Money Market Update

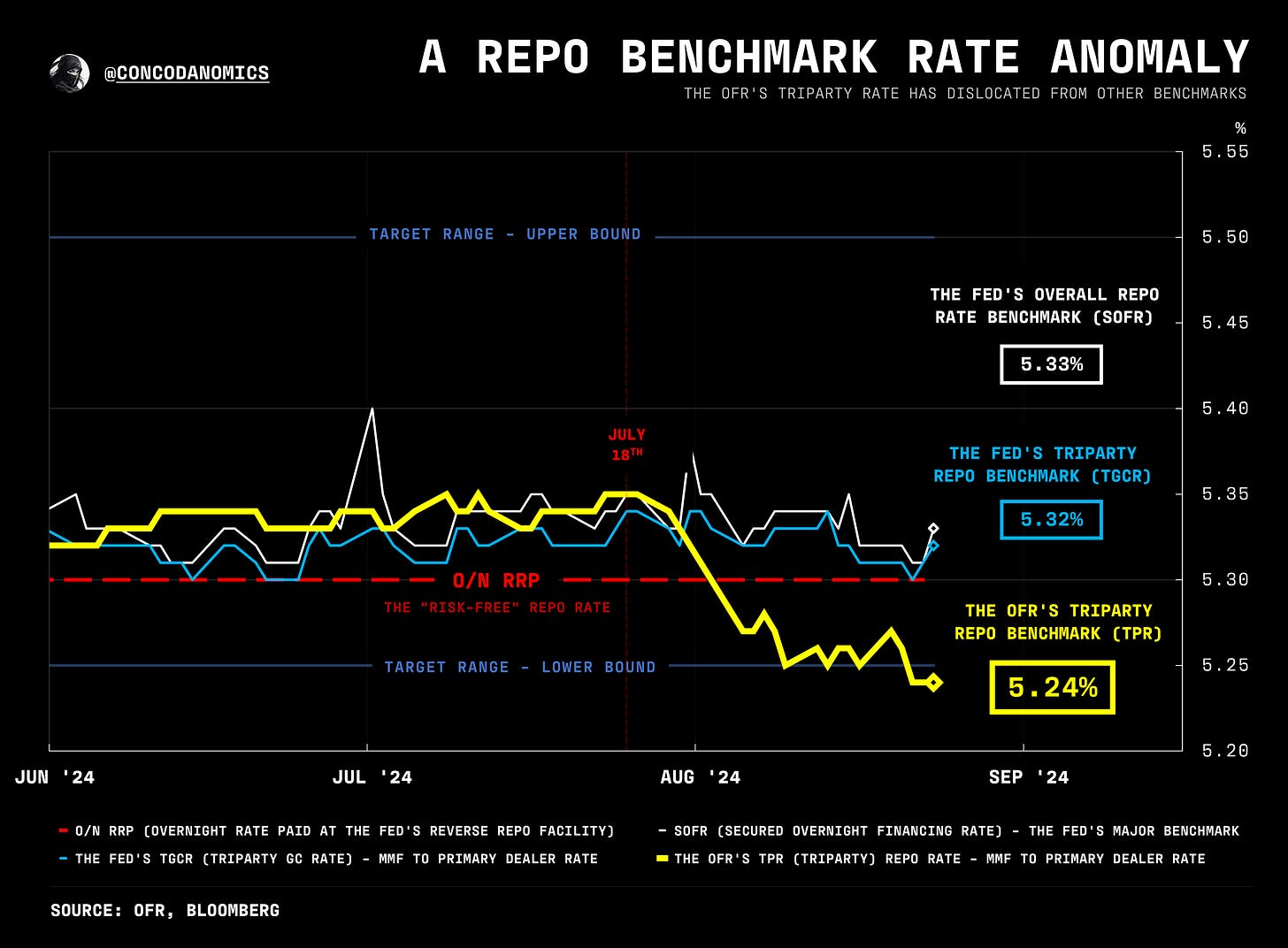

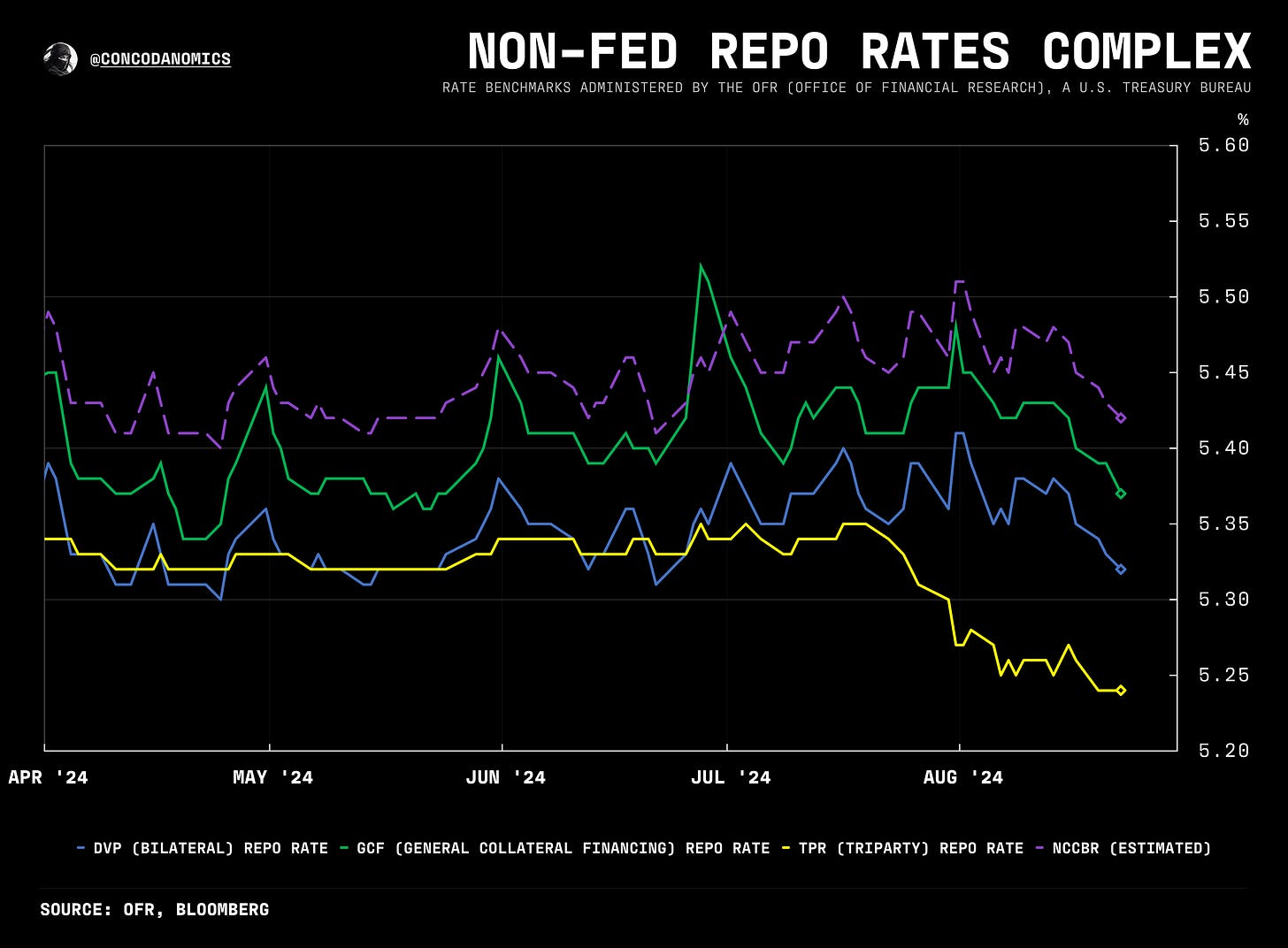

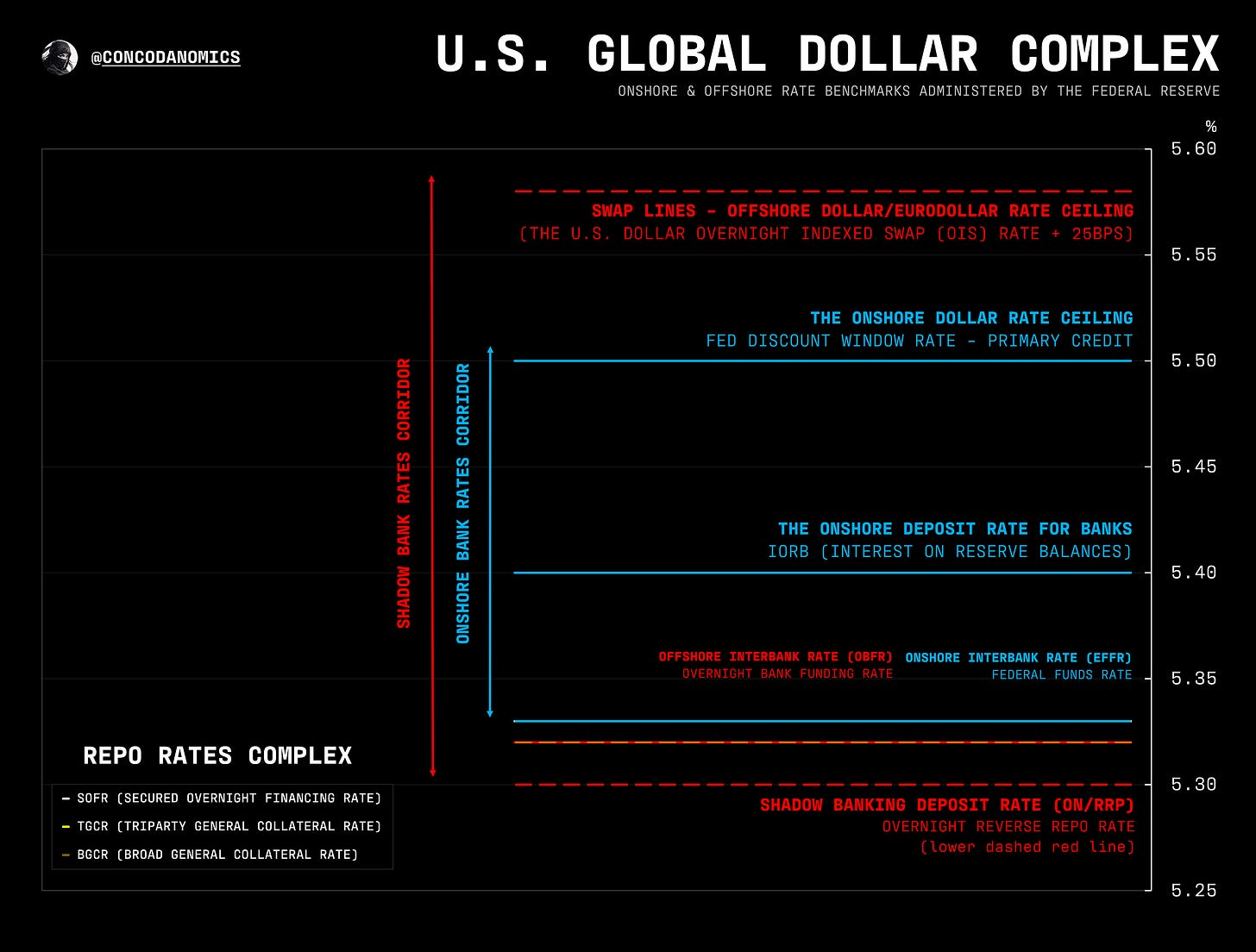

repo rates dive as cash from the RRP & federal entities (GSEs) enters private markets. meanwhile, the repo market dislocation prevails with TPR now printing under the Fed's target range!

