Money Market Update

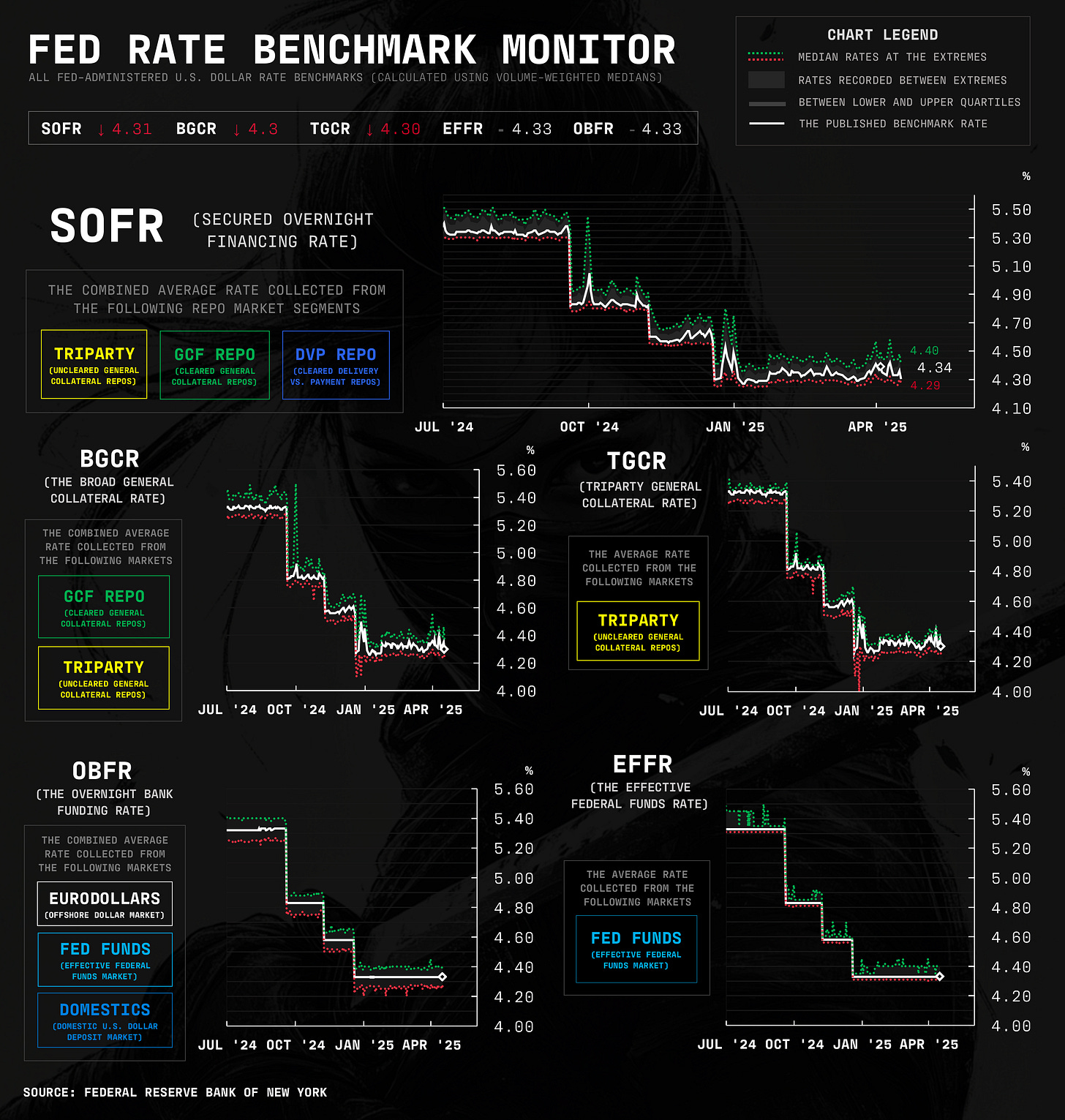

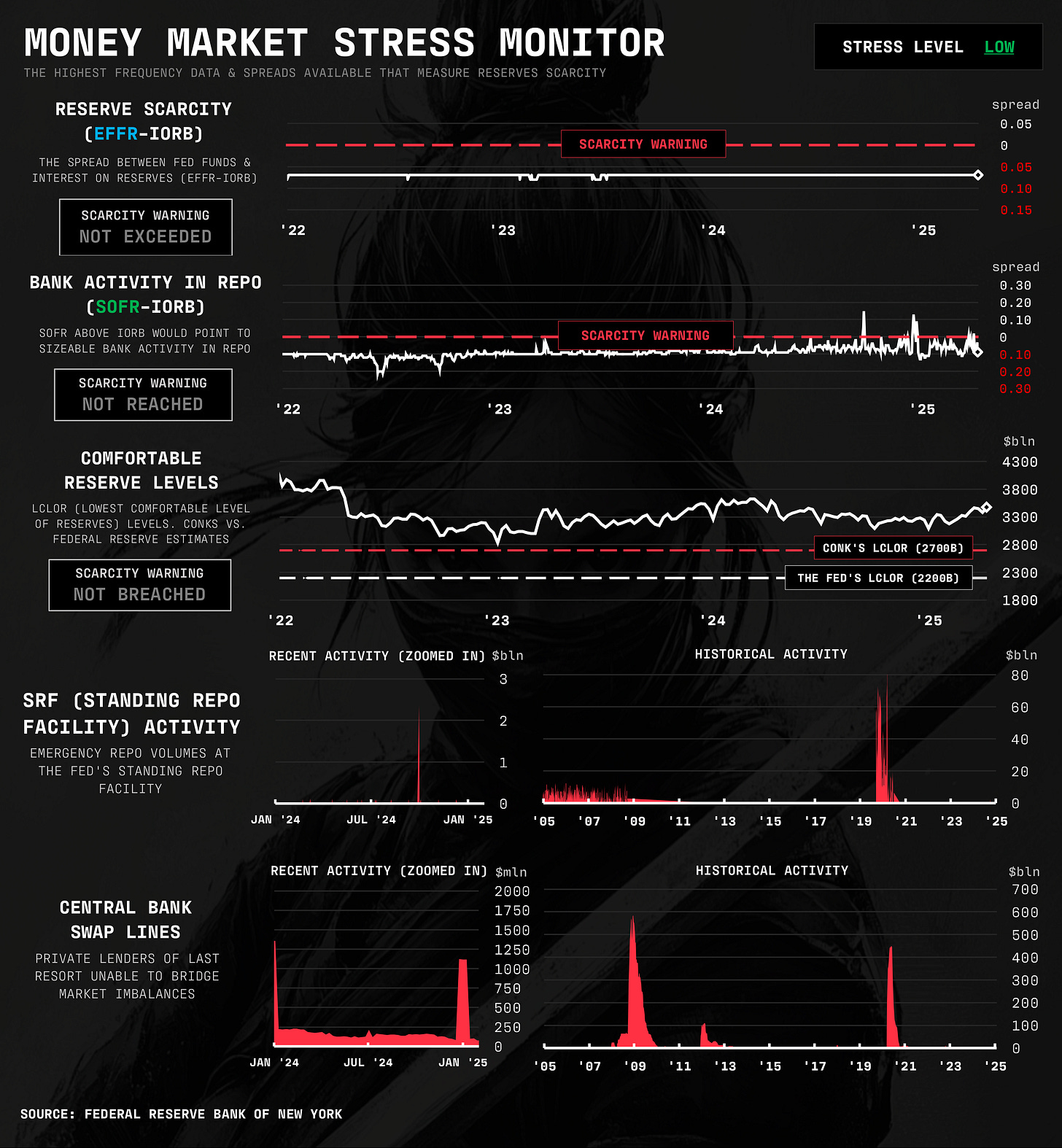

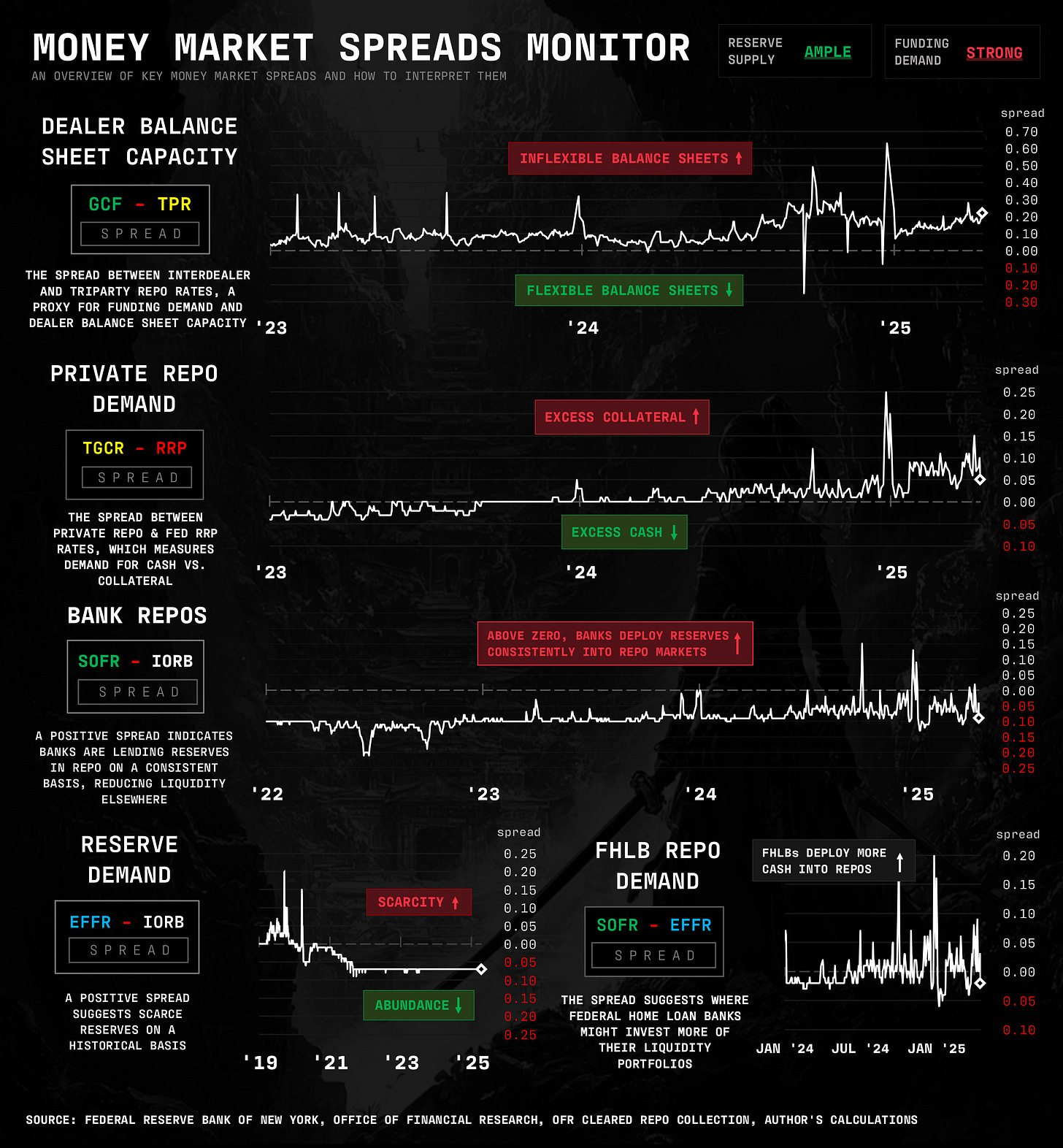

tariff mayhem bleeds slightly, not significantly, into money markets, as major hurdles continue to linger in the shadows

Welcome to another Conks edition. We’re now 48k+ strong.

This is one last money market update before we release the pilot edition of Conks Pro in conjunction with our next major piece. Since this has involved a significant amount of time, encompassing design, writing, and more (all done by yours truly), the pilot edition will be available to all paid subscribers. More details on the future of Conks will be available by the end of the month. Message for more information.

