity.

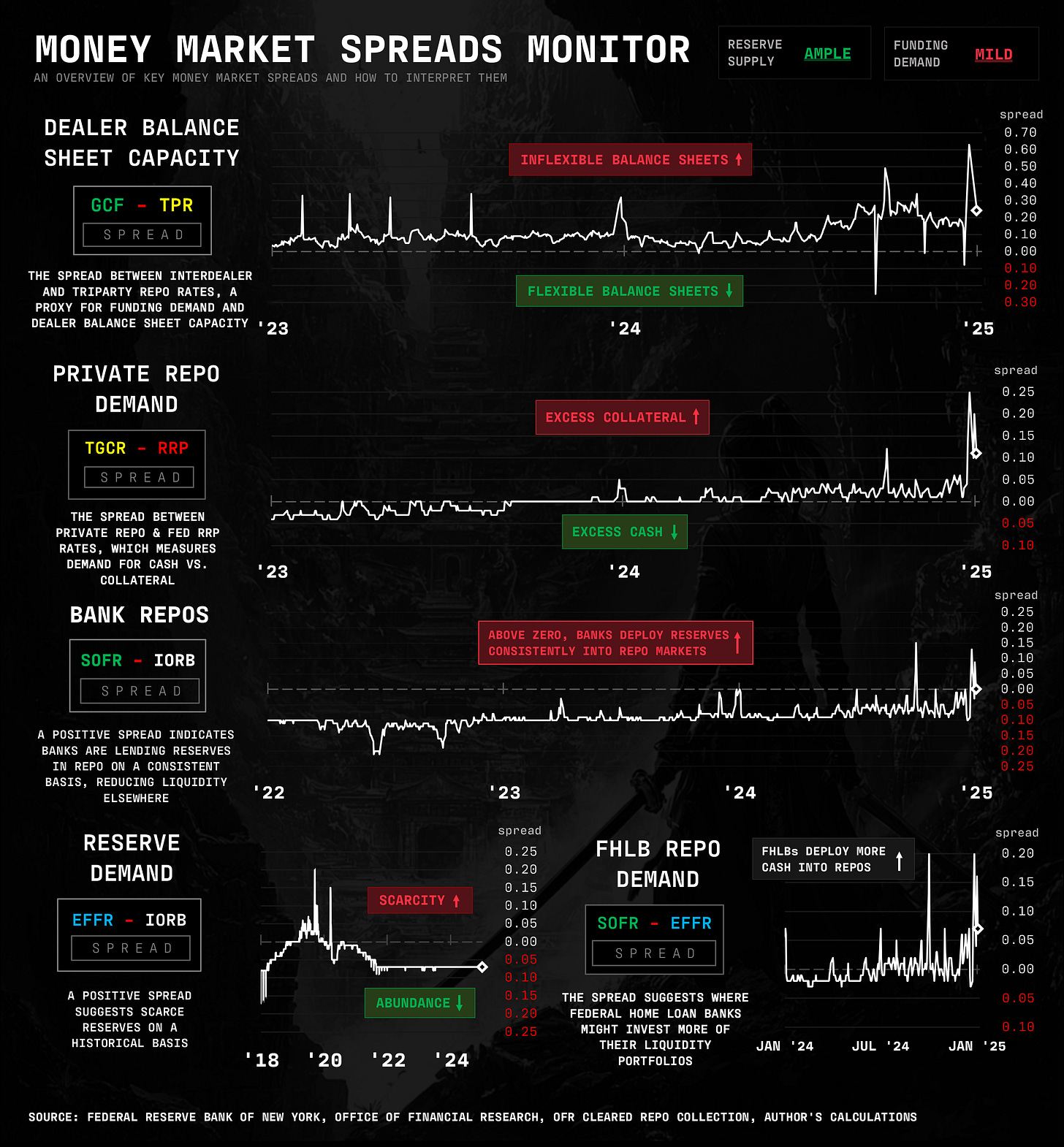

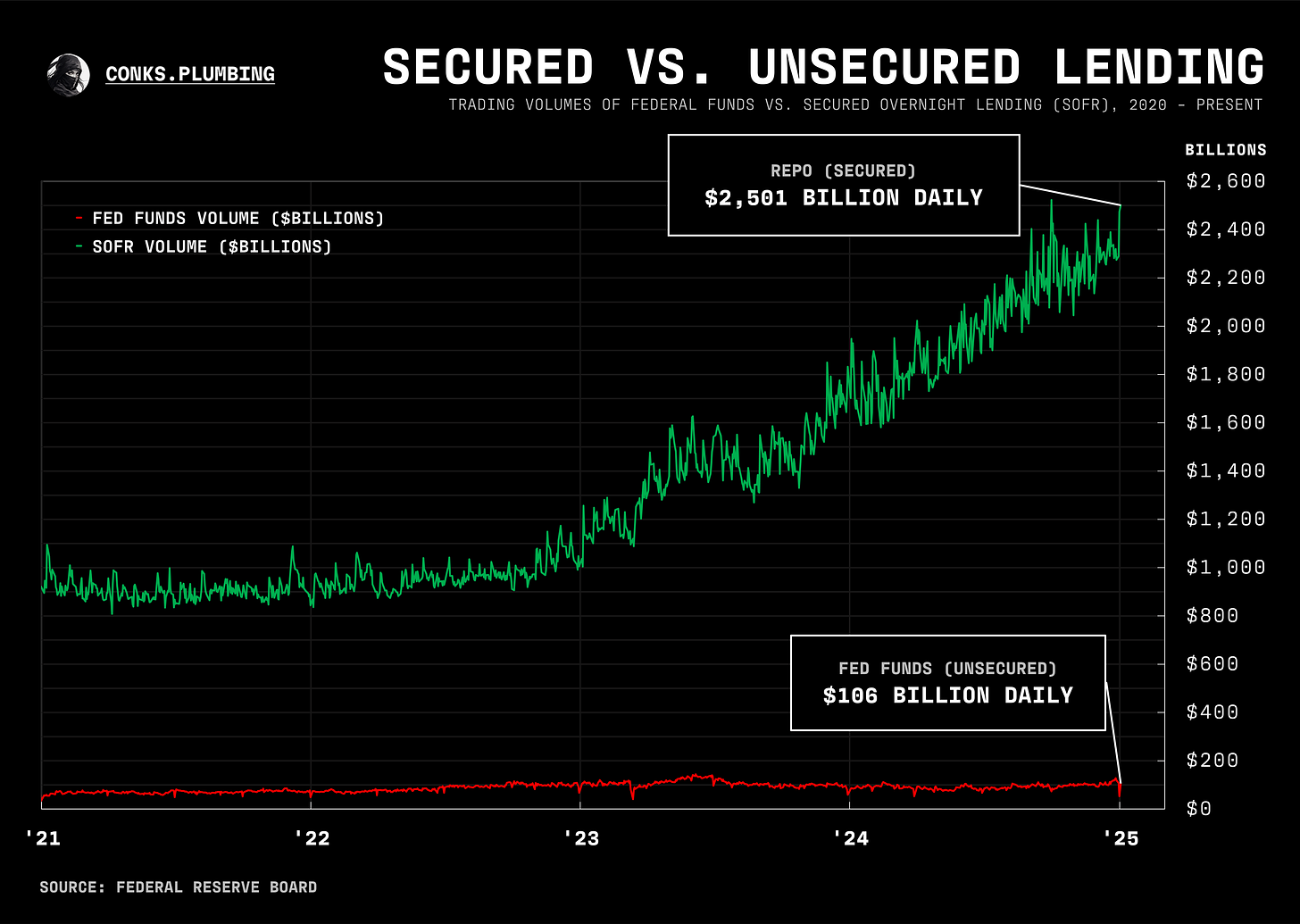

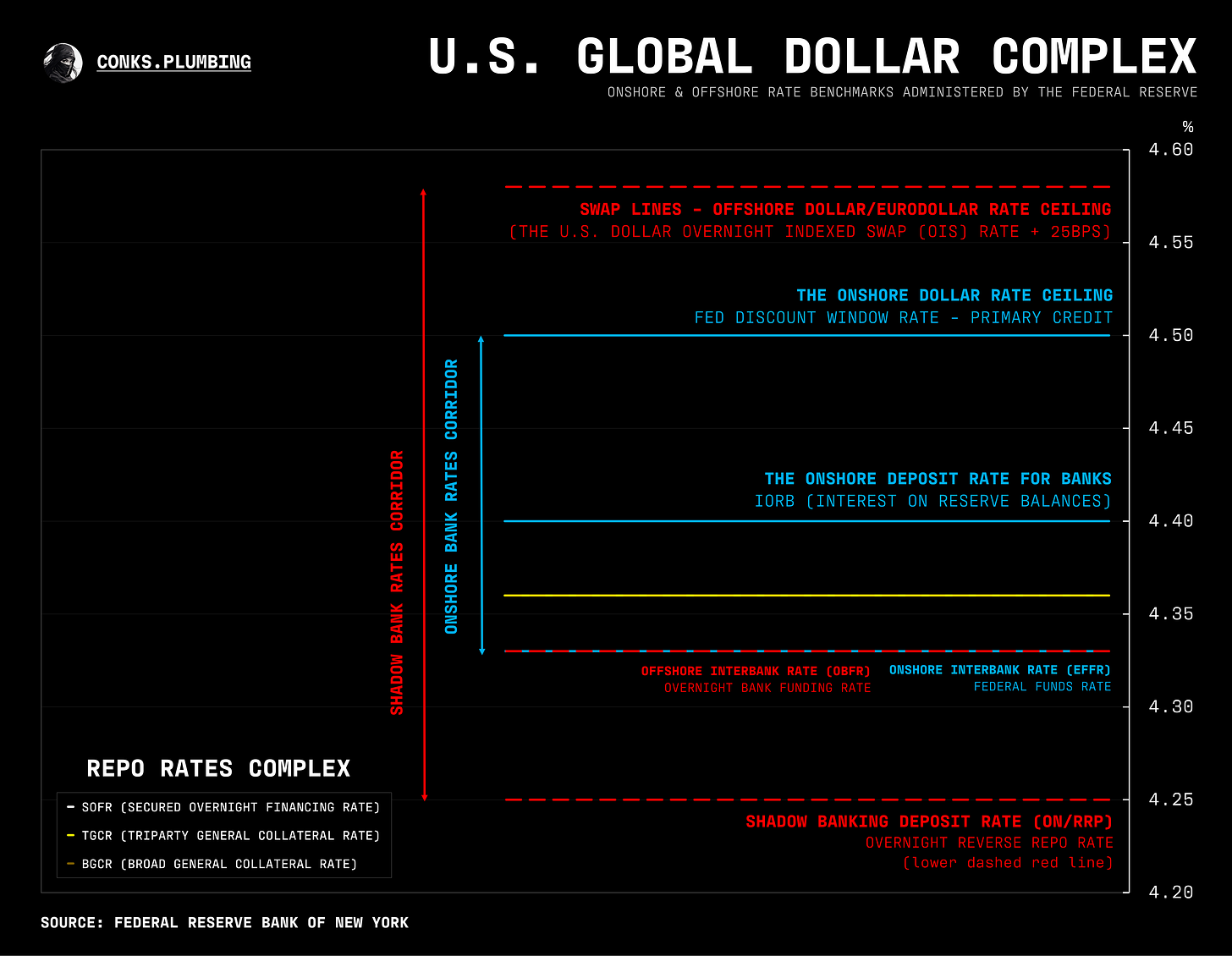

