Money Market Update

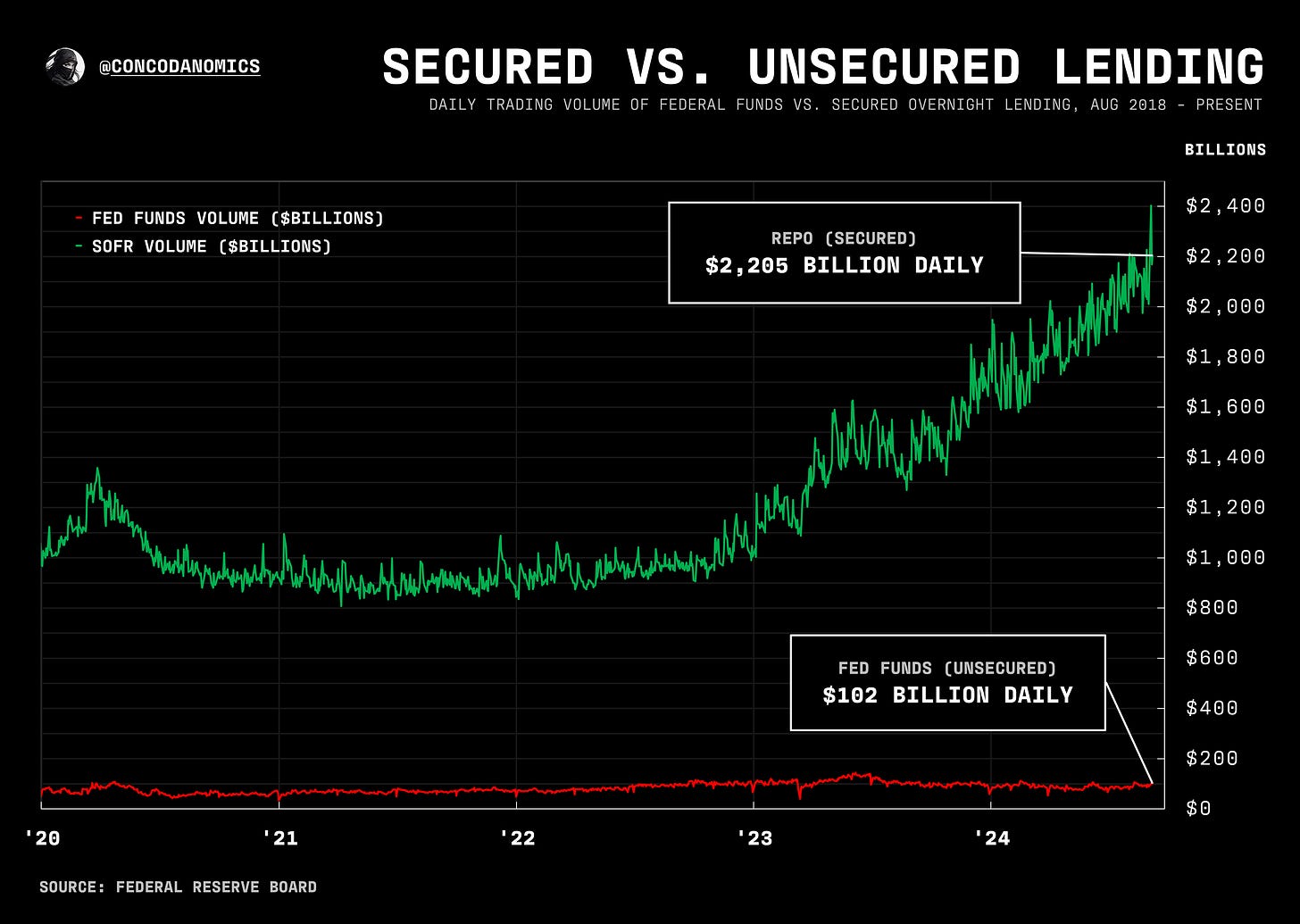

as Fed rate cuts loom, secured dollar funding volumes hit all-time highs, while our new money market stress monitor shows little signs of scarce liquidity

In case you missed it — or you’ve just joined us — the concluding piece of the Repo Market Dislocation went live recently.

