Money Market Update

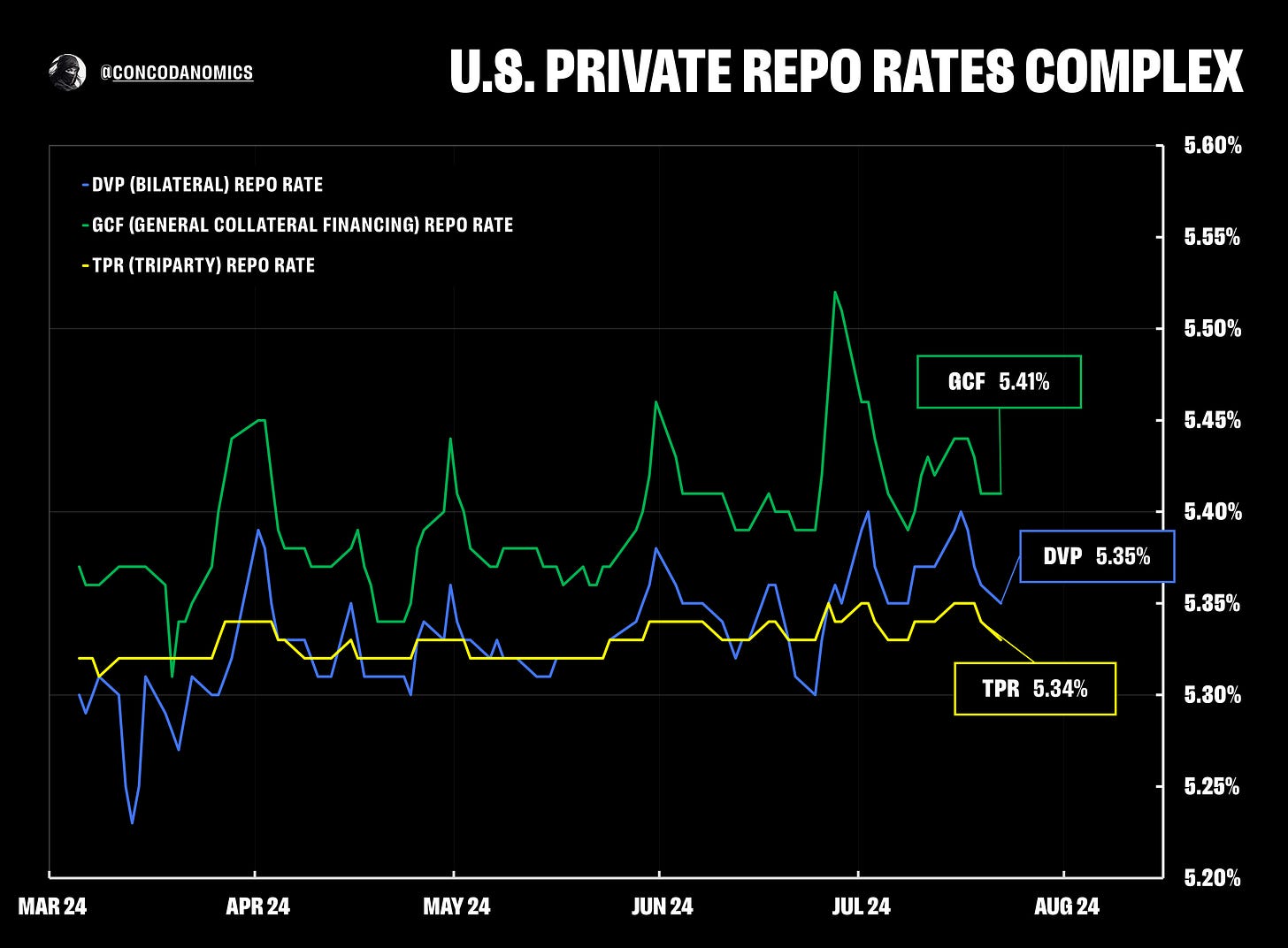

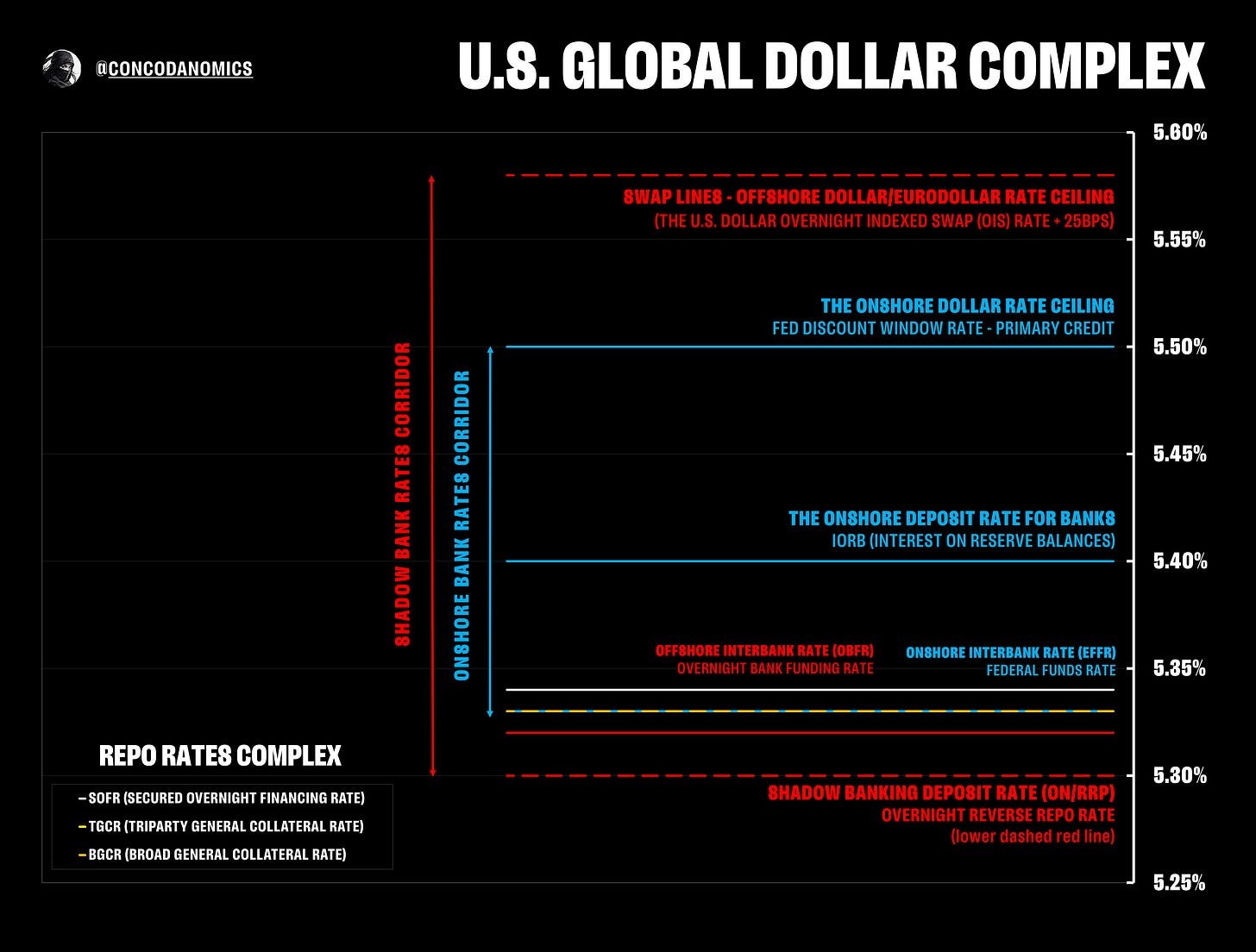

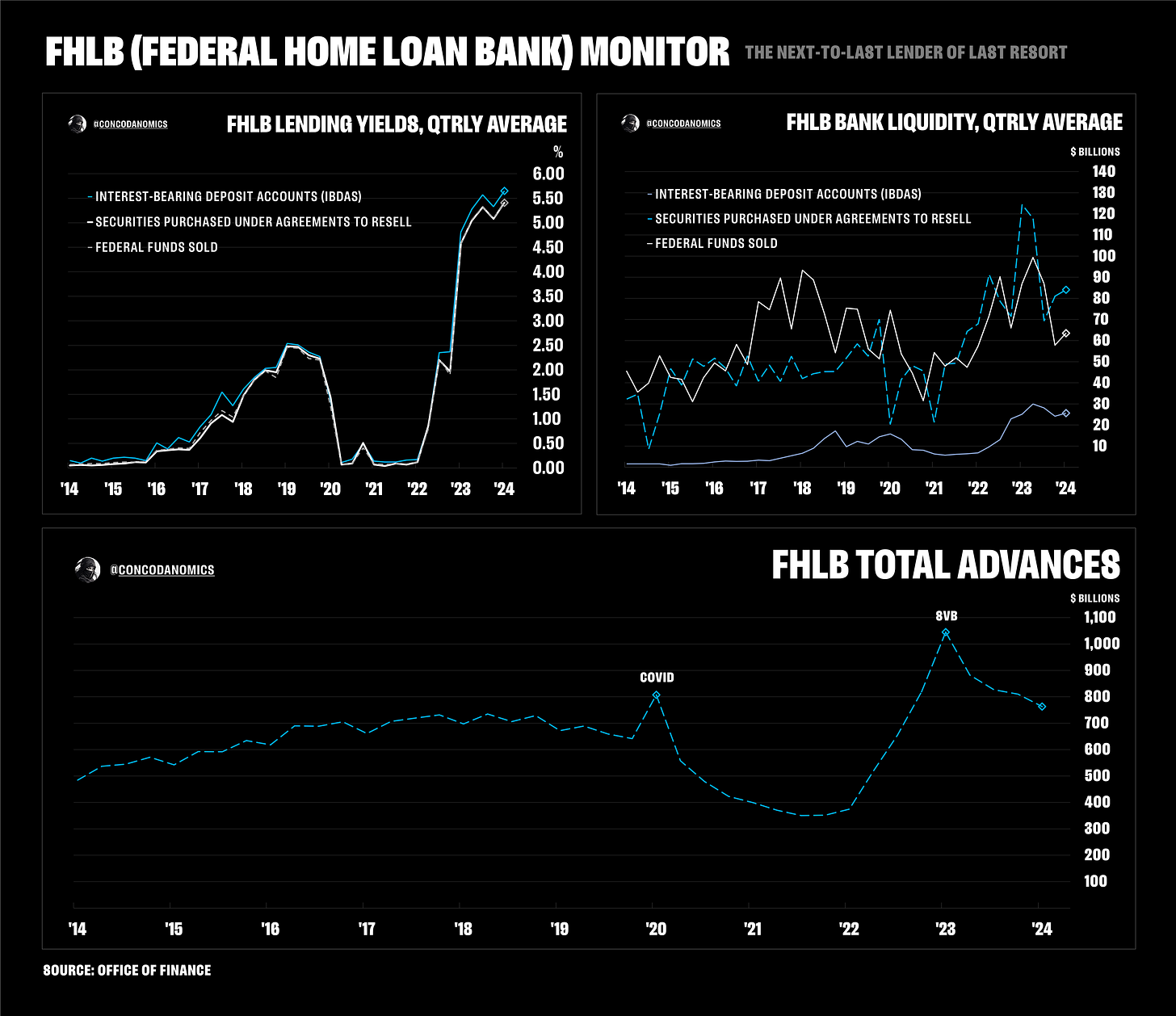

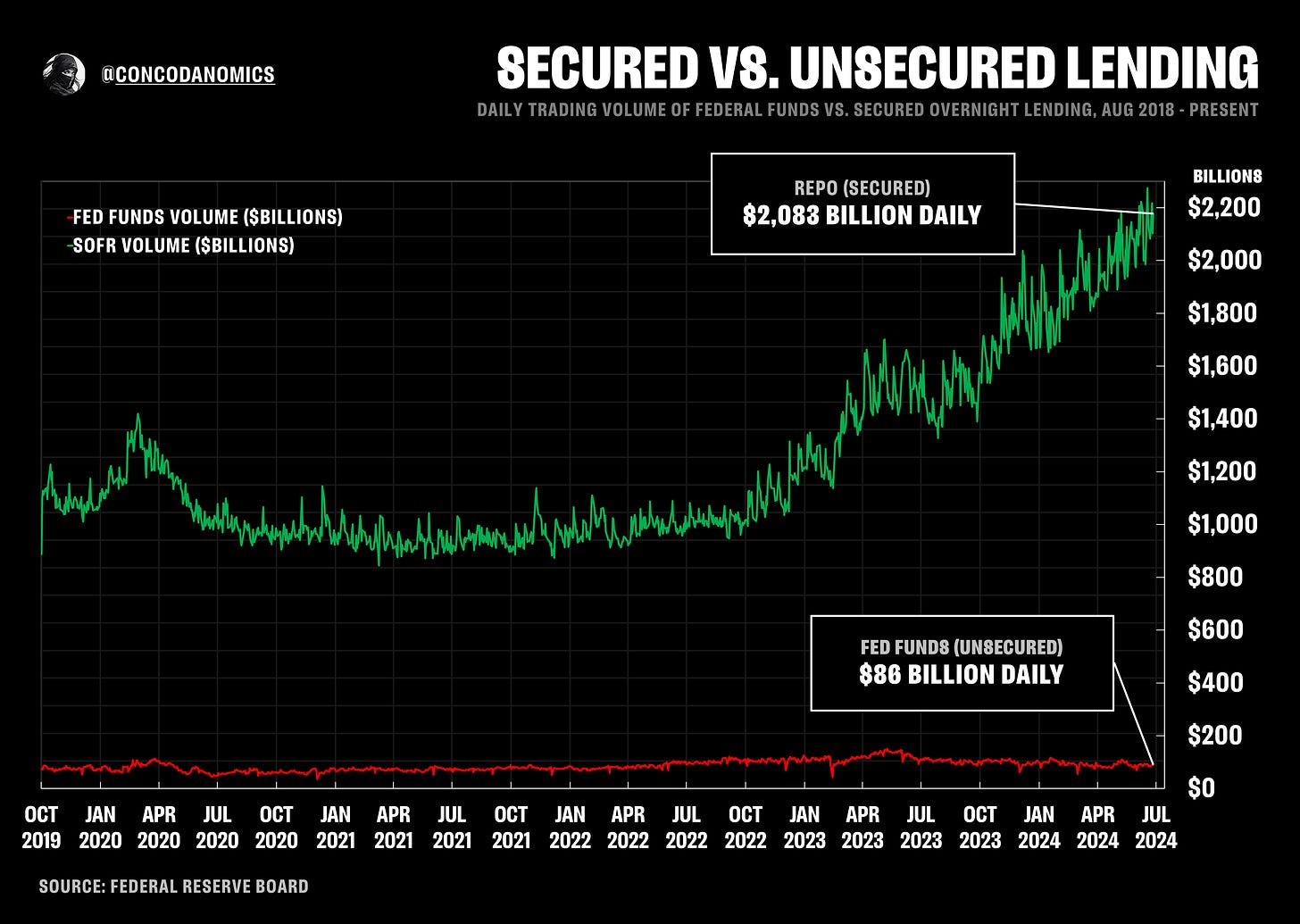

repo volumes reach new highs as rates move away from the Fed's floor. a Fed "repo put", however, seems far away. meanwhile, a new Fed Funds monitor has been added, with a repo "stress monitor" up next

Welcome, Concoda readers. We are now 40.5k+ strong. A slight agenda change. Before publishing our report on the Fed’s global defense mechanism, we’ll be demystifying in detail the repo rate “spikes” that erupt on key financial dates. One topic may be more time-dependent than the other.

