Money Market Update

as another U.S. presidential inauguration approaches, a new Treasury Secretary plus a debt limit battle could make money markets great again

Welcome to another Conks edition. We’re now 45,000+ strong. In case you missed it, we published — in exhaustive detail — the intraday flows of the U.S. repo market.

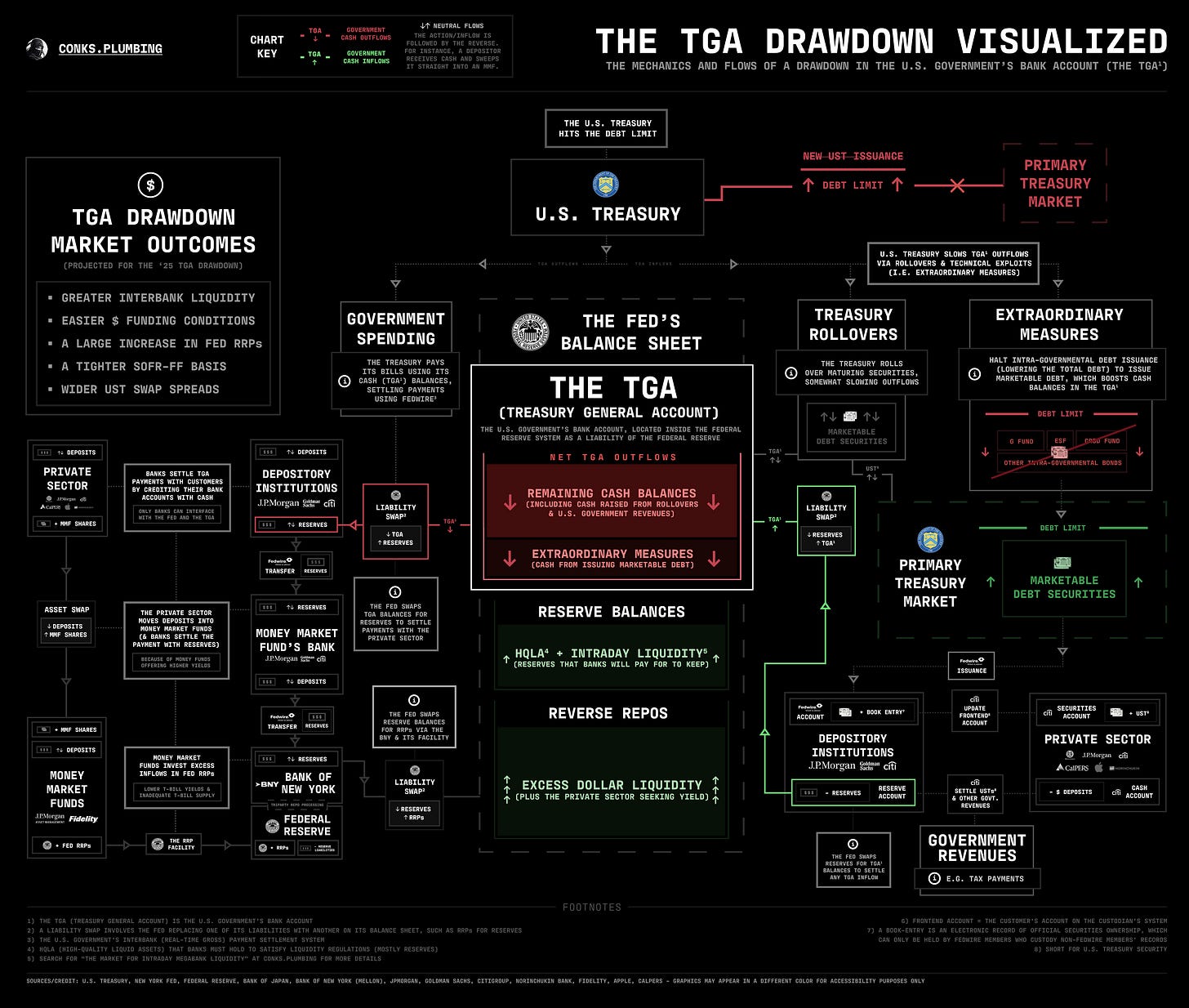

In the previous money market update, we hinted at how debt ceiling-induced flows will induce money market volatility. Our upcoming piece will cover this in detail. A “small” teaser below…

But first, a (gradually improving) money market update...

