Money Market Update

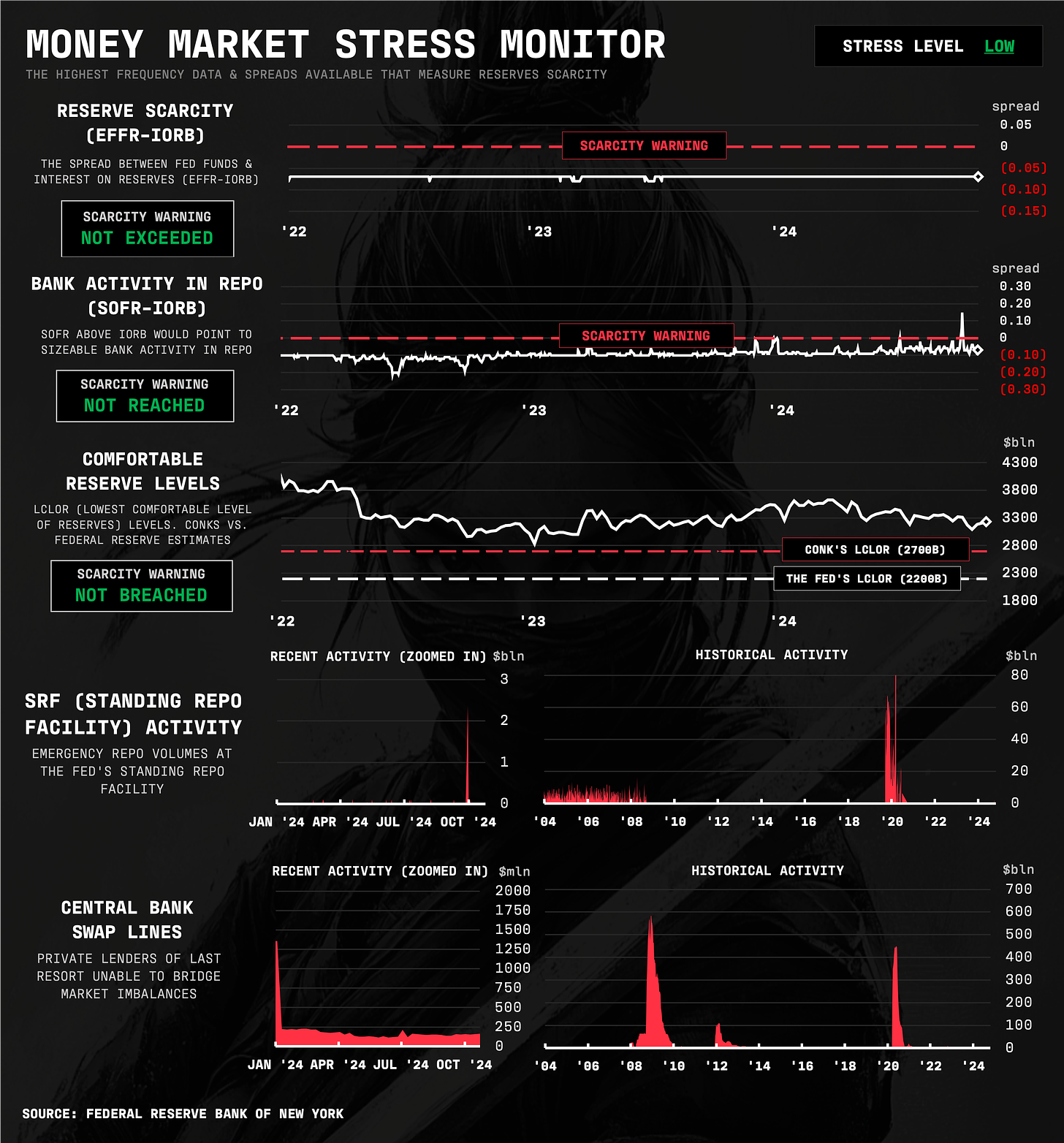

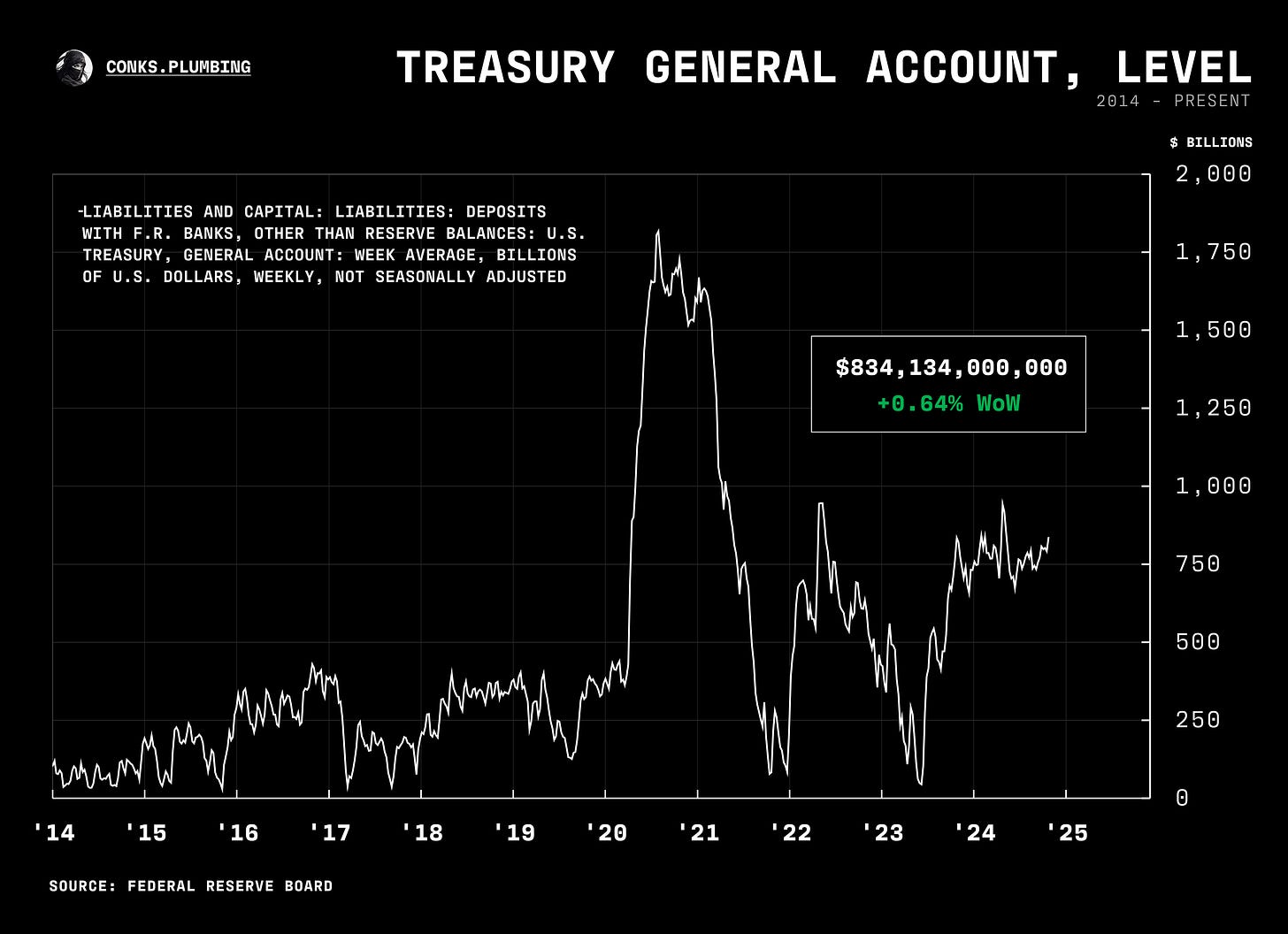

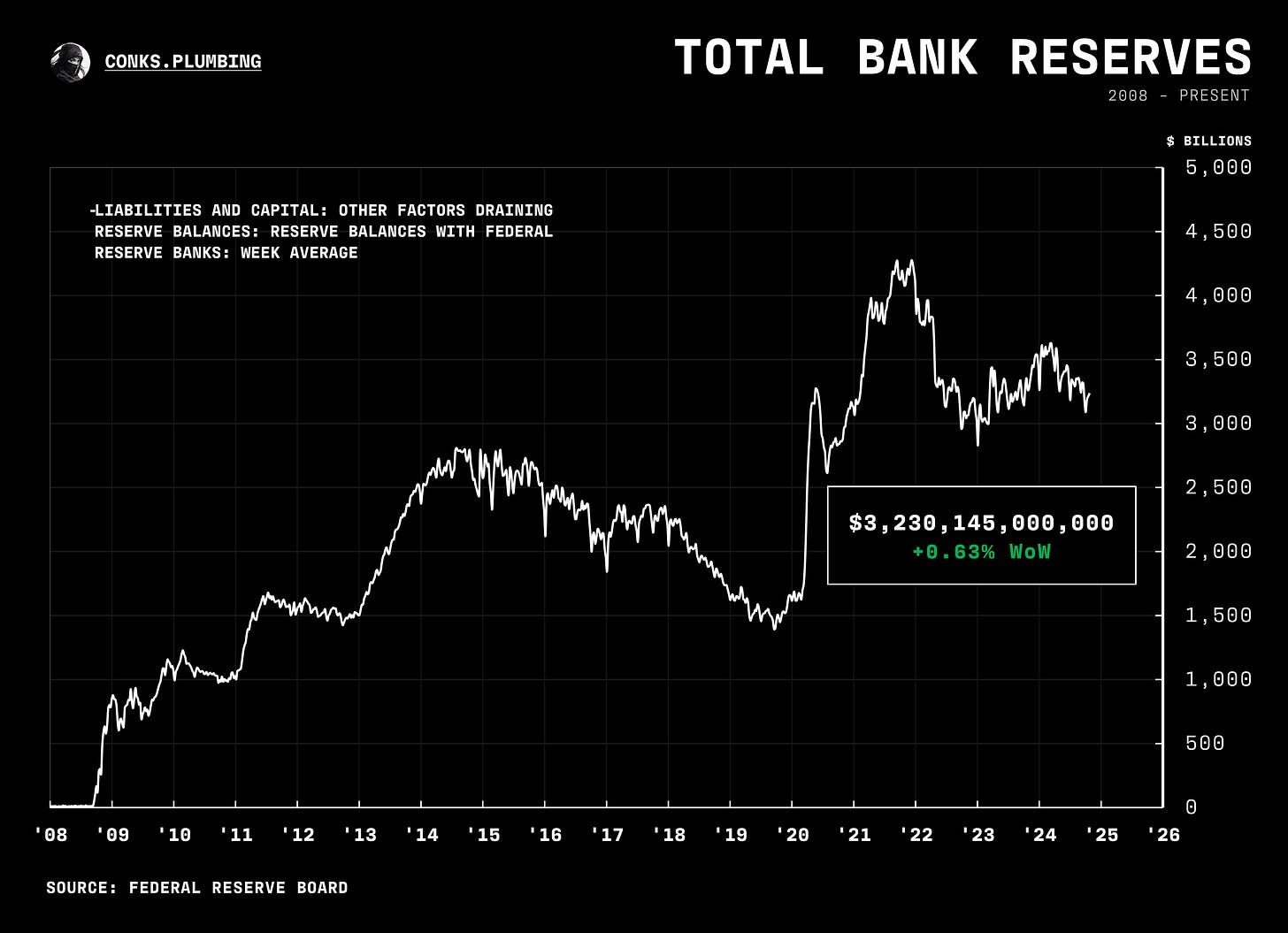

despite a violent quarter-end, our money market stress monitors show no major side effects. paired with the Fed's new indicator pointing to ample reserves, an end to QT remains far away

In case you missed it — or you’ve just joined us — the first part of the Fed’s Repo Defensive went live recently.