But before the big reveal, a money market update…

Summary & Brief Commentary

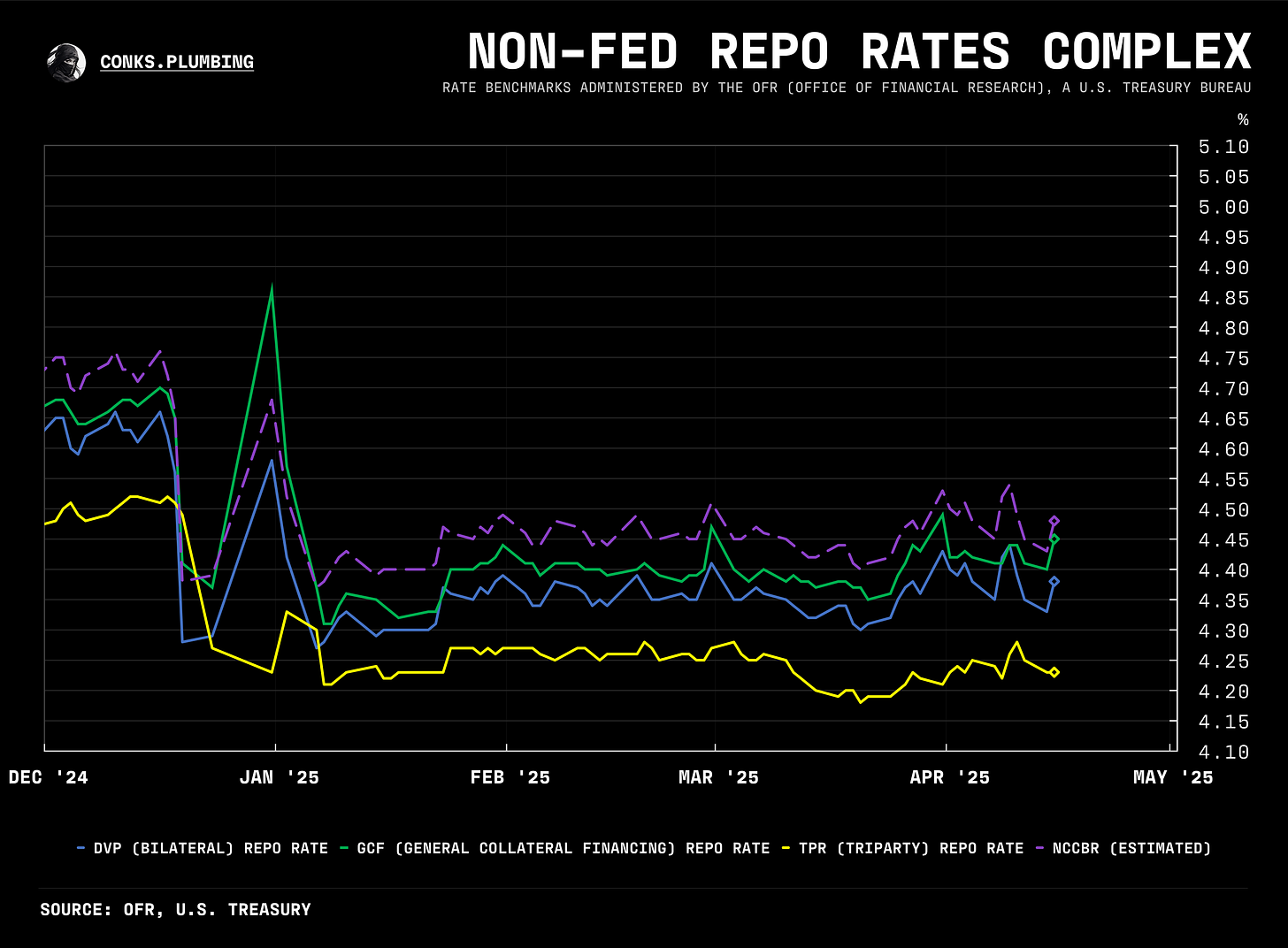

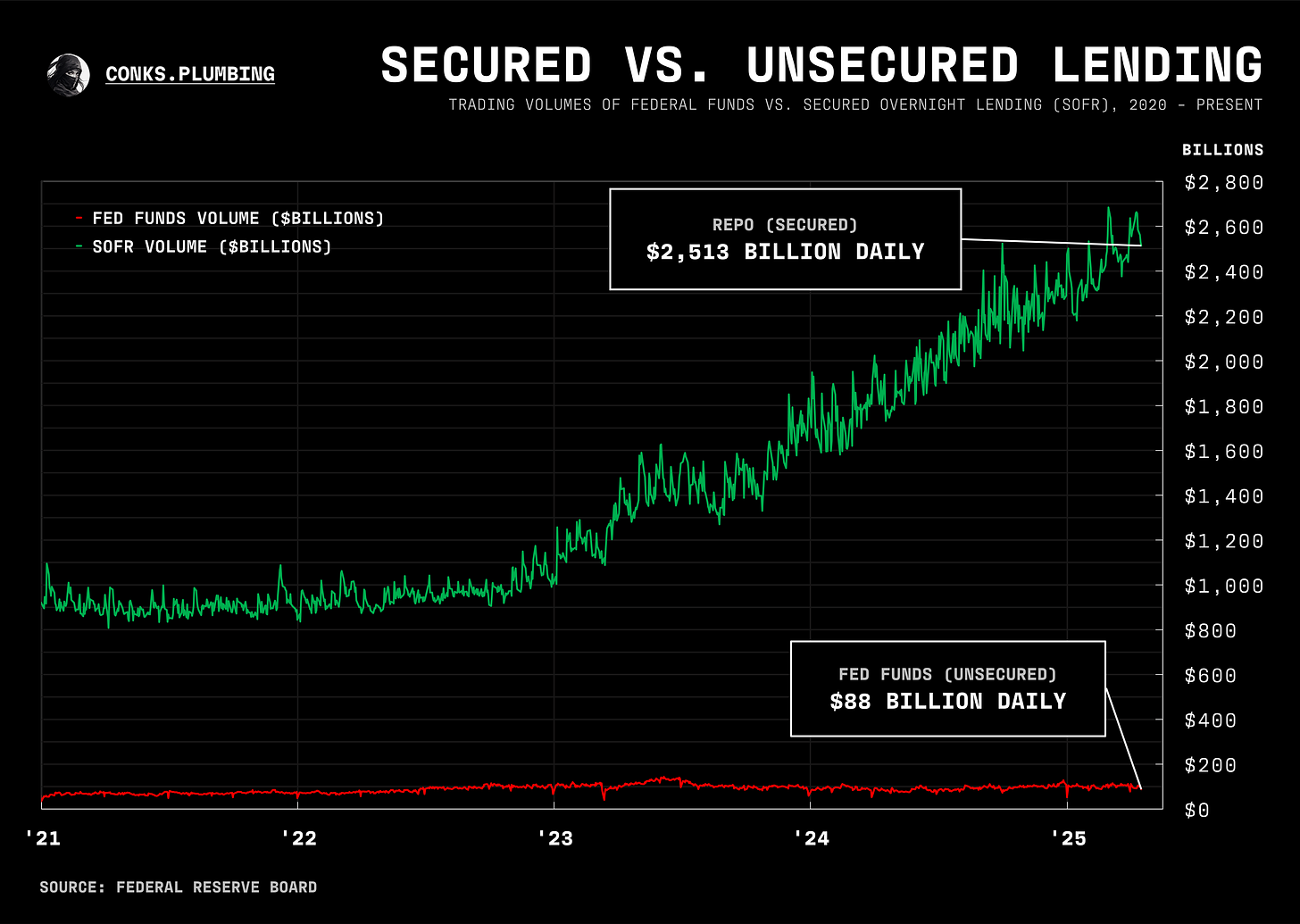

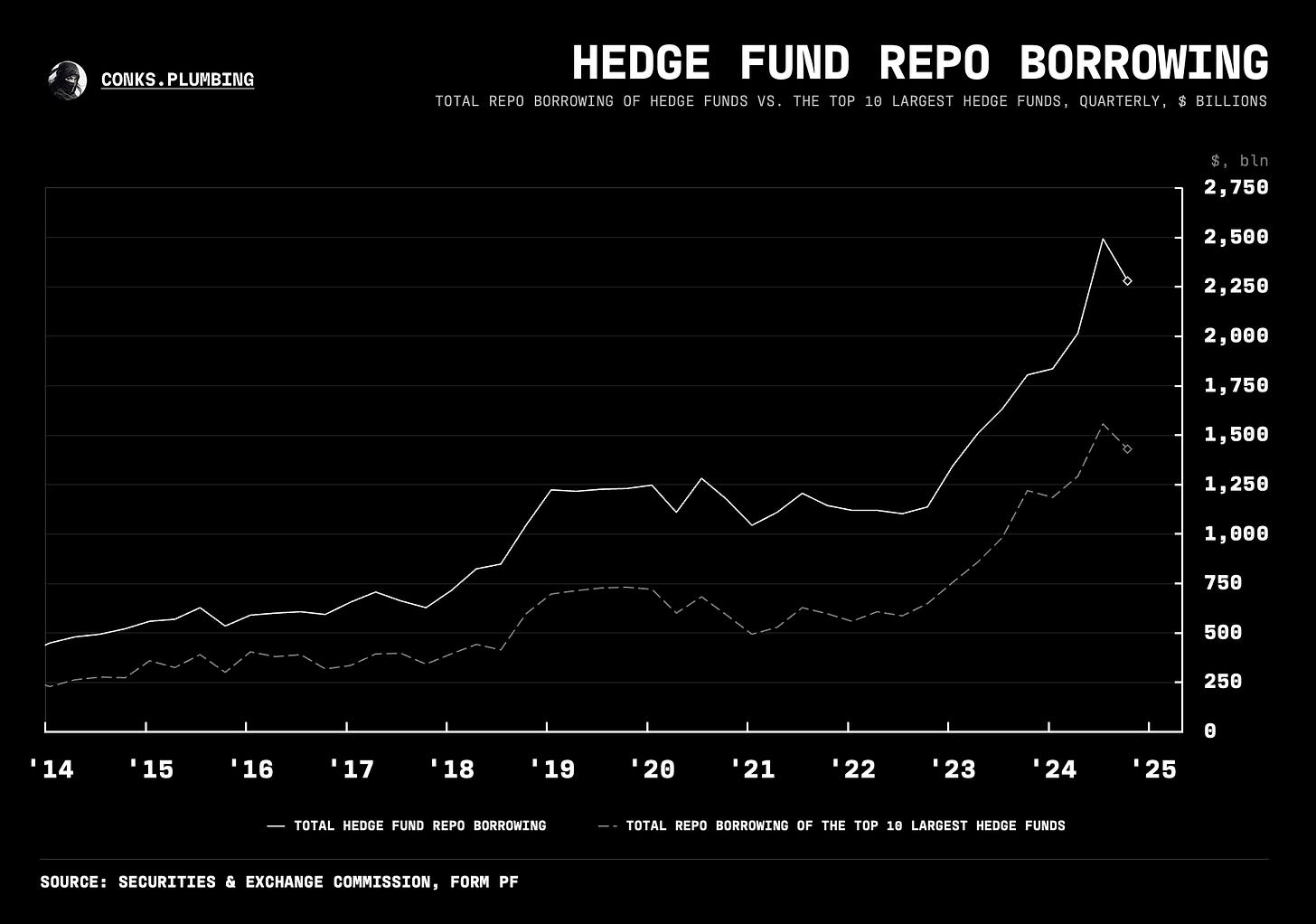

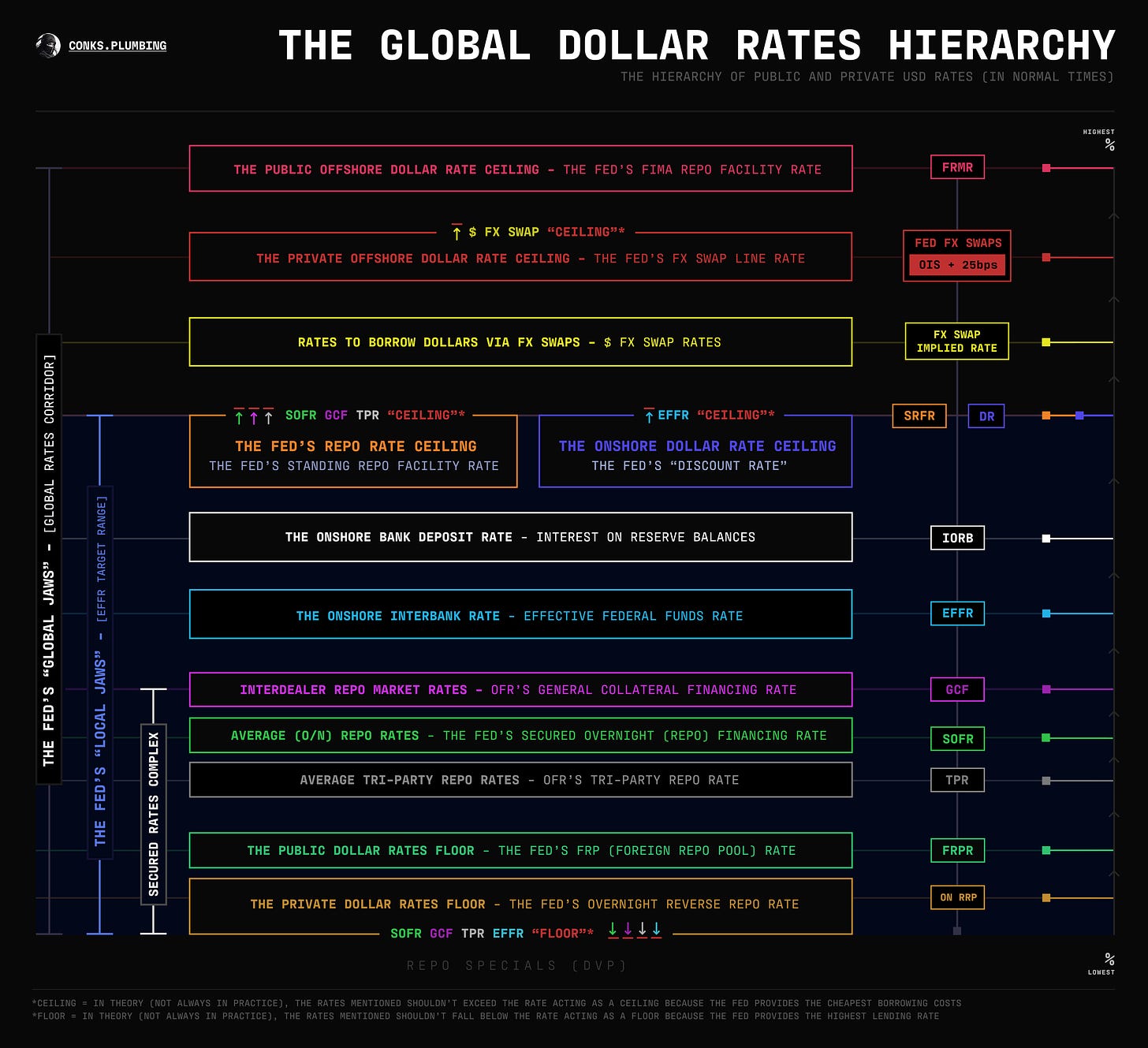

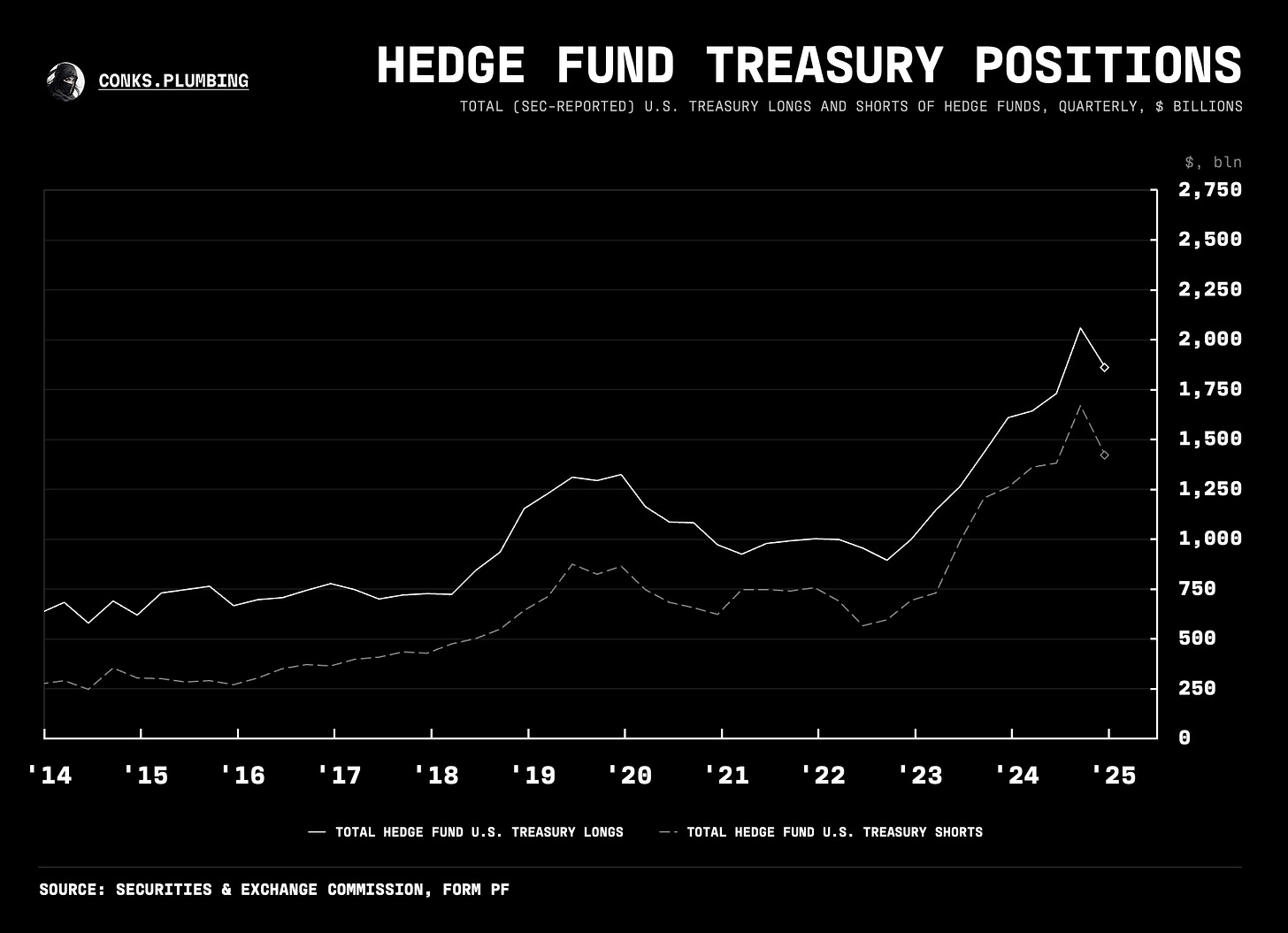

Unlike equities and bonds, funding markets withstood the tariff onslaught with minimal pain. Unsecured markets, such as commercial paper, saw rates jump, but nowhere near crisis levels. Some of the “basis boiz” (Conks’ complementary, not derogatory term for basis traders) were stopped out, yet no significant stress emerged compared to swap spreads, where a couple of large players were rumored to have been caught on the wrong side.