Summary & Brief Commentary

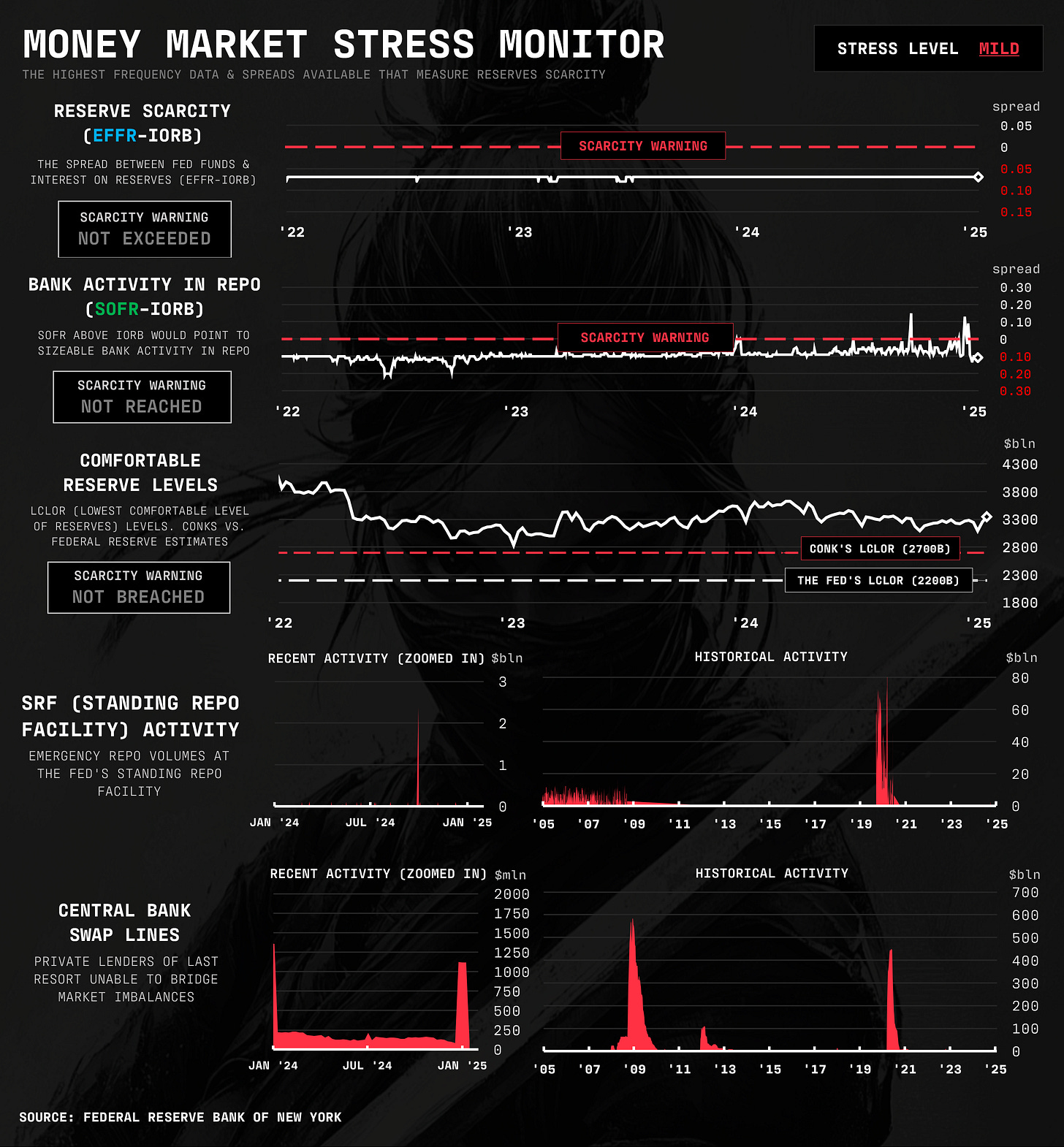

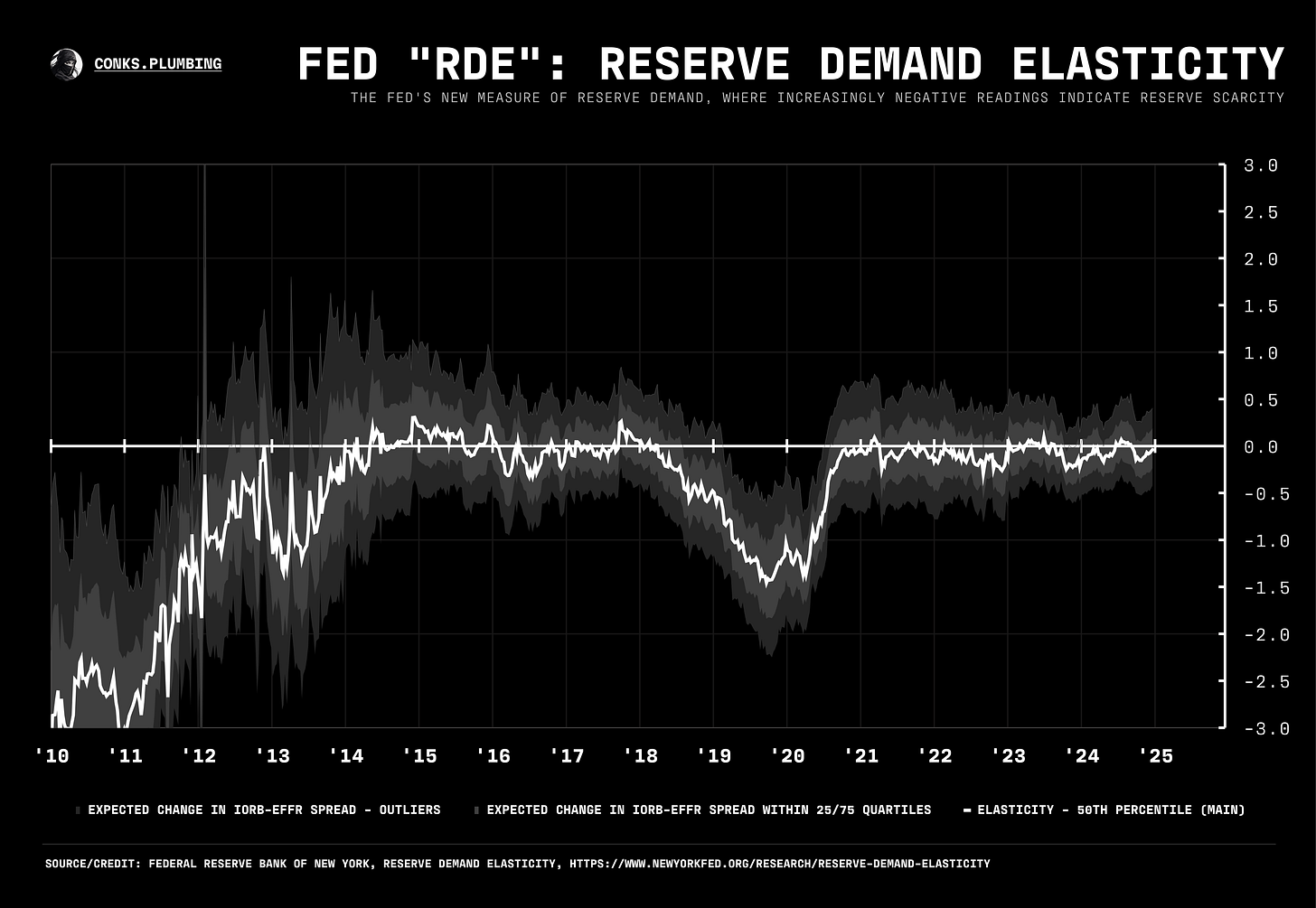

Internal documents created during the 2019 repo spike were released by the Fed last week. These memos revealed how many reserve-draining catalysts, described in the Fed’s Repo Defensive series, helped induce the “repocalypse”.