Part II will hit your screens soon. But first, a money market update…

Summary & Brief Commentary

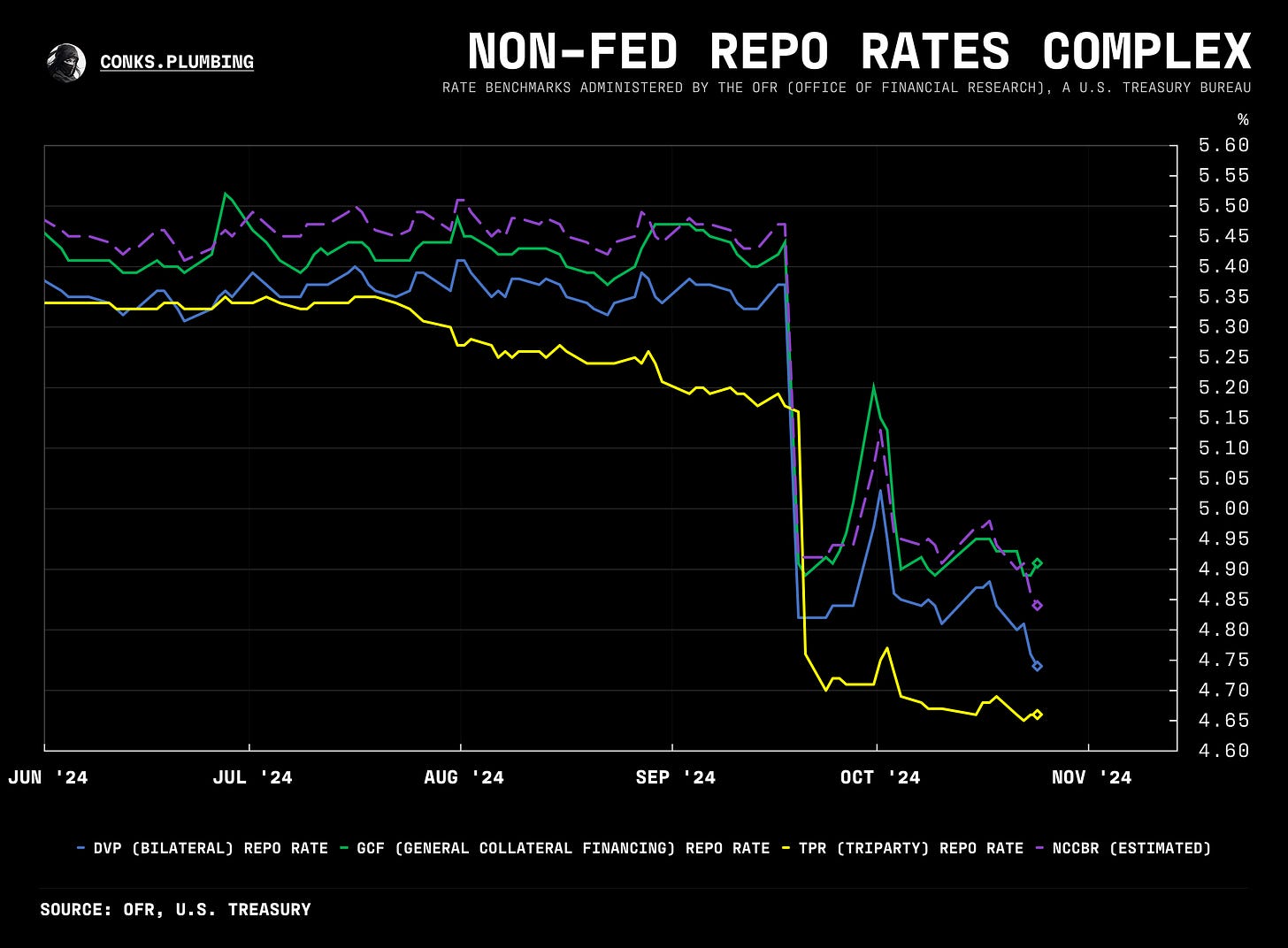

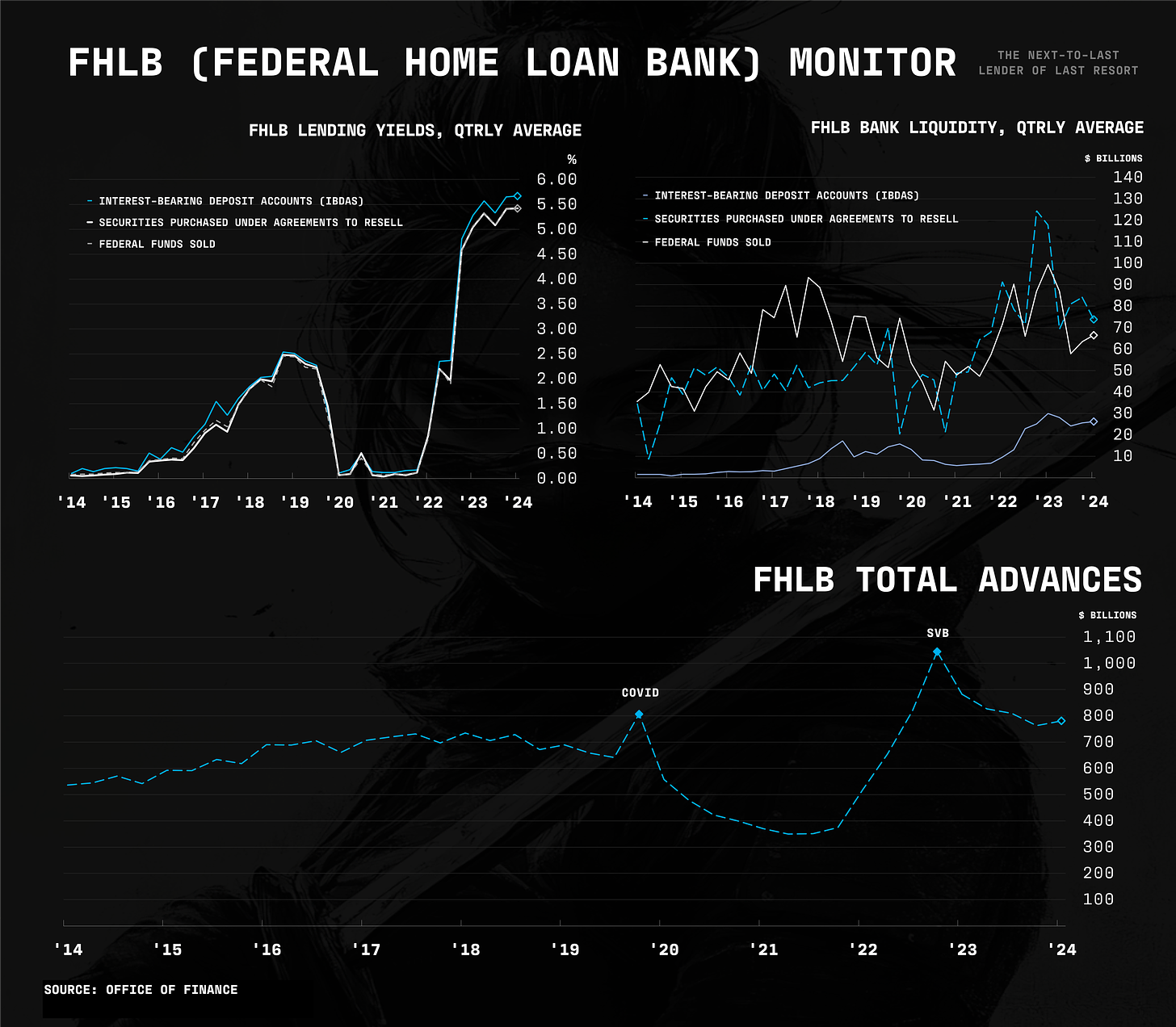

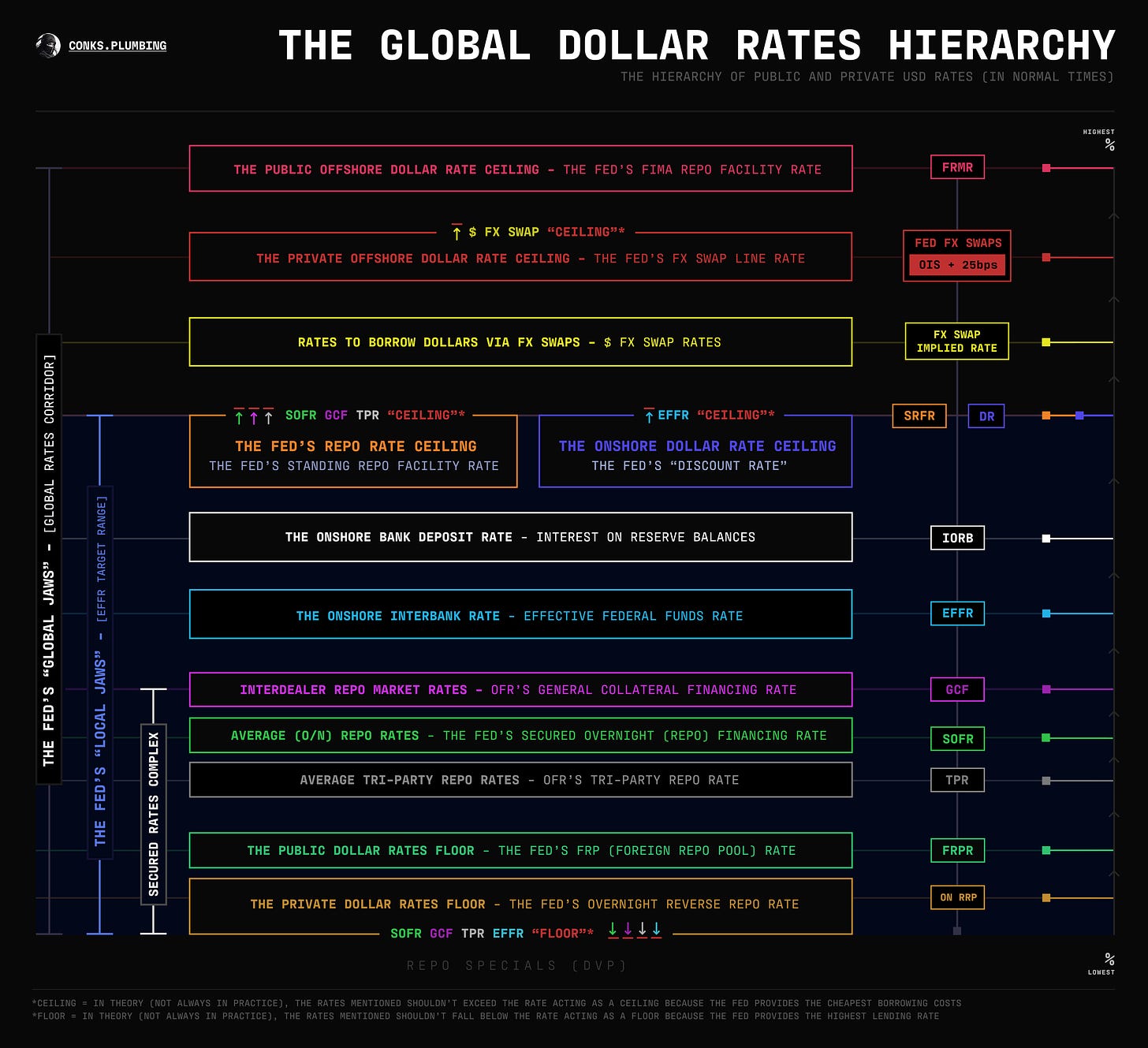

As mentioned in The Fed’s Repo Defensive, it was a stormy September quarter-end, with over $600 billion exceeding the Fed’s minimum borrowing rate at its standing repo facility (SRF). Yet, only a few tapped the Fed’s emergency repo installation. Like with other backstops, officials may need to incentivize usage, and that’s not straightforward. They could increase the types of counterparties that can access emergency repos or decide to centrally-clear SRF trades. But after that, you still have to beat stigma. More on how this might play out is coming soon.