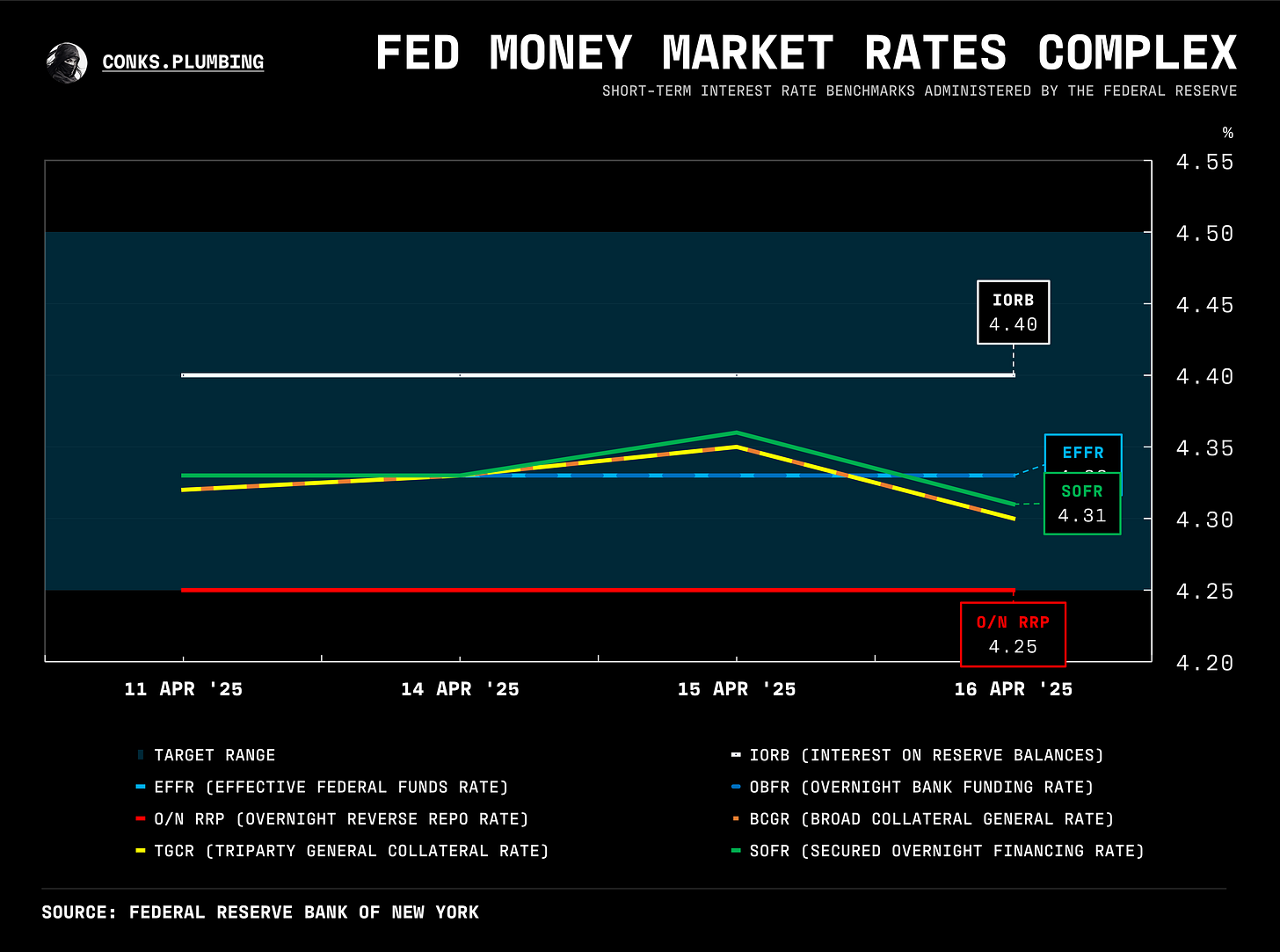

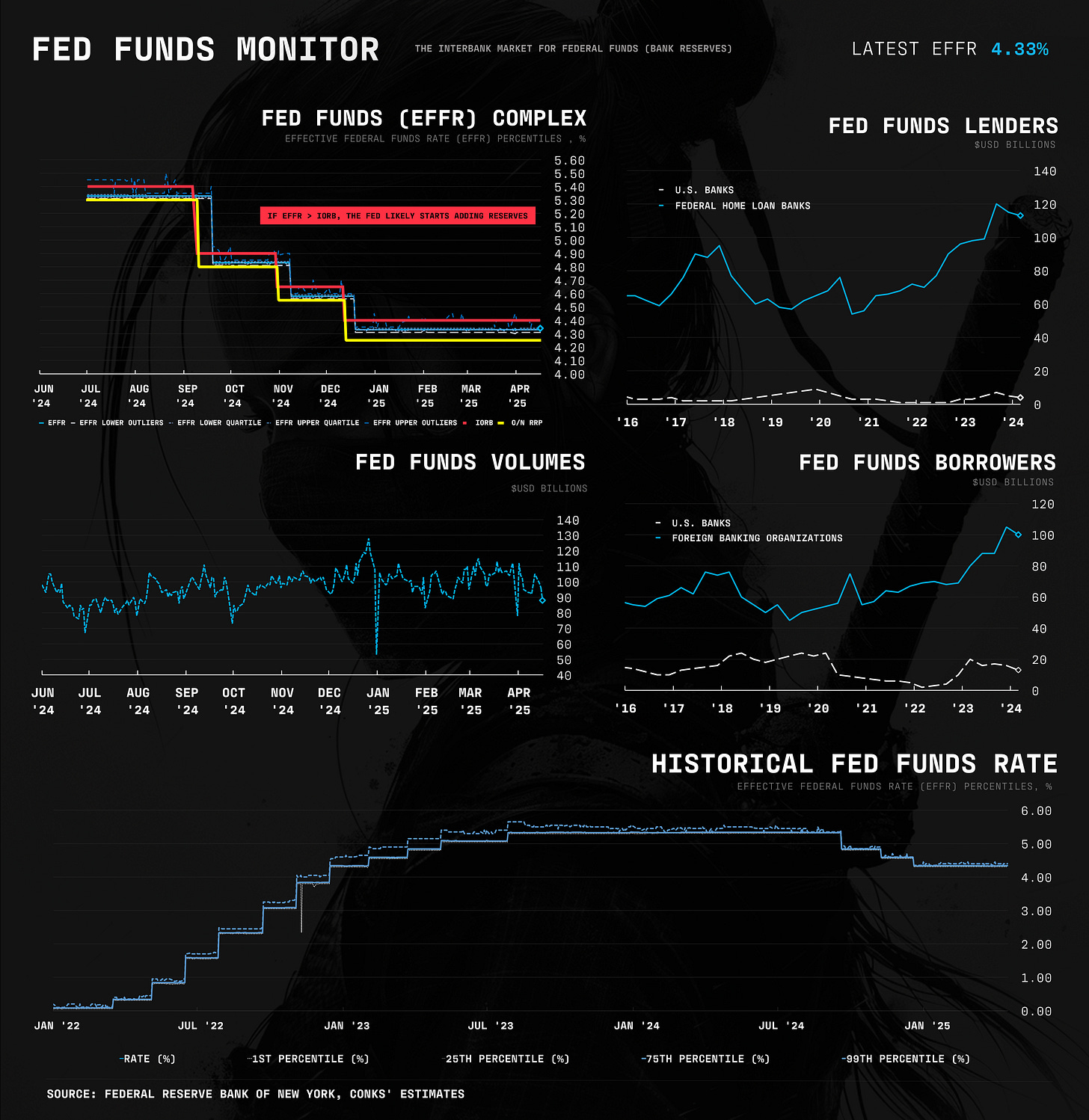

As the mini-episode unfolded, long SOFR-FF basis (short SOFR-FF futures basis) and tightening swap spread trades worked well, partly due to the reasons mentioned in earlier updates, but were exacerbated by the Trump tariff “cascade”. For basis and swap spreads, the next move is highly uncertain. Sometimes it’s best to do nothing until an opportunity presents itself.