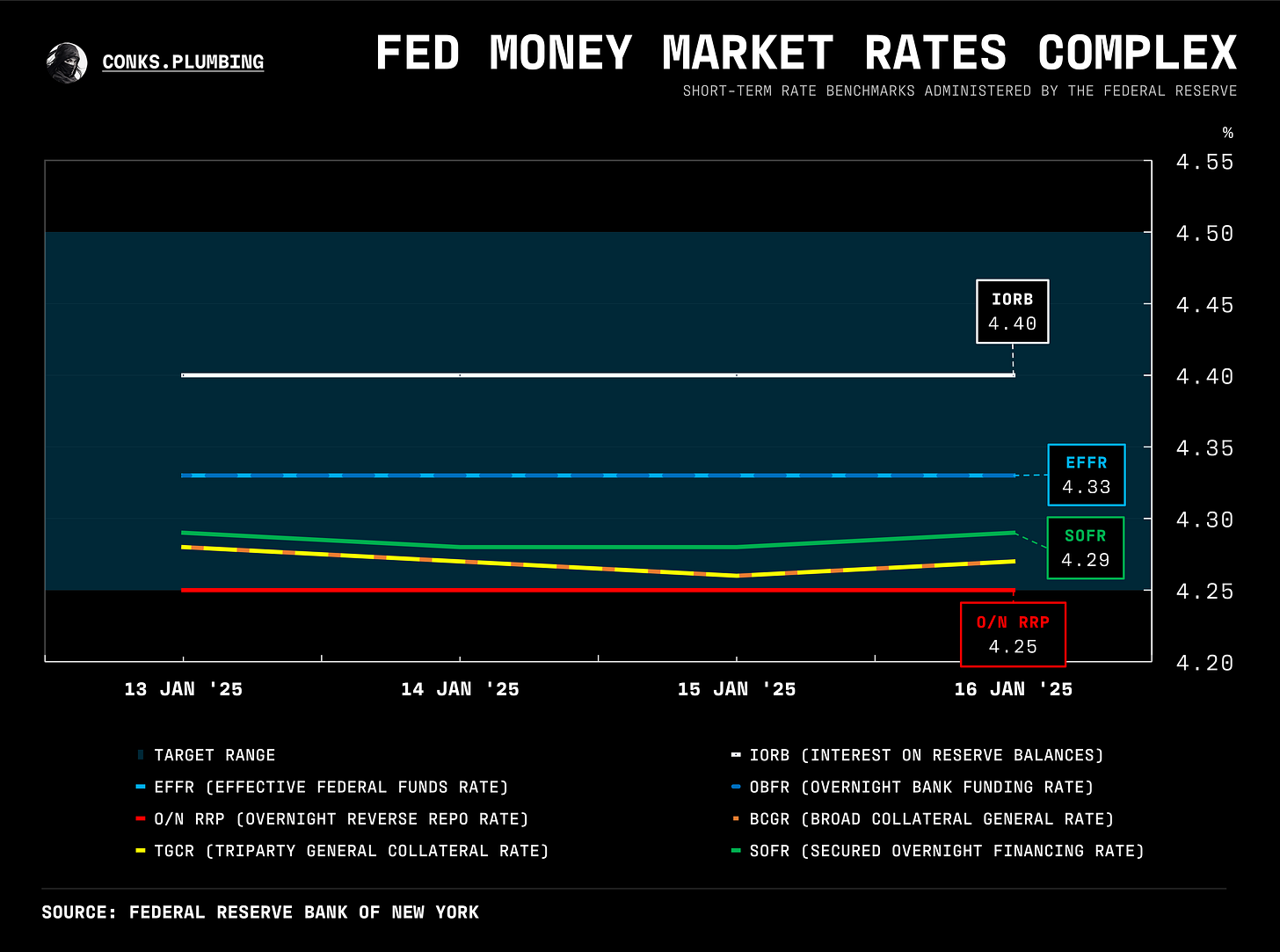

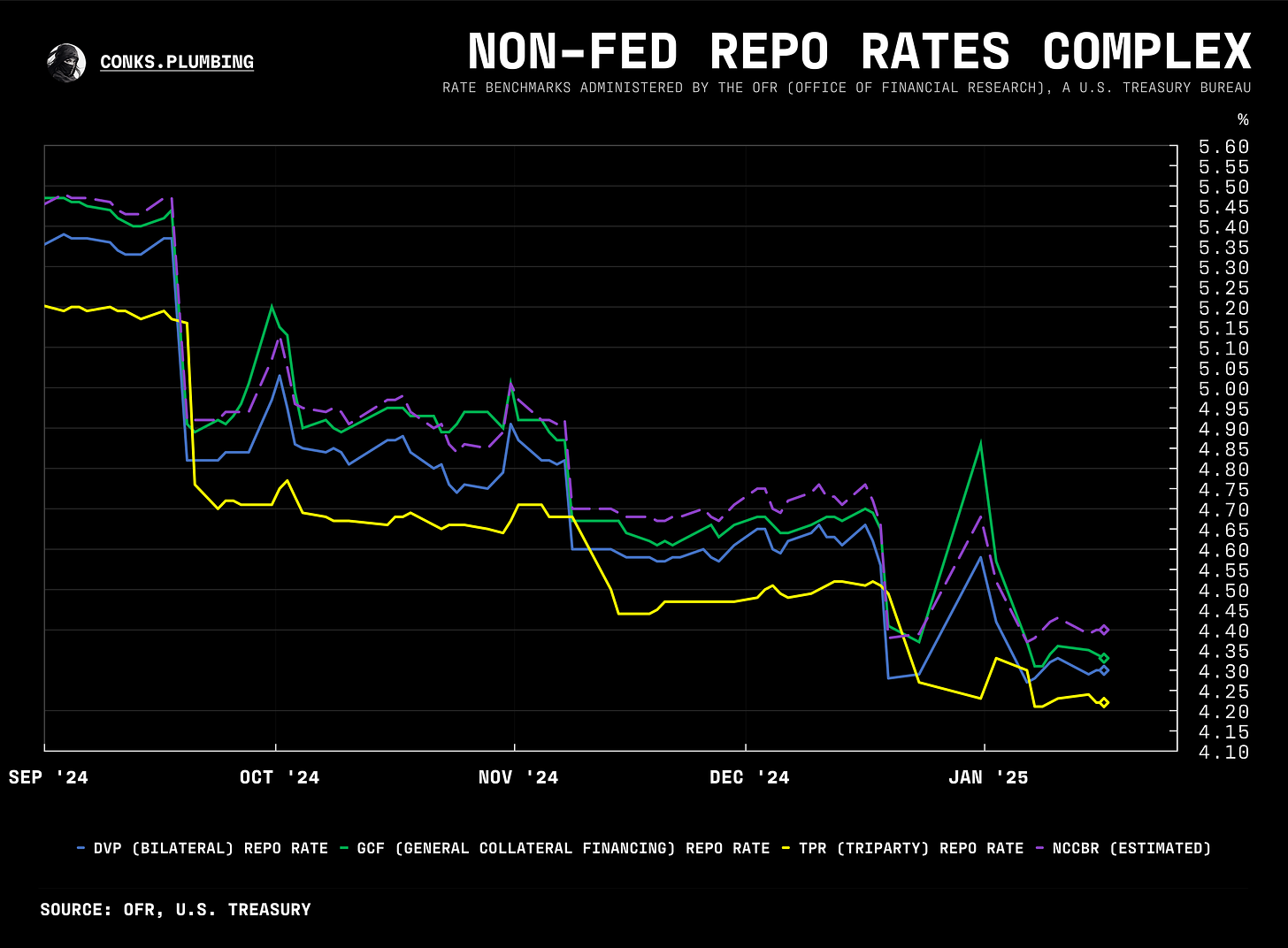

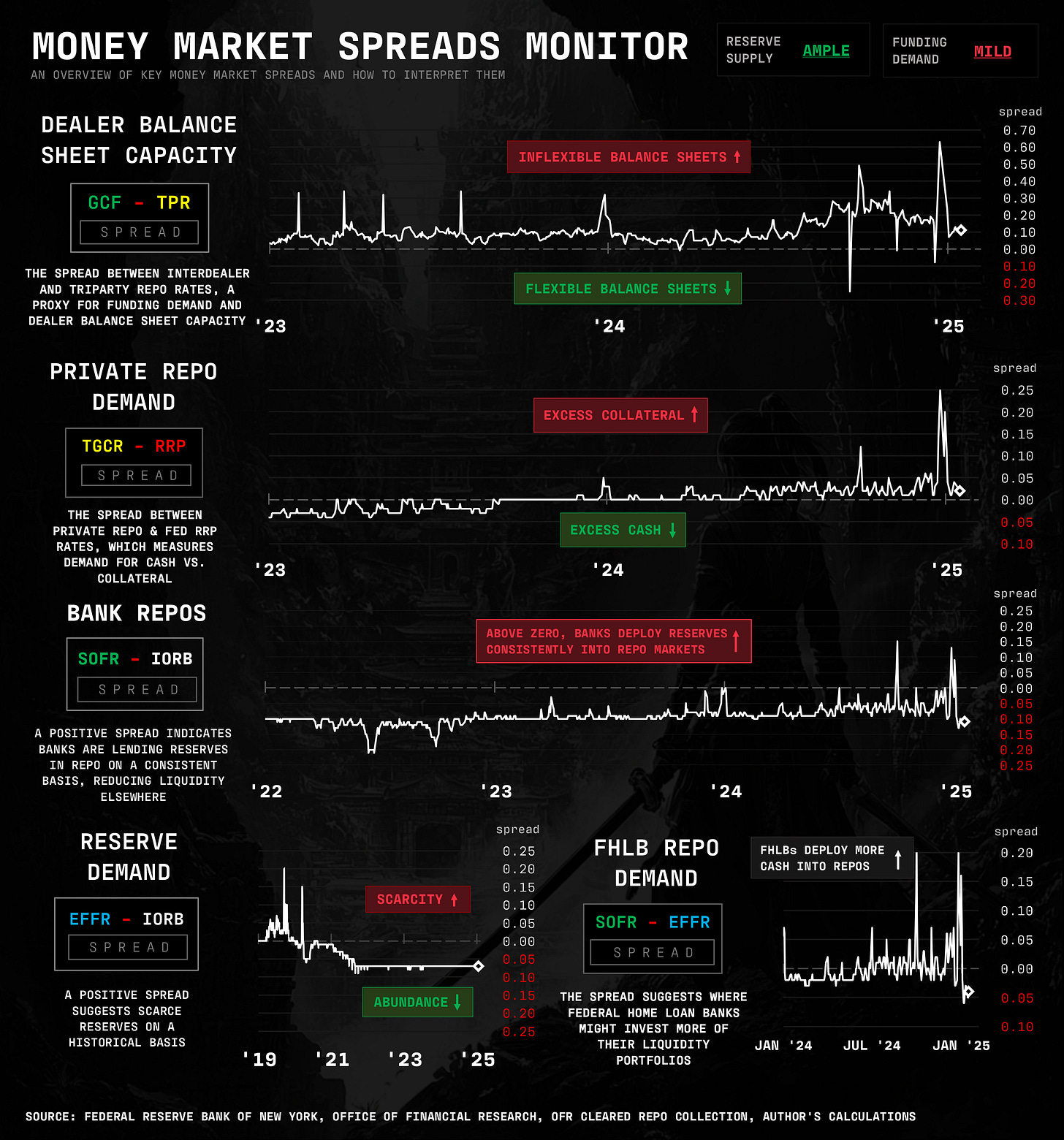

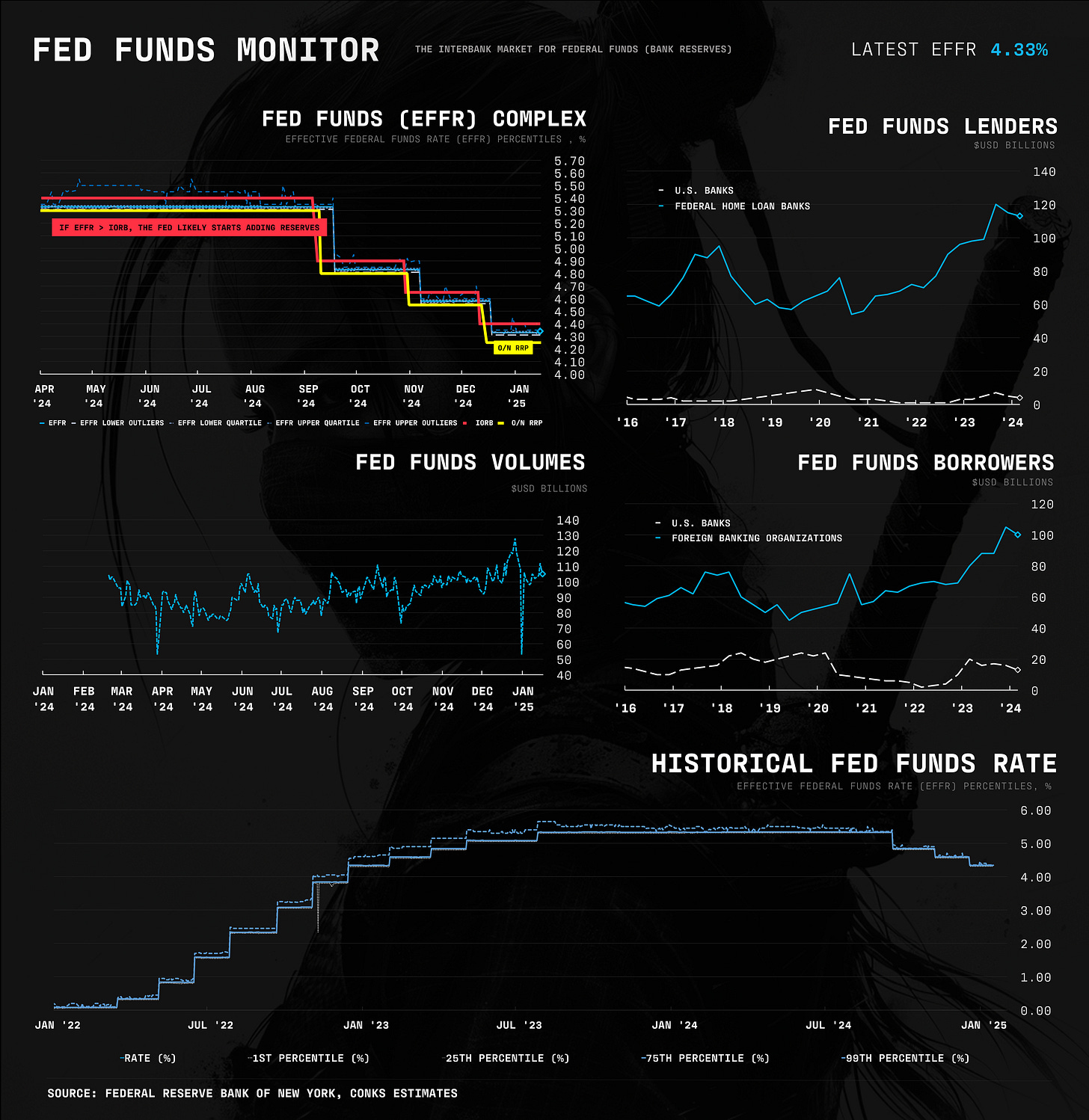

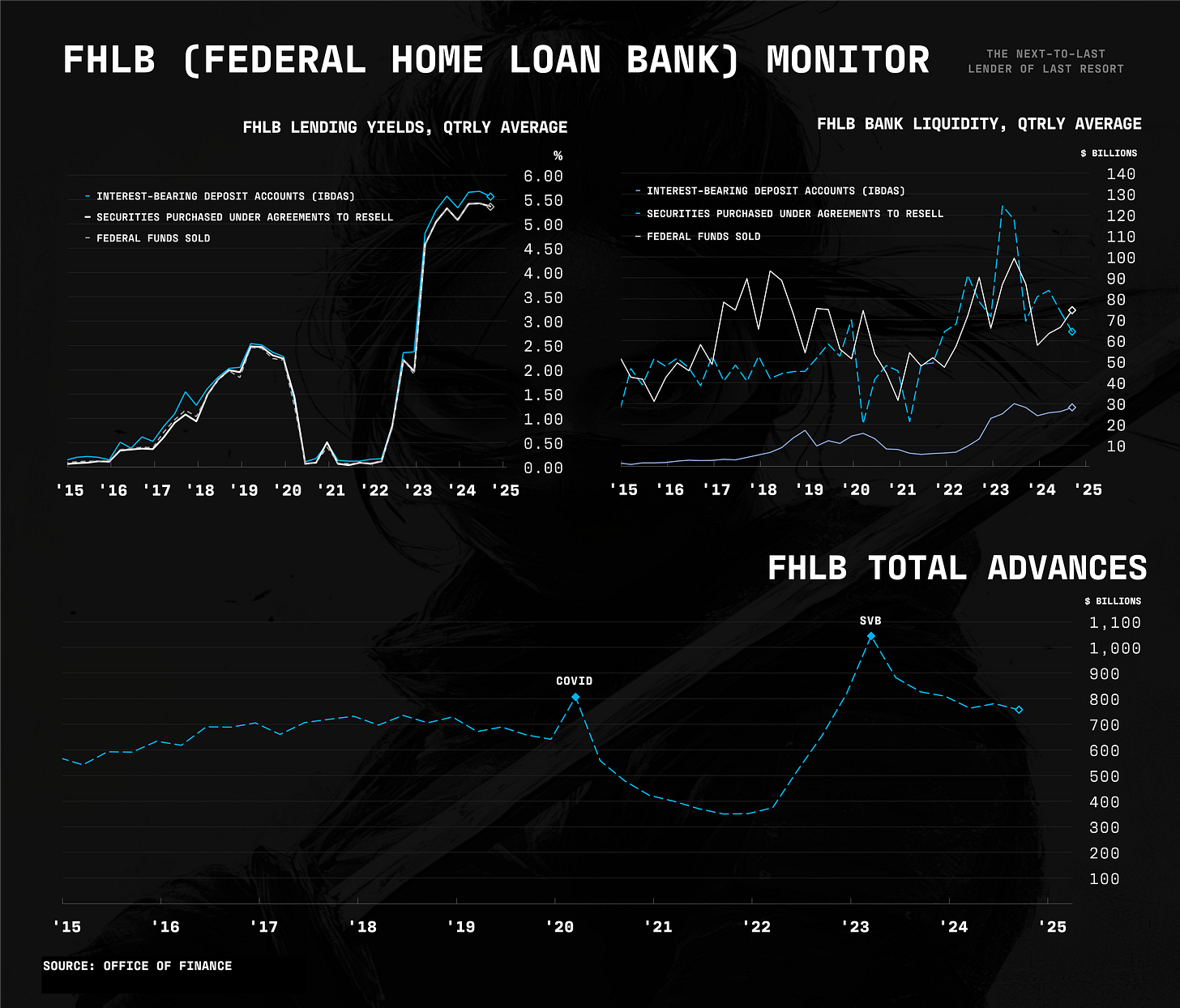

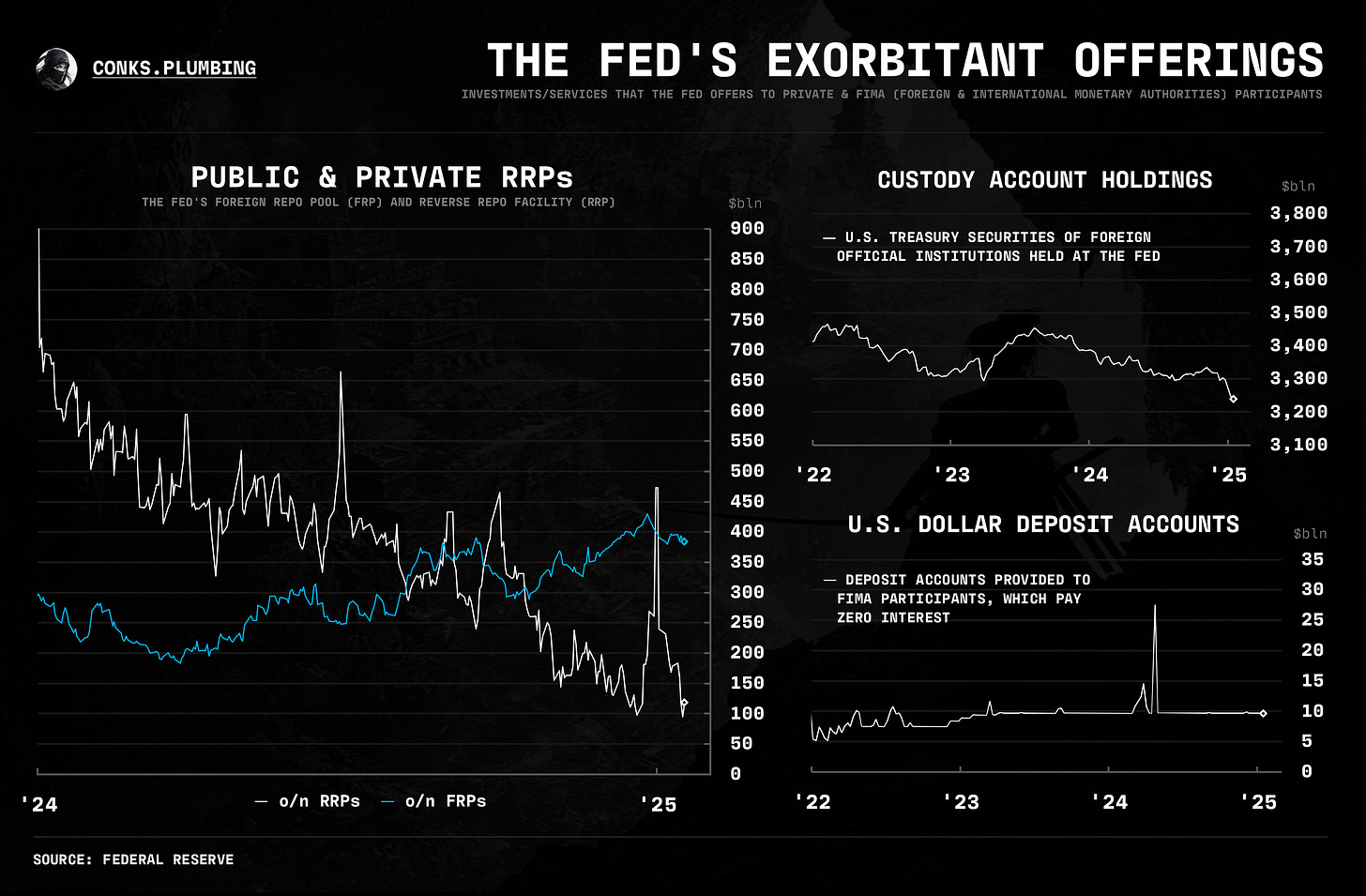

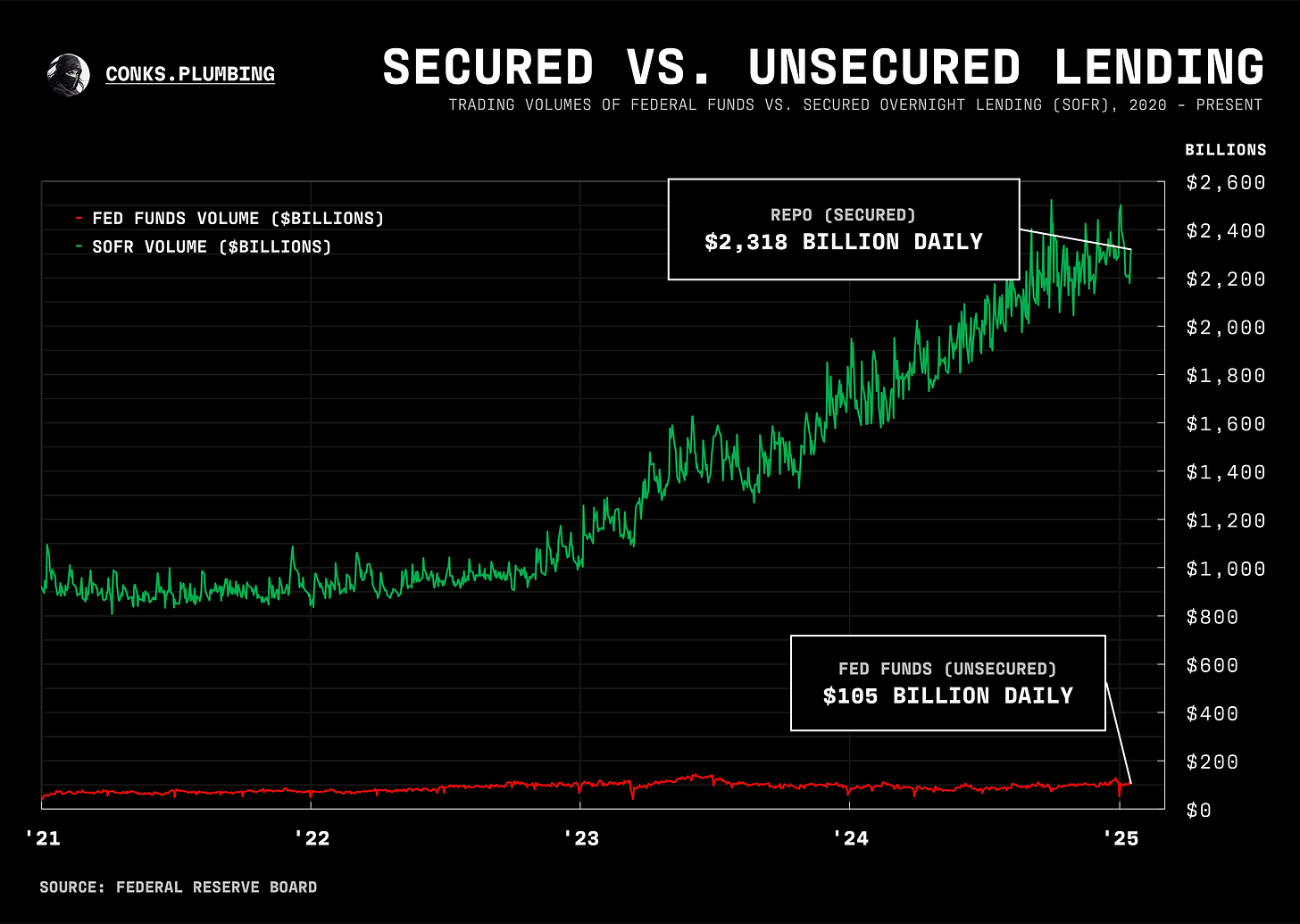

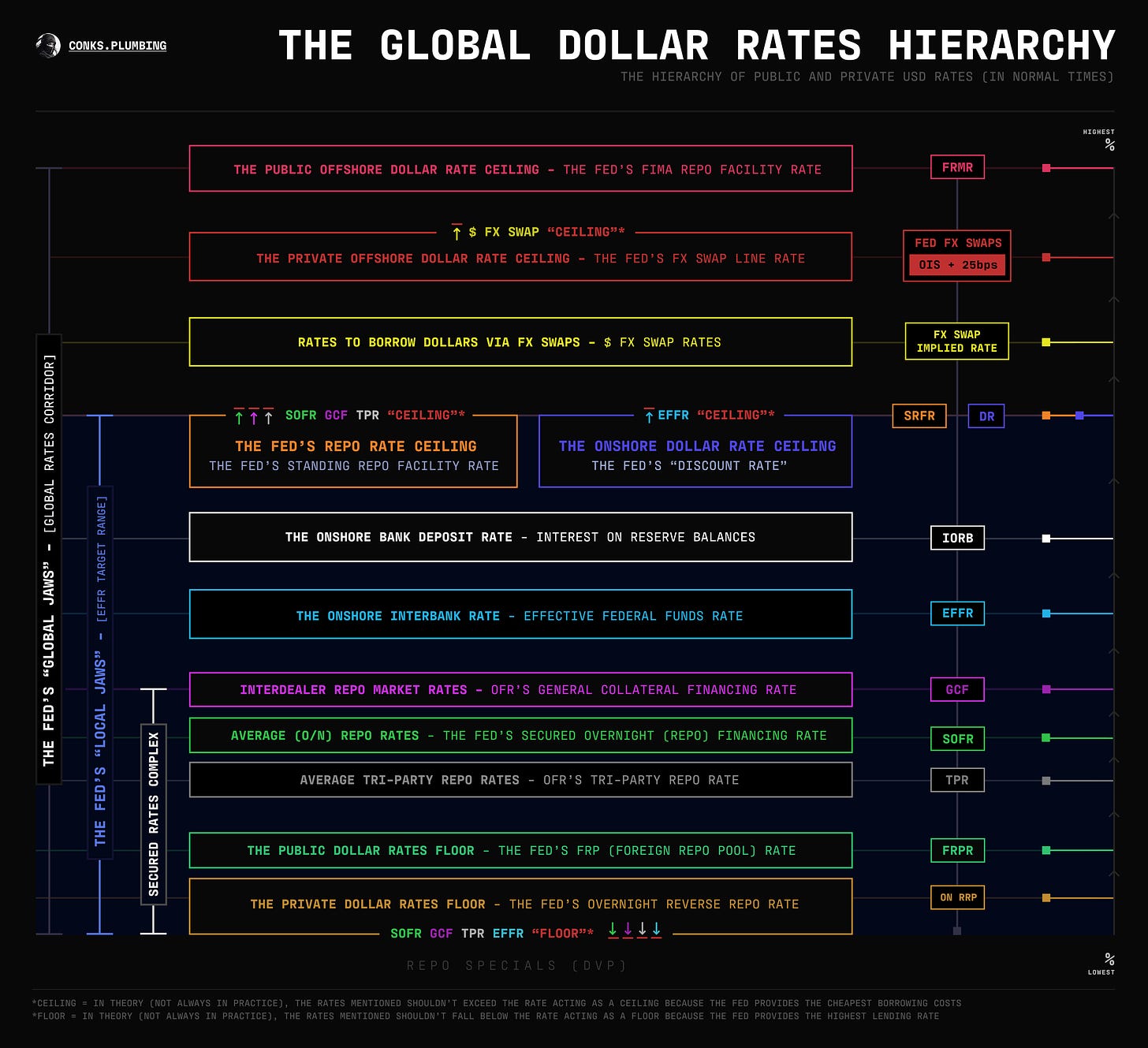

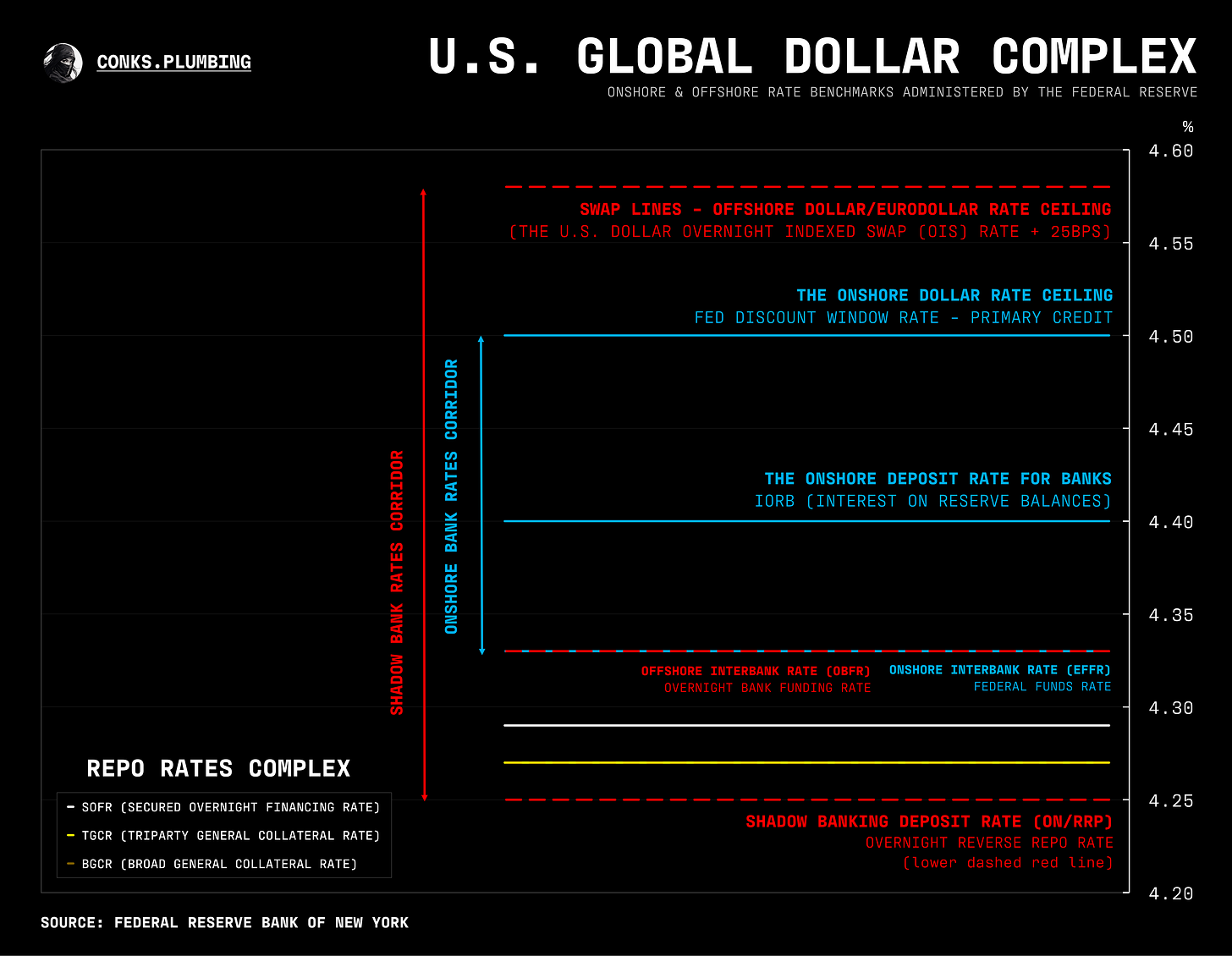

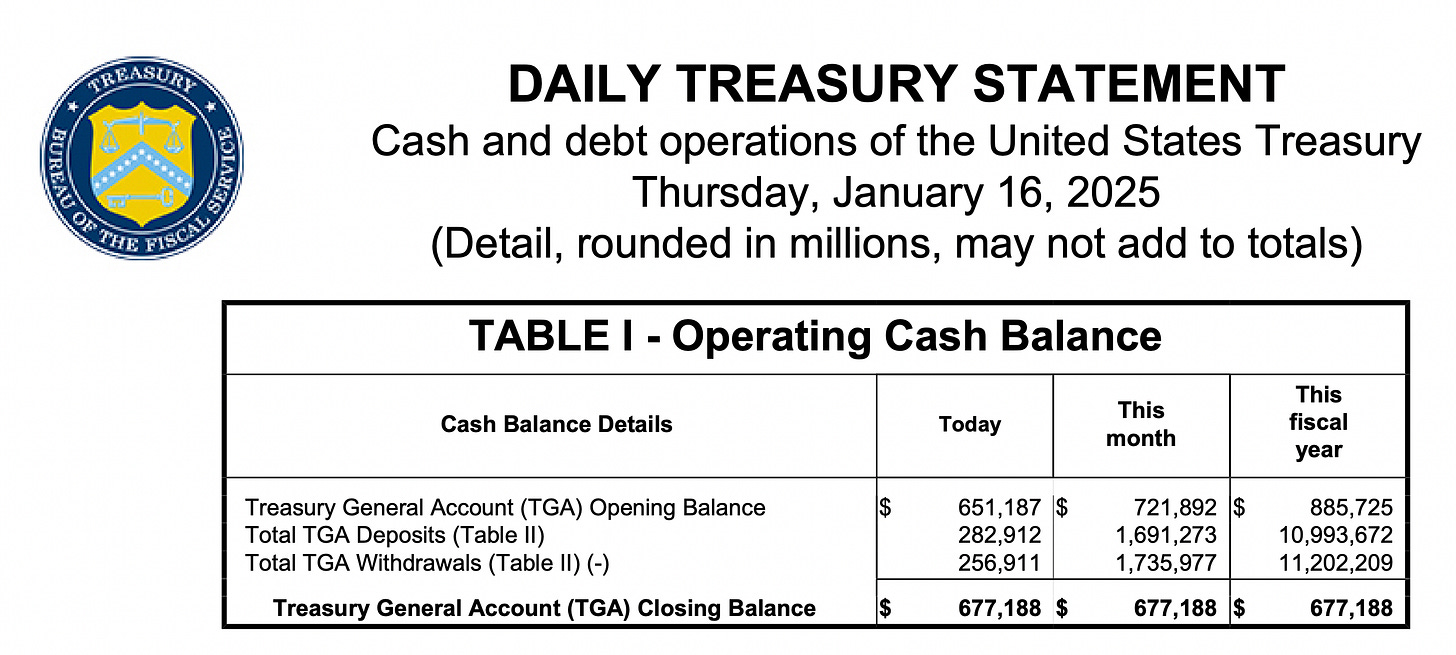

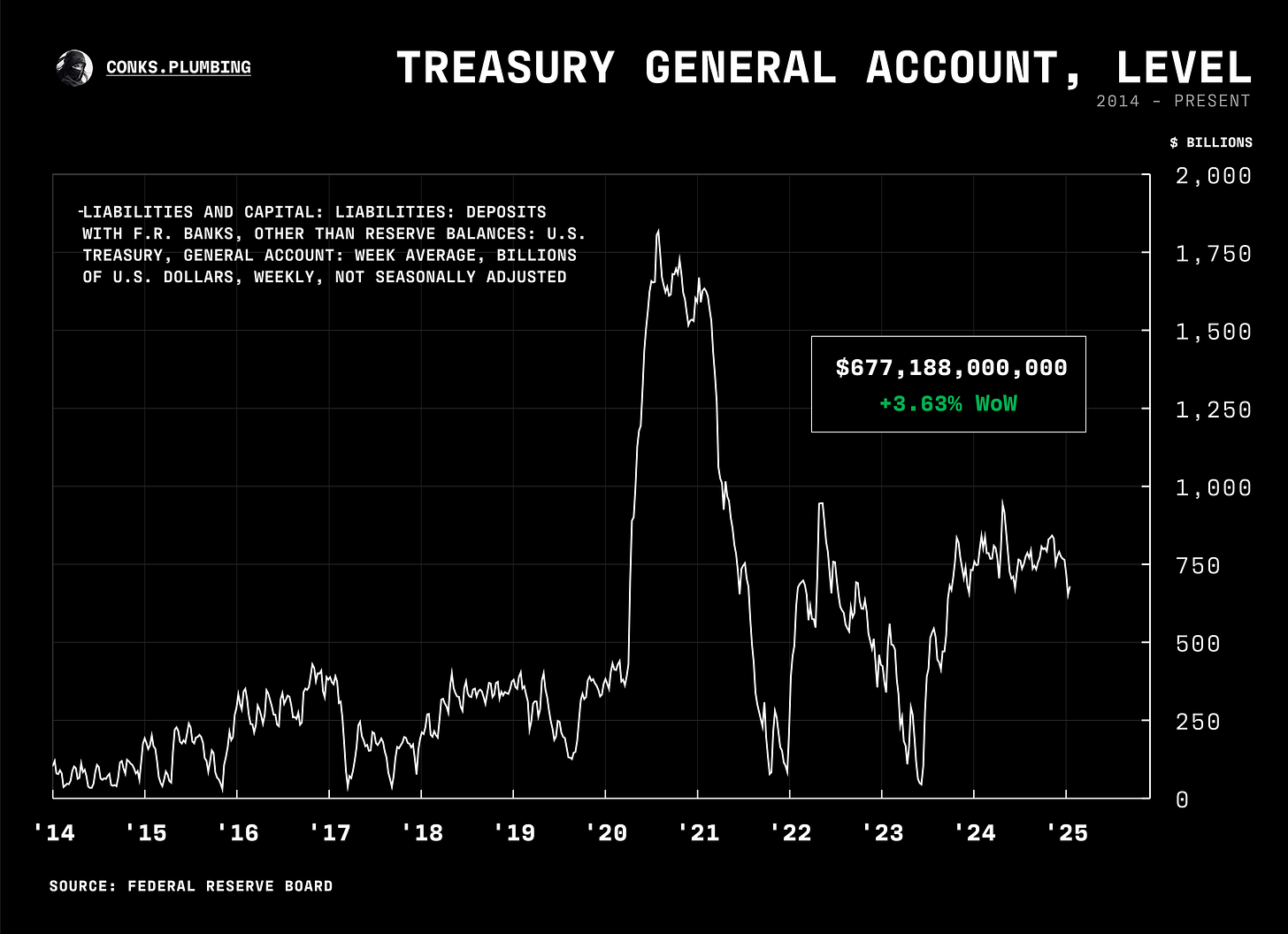

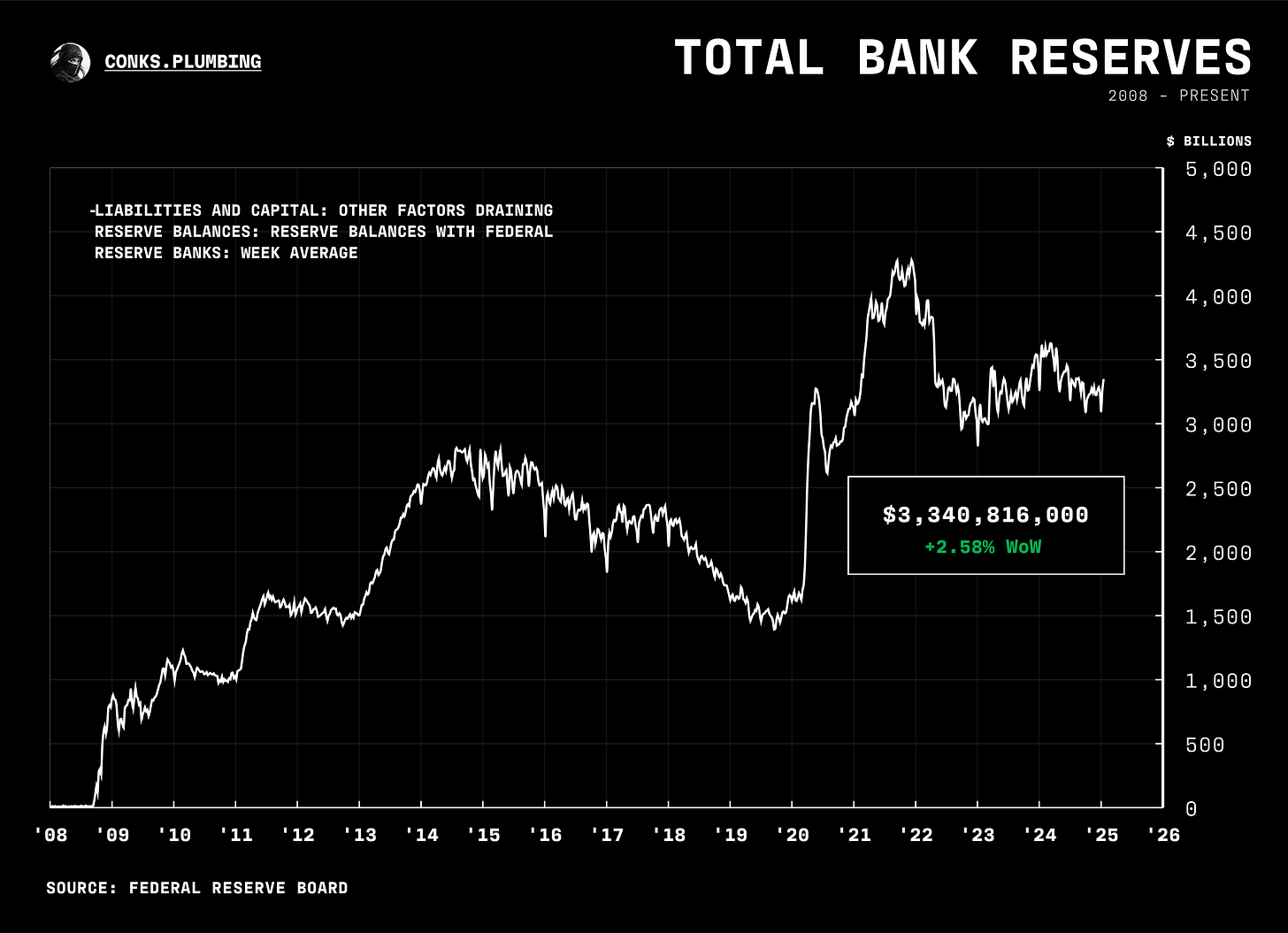

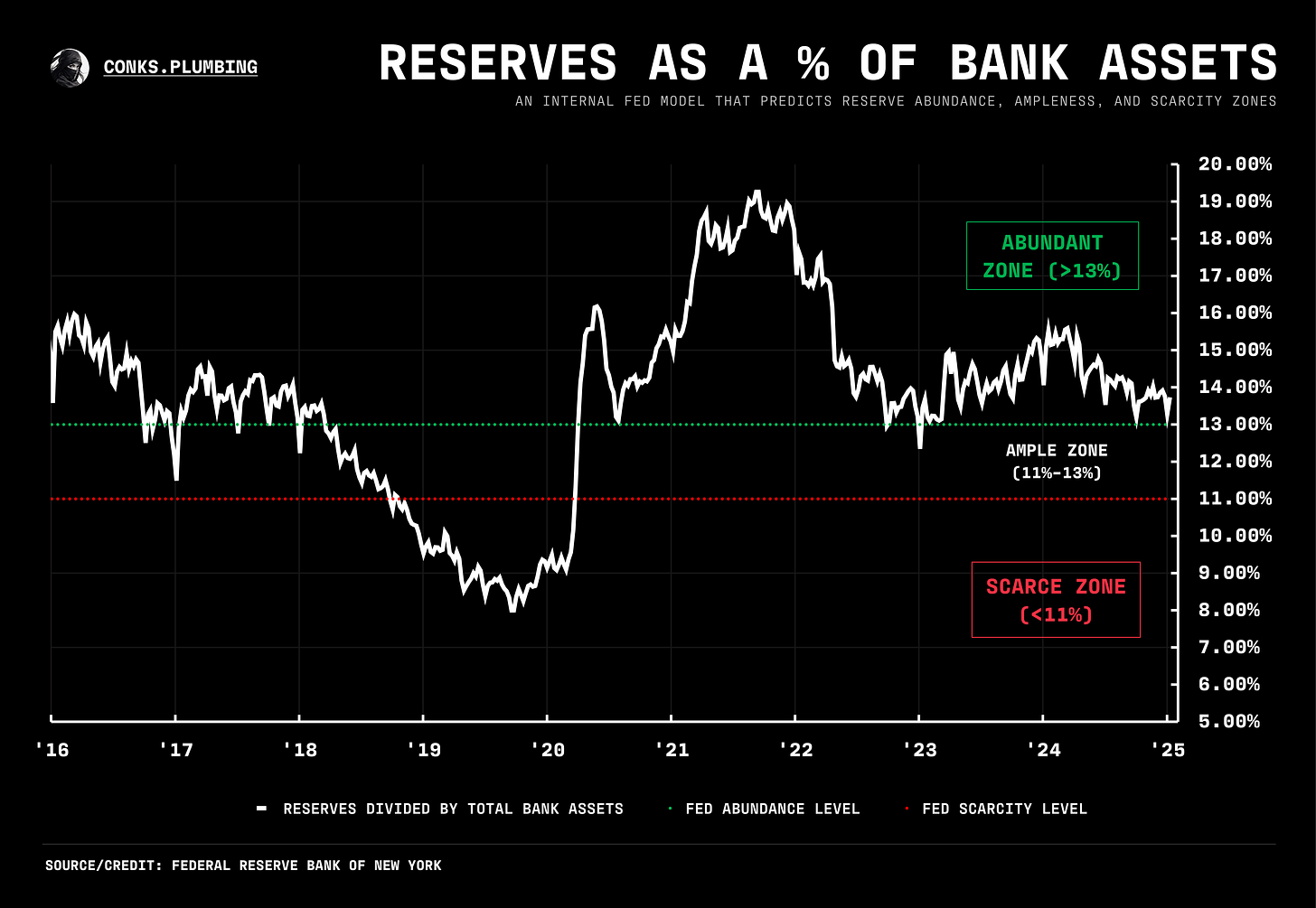

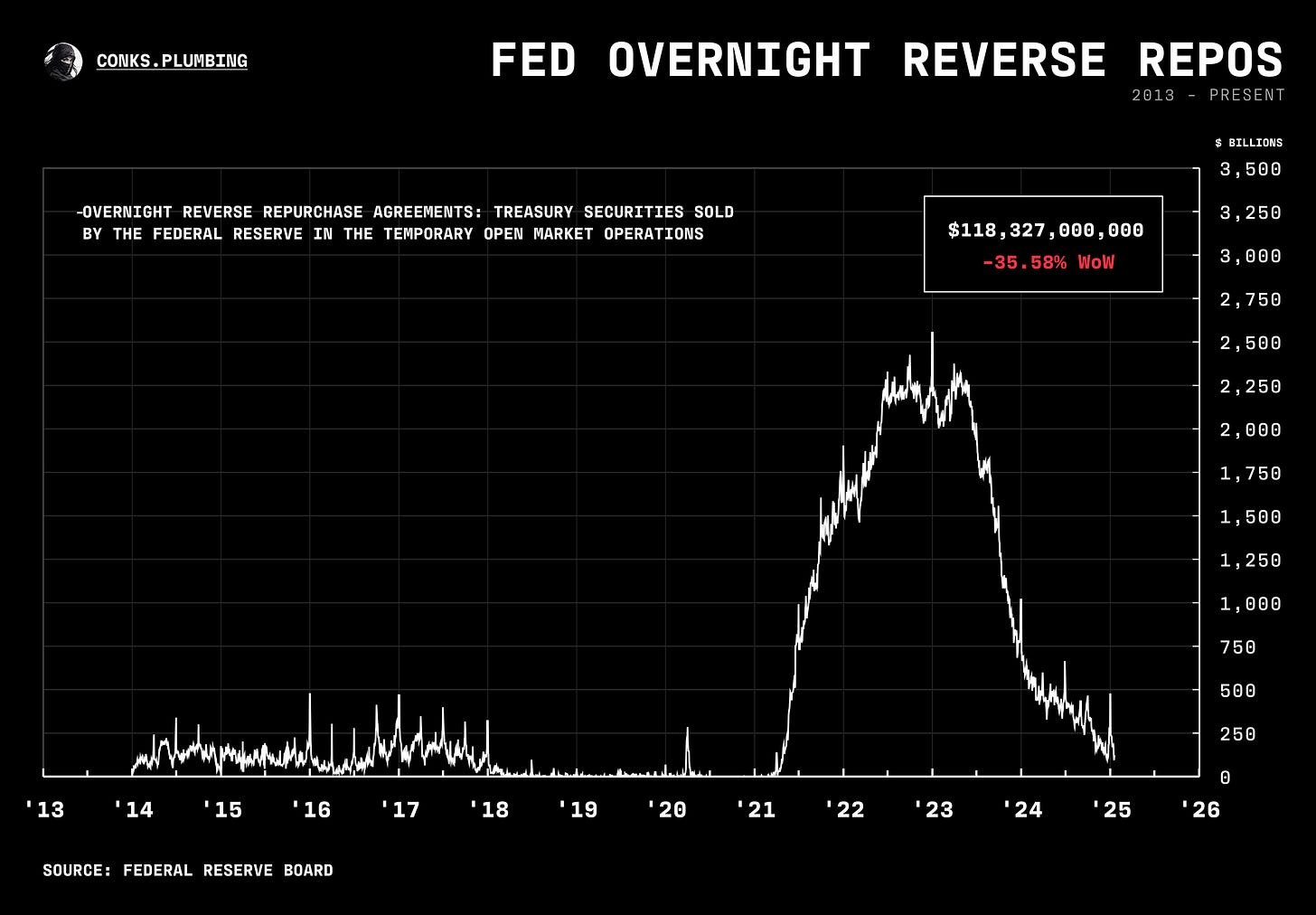

As of today, both reserve balances and elasticity (as shown in the chartbook below) remain in “bullish territory”, just as the TGA drawdown commences. Thus, interbank liquidity will increase further. Most