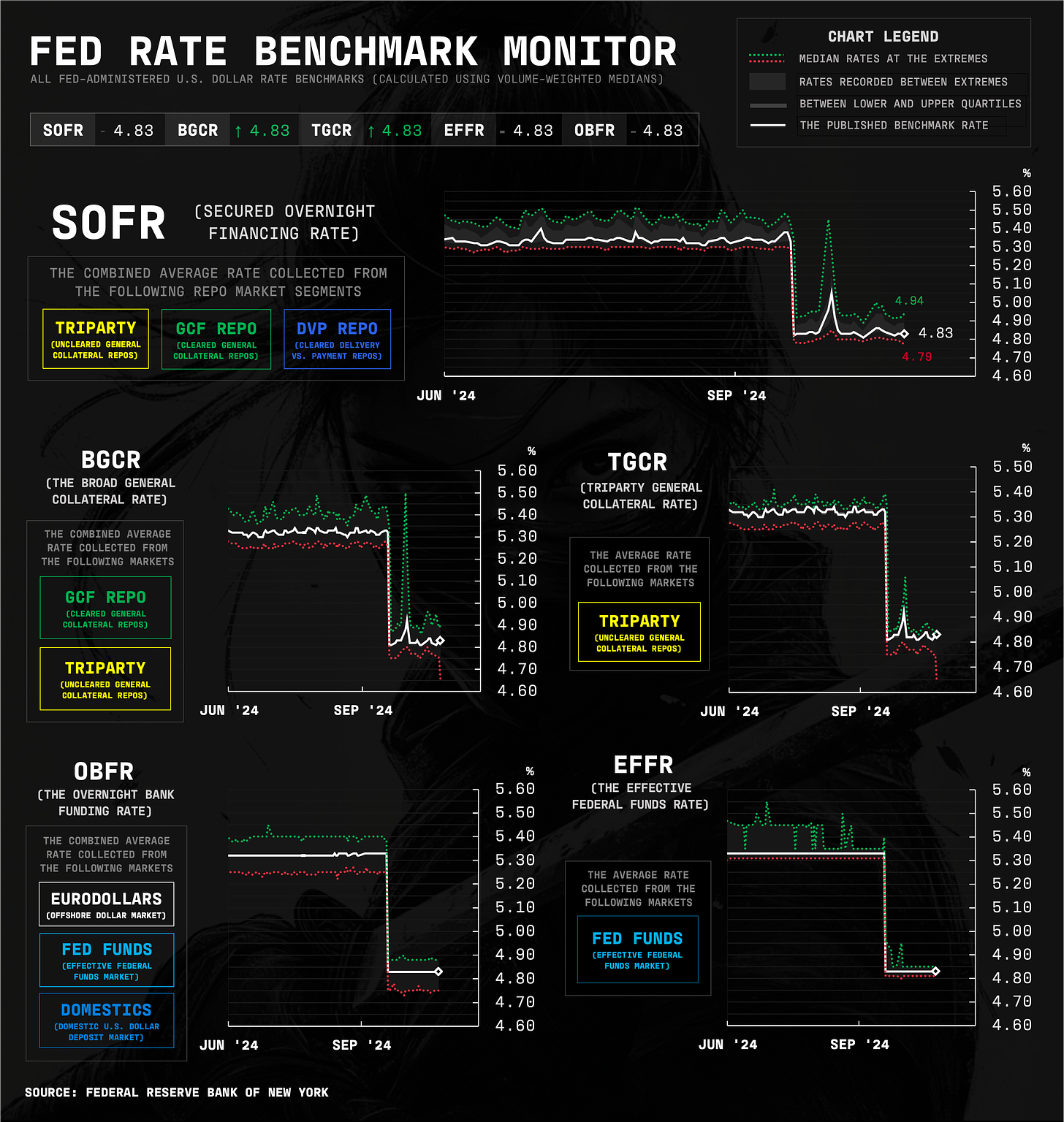

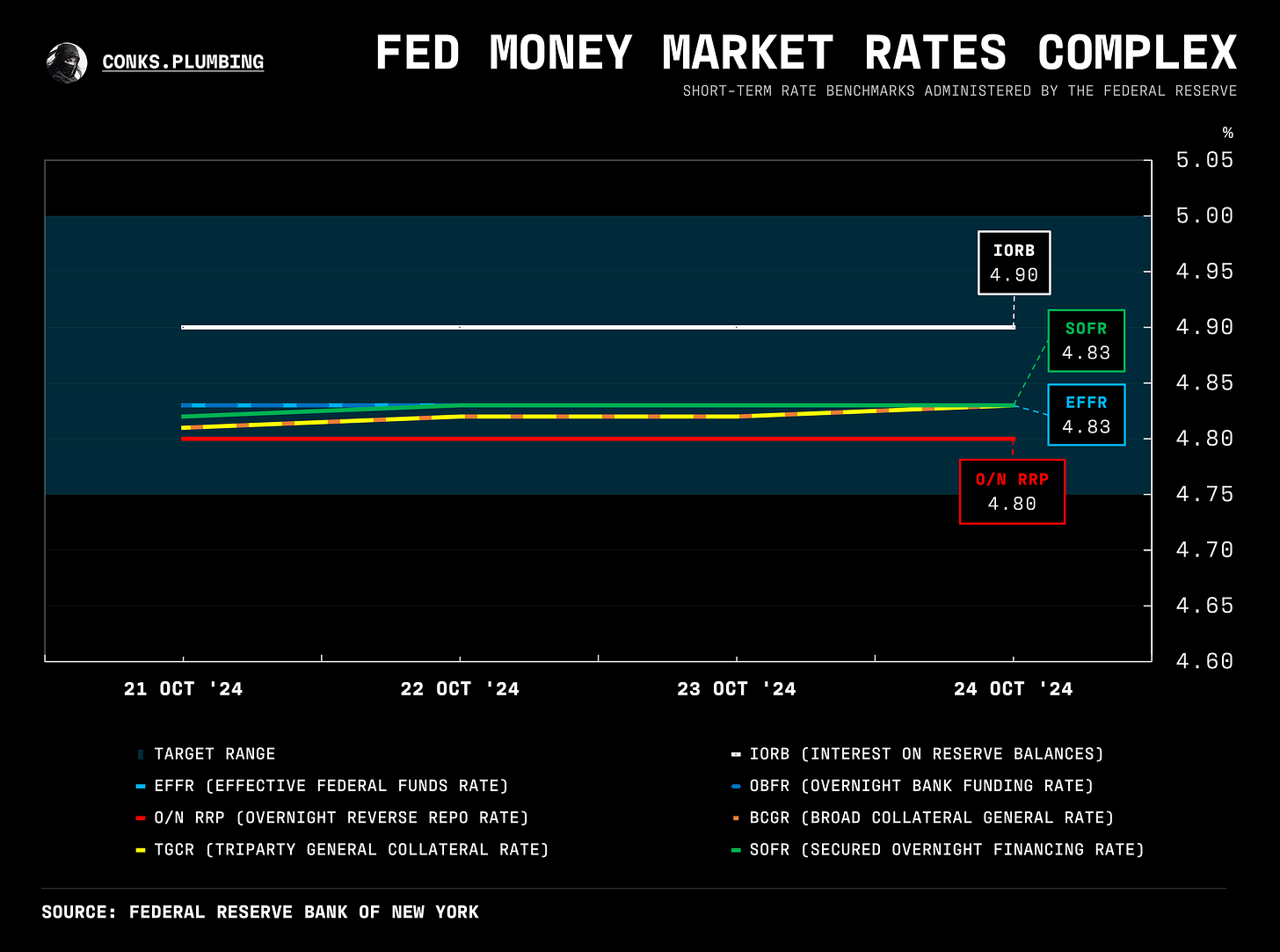

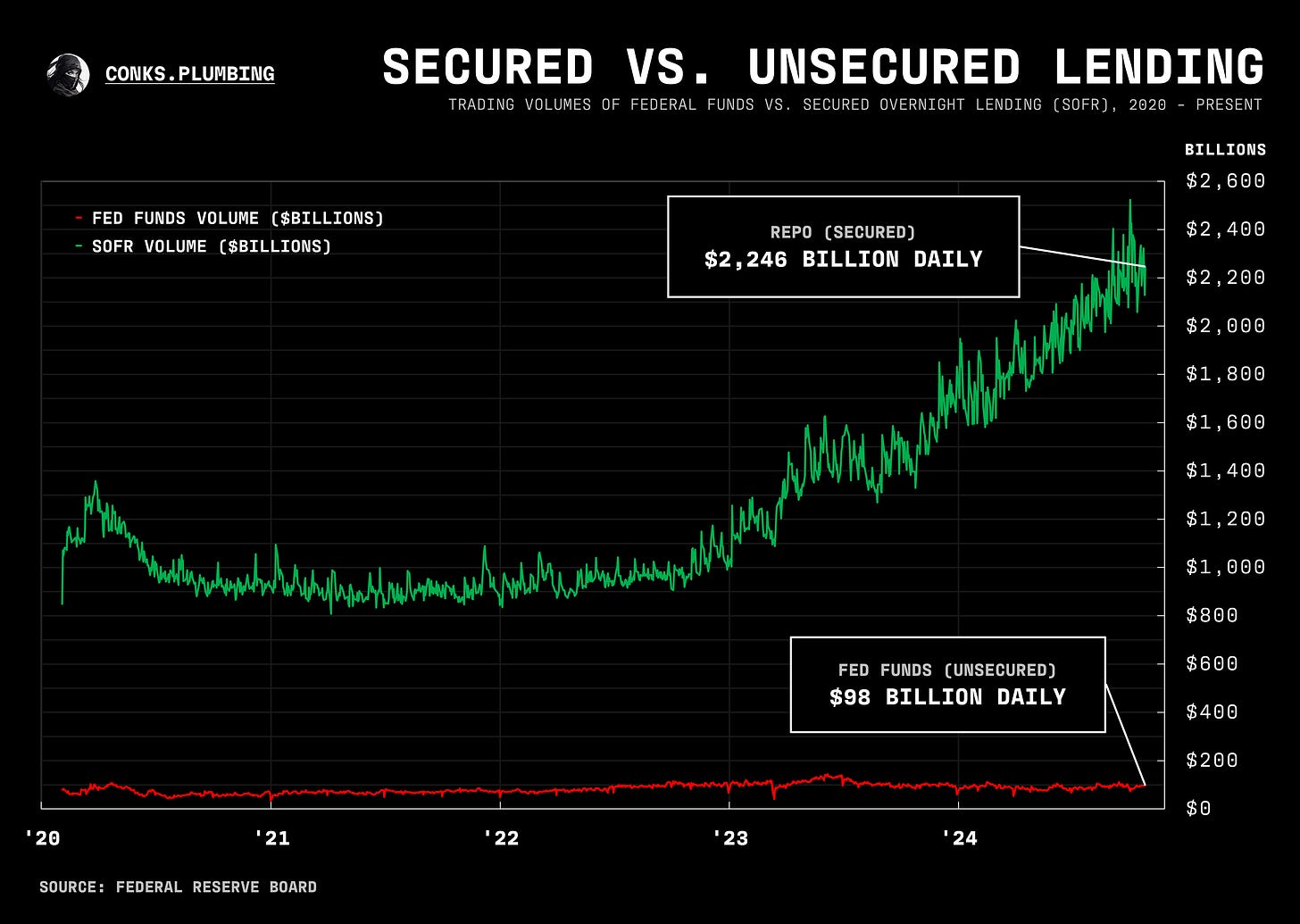

Before the repocalypse, which we referred to recently, large amounts of bank lending via repos — measured by how much SOFR volume traded above IORB (interest on reserve balances) — was a warning sign of scarce liquidity. However, according to Fed data, only around 50% of interdealer trades (where banks tend to transact) print above IORB, much lower than when the repocalypse emerged. Funding pressures are increasing but haven’t reached their limit.

