Money Market Update

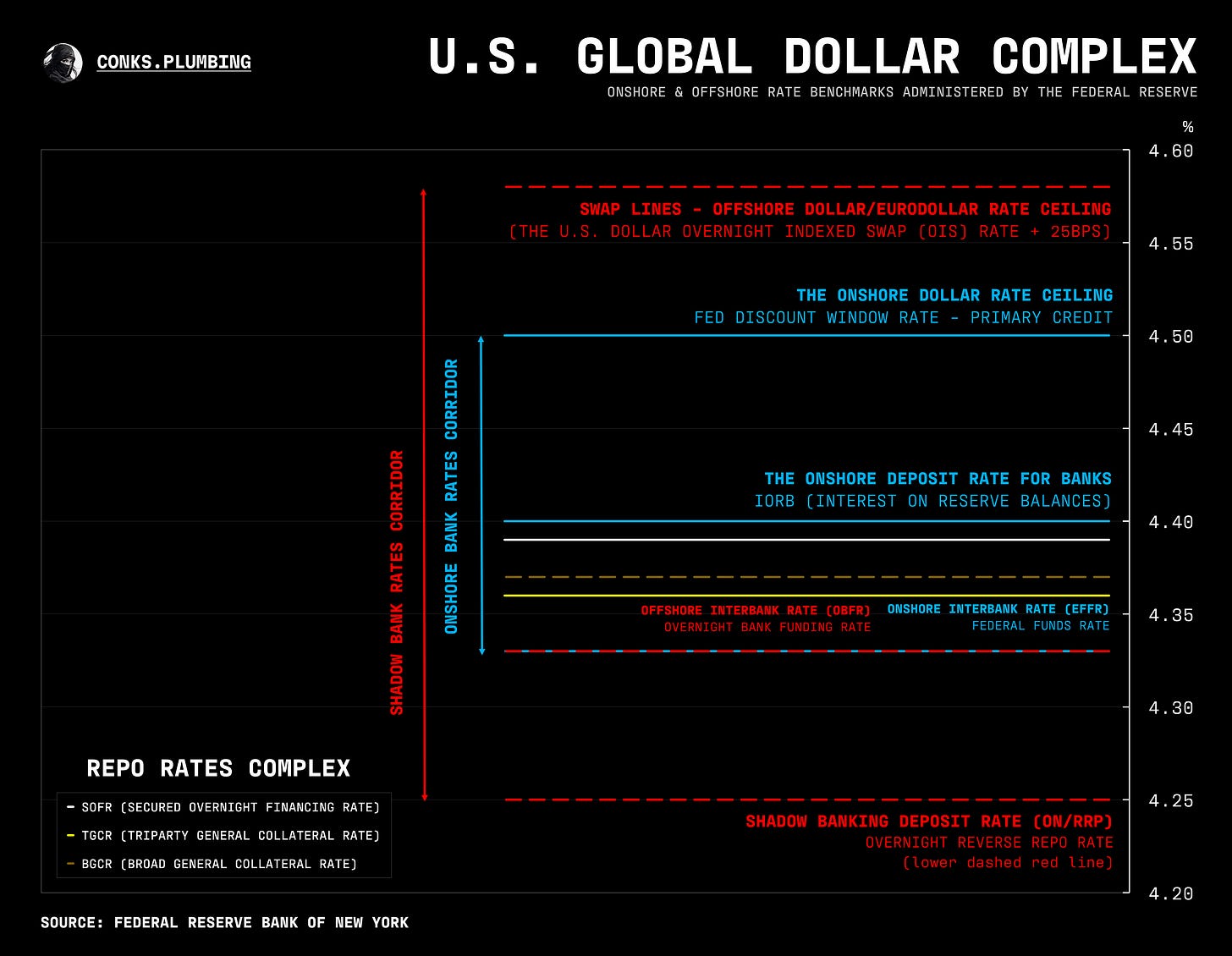

as Trump's tariffs consume the headlines, funding pressures in money markets persist while an unwind of deregulatory hype (i.e. a re-tightening of swap spreads) continues to play out

Welcome to another Conks update. In case you missed it, our latest infographics went live recently.

Meanwhile, we have decided to get it out of the way and open the Conks Store! As requested, more goodies, including infographic prints, will be added by the end of this year.

Not only have we become a Shopify “expert” over the past few weeks, but we have also been developing a Conks Pro version for each future theme we cover. For more info on this, message below with “I’m interested in Conks Pro” and we’ll send you the details once they are set in stone.