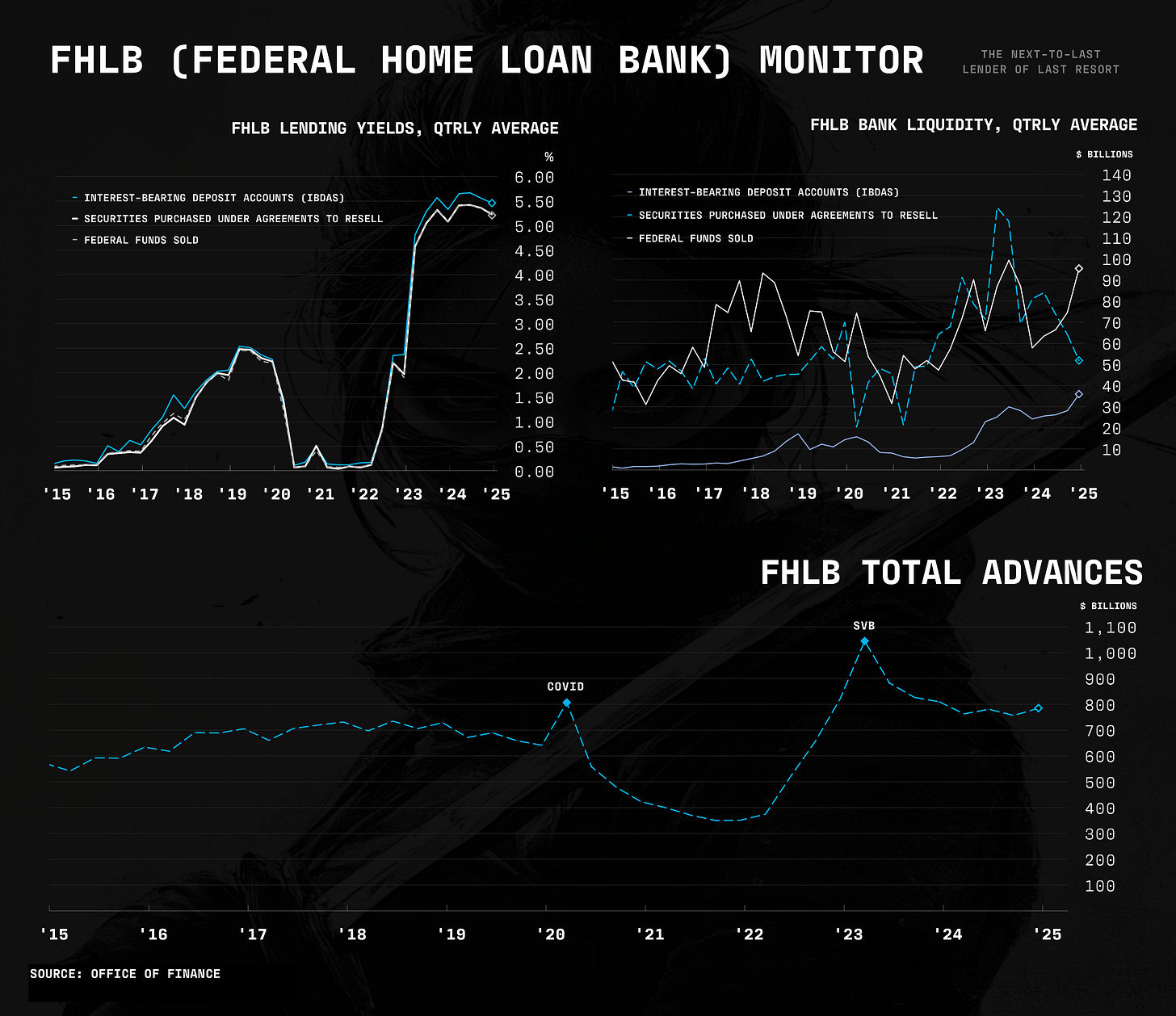

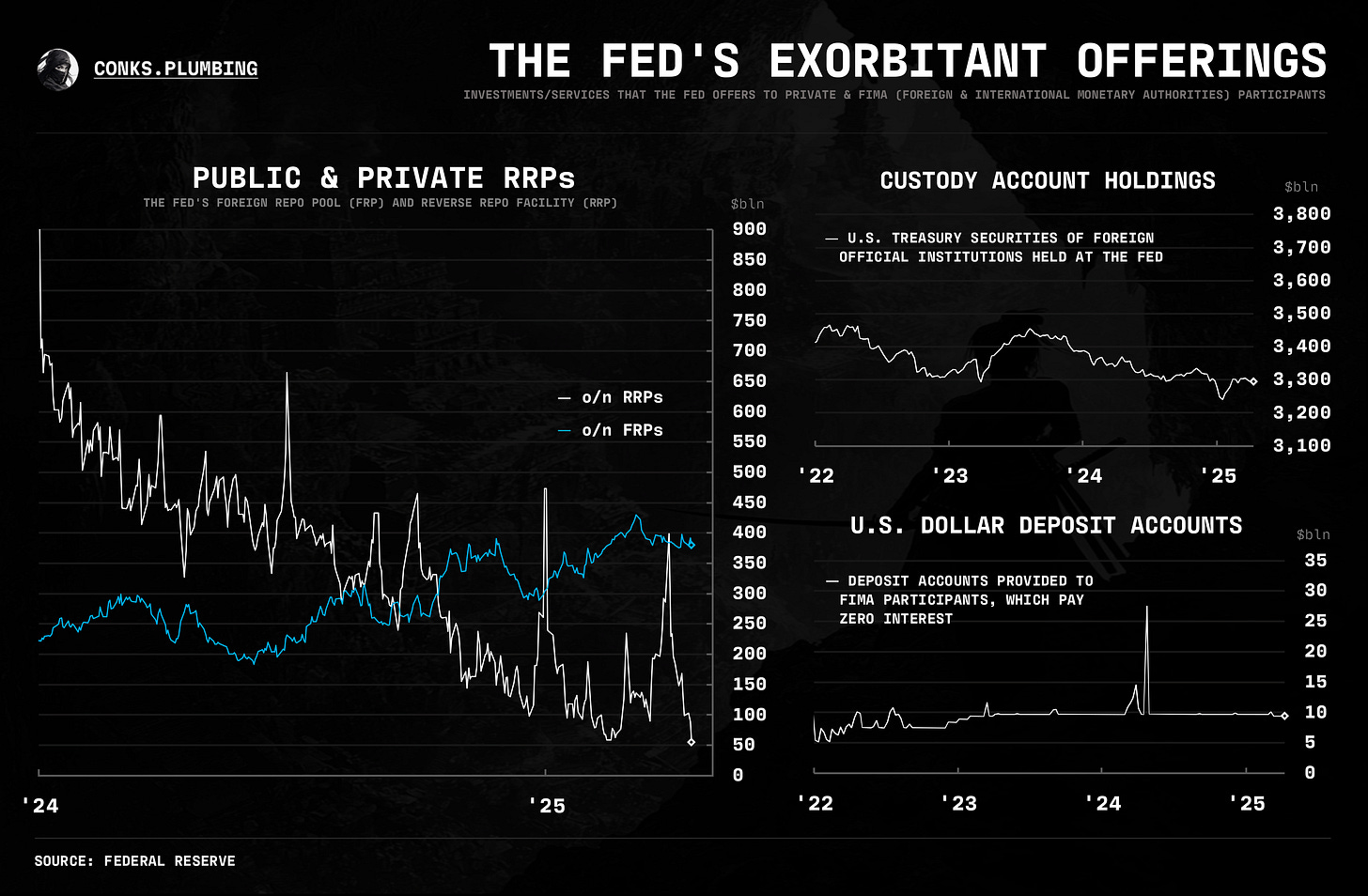

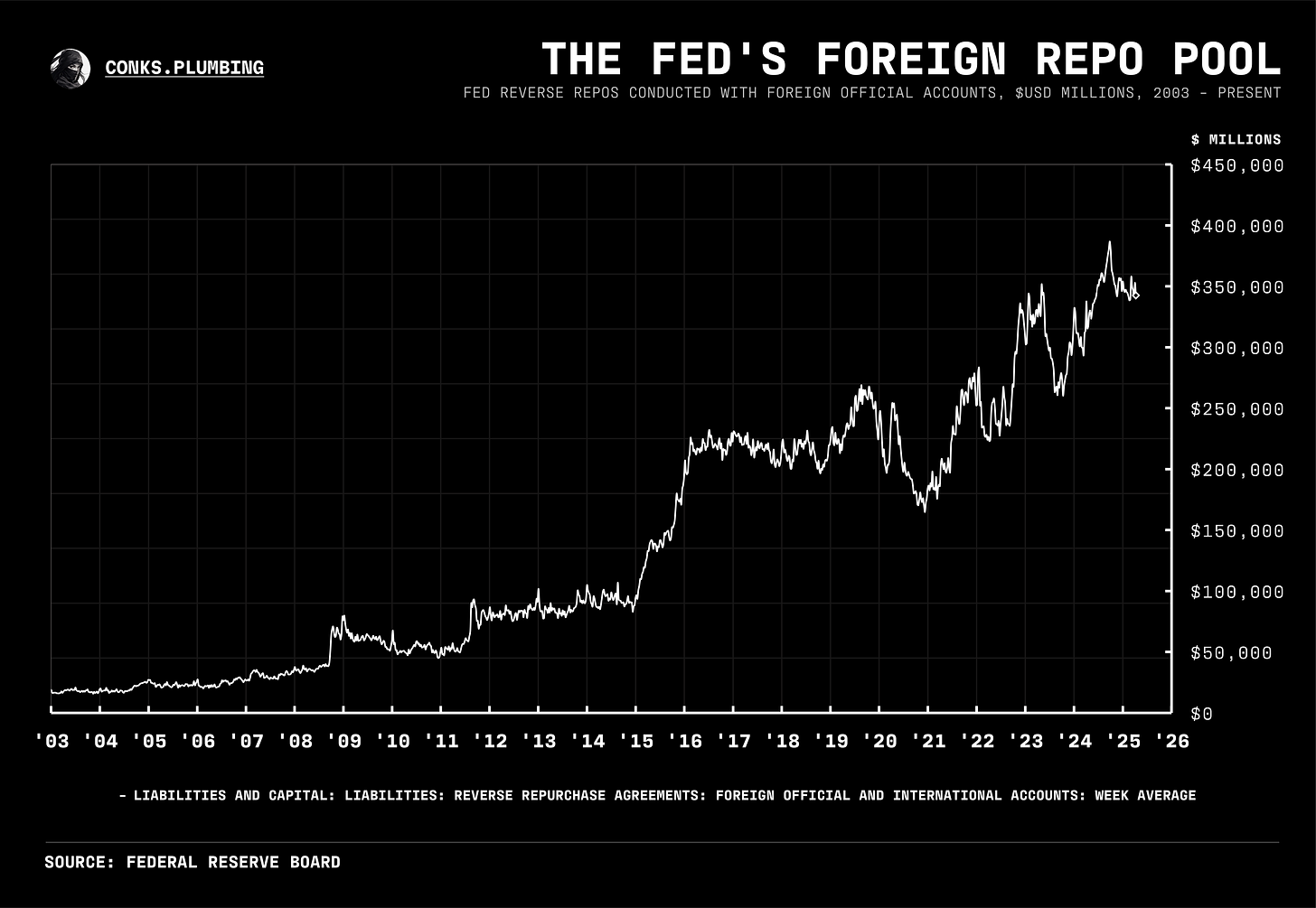

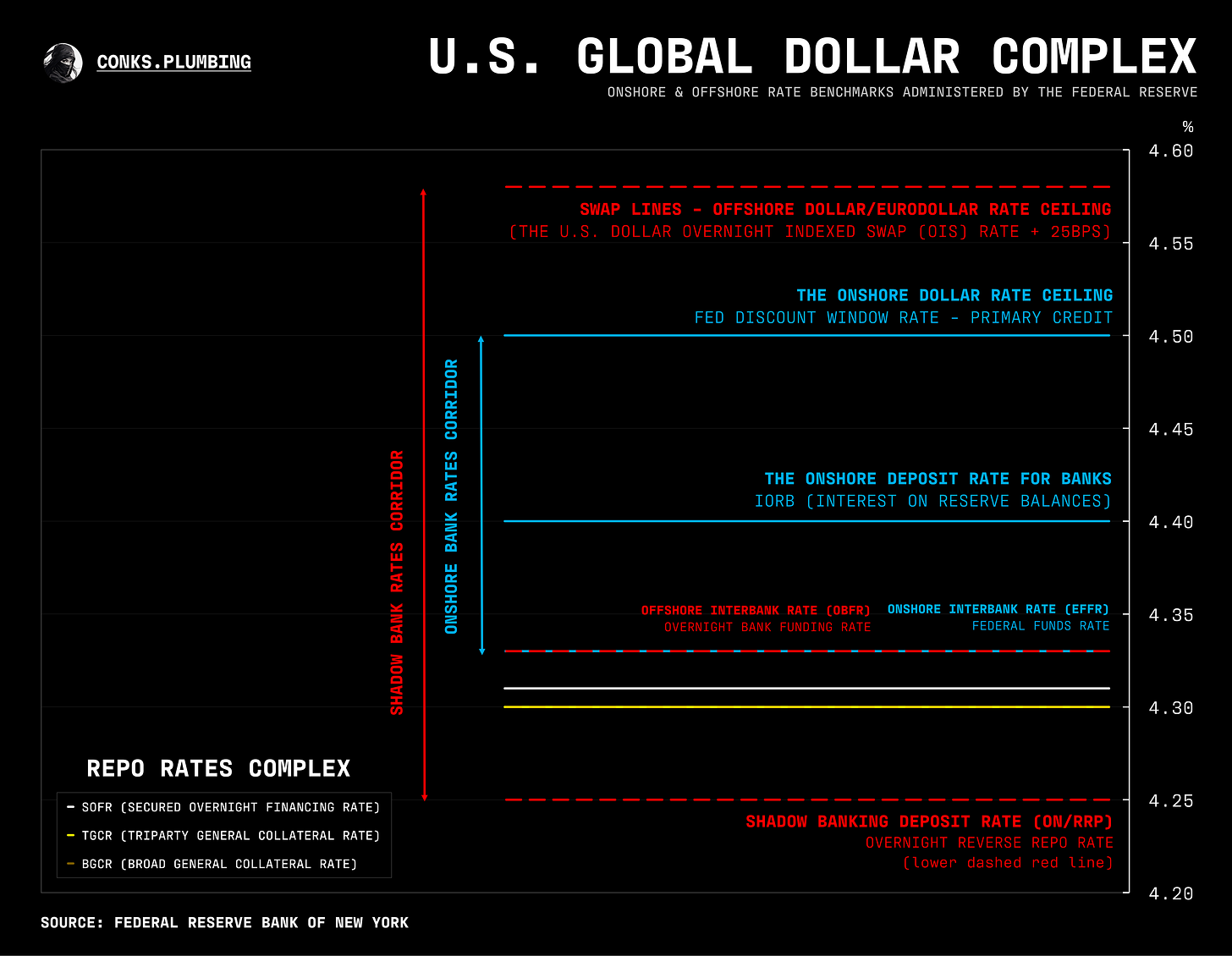

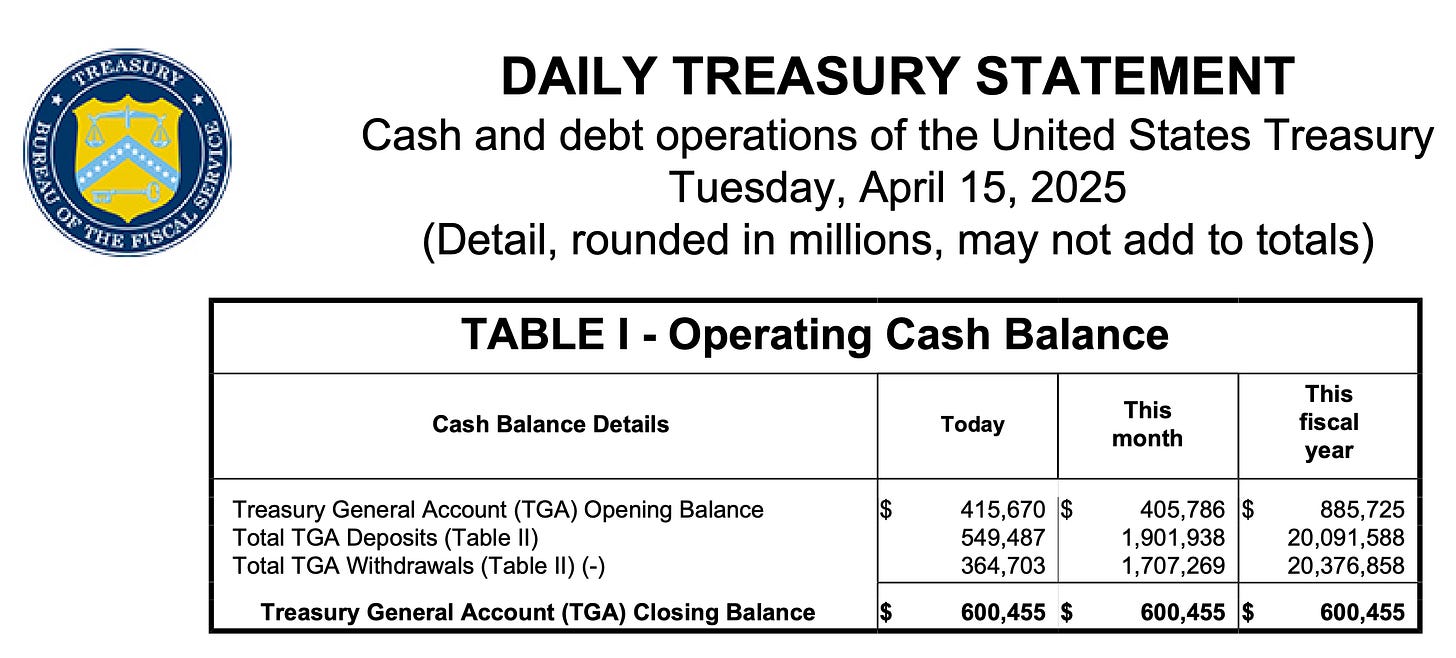

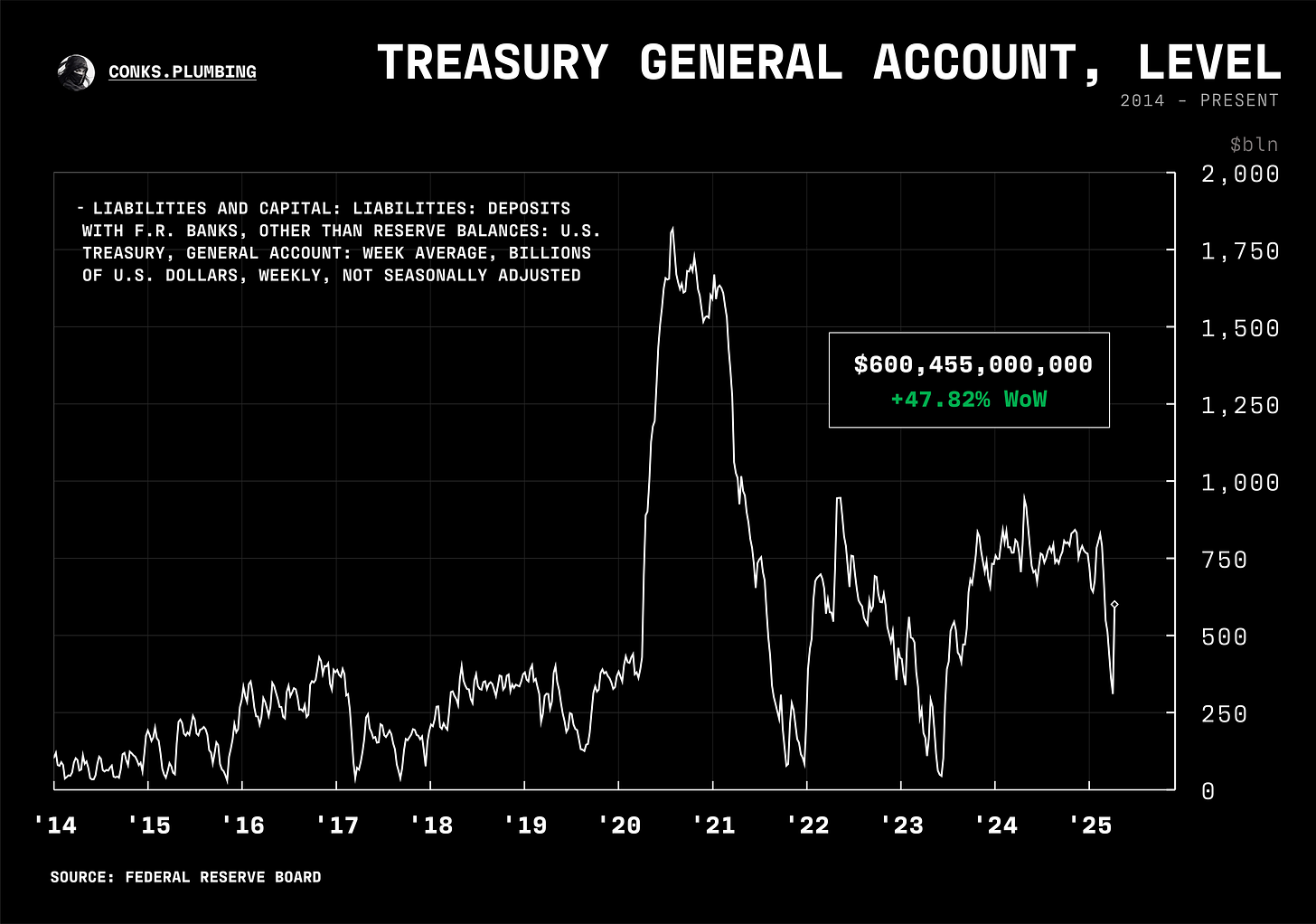

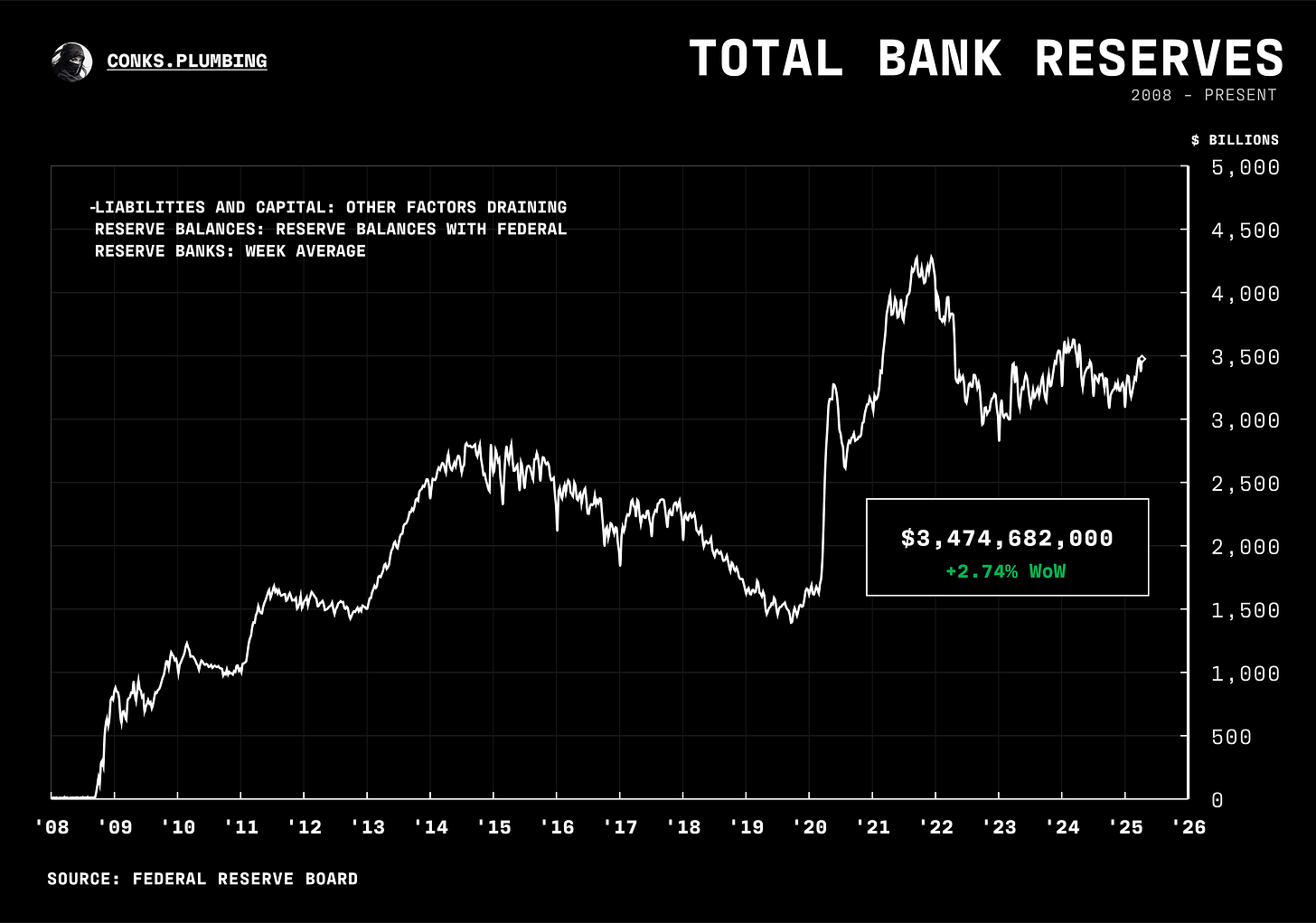

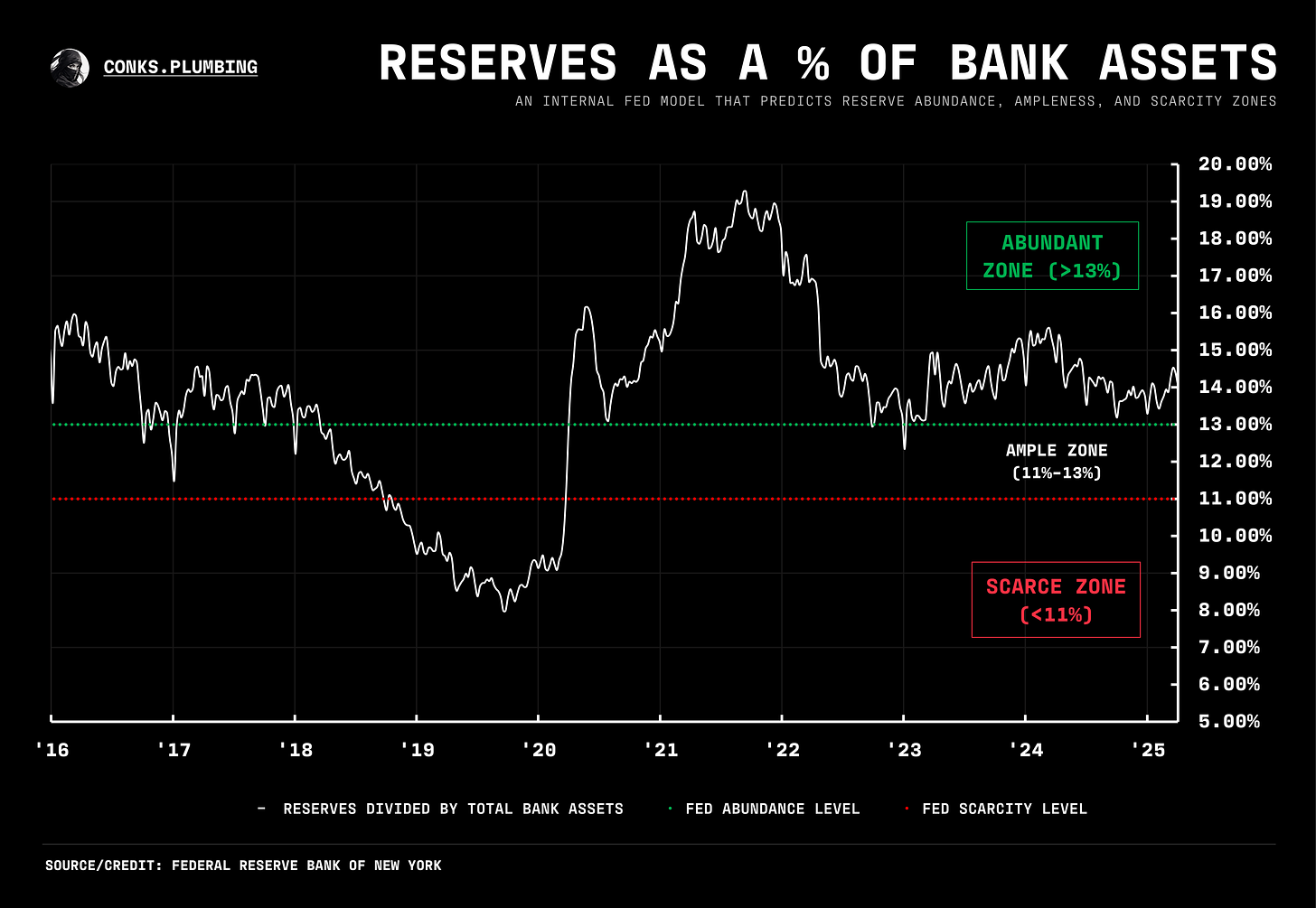

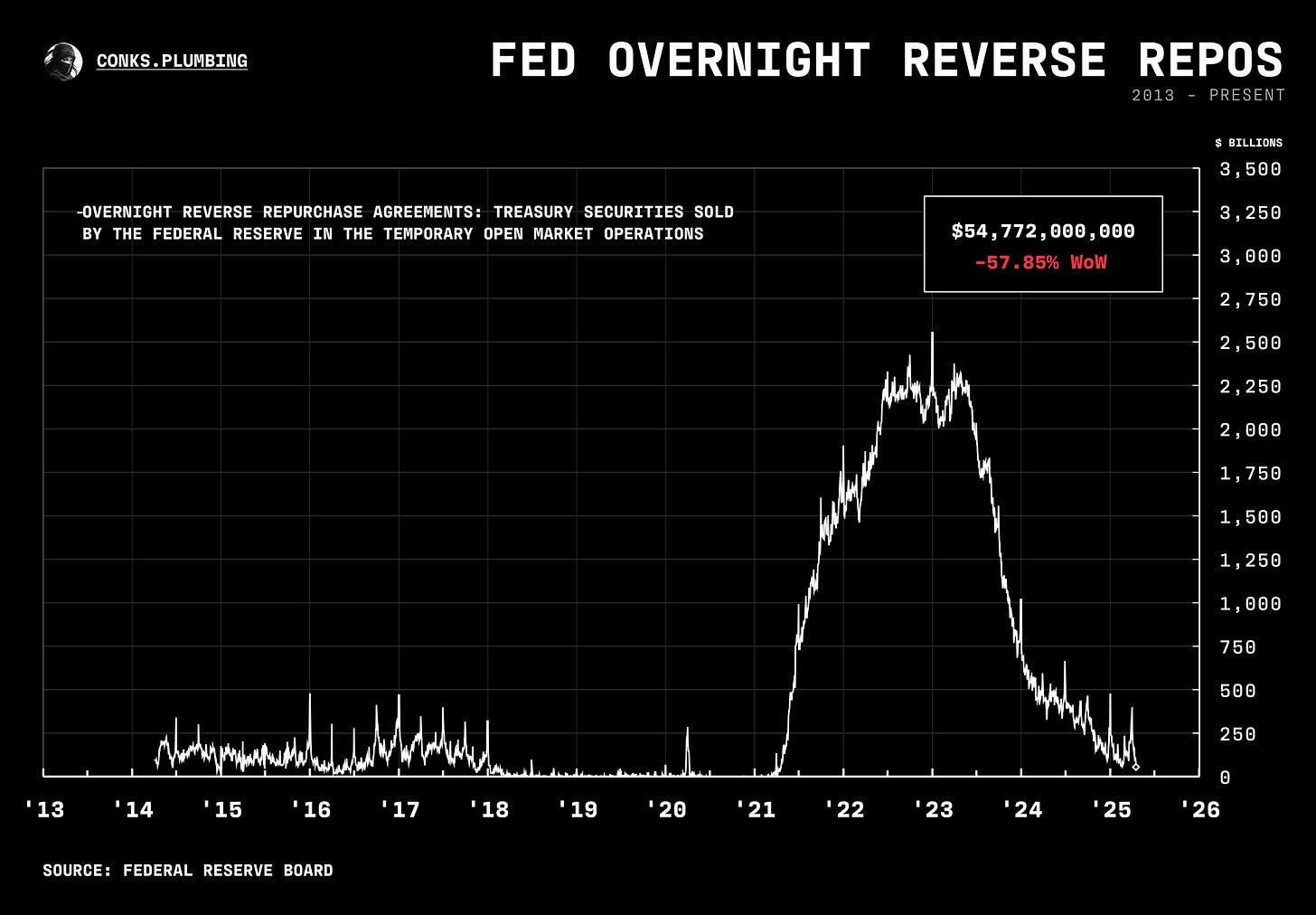

Meanwhile, the TGA “hump” has begun to form with tax receipts prompting an influx of cash into the U.S. government’s bank account. The RRP could even hit zero, but this remains doubtful, given that sponsored repo has yet to reach its full potential. Unlike previously feared, a debt ceiling truce occurring simultaneously is now improbable. A ceasefire has been pushed forward, and the debt ceiling X-date is still