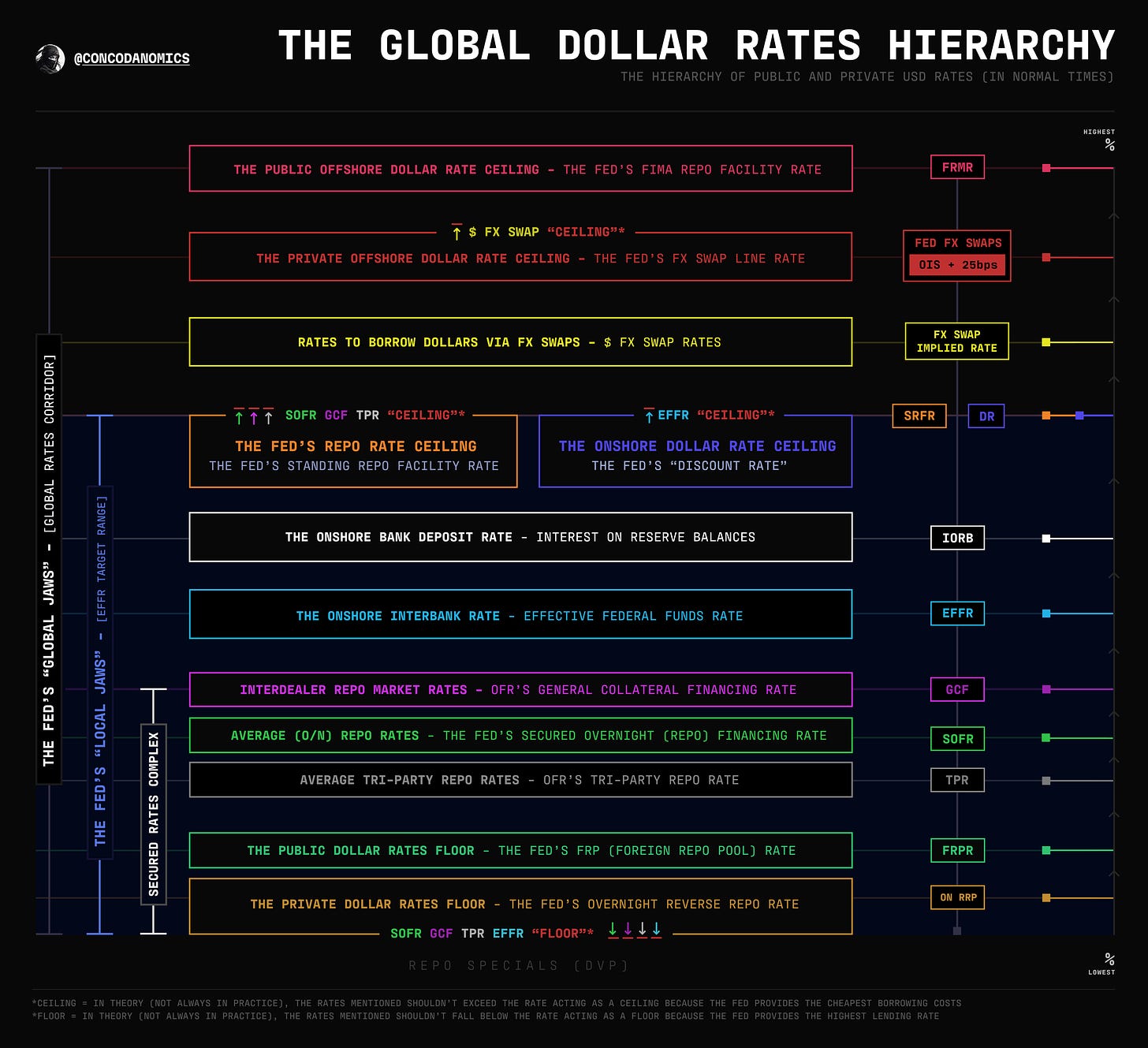

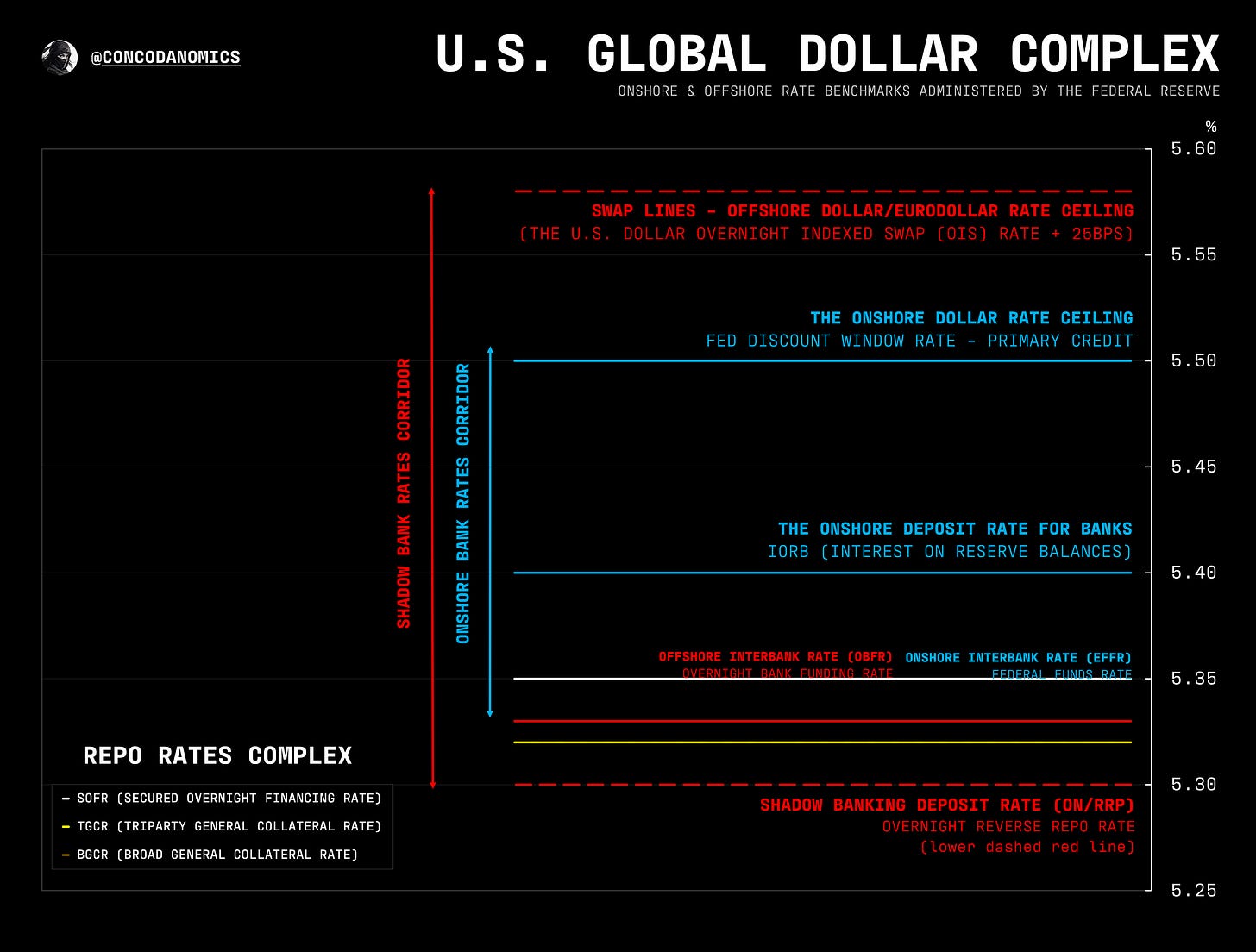

In the next series, we’ll explore the frictions developing at the top of the dollar rates hierarchy (see below), what that suggests for liquidity, and, more importantly, the fate of QT. Plus, a primer on the mysterious cross-currency (XCCY) swaps market. Stay tuned.

But first, a (gradually improving) money market update...