And with that out of the way, let’s get into the money market update…

Summary & Brief Commentary

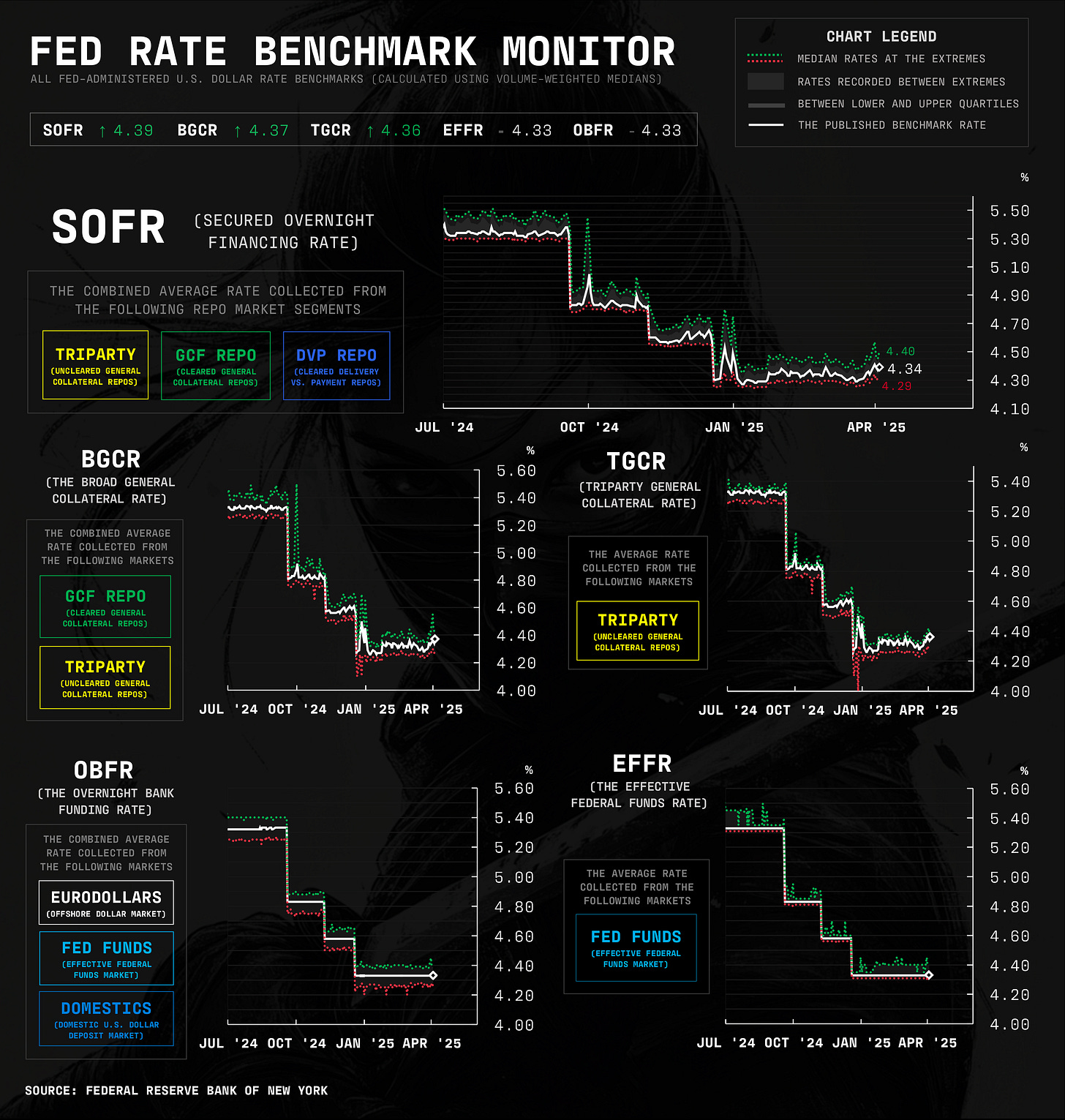

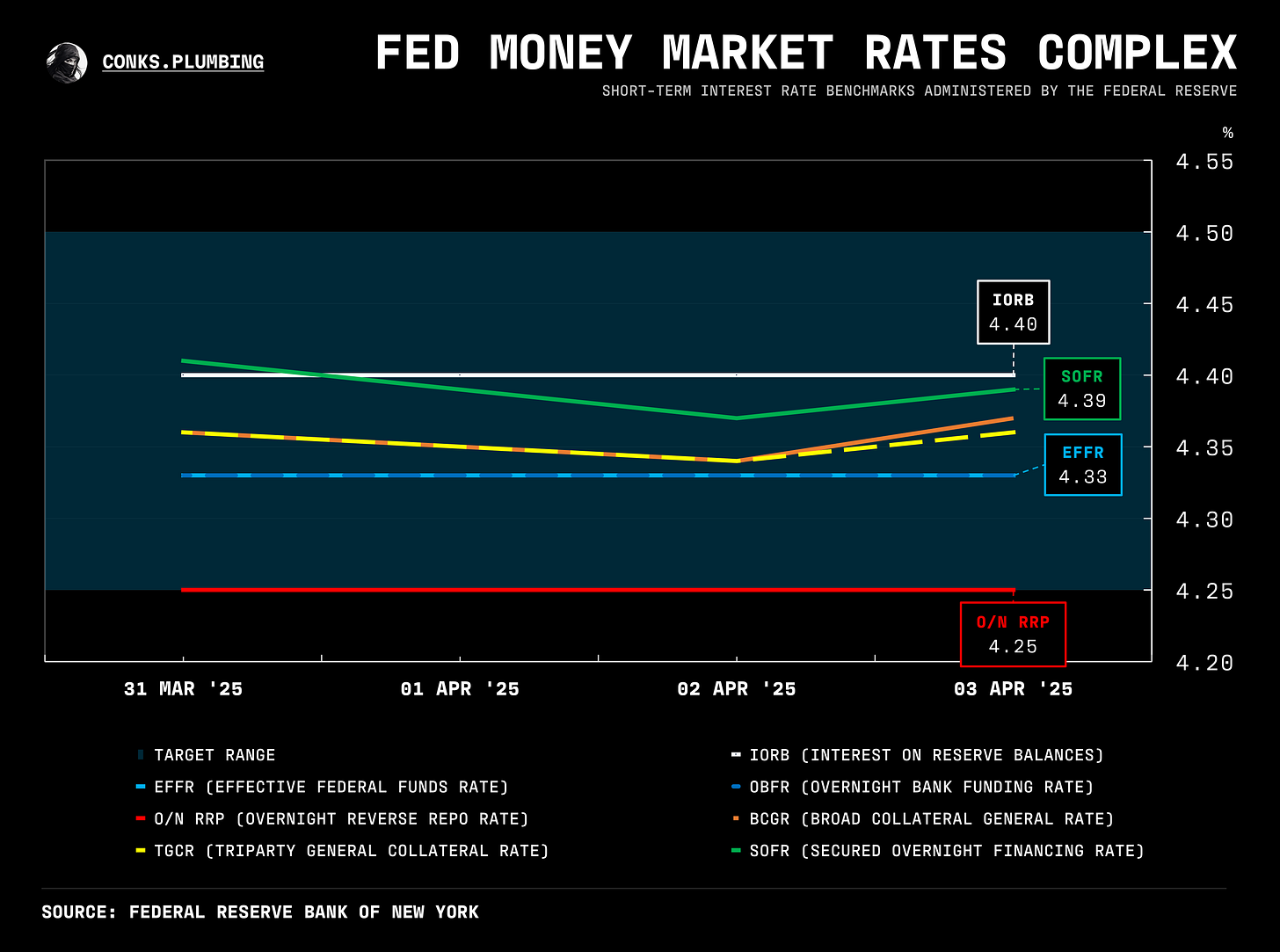

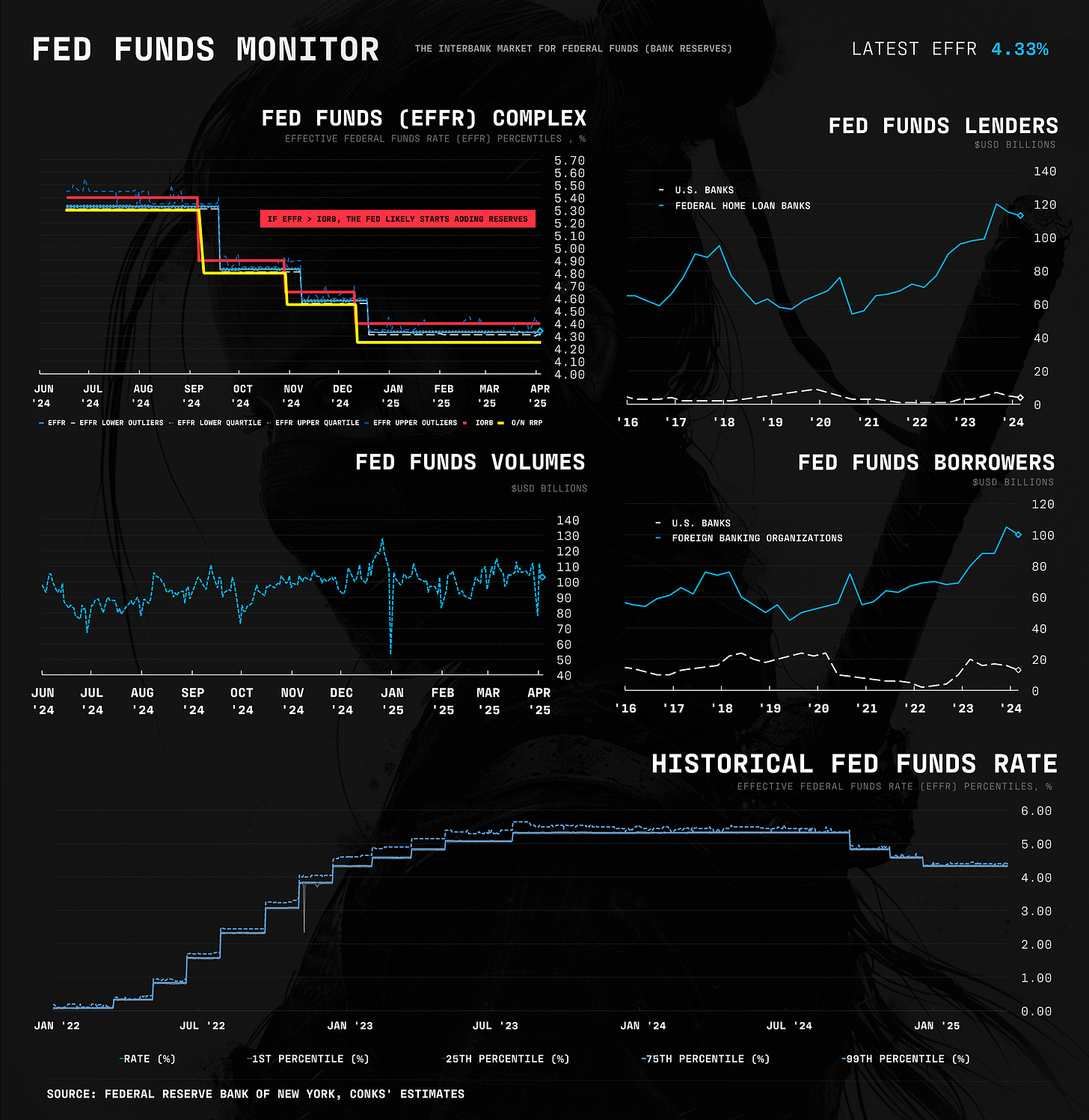

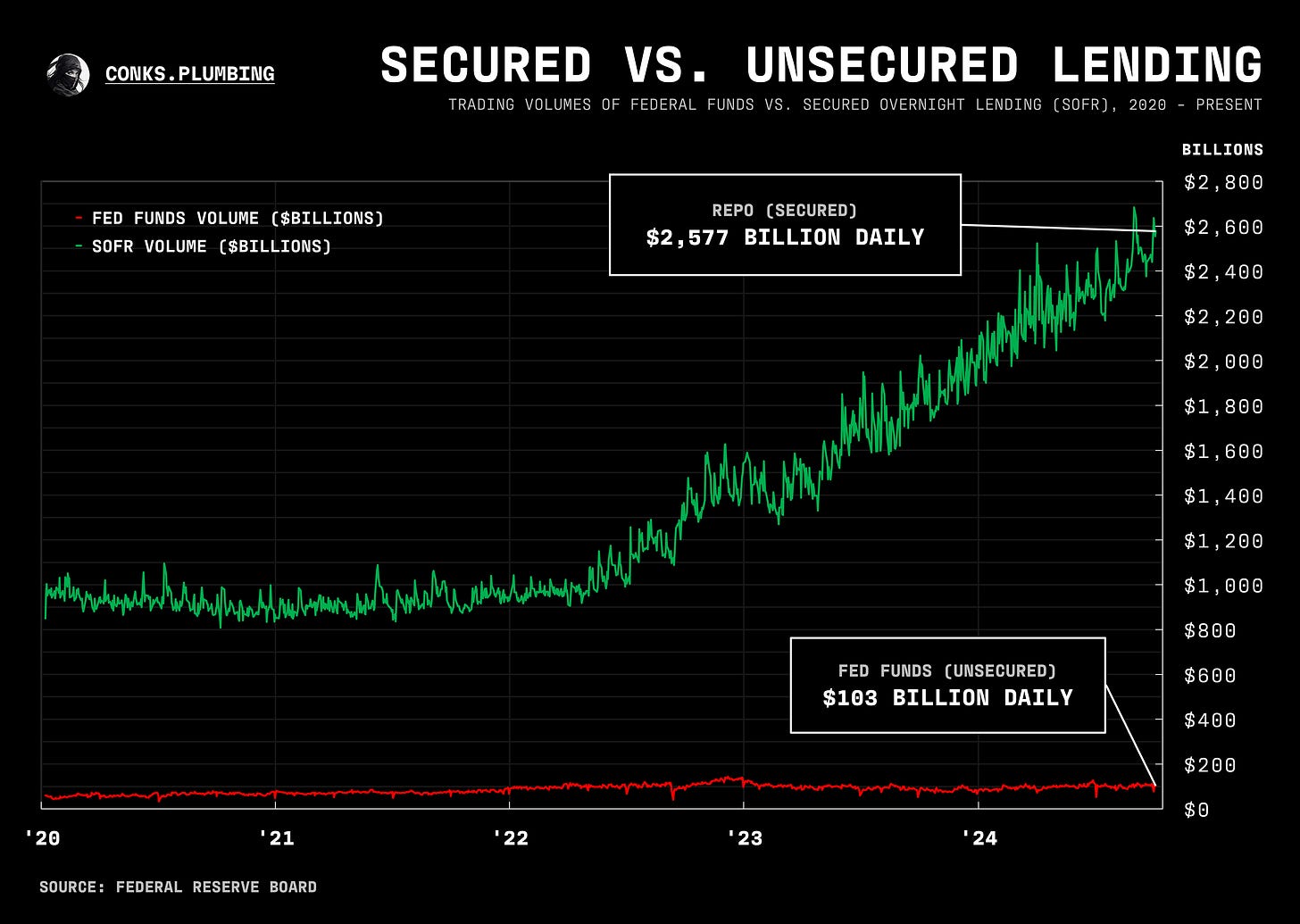