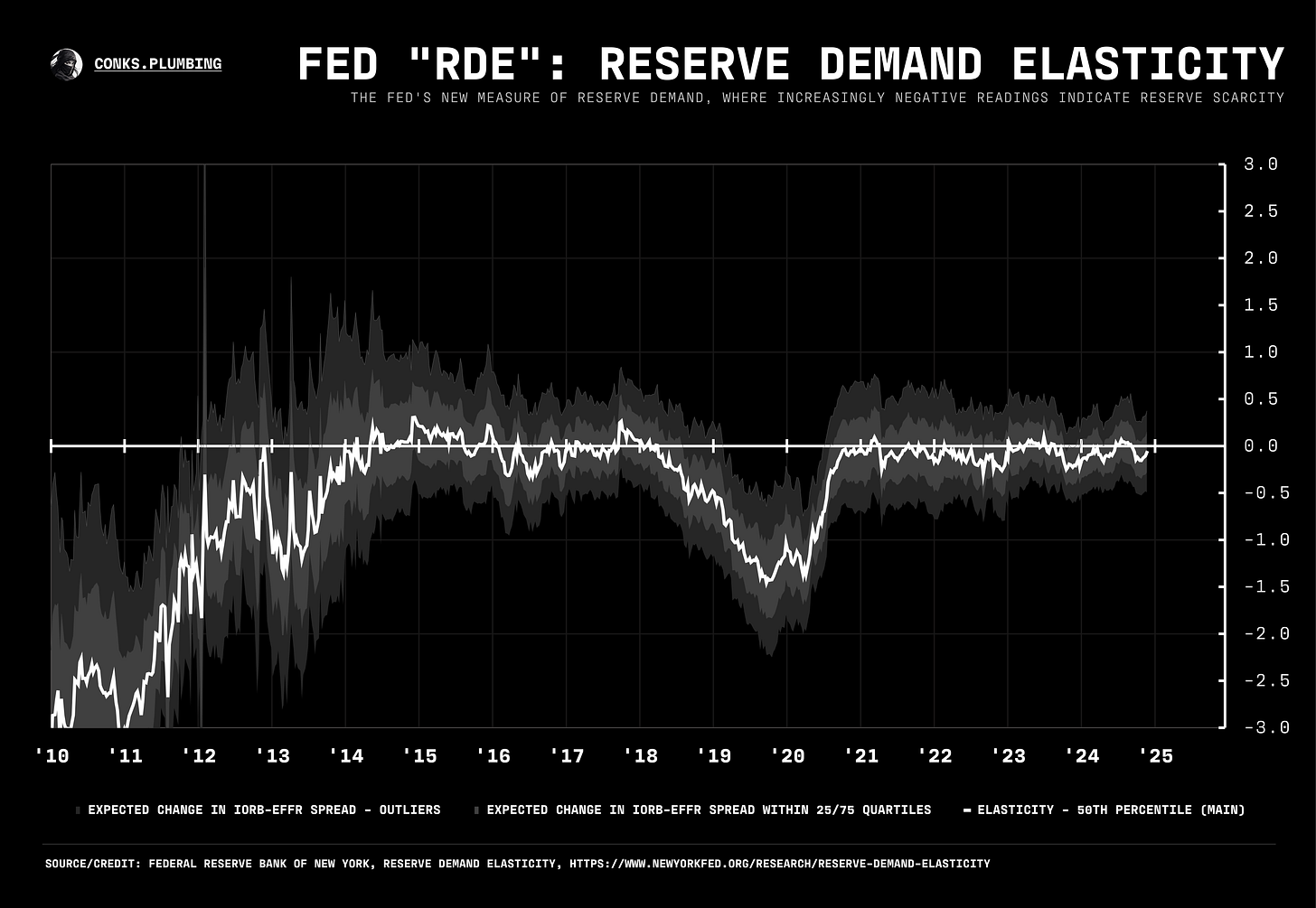

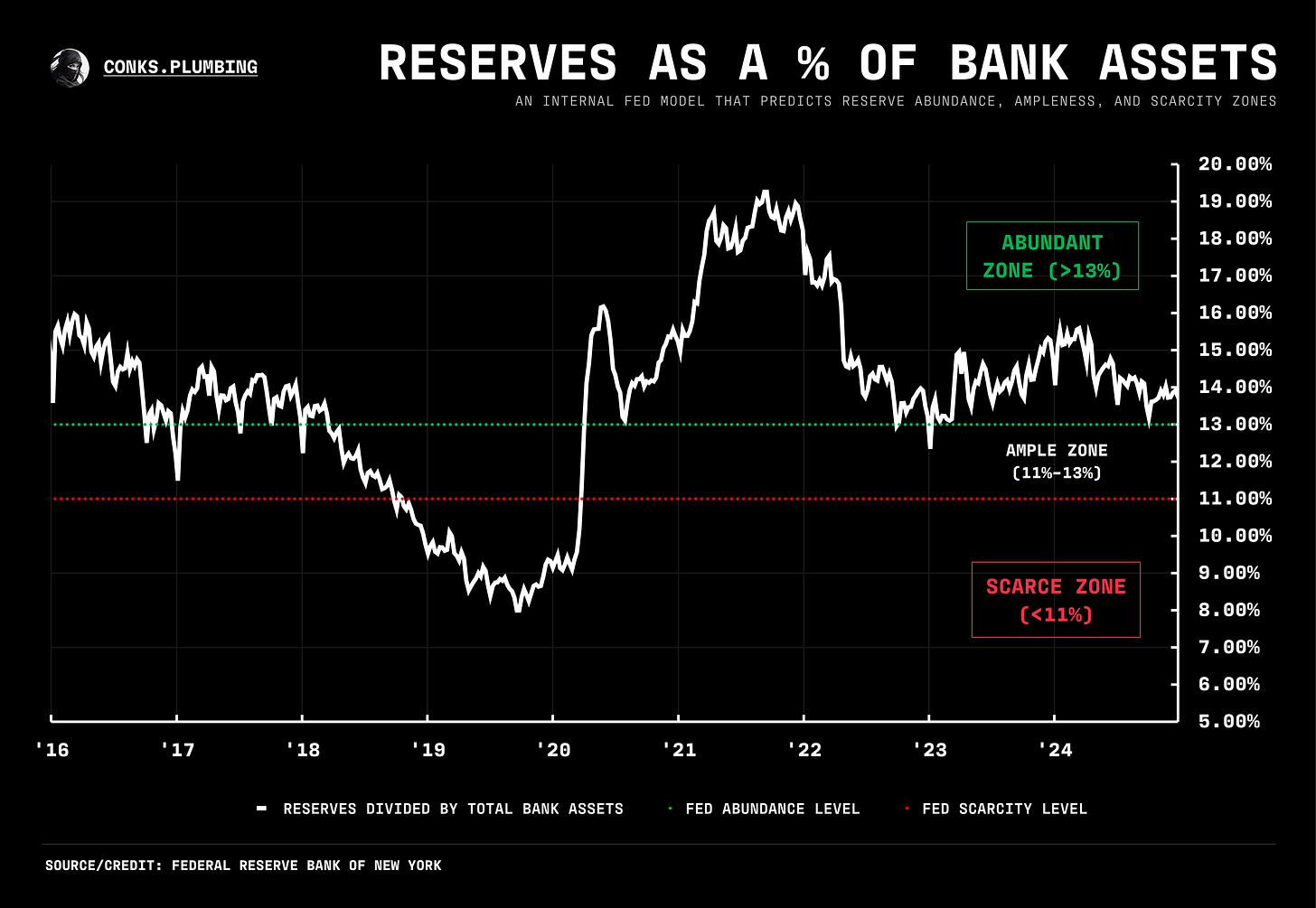

Moreover, EFFR (the Fed Funds rate) didn’t budge at year-end, further verifying that recent rate upheavals are funding-related, not down to the scarcity of reserve balances in Fed accounts.

Meanwhile, in macro markets, the sharp rise in the U.S. dollar index is not a sign of waning liquidity but the result of markets pricing in the Trump trade and relative weakness in Europe. Conks’ monitors (below) suggest “business as usual” for dollar liquidity and, thus, risk assets — i.e. up and to the right.