In case you missed it — or you’ve just joined us — our latest piece, the Repo Market Dislocation, went live recently.

Here is the updated print, now below the Fed’s target range!

Part II is on the way. But first, a (gradually improving) money market update...

Summary & Brief Commentary:

Bond volatility (proxied by MOVE) will likely decrease after Jackson Hole, supporting liquidity across the risk curve. For this and other reasons here, we remain “bullish all assets” as per chat.

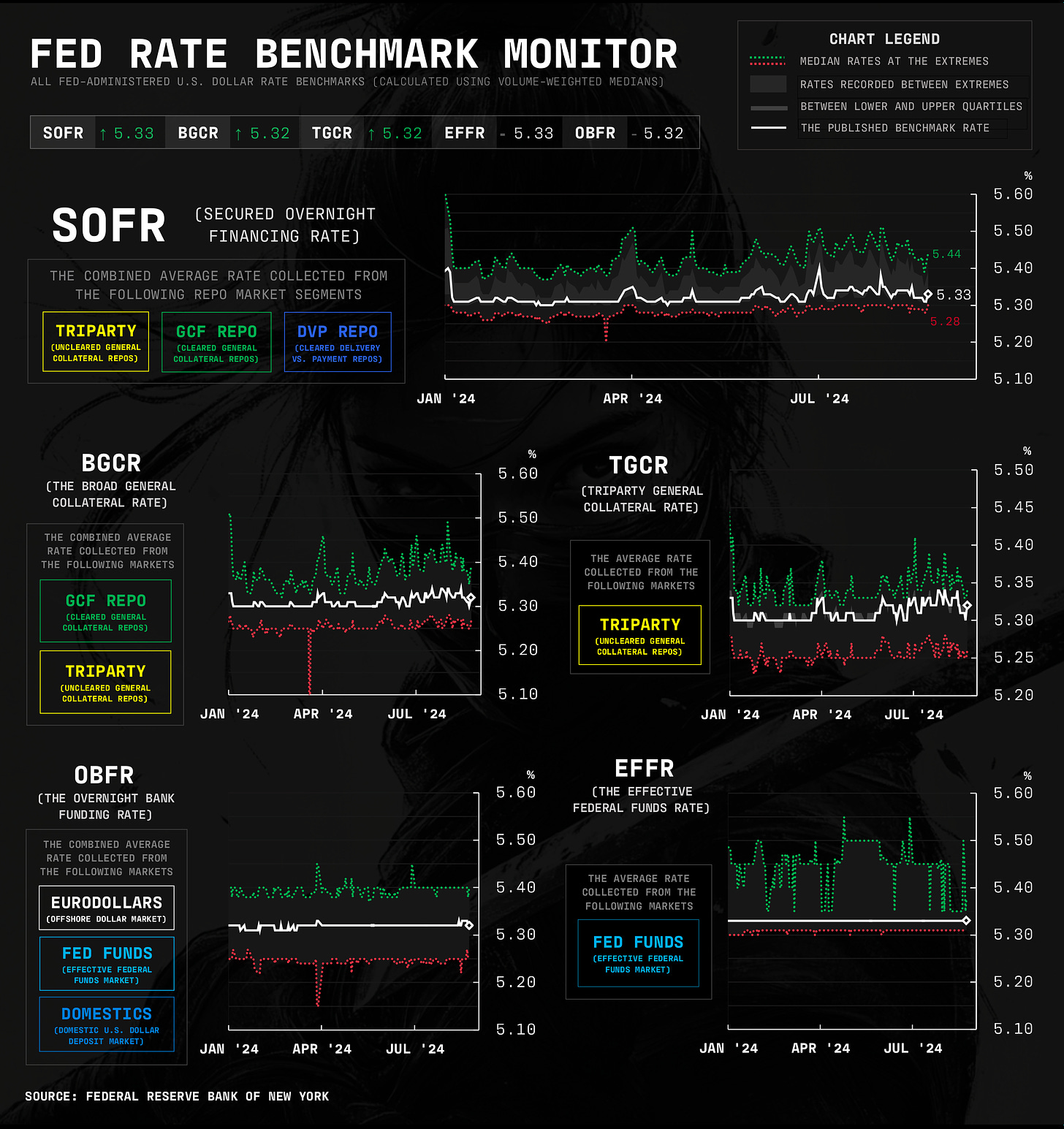

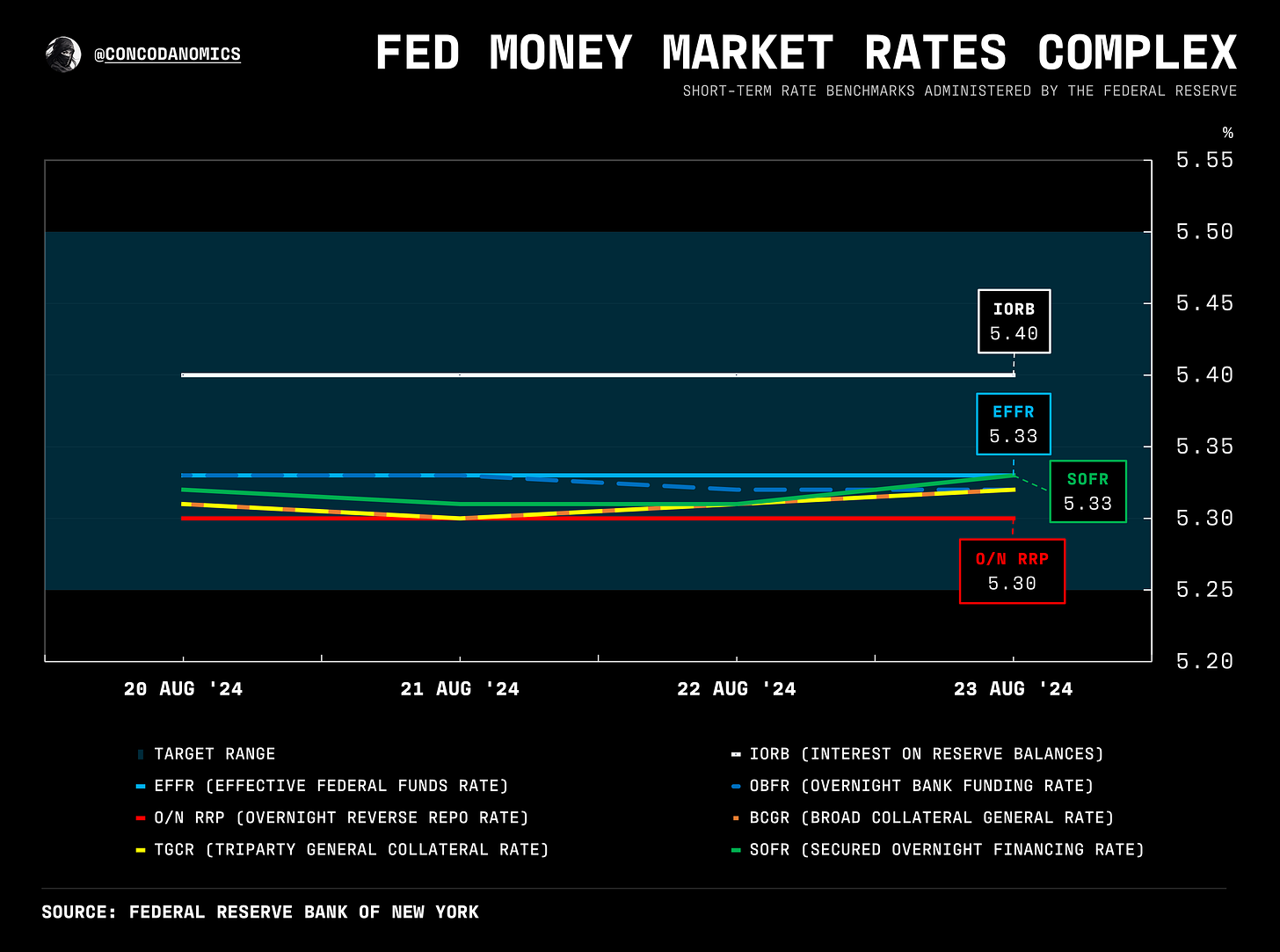

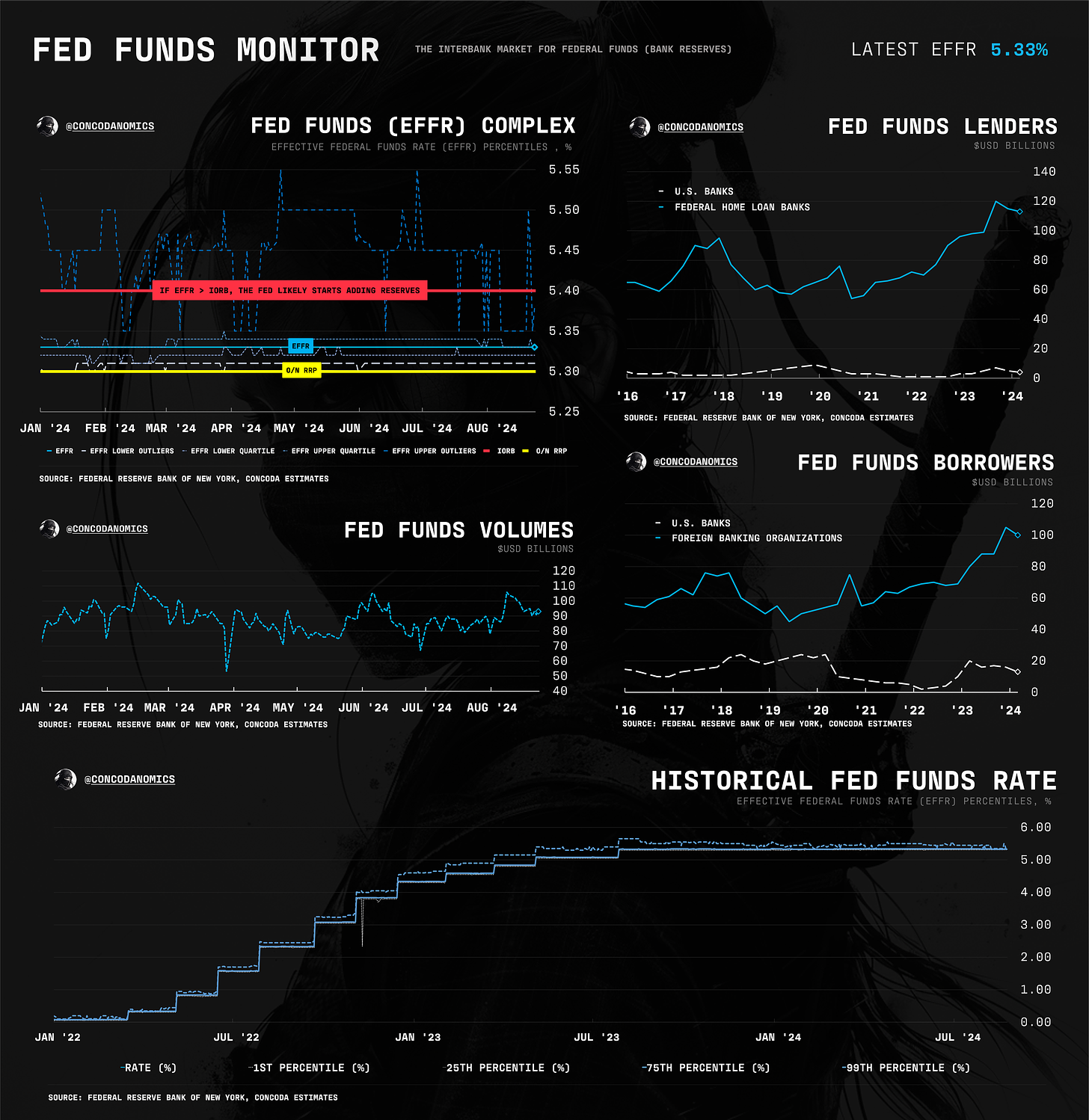