likely mid-August. A debt ceiling resolution awaits and will test funding markets. The Fed Funds rate may even start to move higher after years in slumber…

In market structure, an intraday (triparty) repo market by the BNY — although operational for some time — has been officially marketed to large repo participants. However, those we have spoken to over the last year have yet to find a concrete use for it. For instance, traders already obtain liquidity in the DVP market before intraday triparty provides the same funding, and at a premium rate. Perhaps another Fed/BNY collaboration may incentivize usage and strengthen the Fed’s Repo Defensive.

Lastly, Trump’s ability to dismiss Powell may be overhyped. Powell has not been malfeasant and disagrees with Trump on policy, not the grounds for an easy dismissal. We have already seen pushback on the idea from Treasury Sec Bessent. And if Trump were to follow through, Powell would only have one more year left on his term and would be willing to fight to preserve his job. Is it worth the (rather significant) adverse market reaction? Surely not. Lest we forget, firing the Fed Chair also does not guarantee that rates will be cut that easily.

And with that, onto the chartbook…

If you act on anything provided in this newsletter, you agree to the terms in this disclaimer. Everything in this newsletter is for educational and entertainment purposes only and NOT investment advice. Nothing in this newsletter is an offer to sell or to buy any security. The author is not responsible for any financial loss you may incur by acting on any information provided in this newsletter. Before making any investment decisions, talk to a financial advisor.

EFFR, OBFR, SOFR, TGCR, and BGCR are subject to the Terms of Use posted at newyorkfed.org. The New York Fed is not responsible for publication of tri-party data from the Bank of New York Mellon (BNYM) or GCF Repo/Delivery-versus-Payment (DVP) repo data via DTCC Solutions LLC (“Solutions”), an affiliate of The Depository Trust & Clearing Corporation, & OFR, does not sanction or endorse any particular republication, and has no liability for your use.

Dummy q but what would tightening or widening swap spreads signify anyway? Same for SOFR/FF. No good explanation online. Swap Spreads tell us there are funding pressures as TSYs sold off? Same for SOFR FF?

real