TGA outflows (i.e. reserves), however, will end up as Fed RRPs, with depositors moving into higher-yielding money funds — which must turn to the Fed’s balance sheet as t-bill supply decreases. A debt limit resolution will unwind these flows.

Regarding the debt limit, Sec. Yellen has announced that extraordinary measures will begin on January 21st. (Subscribers can check the chat now for related infographics, which will be explained in more detail soon.)

With recent moves in risk assets, our view that the rise in the DXY (U.S. dollar index) is not a sign of weak liquidity seems to be playing out. Despite increased credit creation, an ample supply of collateral and reserves, plus an RRP above zero, risk assets and the dollar can still rise together.

Right now, the bond market is more of a threat to equities. We’re trying to understand how Bessent will approach duration (longer-term debt) issuance. After all, the U.S. Treasury is not a hedge fund but a department increasingly run on models and how officials interpret their output. We think Bessent may be misperceiving why Yellen chose heavy bill issuance, so any rise in coupon issuance won’t be for political motives but because of “technical factors” — i.e., the output of internal Treasury models, which will start favoring increased duration issuance in the second half of ‘25. Muster the “stealth tightening”!

As an offsetting force, following recent longer-term yield moves, more foreign buyers will likely re-enter the U.S. Treasury market. European & Canadian investors have only just been able to receive a