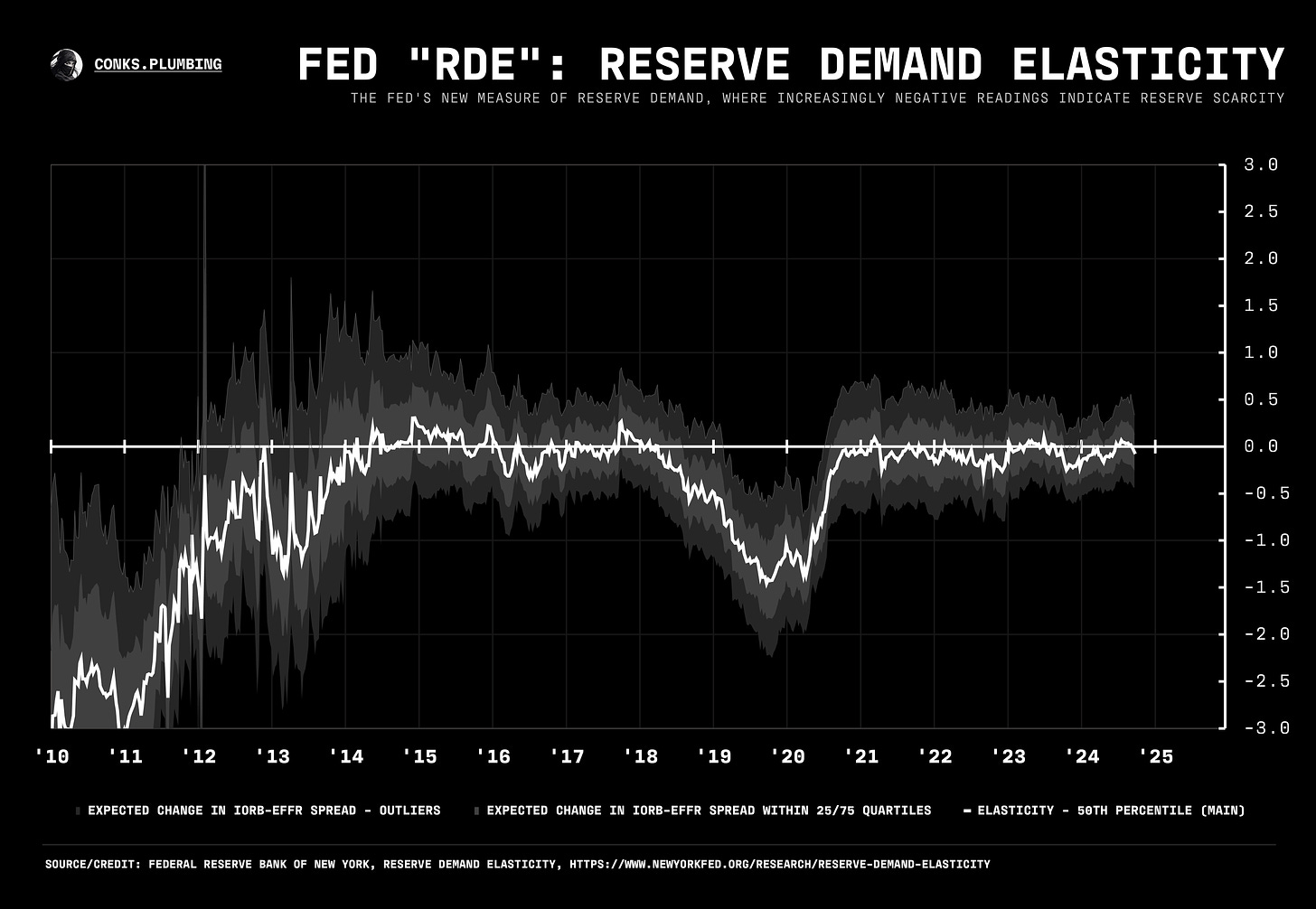

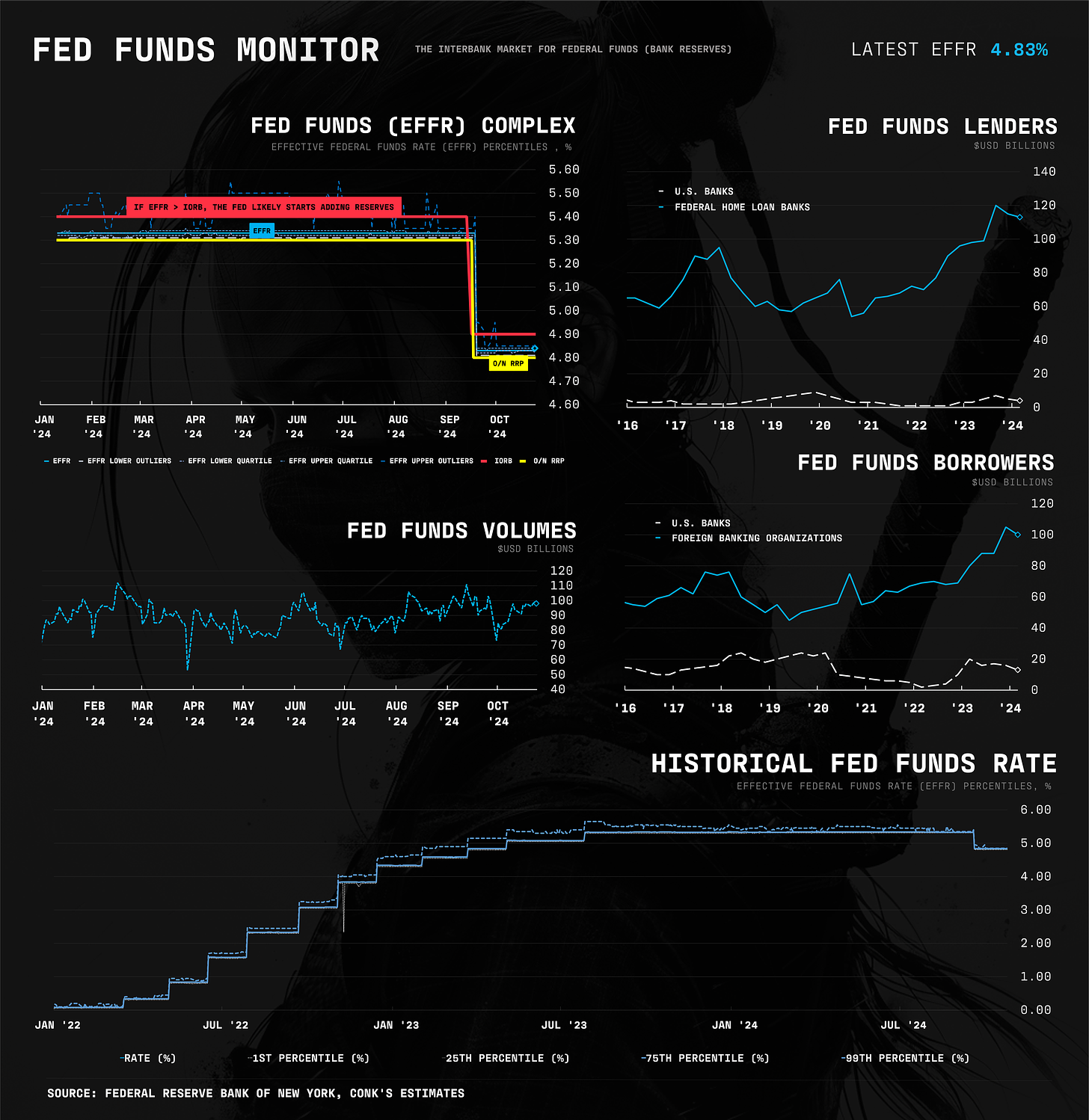

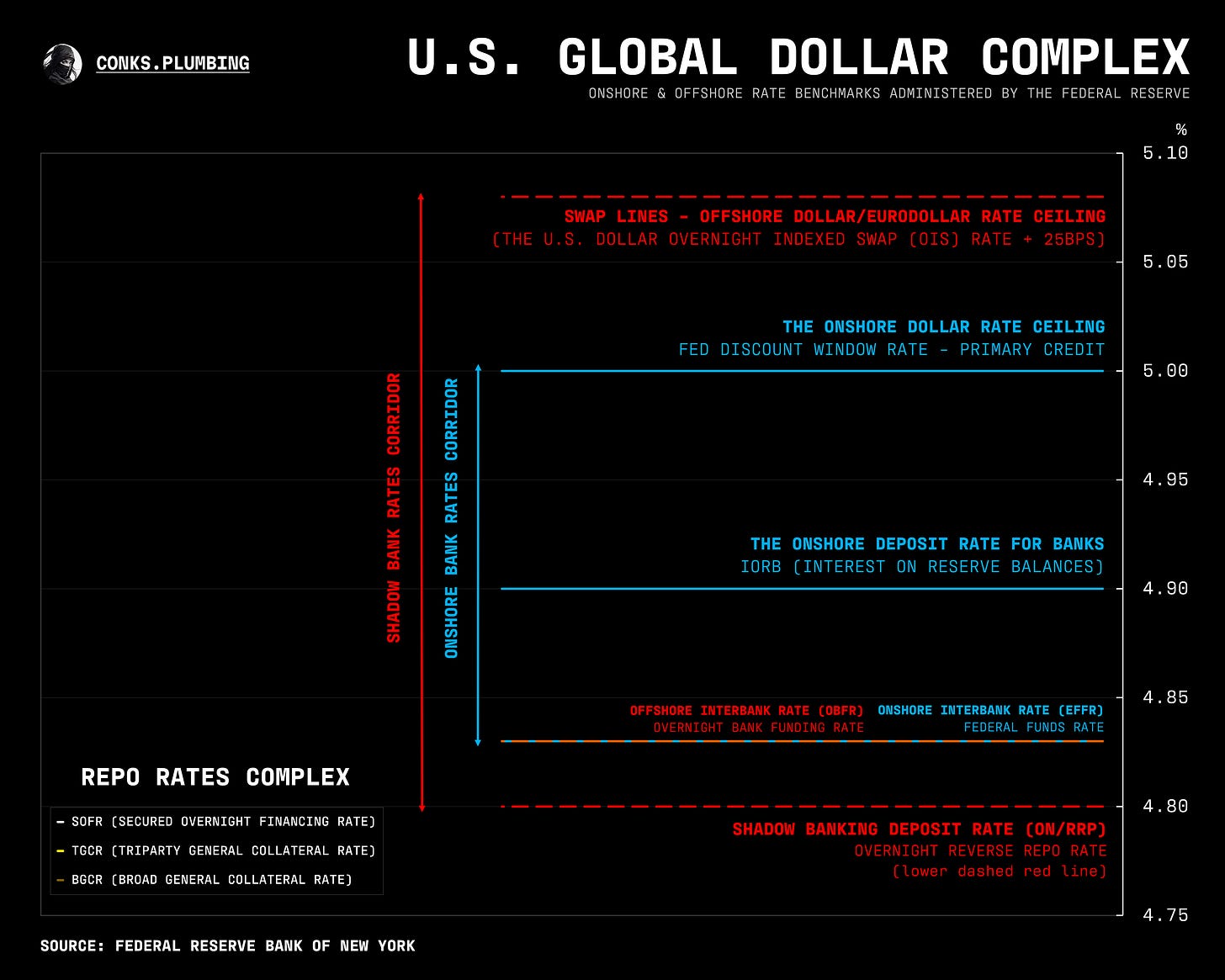

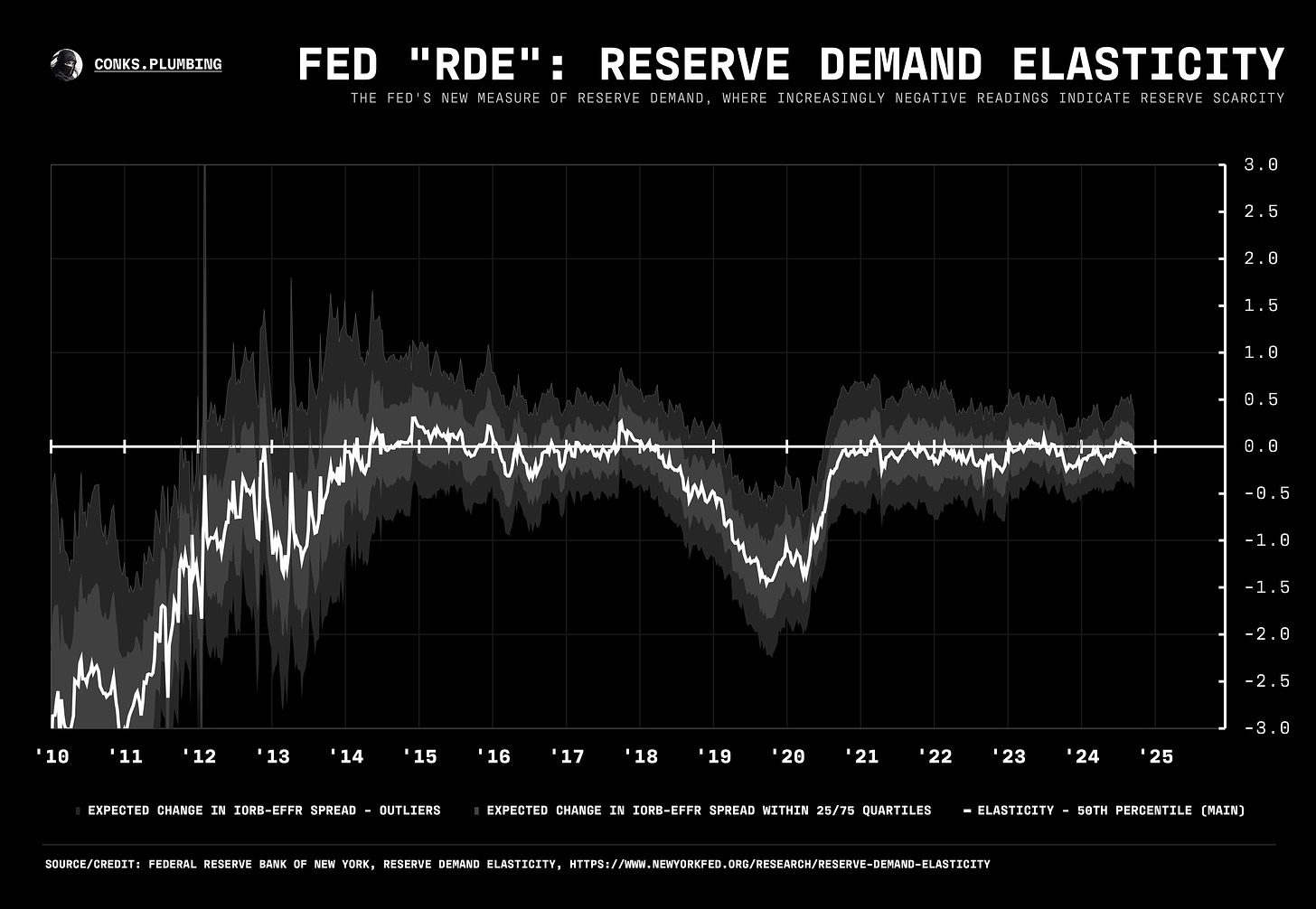

Coincidentally, the Fed released a new liquidity measure: RDE (short for reserve demand elasticity). According to its architects, “[RDE] measures by how much the federal funds rate changes in response to a small shift in reserve supply” (see above). More precisely, it measures potential changes to the spread between IORB (interest on reserve