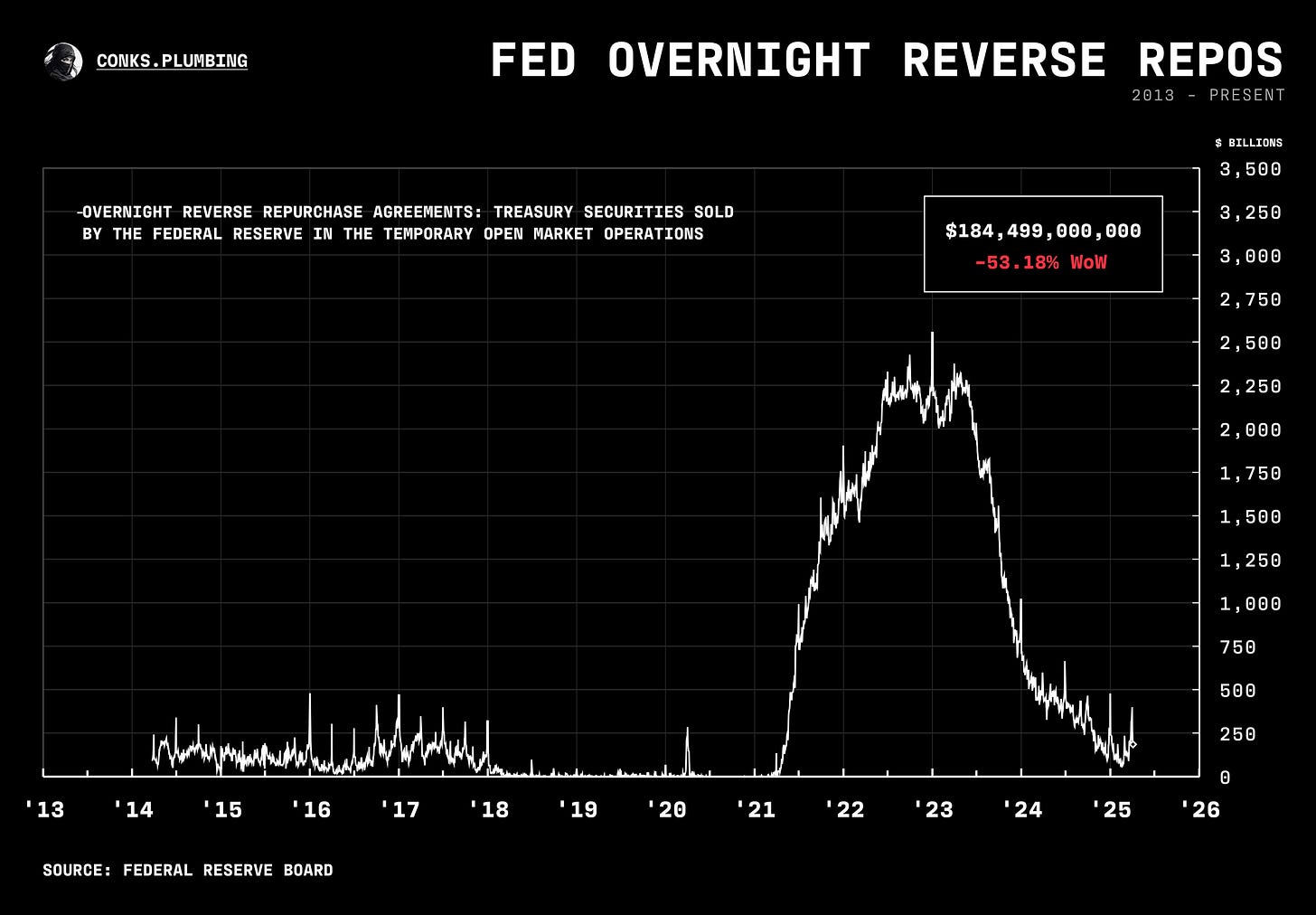

Instead of a full QT pause, the Fed executed a “QT slow” or quasi-pause. This was much less than the market expected, as continuing to long the SOFR-FF basis (shorting the SOFR-FF futures curve) paid off once again.