Summary & Brief Commentary

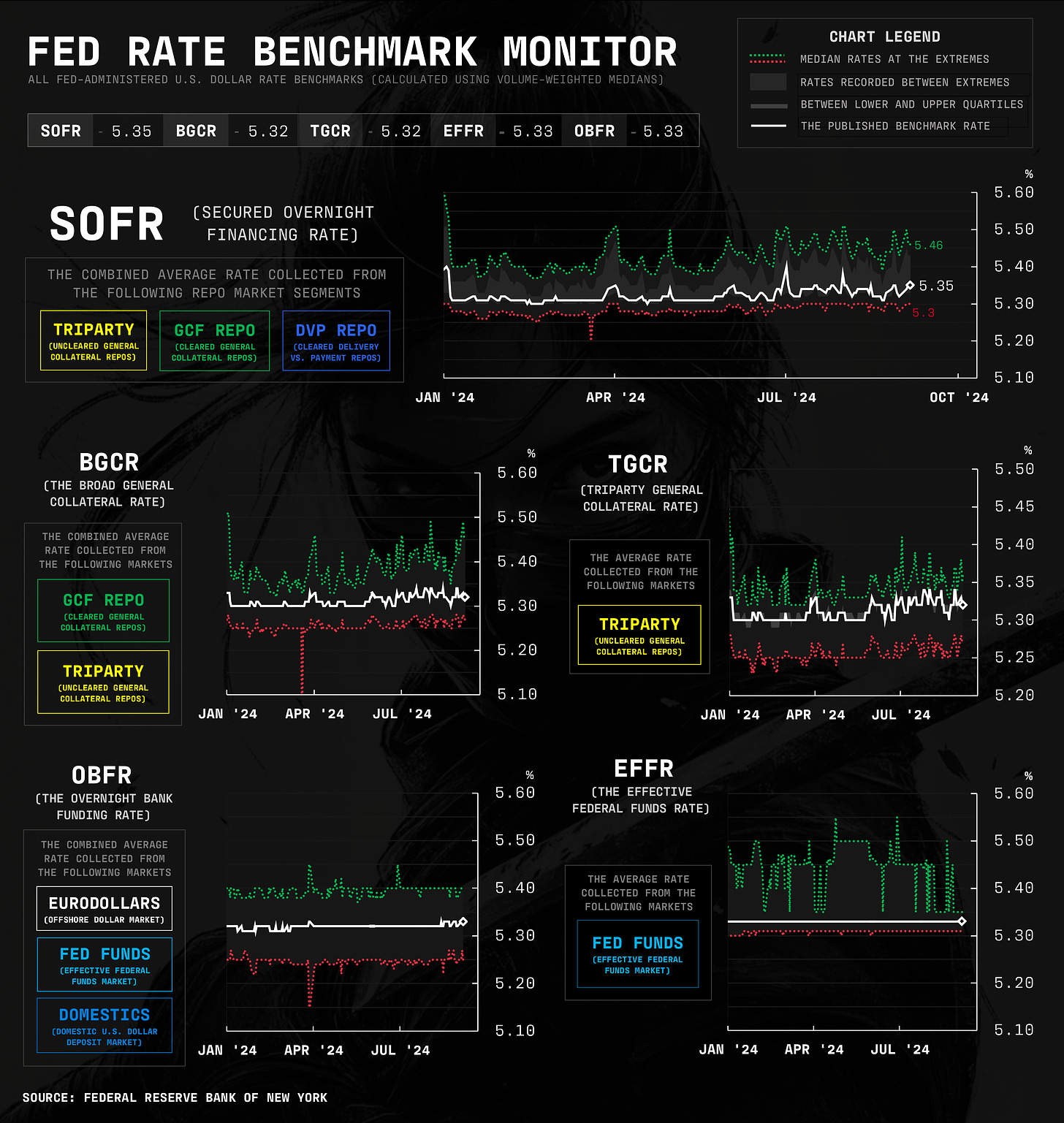

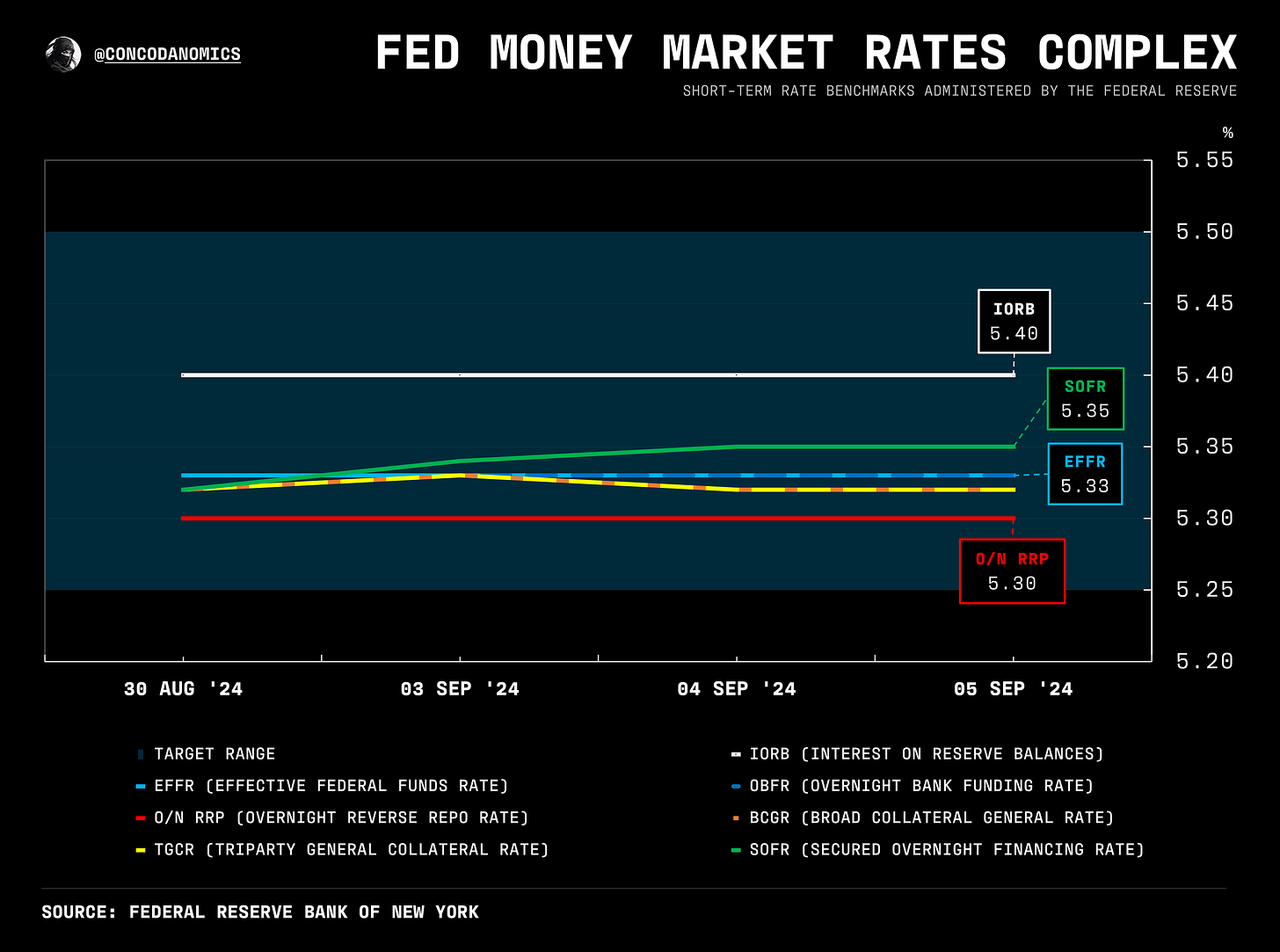

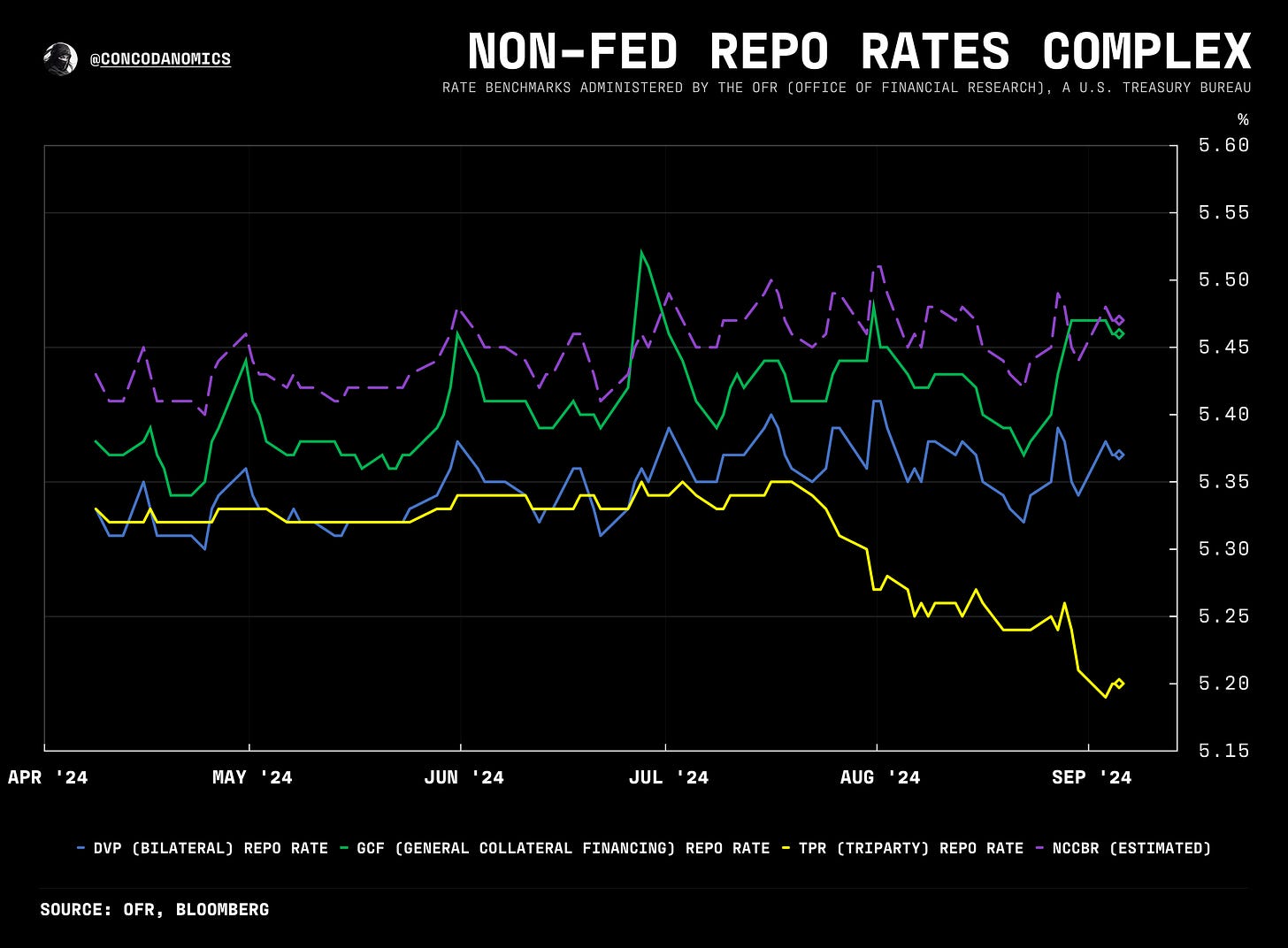

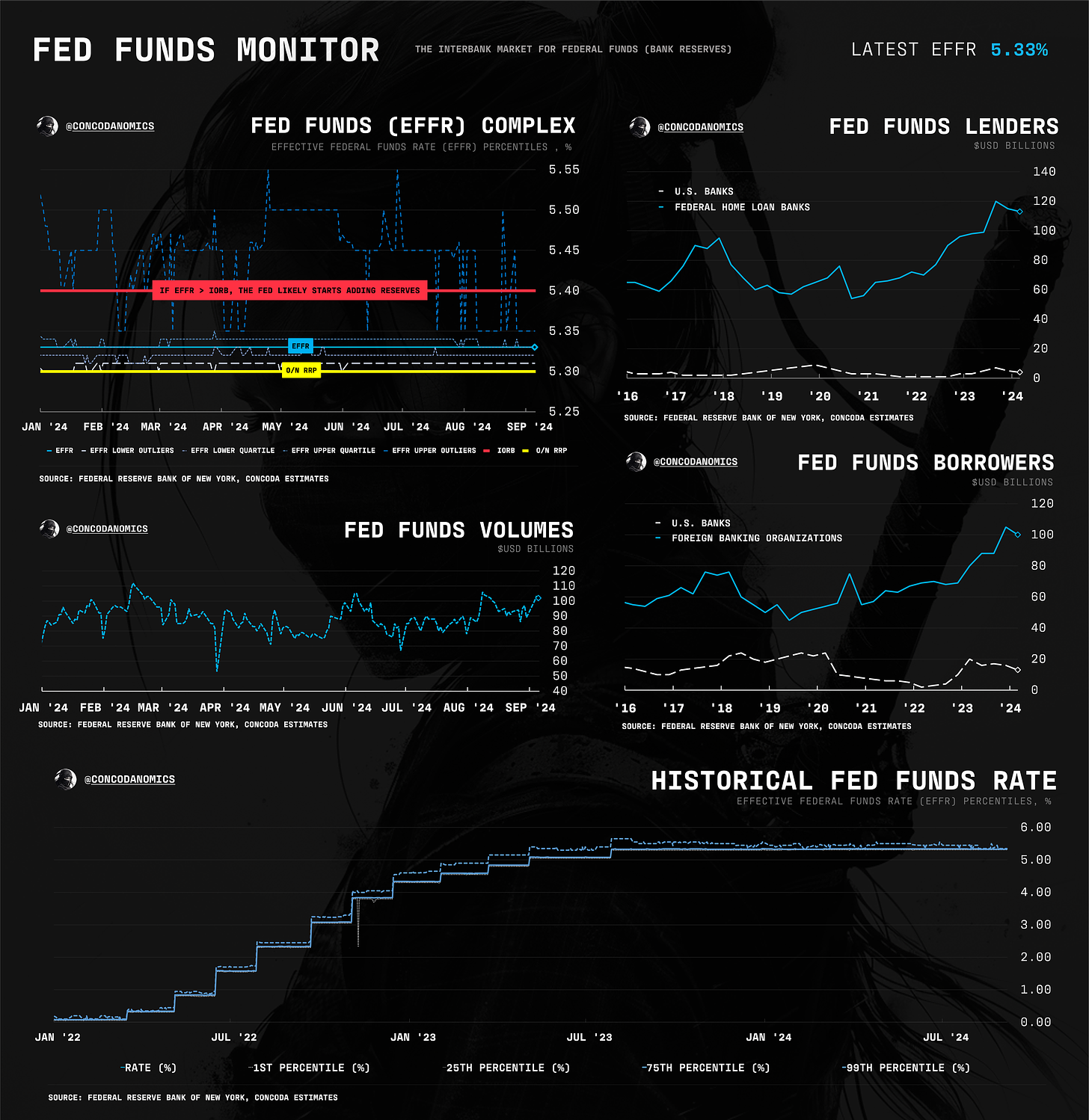