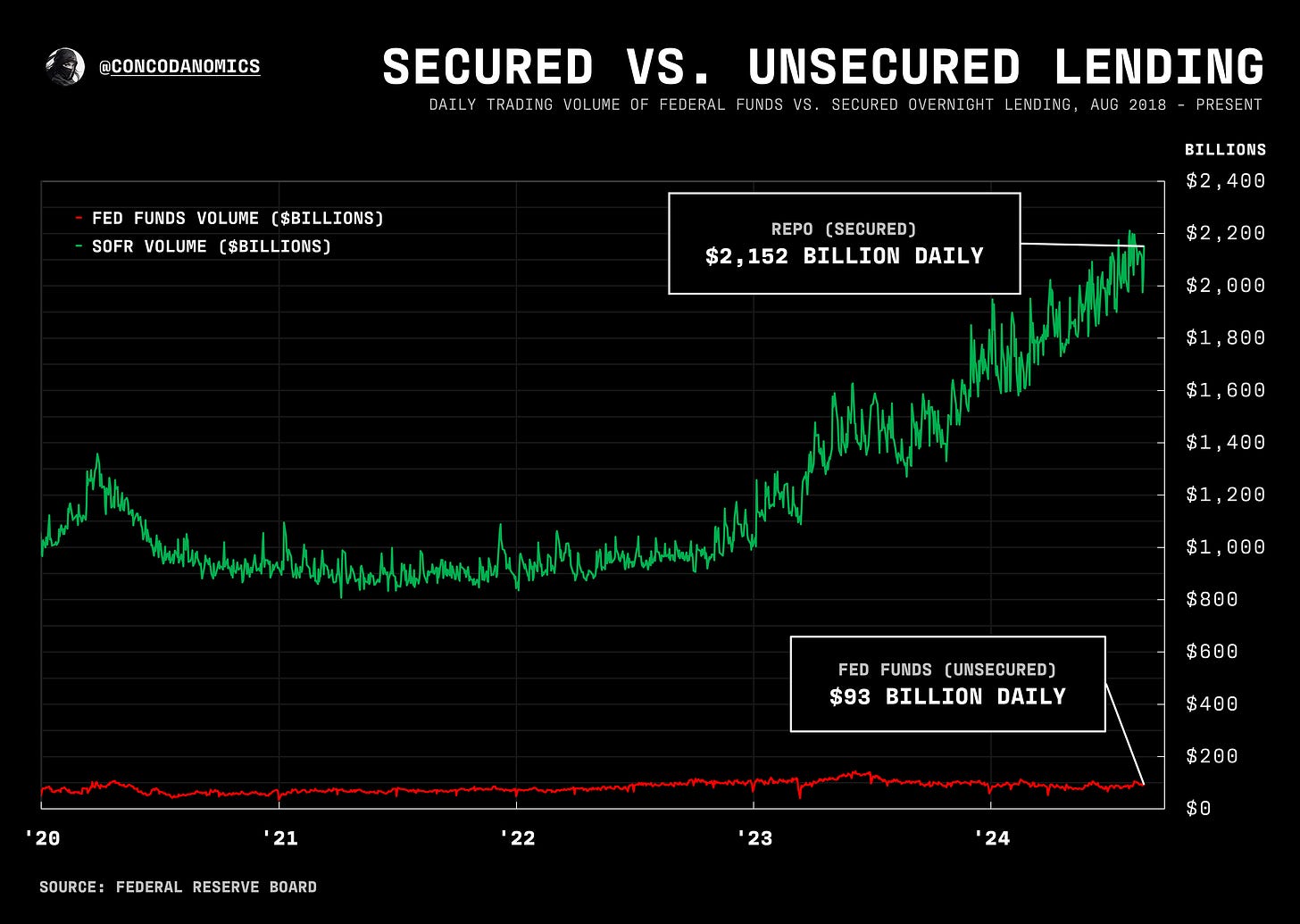

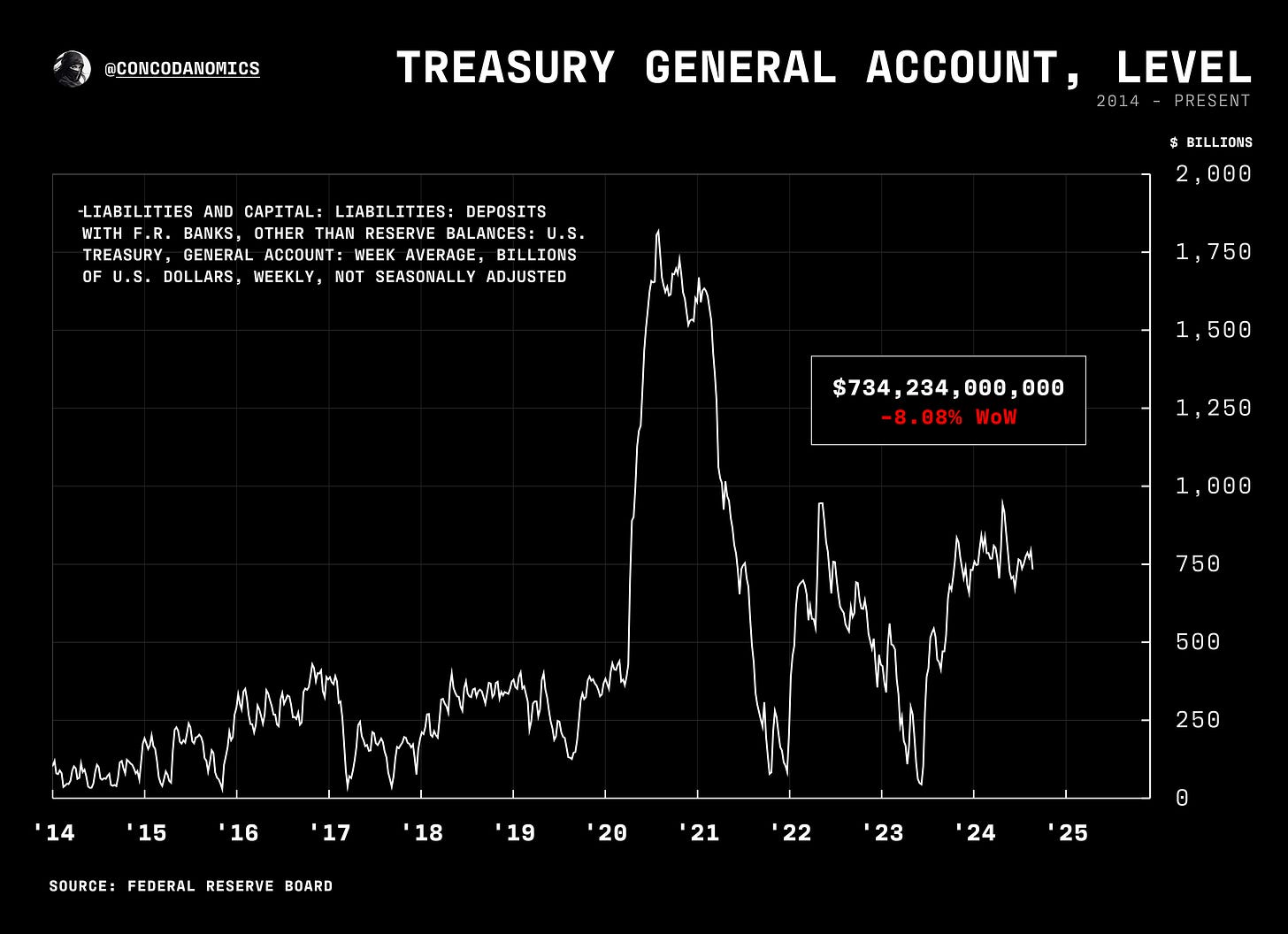

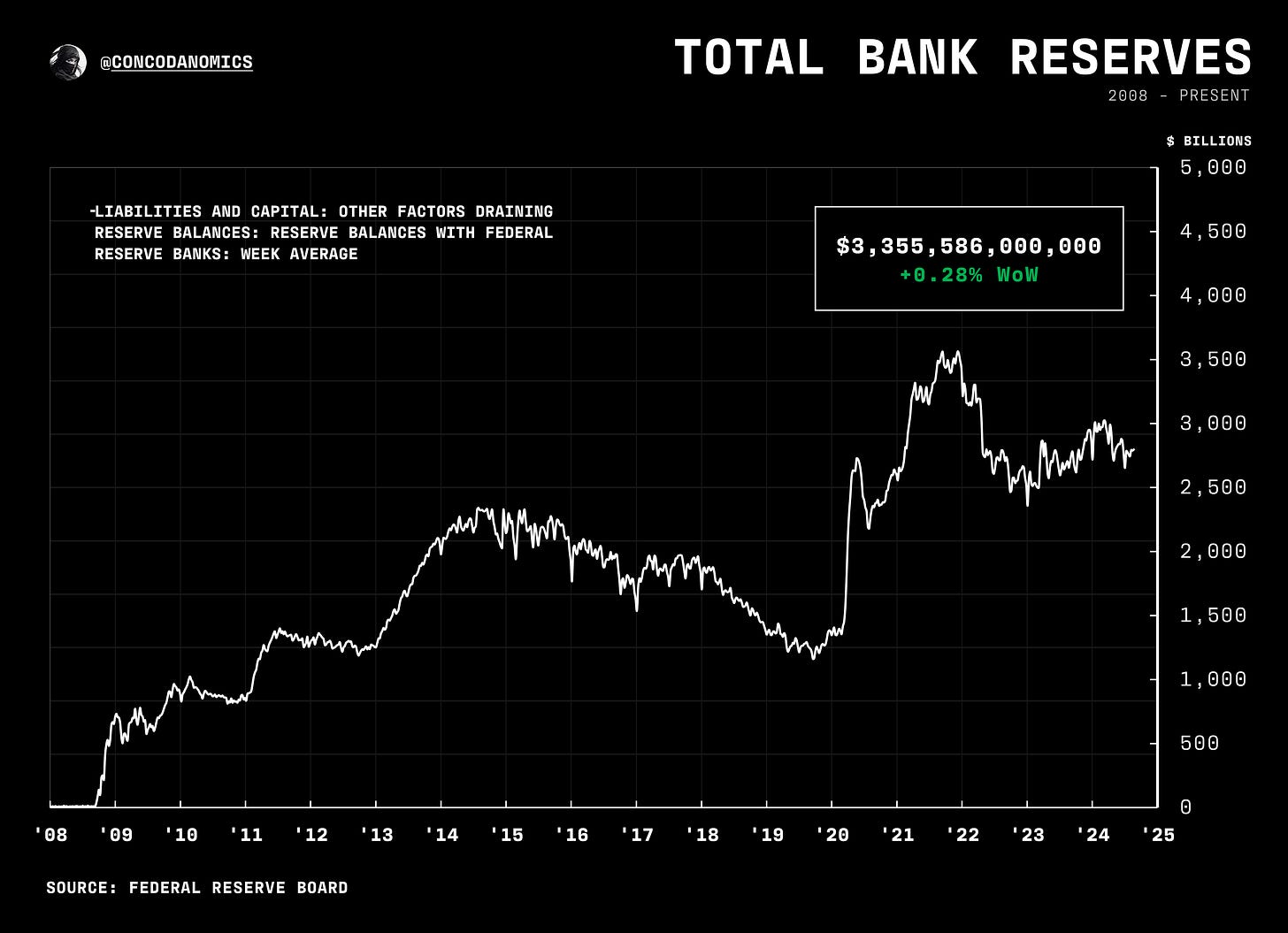

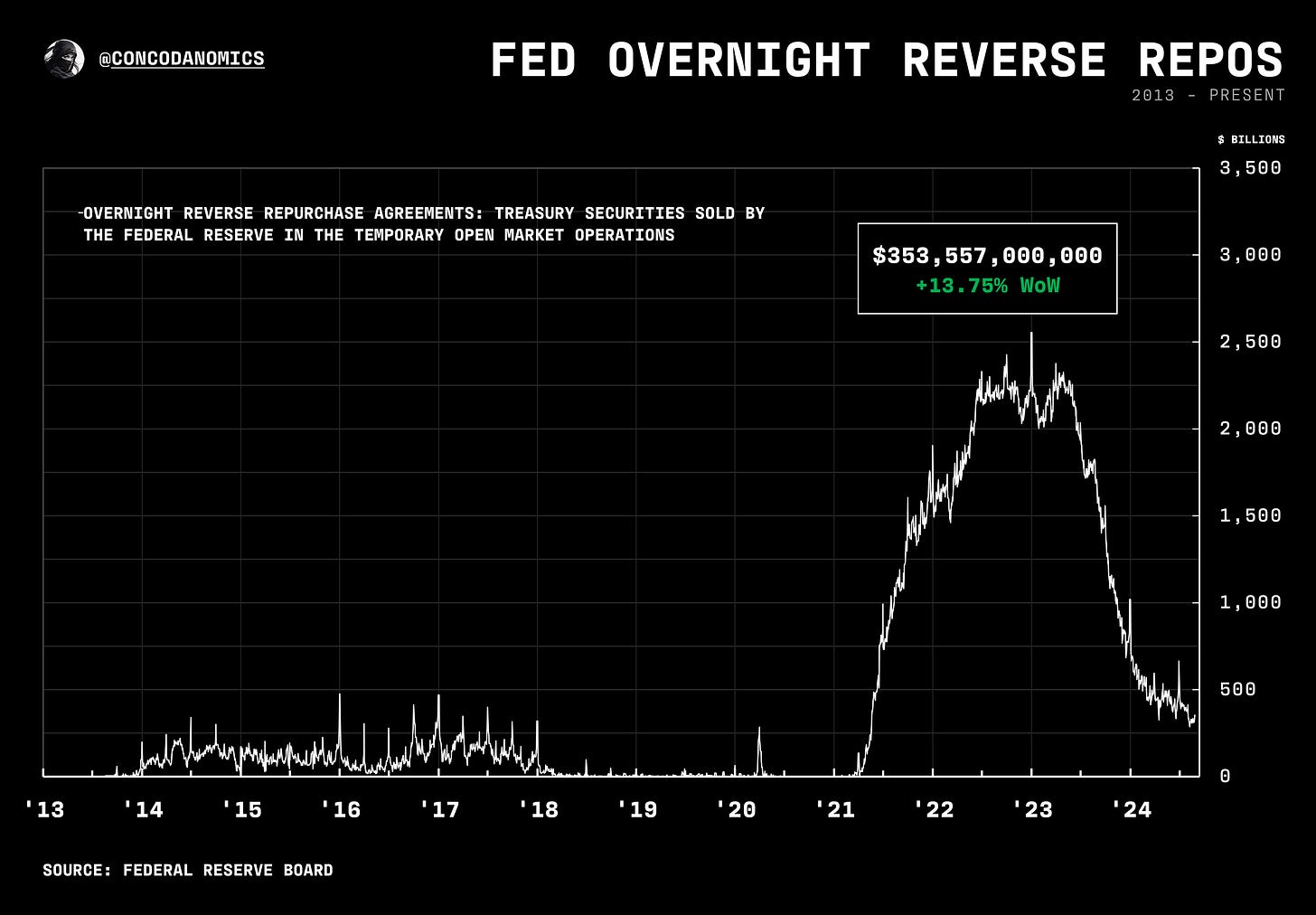

Bank reserves remain ample, with a significant drawdown in Fed RRPs. Sources say repos in private markets became relatively attractive, and the number of counterparties