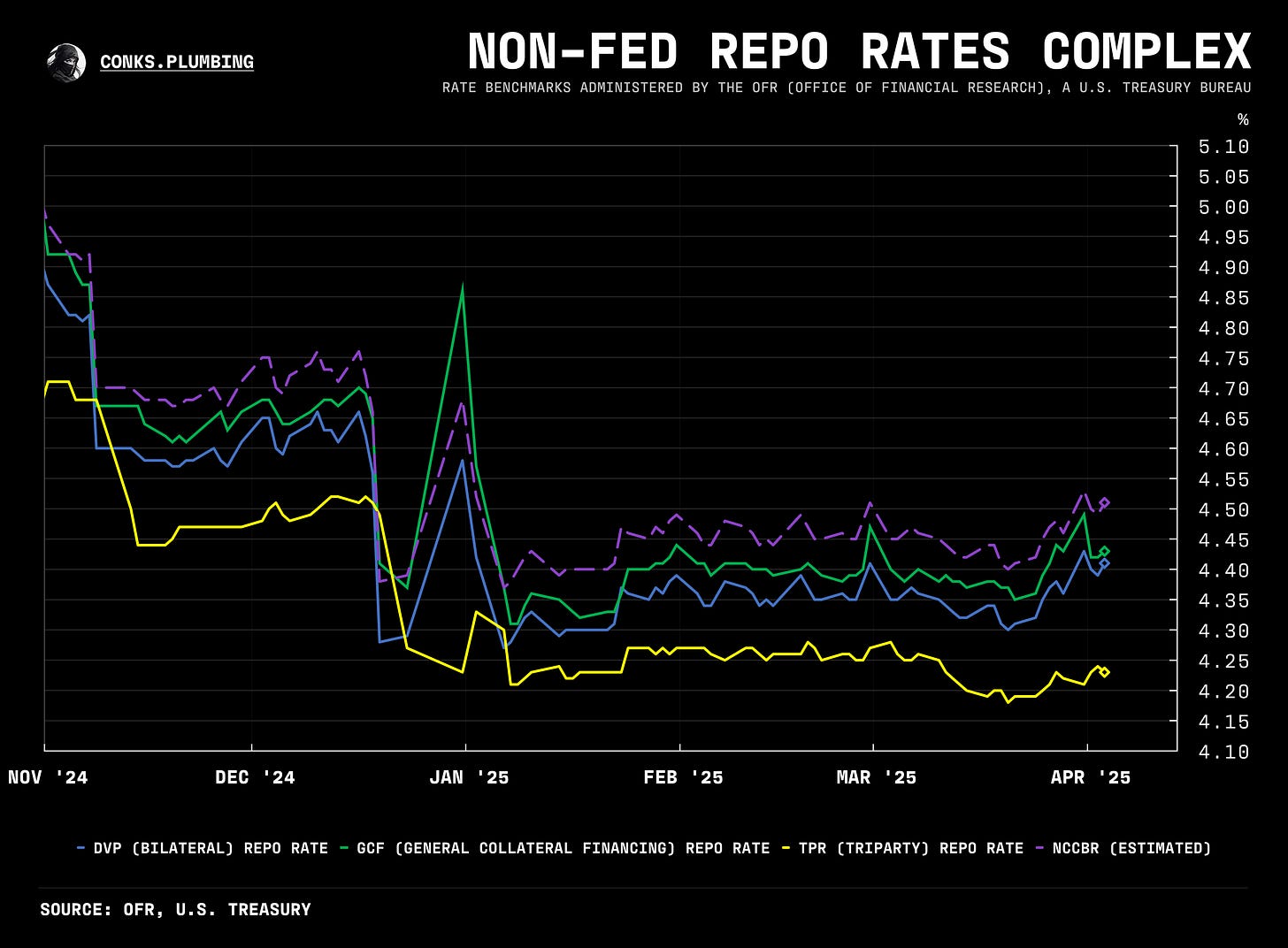

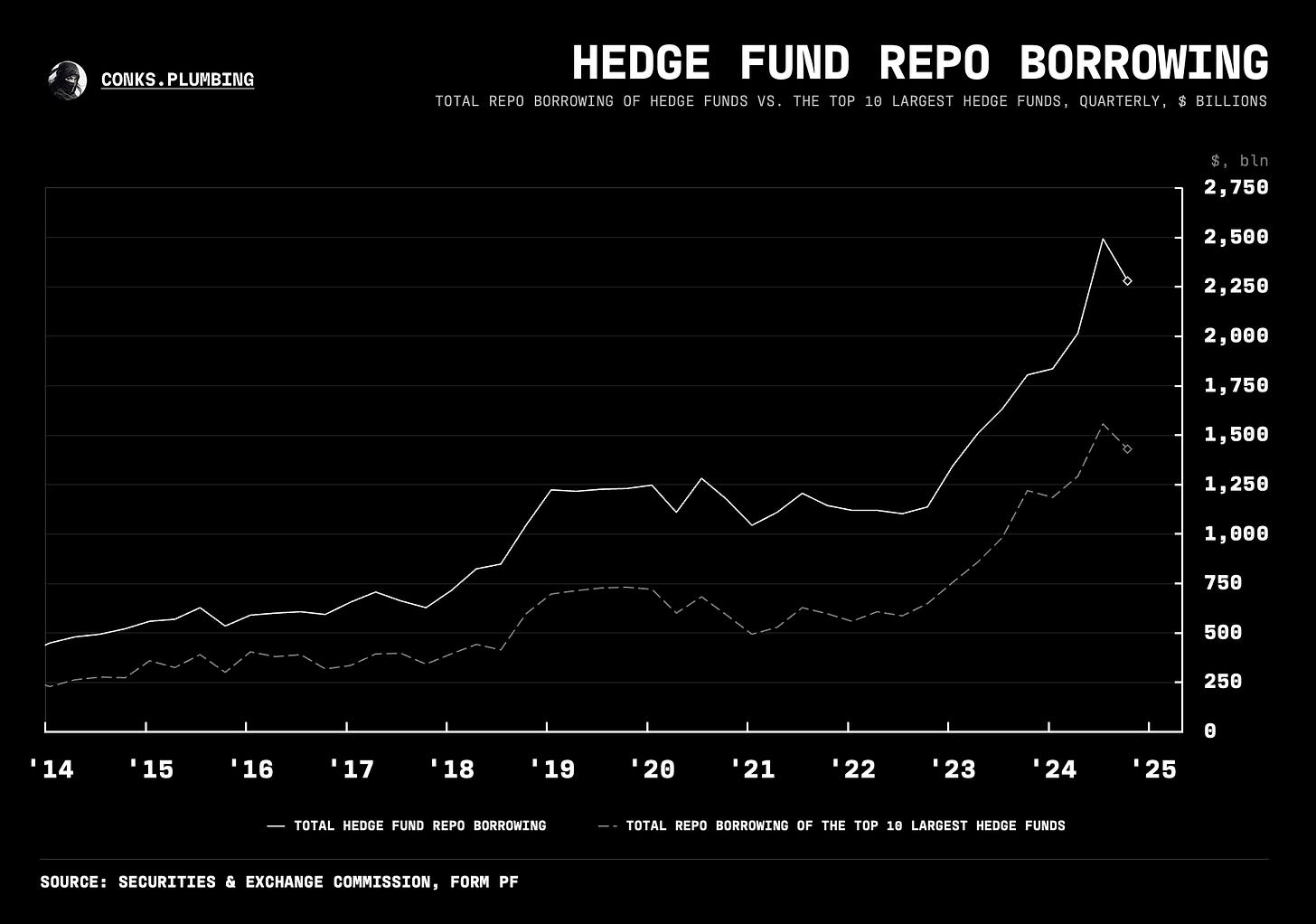

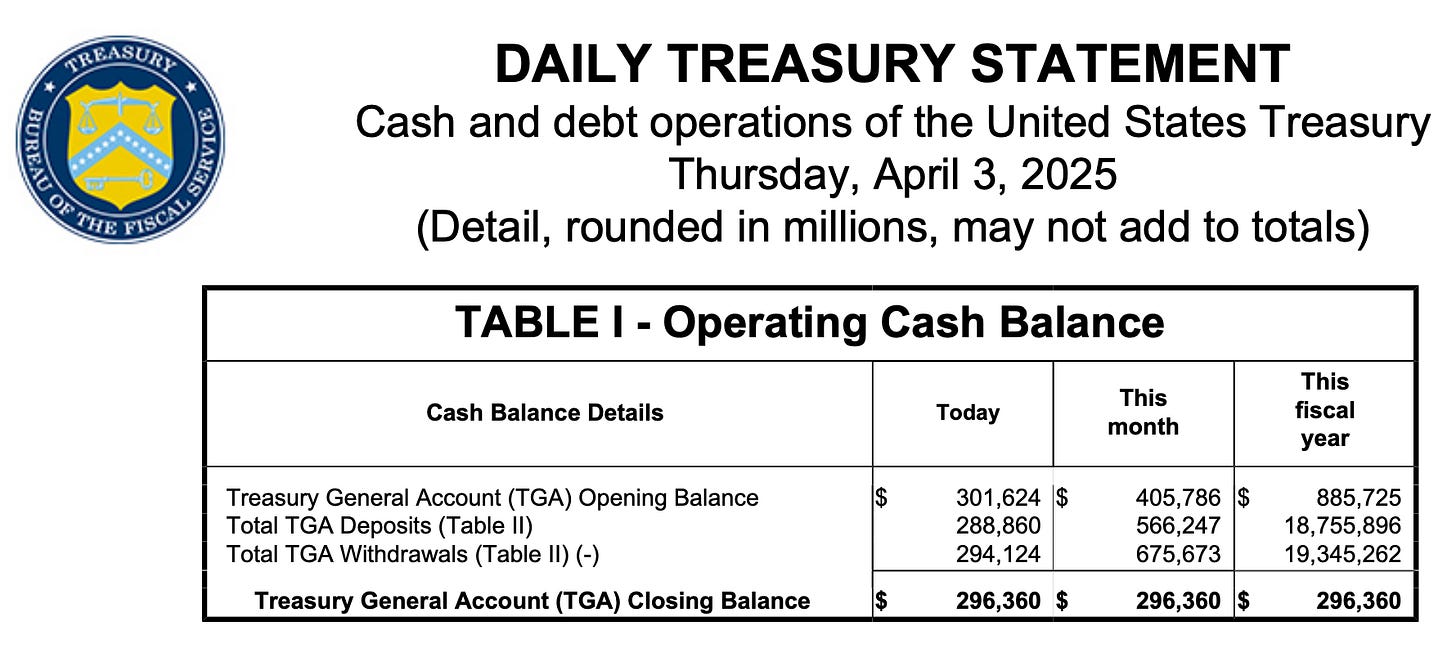

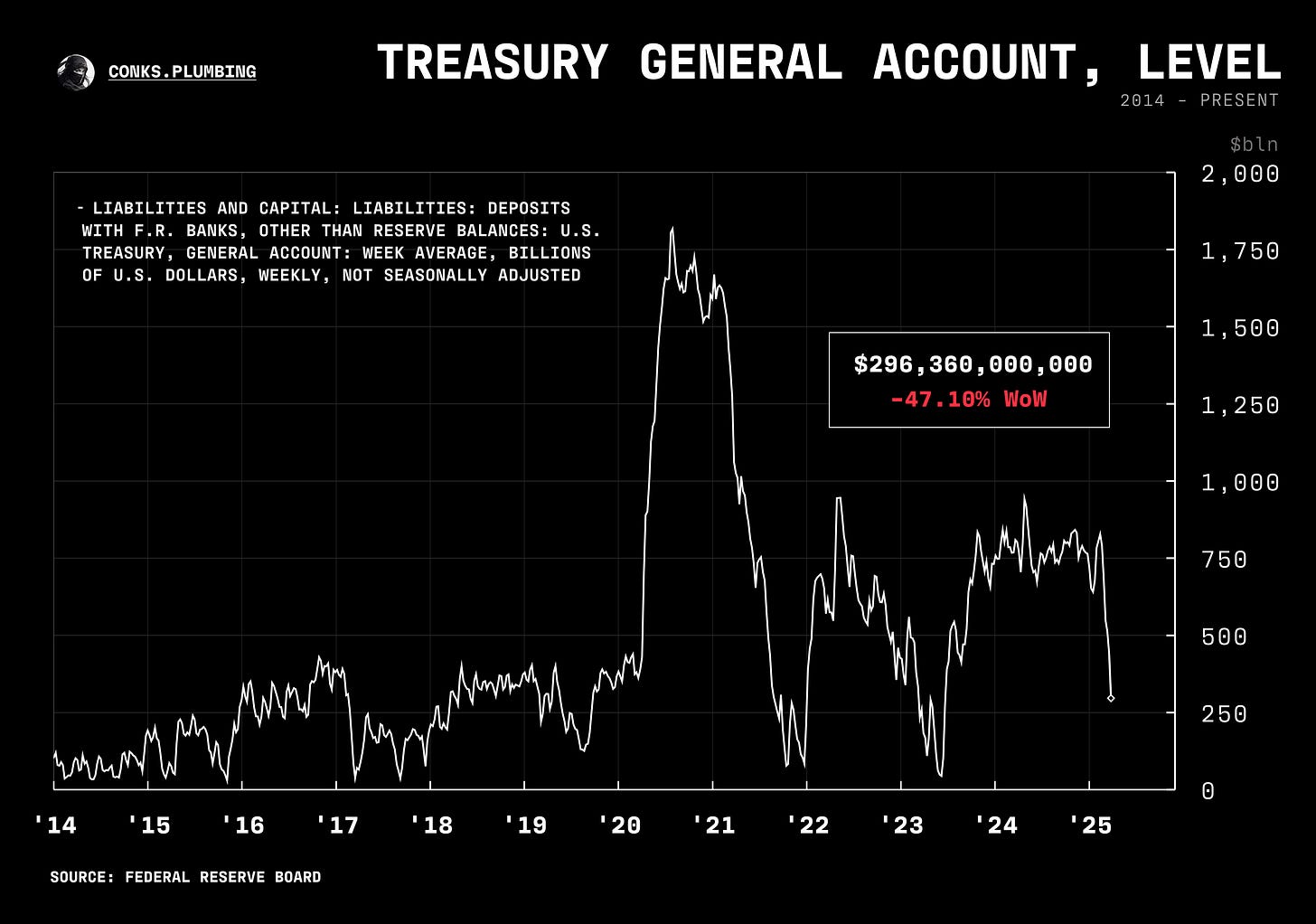

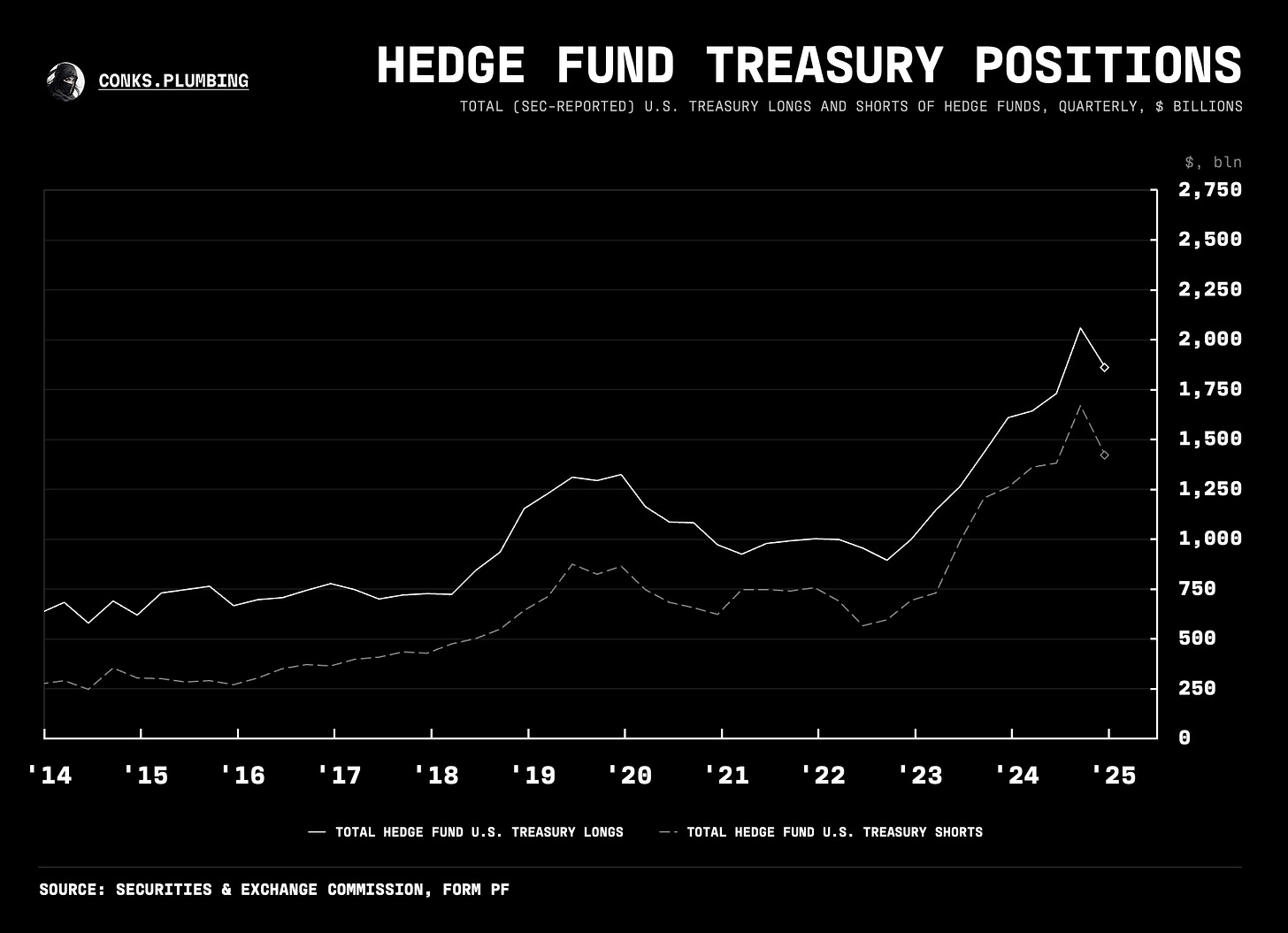

Going forward, the Fed reducing its runoff to only $5 billion in USTs (U.S. Treasuries) will likely reduce cash-futures basis trade opportunities and volumes. Coincidentally, hedge fund repo borrowing (a major part of the basis trade) seems to have peaked late last year (as seen in the chartbook below).