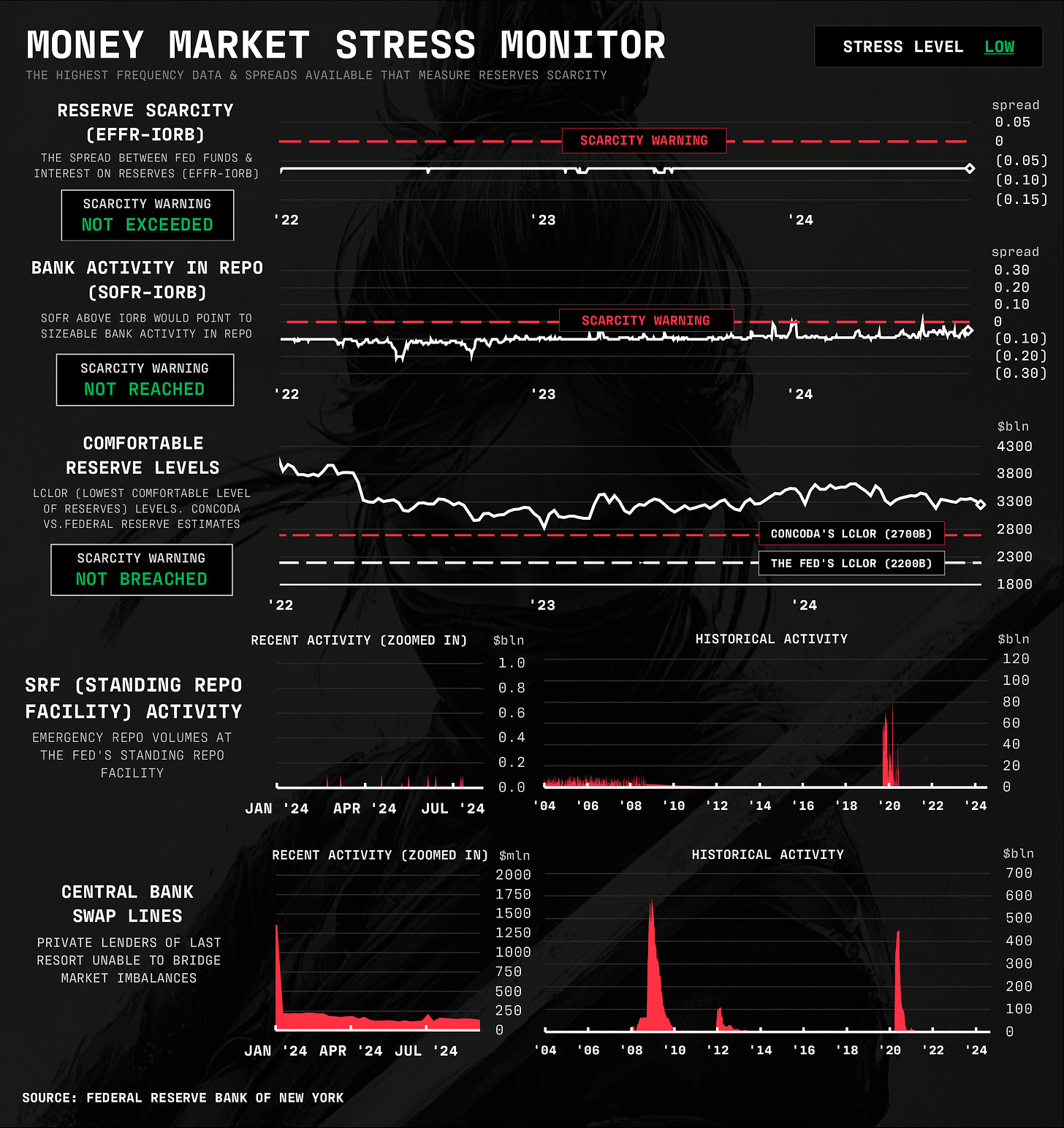

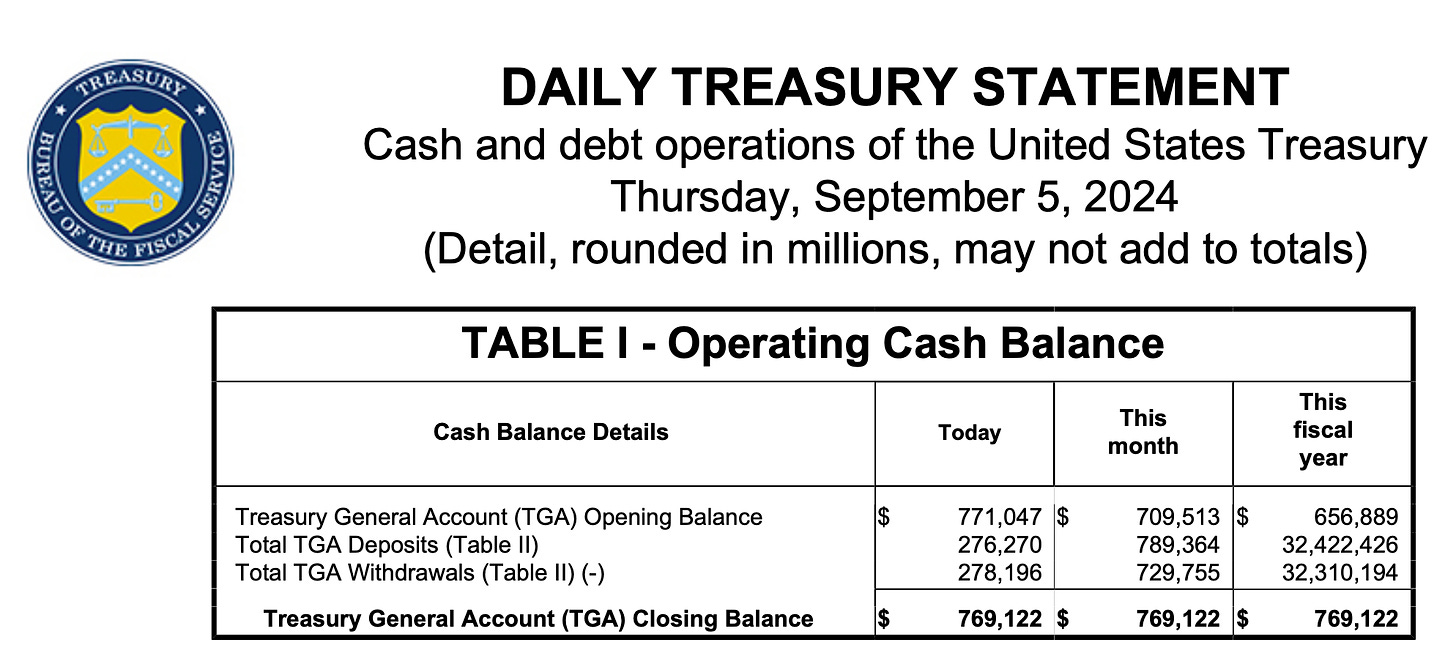

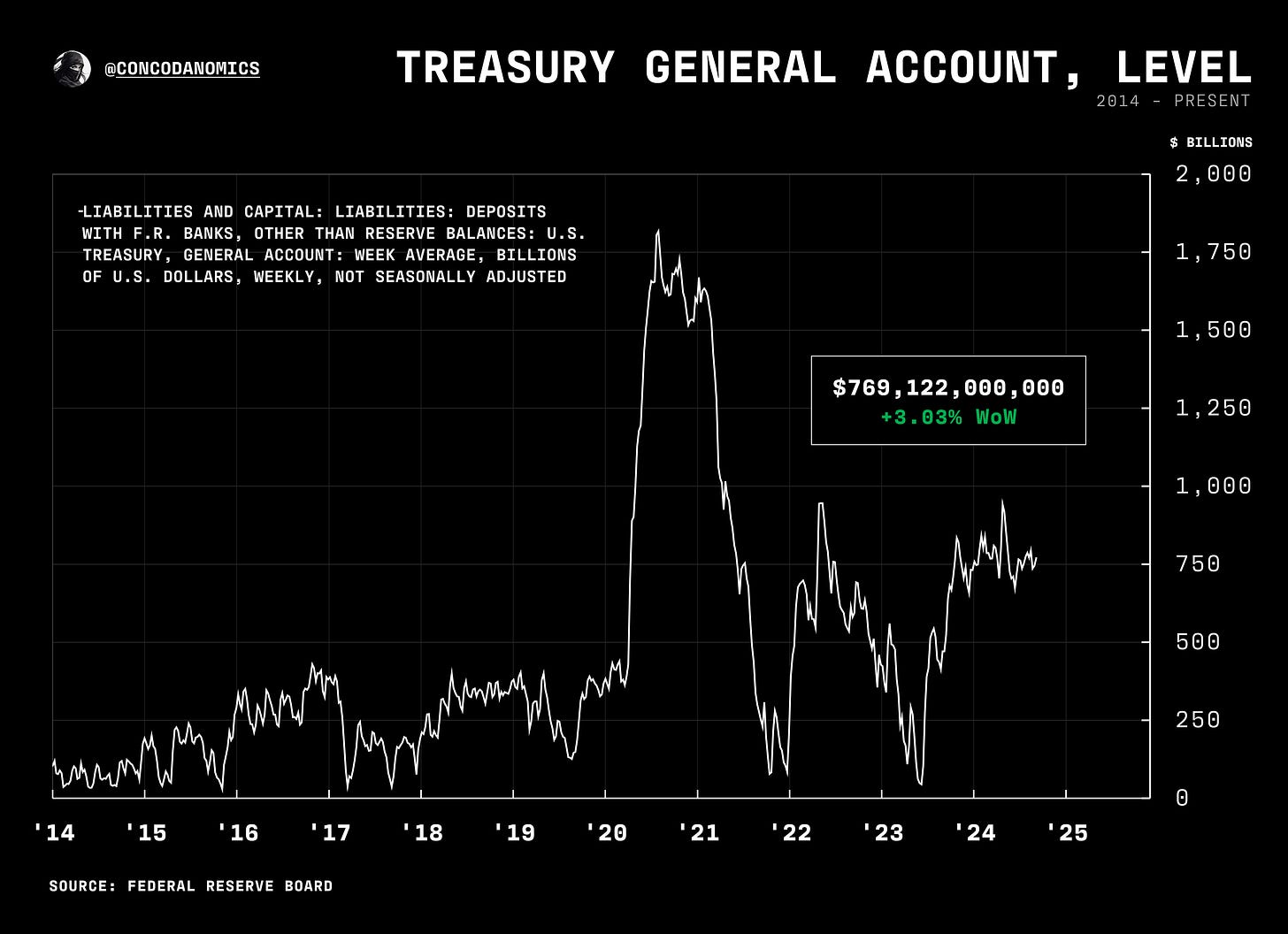

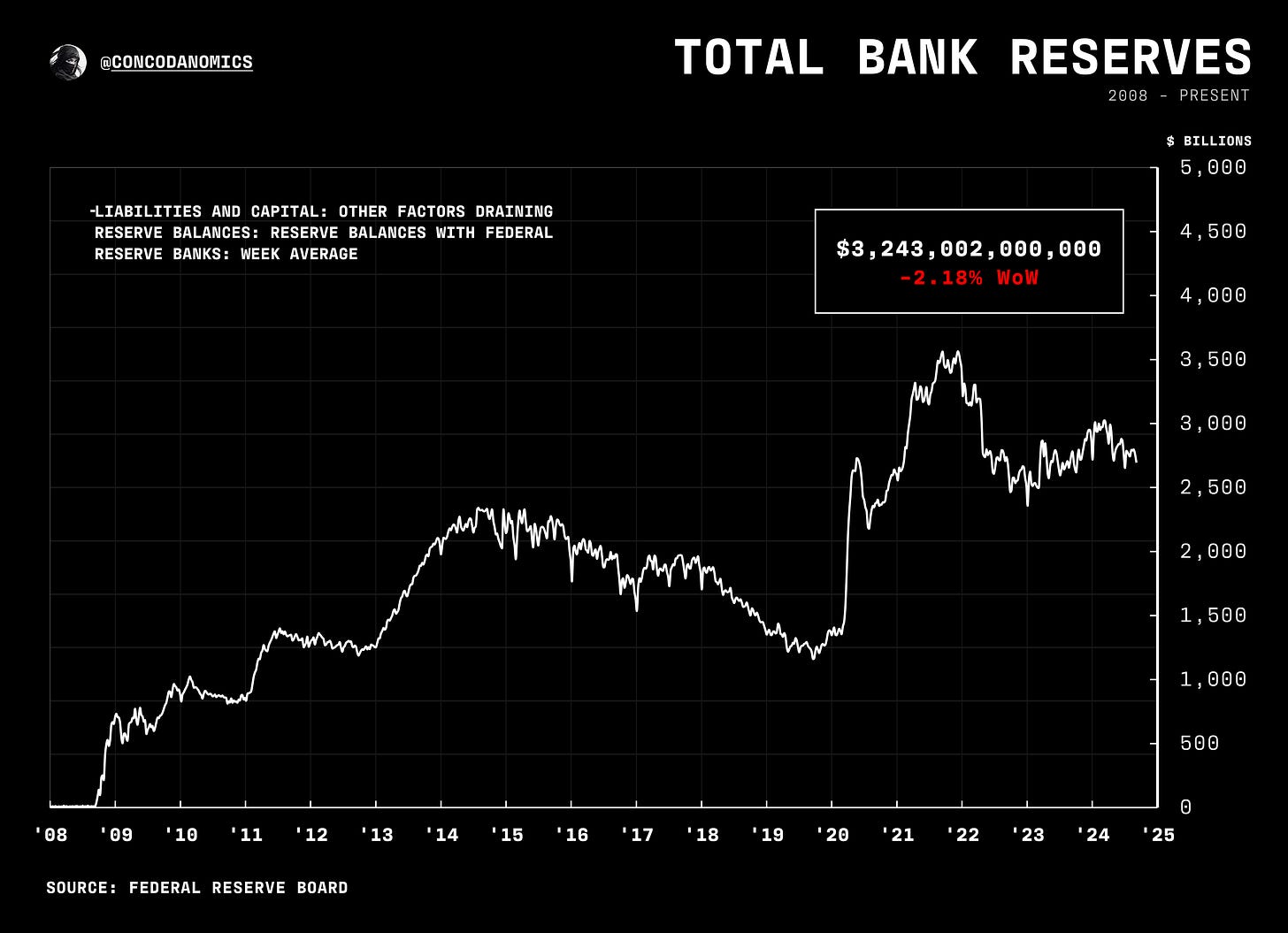