And with that said, onto the money market update…

If you act on anything provided in this newsletter, you agree to the terms in this disclaimer. Everything in this newsletter is for educational and entertainment purposes only and NOT investment advice. Nothing in this newsletter is an offer to sell or to buy any security. The author is not responsible for any financial loss you may incur by acting on any information provided in this newsletter. Before making any investment decisions, talk to a financial advisor.

EFFR, OBFR, SOFR, TGCR, and BGCR are subject to the Terms of Use posted at newyorkfed.org. The New York Fed is not responsible for publication of tri-party data from the Bank of New York Mellon (BNYM) or GCF Repo/Delivery-versus-Payment (DVP) repo data via DTCC Solutions LLC (“Solutions”), an affiliate of The Depository Trust & Clearing Corporation, & OFR, does not sanction or endorse any particular republication, and has no liability for your use.

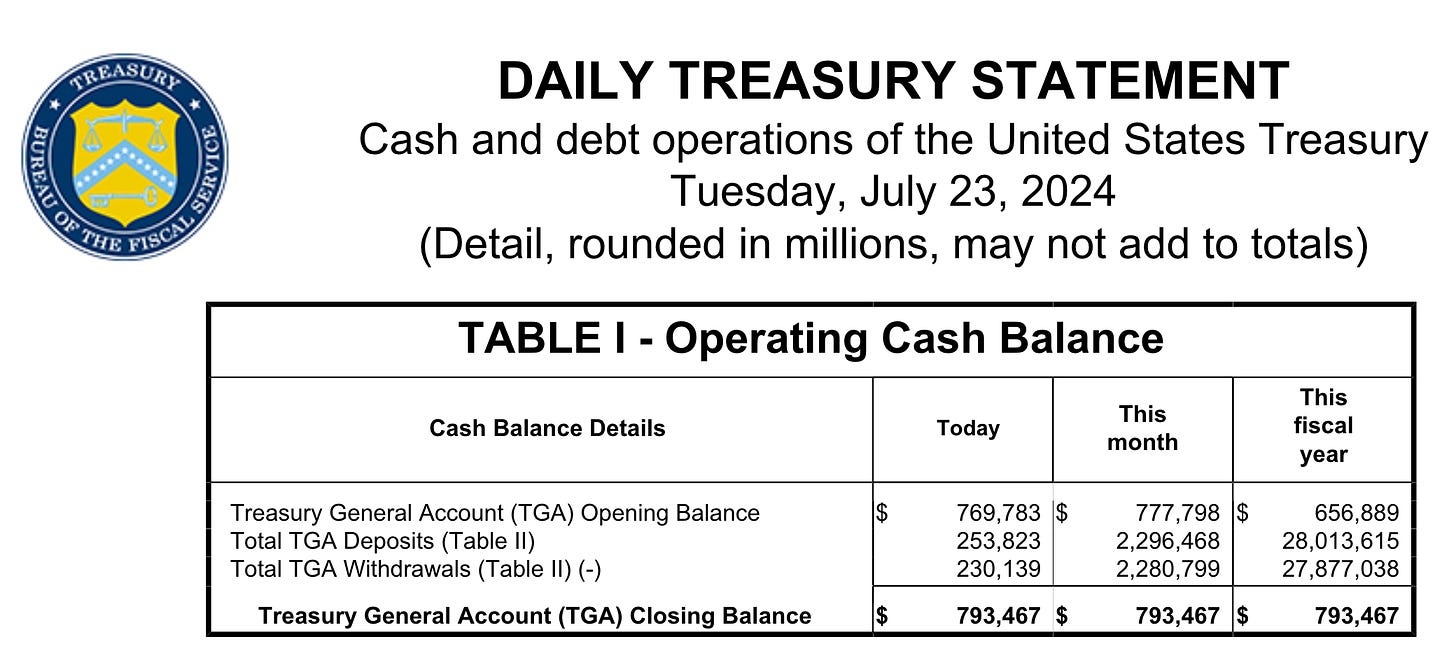

Are your expectations for the QRA today 750 for this and 500 for next qtr?