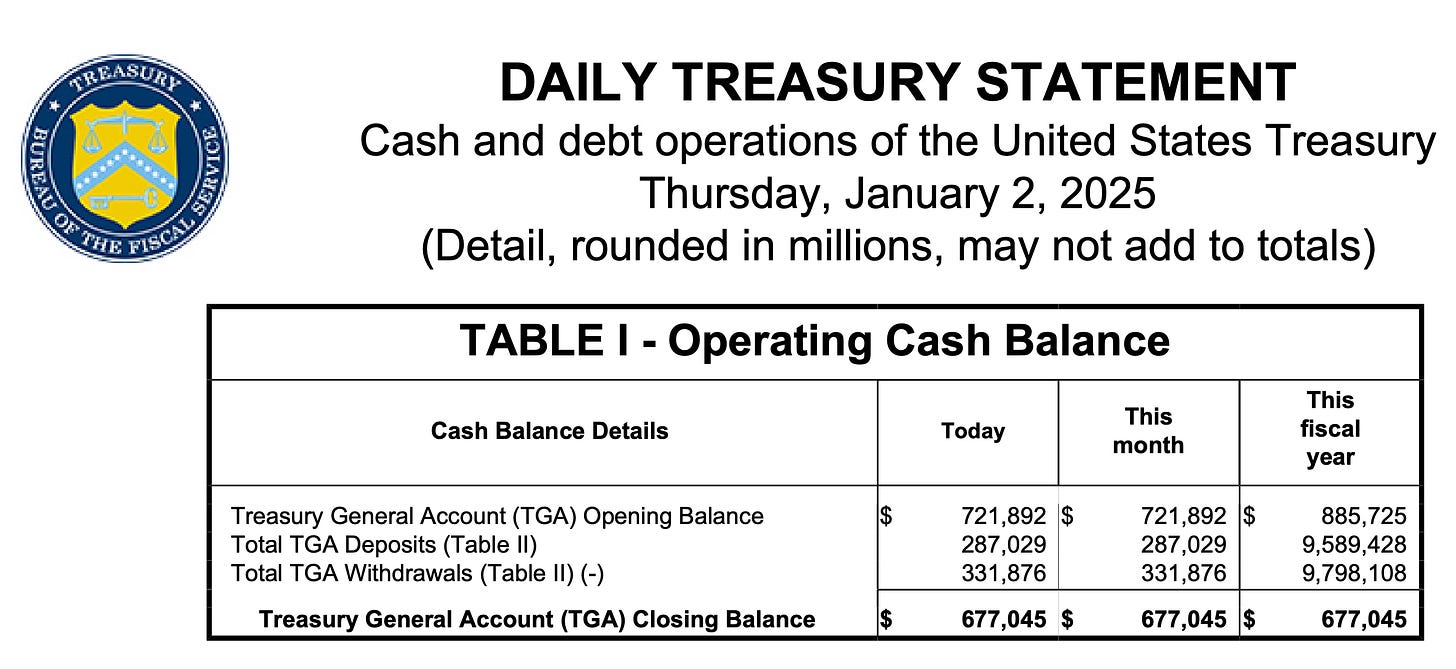

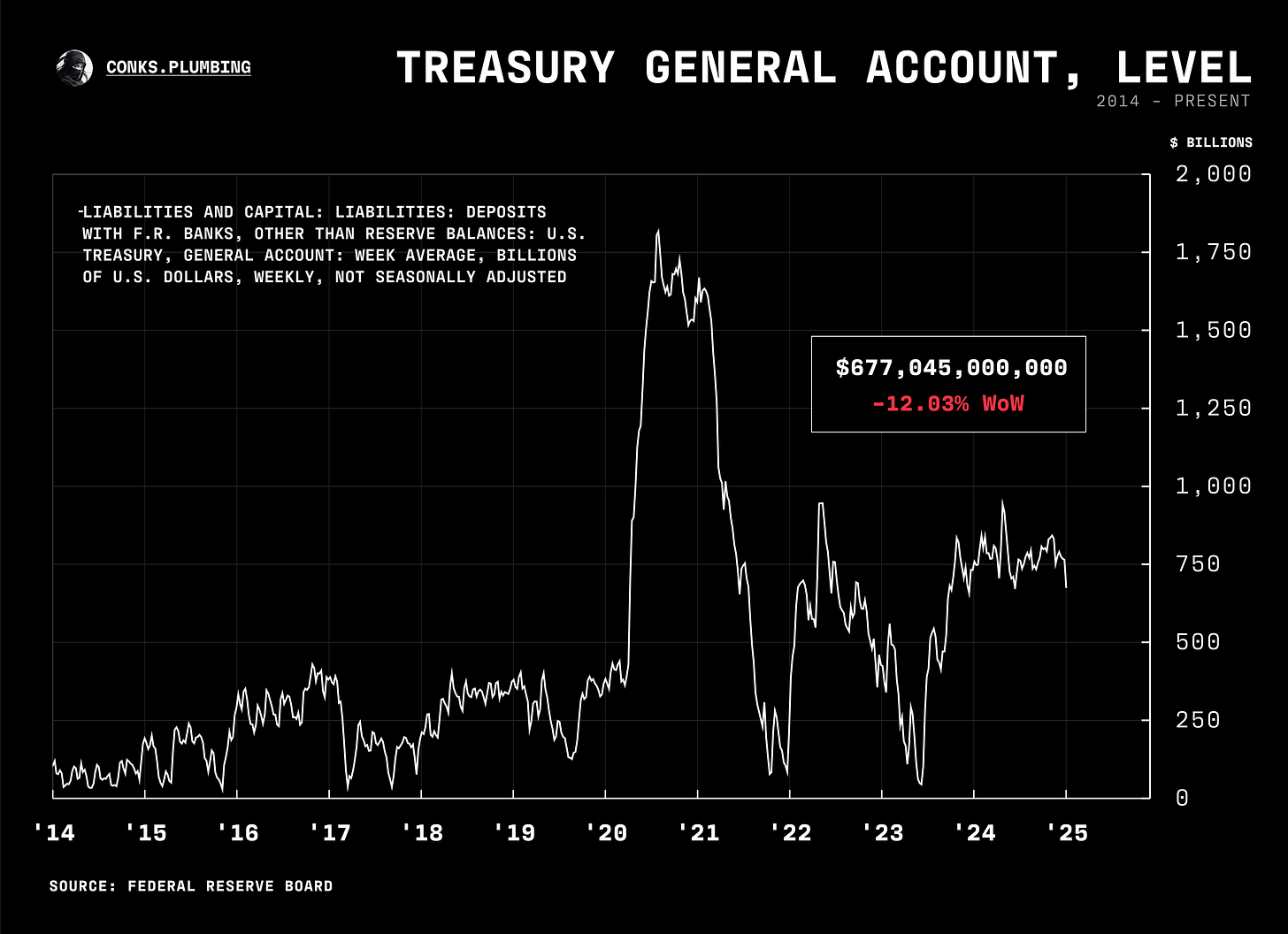

Lastly, the debt ceiling will become the most prominent theme in money markets until (and briefly after) a resolution has been reached in Congress. Interbank liquidity will rise as the TGA gets drawn down, yet this will not necessarily ease funding pressures. More on that later…

Now, for the chartbook (more monitors on the way)…

If you act on anything provided in this newsletter, you agree to the terms in this disclaimer. Everything in this newsletter is for educational and entertainment purposes only and NOT investment advice. Nothing in this newsletter is an offer to sell or to buy any security. The author is not responsible for any financial loss you may incur by acting on any information provided in this newsletter. Before making any investment decisions, talk to a financial advisor.

EFFR, OBFR, SOFR, TGCR, and BGCR are subject to the Terms of Use posted at newyorkfed.org. The New York Fed is not responsible for publication of tri-party data from the Bank of New York Mellon (BNYM) or GCF Repo/Delivery-versus-Payment (DVP) repo data via DTCC Solutions LLC (“Solutions”), an affiliate of The Depository Trust & Clearing Corporation, & OFR, does not sanction or endorse any particular republication, and has no liability for your use.

The FX Swap operations over year end look only to be just over $1B with ECB, does that (relatively) tiny amount for an FX Swap really make any difference ?

Thanks Conks. Why is your LCLoR higher than the Fed's? I know you've talked about this, iirc it's in anticipation of a TGA refill sometime down the road. Was curious if there is any other reason.

Cheers.