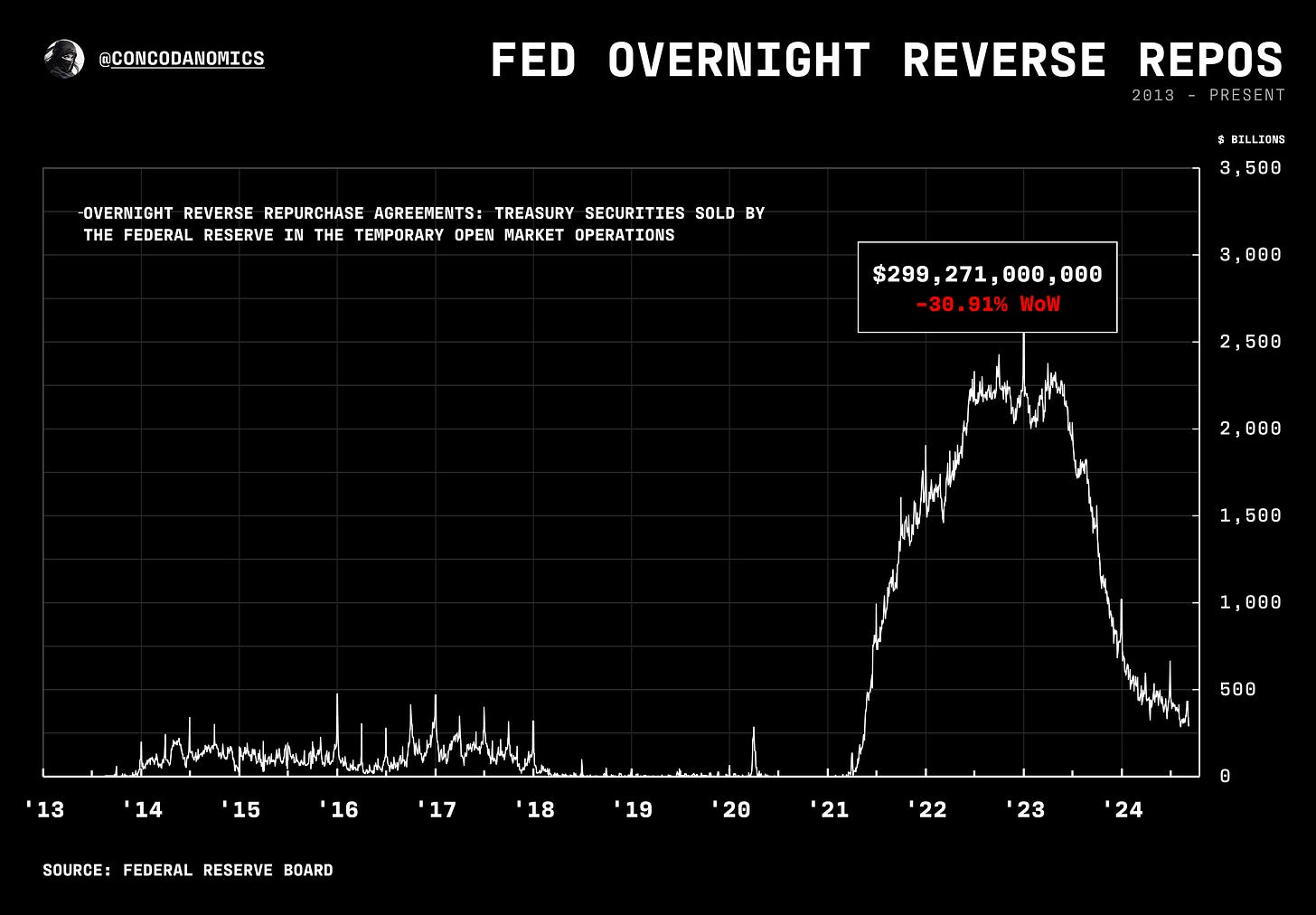

After a cash flood in August, repo rates are again rising. Don’t mistake this for liquidity shortages. Sometimes, rates rise when the demand for repo funding (mostly from hedge funds) increases substantially, which is more likely — as reserves remain ample. Our monitors display low money market stress, apart from on period-ends (which is to be expected).