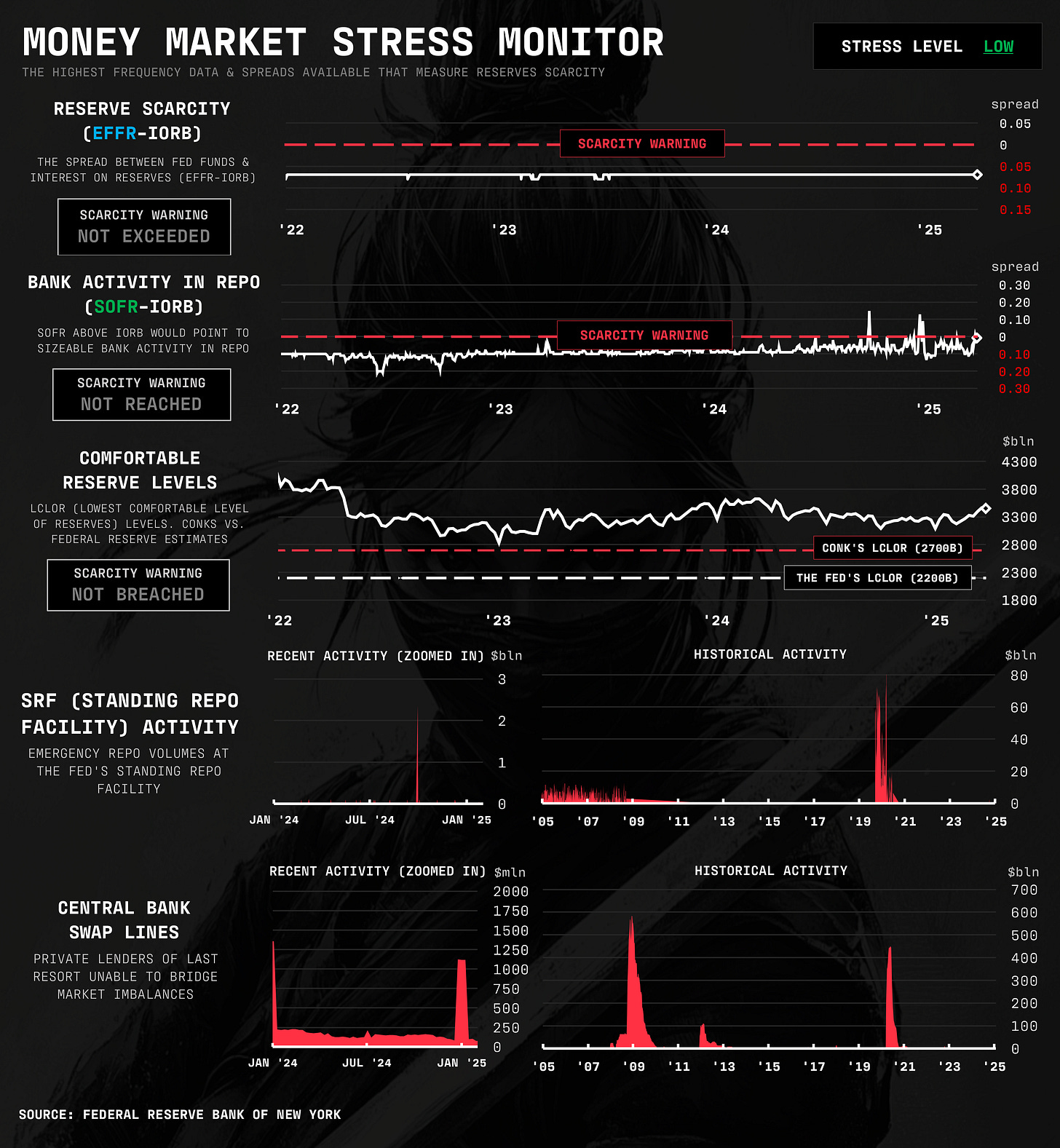

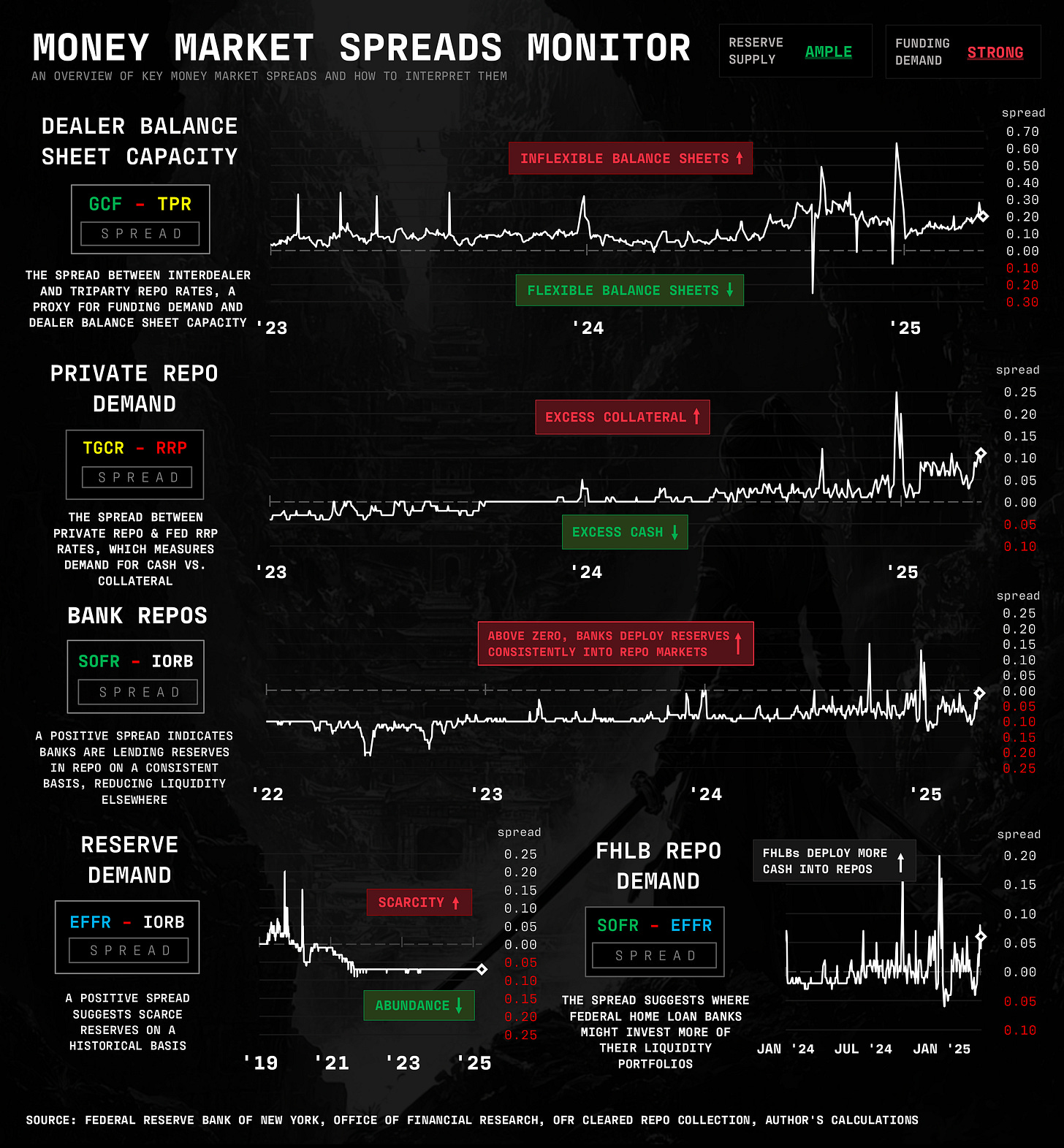

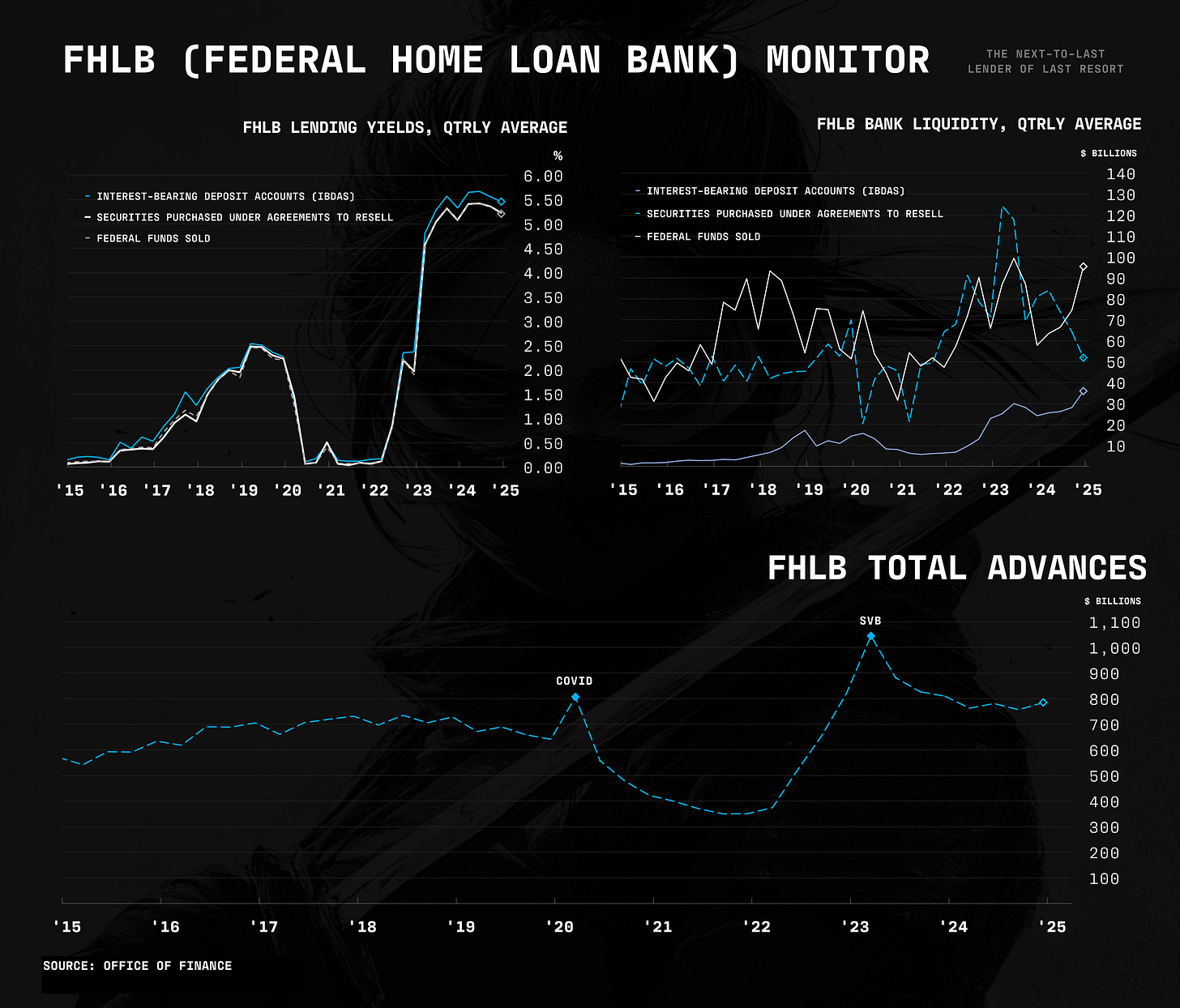

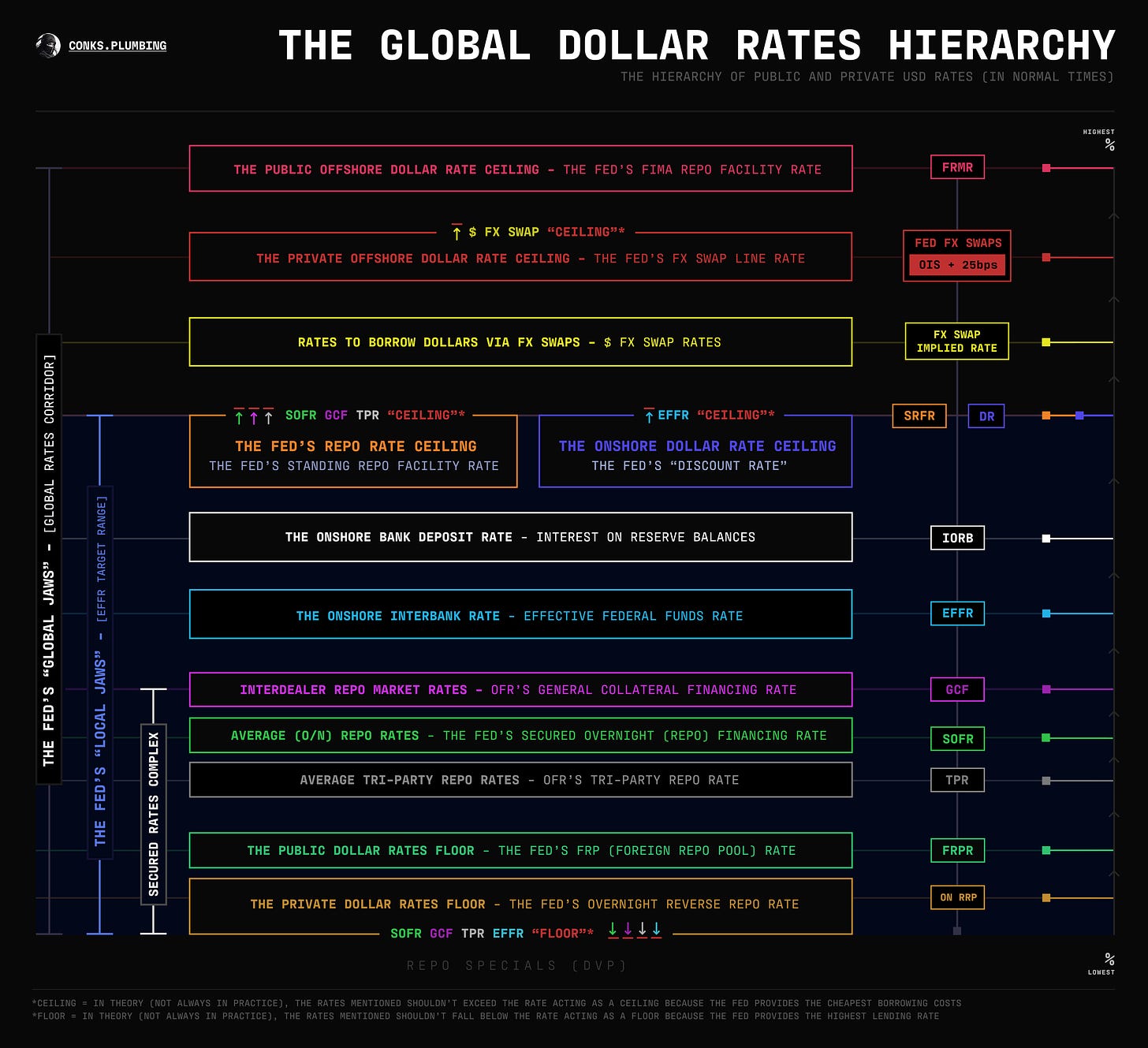

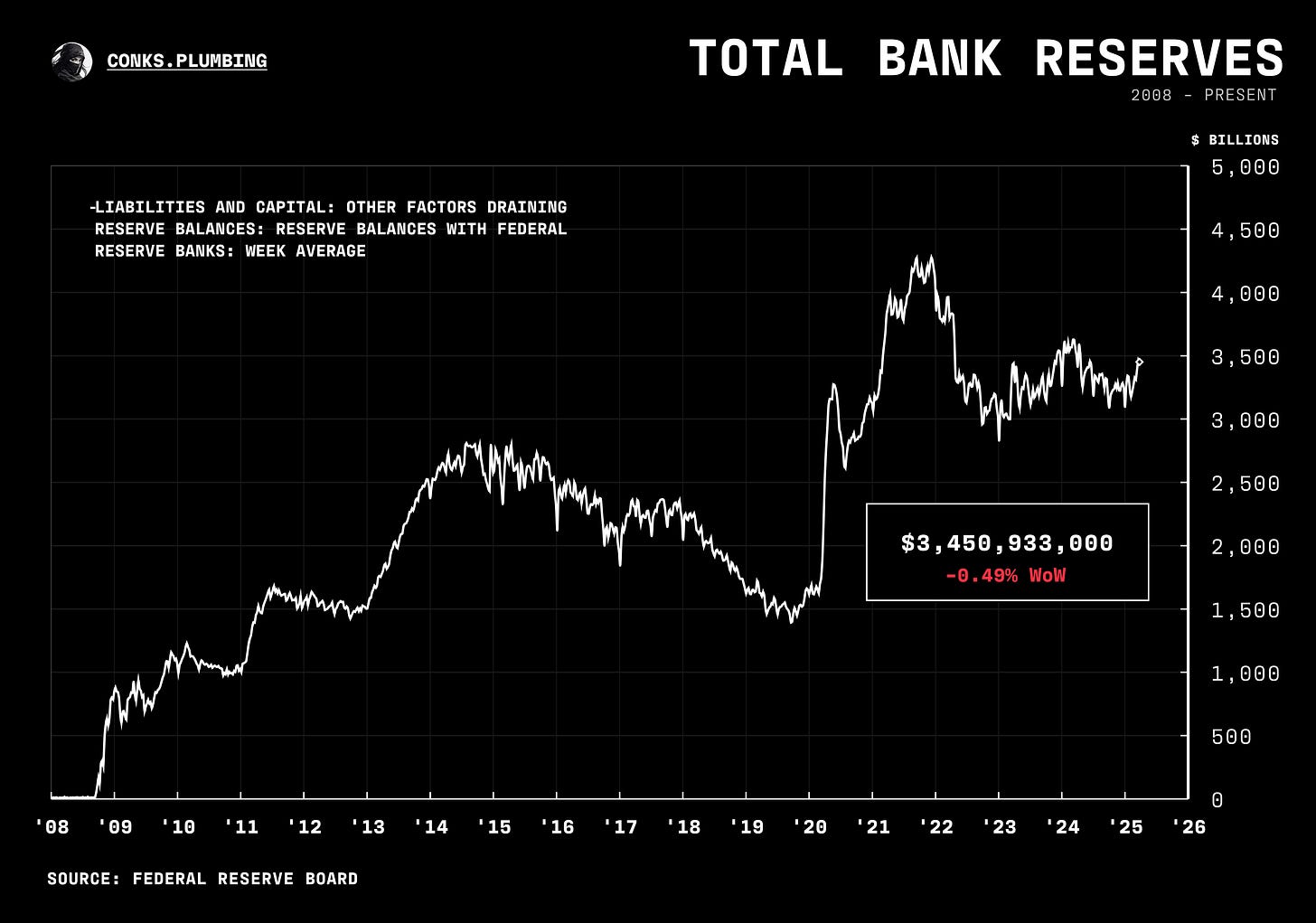

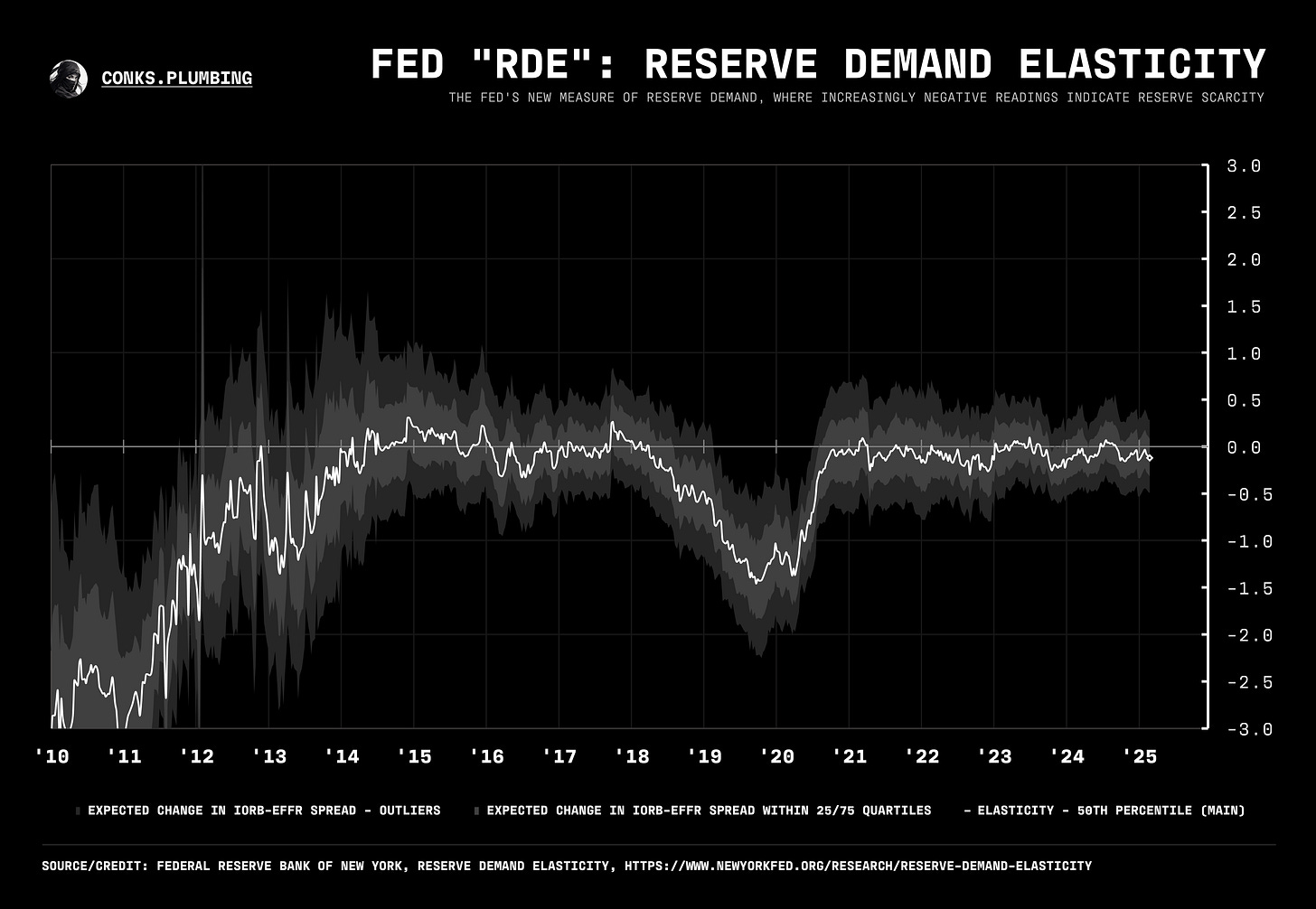

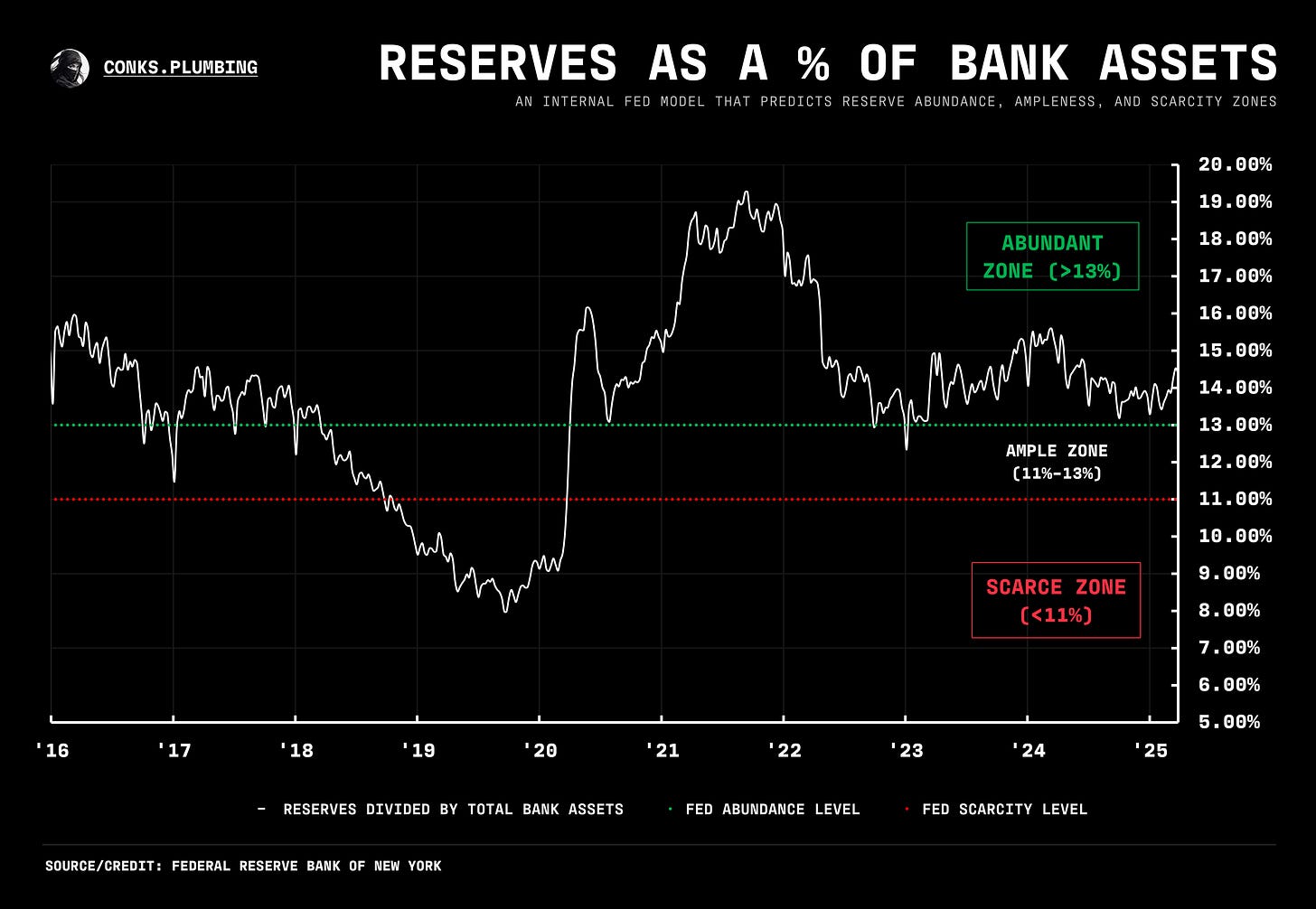

Even so, pressure on money market rates has come from demand for repos rather than scarcity of reserves. Glancing at our proxies on the money market spreads monitor (below), dealer balance sheets remain constrained — presumably less so on the “equity repo” side after last week. The latest FHLB data (see the FHLB monitor) reveals increased demand from megabanks for intraday liquidity via higher IBDA volumes. Yet, all other measures we track show no imminent need for reserves.

As for general liquidity, we maintain the same views as our last update. This is plainly a selloff driven by macro events, exacerbated by structural market forces: “General macro liquidity … remains ample. Yet, this won’t suffice against U.S. heads of state prompting a selloff for the greater good — leading to price-insensitive selling (e.g. trading desks hitting their risk limits).”