balances paid to banks) and EFFR (effective federal funds rate paid in the interbank market to obtain bank reserves).

In other words, if RDE decreases, the Fed Funds rate has likely increased, indicating scarce reserve balances at banks. But if reserves are ample, then changes in reserve balances won’t affect the Fed Funds rate, and therefore, RDE will equal near zero (i.e. the IORB-EFFR spread doesn't move). Right now, we’re hovering in the “ample zone”.

Meanwhile, as explained in The Repo Market Dislocation: Part II, the Fed has finalized its changes to SOFR (which will go live in November). Centrally cleared repos flowing into SOFR via The Repo Exodus will no longer severely alter the Fed’s primary repo benchmark.

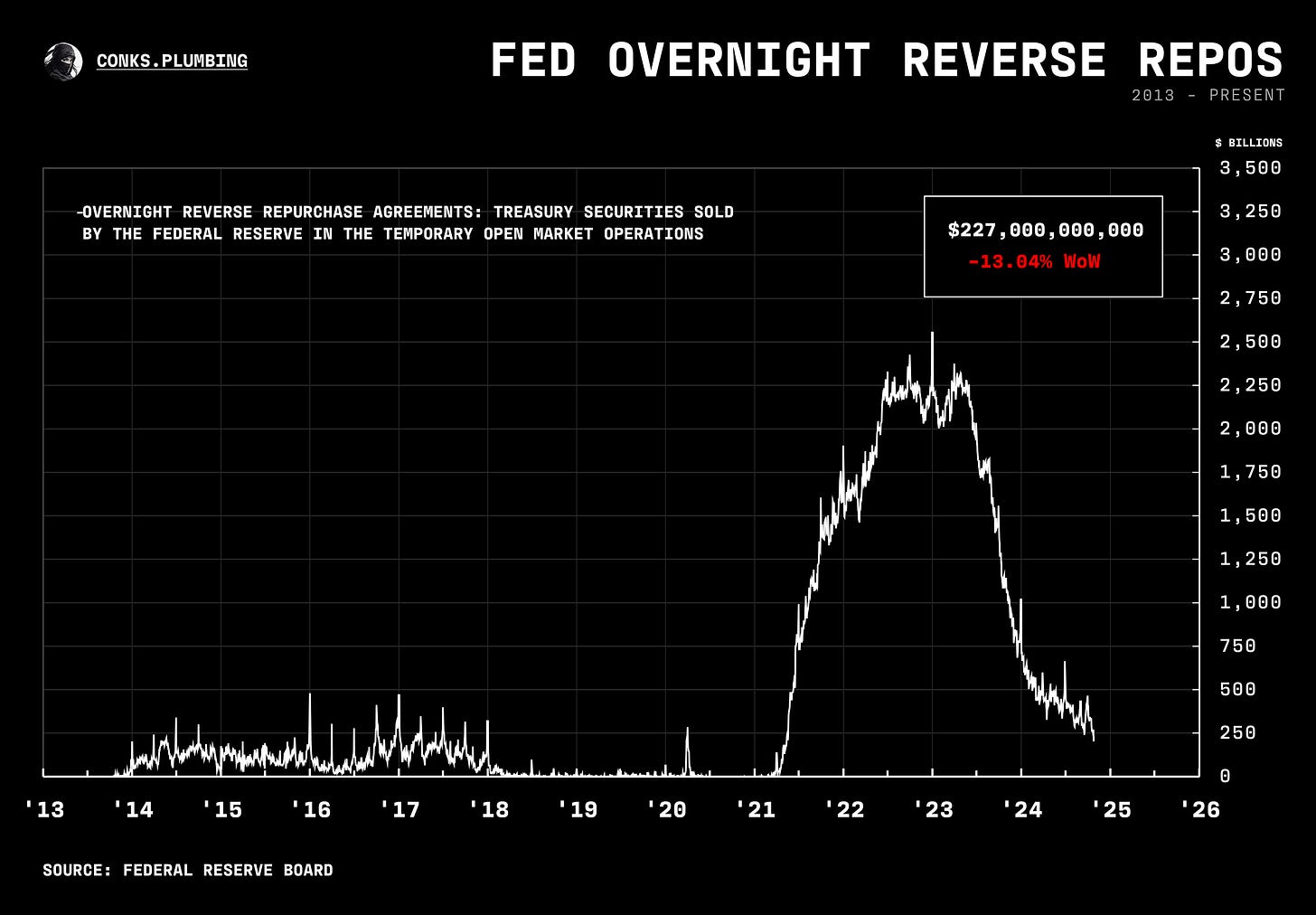

The Fed’s RRP usage continues to decline but will persist until money market funds (MMFs) decide to increase their — self-imposed — counterparty exposure limits or add more sponsored repo relationships. This remains the key driver keeping RRP volumes above zero.