Fed Funds volumes spiked again at month-end. However, the highest rates recorded (trades in the 99th percentile) have printed below interest on reserve balances (IORB).

Meanwhile, as The Great Flattening explains, month-end repo spikes have become a regular market fixture. August month-end was particularly explosive. Let’s see what the September quarter-end brings.

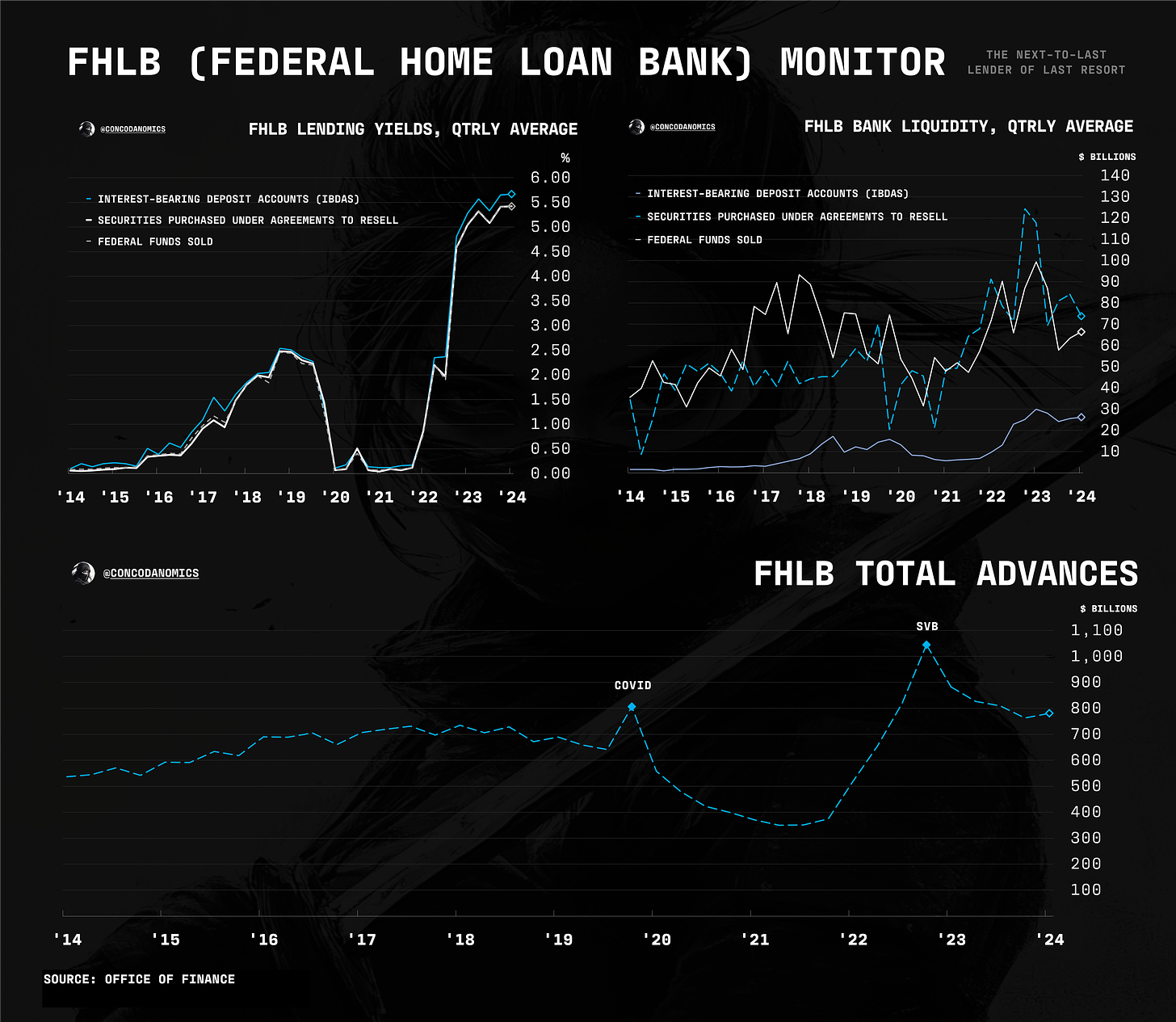

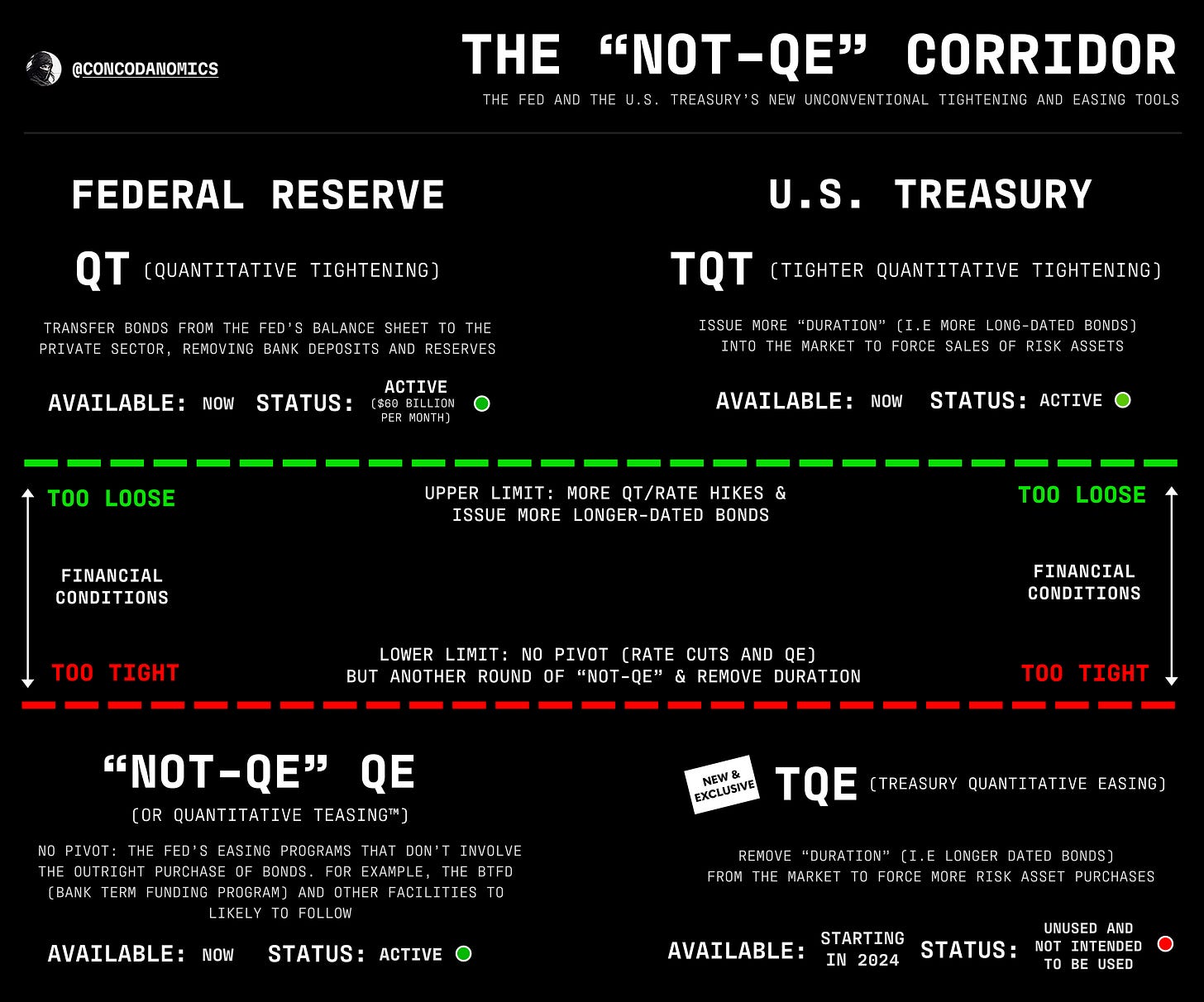

QT ends sooner rather than later for reasons we’ll explain in detail in our coming pieces. Note: it has nothing to do with Bollinger Bands.

STIR futures are doing usual STIR things: pricing in “too many” cuts. SFRU4Z4 is pricing over 3 cuts (-0.8225) by year-end, and SFRU4U5 just under 8 cuts (-1.96) by September 2025. Expect consolidation in the next week or so before more overshooting commences.

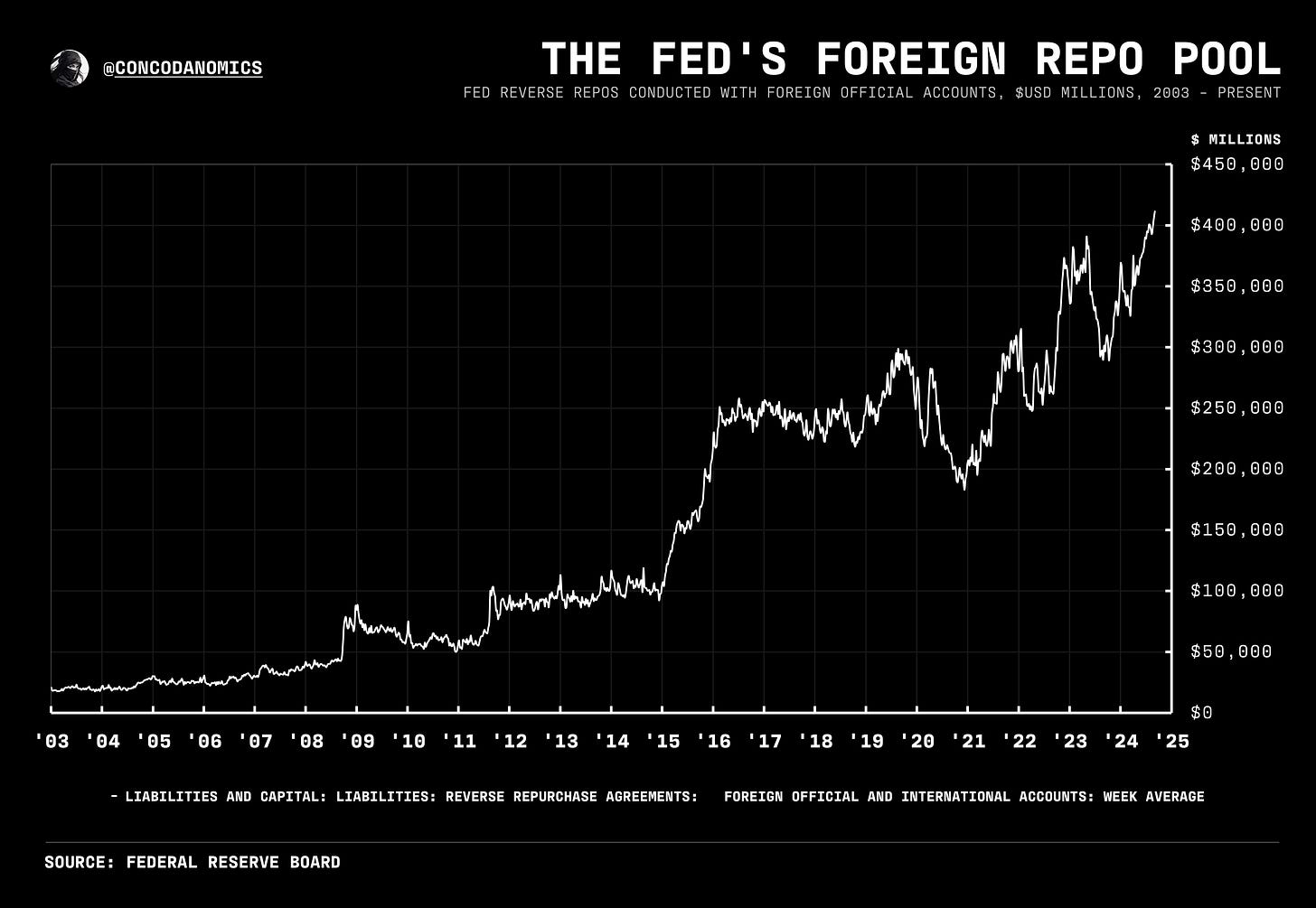

As the Treasury curve steepens further, foreign FX-hedged investors should start returning to dollar markets: a negative for XCCY bases and bullish for dollar assets and the DXY. However, the rate-cut narrative will overpower (matter more than) these drivers.

We are fading the recent spike in MOVE since the last money market update. A repeat of August's events is unlikely. We’re in for another Great Chop in September, which is neither bearish nor bullish — just tedious. We remain bullish “all assets” (i.e. stocks, bonds, precious metals). The main issue is stretched positioning.