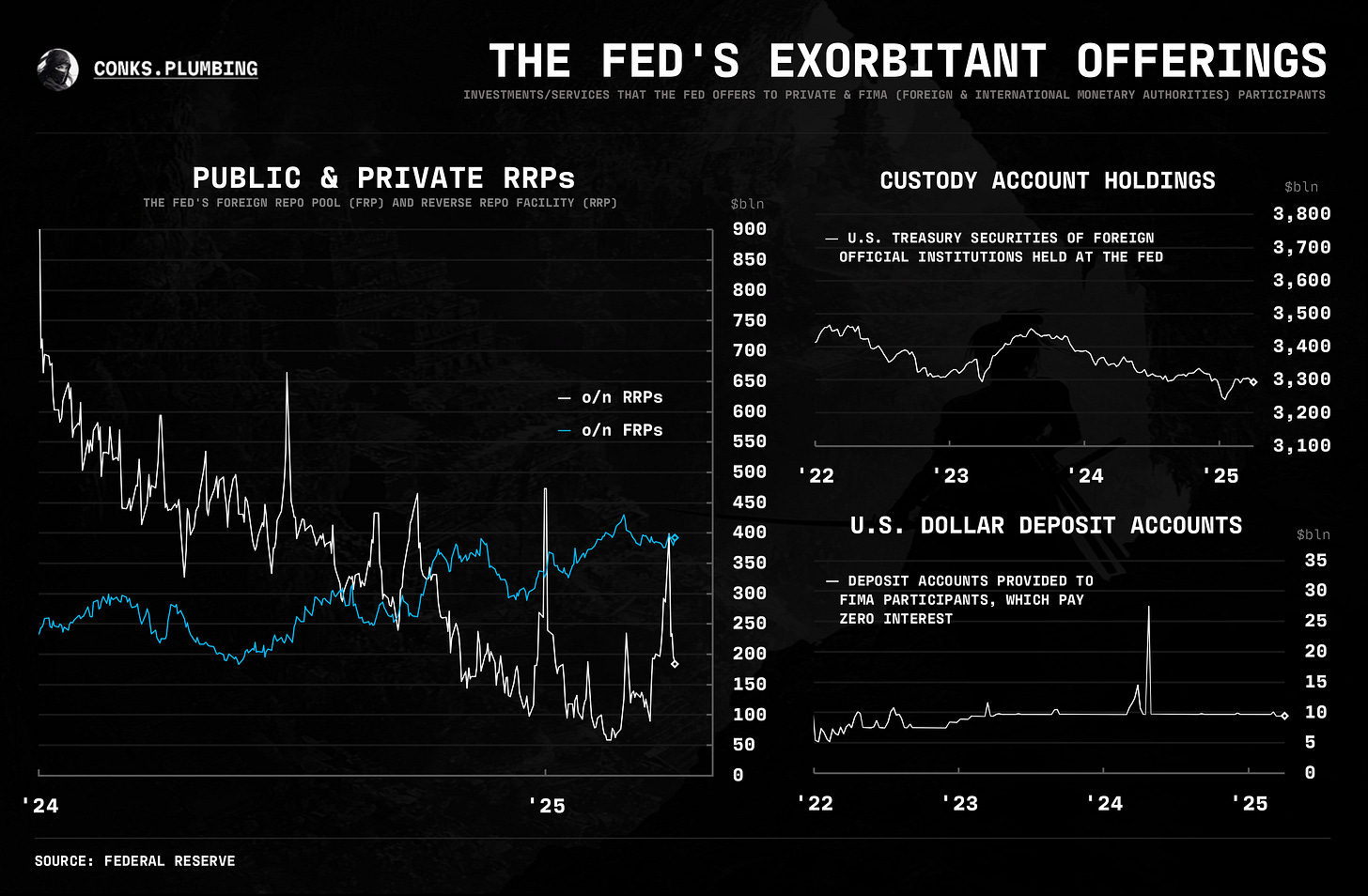

Elsewhere, the unwinding of the deregulatory hype trade has played out via a re-tightening of swap spreads, as expected in The Fed’s Relief Valve: Part I. Over the long term, we expect spreads to eventually widen, not tighten, since more deregulatory measures are implemented, such as the “SLR rework”. The level of plumbing deregulation depends on how much influence Treasury Secretary Bessent (and the Fed’s pro-deregulatory board member Bowman) can obtain.

As the deregulation narrative enters the mainstream, however, the Fed has increased its strictness behind the scenes. Officials have grown concerned over a trillion or so in overnight (o/n) Treasury repo exposures that the most prominent dealer banks hold, which — officials say — could lead to instability. Some banks have thus been forced to term out their repos via forward-starting trades to “lower” o/n exposures that bear more risk. But more on that later.

Now, onto the chartbook…

If you act on anything provided in this newsletter, you agree to the terms in this disclaimer. Everything in this newsletter is for educational and entertainment purposes only and NOT investment advice. Nothing in this newsletter is an offer to sell or to buy any security. The author is not responsible for any financial loss you may incur by acting on any information provided in this newsletter. Before making any investment decisions, talk to a financial advisor.

EFFR, OBFR, SOFR, TGCR, and BGCR are subject to the Terms of Use posted at newyorkfed.org. The New York Fed is not responsible for publication of tri-party data from the Bank of New York Mellon (BNYM) or GCF Repo/Delivery-versus-Payment (DVP) repo data via DTCC Solutions LLC (“Solutions”), an affiliate of The Depository Trust & Clearing Corporation, & OFR, does not sanction or endorse any particular republication, and has no liability for your use.

I’m interested in Conks Pro! :)

Timely update Mr. C. I heard, "it's all computers."