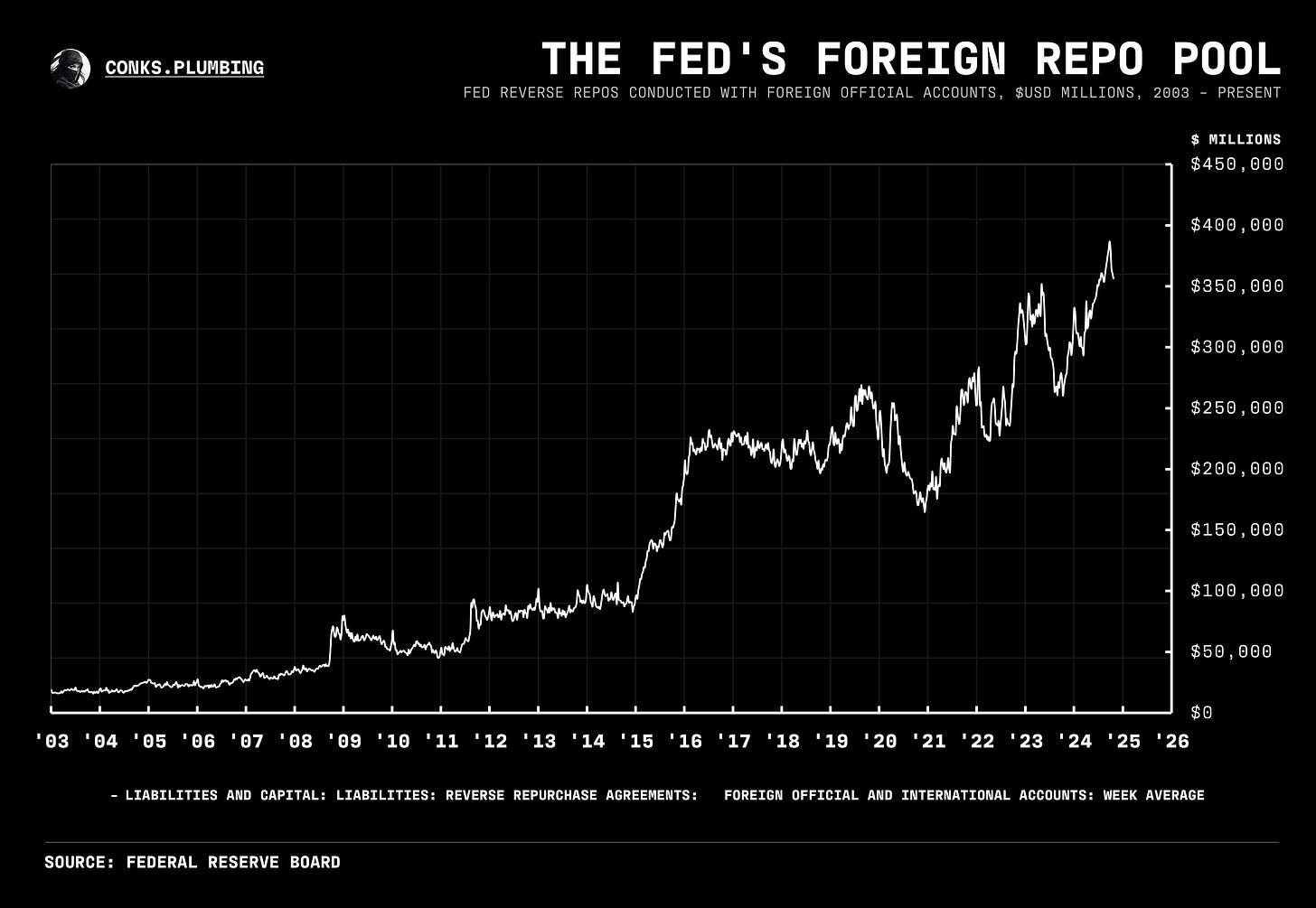

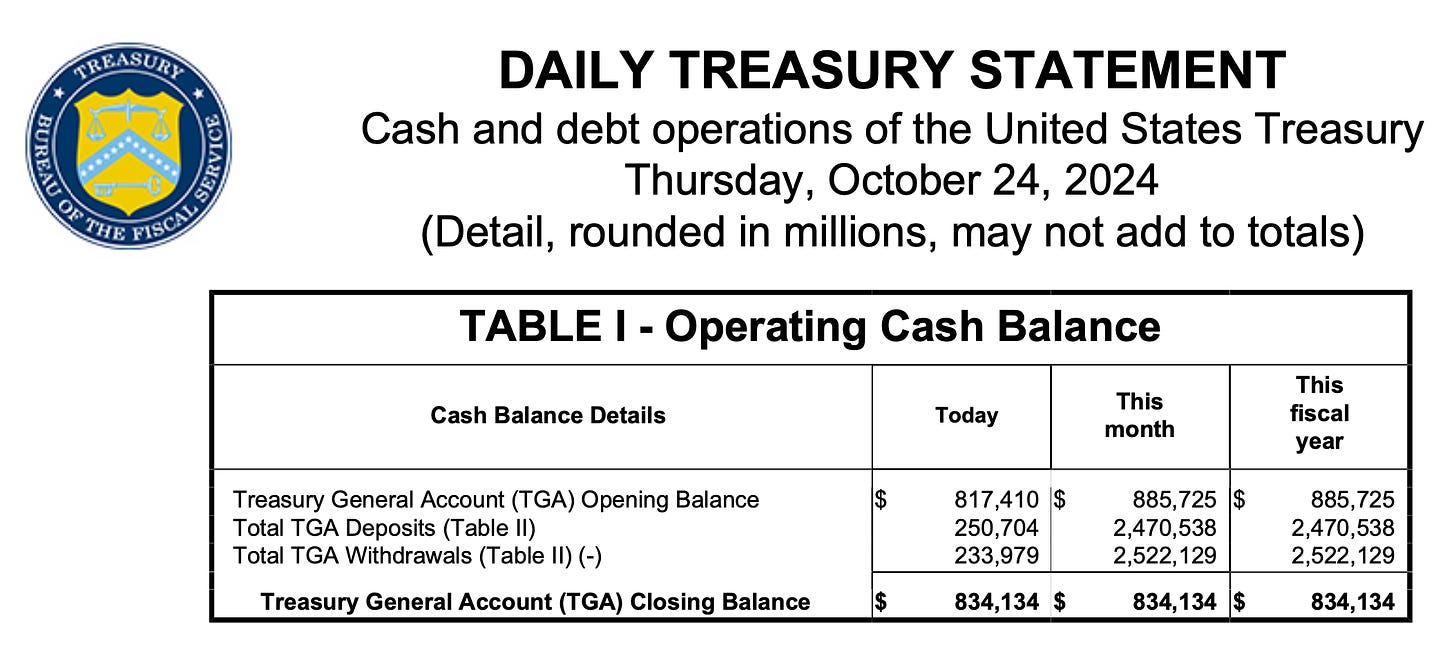

There was also finally a significant drawdown in the foreign repo pool (FRP), the Fed’s excess cash absorber for foreign central banks unable to invest their dollars elsewhere (chart available below). Has the Fed lowered its secretive FRP rate, prompting outflows? We won’t know as it’s under lock and key. But money has begun to flow out and into U.S. bank deposits and t-bills.

As for macro, equities outperformed bonds. Now, the opposite appears more attractive. We think the Fed still cuts twice (two 25bps cuts, to be precise) this year. Don’t fight the Fed — but maybe fight Conks.

Now for the chartbook (more monitors — four to be exact — on the way)…

If you act on anything provided in this newsletter, you agree to the terms in this disclaimer. Everything in this newsletter is for educational and entertainment purposes only and NOT investment advice. Nothing in this newsletter is an offer to sell or to buy any security. The author is not responsible for any financial loss you may incur by acting on any information provided in this newsletter. Before making any investment decisions, talk to a financial advisor.

EFFR, OBFR, SOFR, TGCR, and BGCR are subject to the Terms of Use posted at newyorkfed.org. The New York Fed is not responsible for publication of tri-party data from the Bank of New York Mellon (BNYM) or GCF Repo/Delivery-versus-Payment (DVP) repo data via DTCC Solutions LLC (“Solutions”), an affiliate of The Depository Trust & Clearing Corporation, & OFR, does not sanction or endorse any particular republication, and has no liability for your use.

I never thought of the Fed's repo facility as stigmatized. I guess tapping it would imply that a borrower has no other triparty relationships with MMFs, hence the stigma? Since it's brand new it seems like a surprising way to think about it. Thanks.

In X, everyone says you're crazy to buy bonds, citing the US debt problem, the inflation problem, the strength of US employment and the economy, and Trump.

But I don't think so, and I was relieved to see what conks had to say.

‘I'm not the only one who's crazy.’