While a new money market stress monitor was added, sadly, this may be the last time the unconventional corridor graphic appears. Traditional easing measures are on the way.

Now, for the chartbook (more monitors coming soon)…

If you act on anything provided in this newsletter, you agree to the terms in this disclaimer. Everything in this newsletter is for educational and entertainment purposes only and NOT investment advice. Nothing in this newsletter is an offer to sell or to buy any security. The author is not responsible for any financial loss you may incur by acting on any information provided in this newsletter. Before making any investment decisions, talk to a financial advisor.

EFFR, OBFR, SOFR, TGCR, and BGCR are subject to the Terms of Use posted at newyorkfed.org. The New York Fed is not responsible for publication of tri-party data from the Bank of New York Mellon (BNYM) or GCF Repo/Delivery-versus-Payment (DVP) repo data via DTCC Solutions LLC (“Solutions”), an affiliate of The Depository Trust & Clearing Corporation, & OFR, does not sanction or endorse any particular republication, and has no liability for your use.

Always appreciate your perfectly detailed but-concise write-ups, Conks.

Chuckled at this:

"QT ends sooner rather than later for reasons we’ll explain in detail in our coming pieces. Note: it has nothing to do with Bollinger Bands."

Enjoy the rest of your weekend.

Do you mind elaborating a bit more on this point: "With the yield curve uninverting, foreign FX-hedged investors should start returning to dollar markets"? Why would curve uninverting prompt foreign fx-hedged investors back to dollar markets?