superior yield from 10-year Treasuries on an FX-hedged basis. Japanese investors, however, still need another ~75bps of pickup.

Elsewhere, the Fed’s Vice Chair of Supervision, Michael Barr, announced he will step down in the next quarter. Swap spreads — the difference between swap rates and the yield on U.S. Treasuries — “rallied” on the announcement, showing the market expects deregulation after his departure (since a major driver of swap spreads is the capital costs involved in market making). This alone won’t be enough to unwind a lot of the tightening (downward move) in swap spreads. Soon, increased UST (U.S. Treasury) supply will resume as the primary bearish driver.

Lastly, upcoming money market monitors include a U.S. Treasury monitor and a banking monitor. Stay tuned!

And with that, onto the chartbook…

If you act on anything provided in this newsletter, you agree to the terms in this disclaimer. Everything in this newsletter is for educational and entertainment purposes only and NOT investment advice. Nothing in this newsletter is an offer to sell or to buy any security. The author is not responsible for any financial loss you may incur by acting on any information provided in this newsletter. Before making any investment decisions, talk to a financial advisor.

EFFR, OBFR, SOFR, TGCR, and BGCR are subject to the Terms of Use posted at newyorkfed.org. The New York Fed is not responsible for publication of tri-party data from the Bank of New York Mellon (BNYM) or GCF Repo/Delivery-versus-Payment (DVP) repo data via DTCC Solutions LLC (“Solutions”), an affiliate of The Depository Trust & Clearing Corporation, & OFR, does not sanction or endorse any particular republication, and has no liability for your use.

Thank you for the update. For these short-form notes, this one was very informative! Looking forward to reading about the plumbing behind how EMs flow to reserves vs to RRPs - until I just read this, I thought the recent 5bp technical adjustment to Fed RRPs was at least partially intended to help guide TGA outflows into bank reserves. So I'm surprised to hear the opposite.

In your next piece, are you going to detail more of what you think Bessent will do with duration?

Cheers and thanks again.

Wouldn't it be a burden on US finances if start to increase the issuance of long-term bonds from the 4% level of base interest rate?