in cleared repo increased (creating more lending opportunities for those formerly parking funds in the RRP).

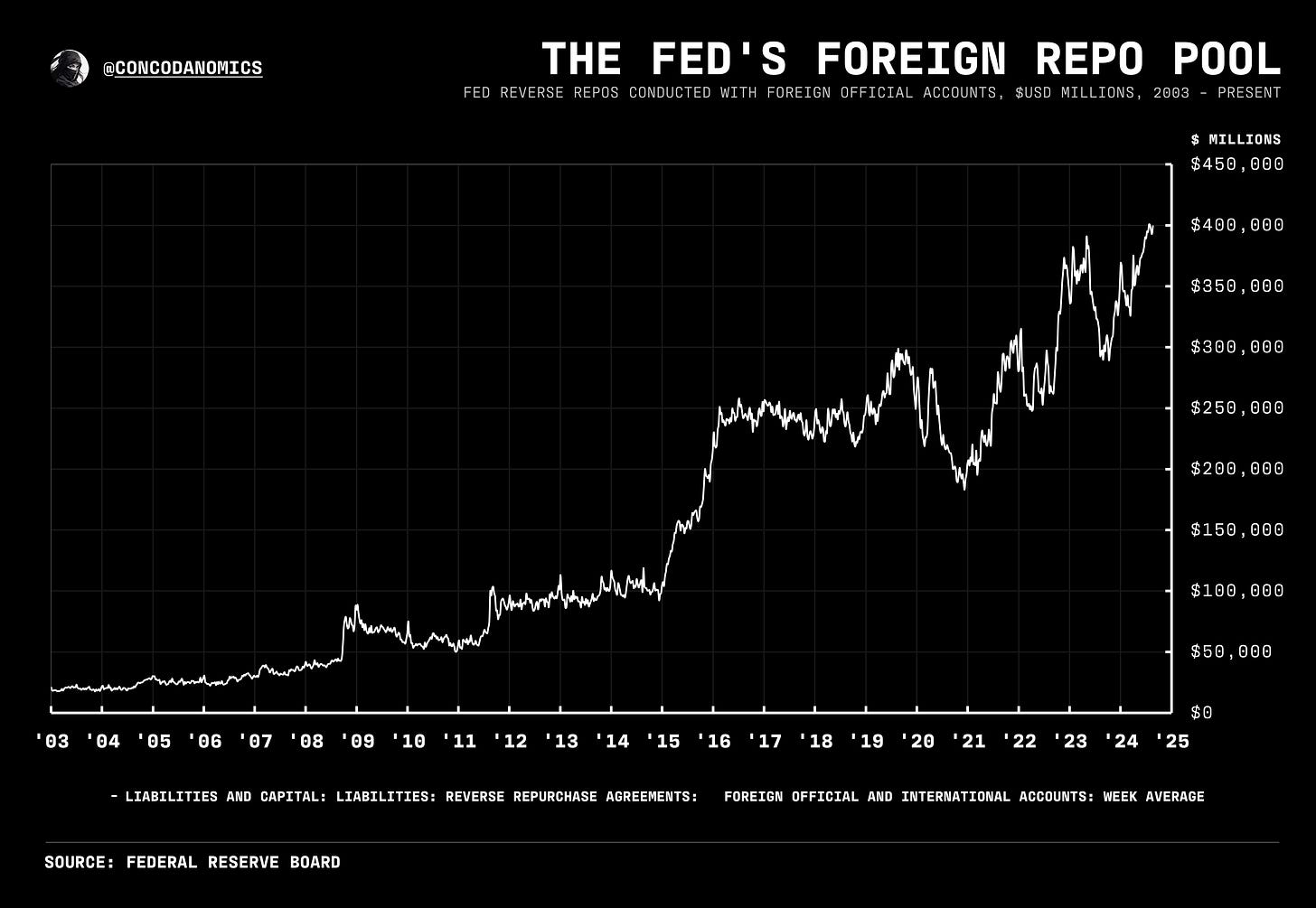

Could the Fed consider limiting usage or reducing the rate offered on its foreign repo pool now that it’s reached near highs, releasing reserves back into the banking system? It’s possible, but other less politically sensitive options exist.

Dealer balance sheets remain constrained, but that’s been true for most of 2024. The yield curve un-inverting (a curve steepening) will help fix that, allowing inventories to clear.

In XCCY land, the $/¥ (dollar-yen) cross-currency basis has recovered.

Despite SOFR printing relatively higher, private repo rates have been falling due to seasonal cash inflows from federal agencies (GSEs) and RRP outflows — as aforementioned.

The Fed Funds market remains in its “undead” state, even after a volume spike. Eurodollar rates dipped slightly.

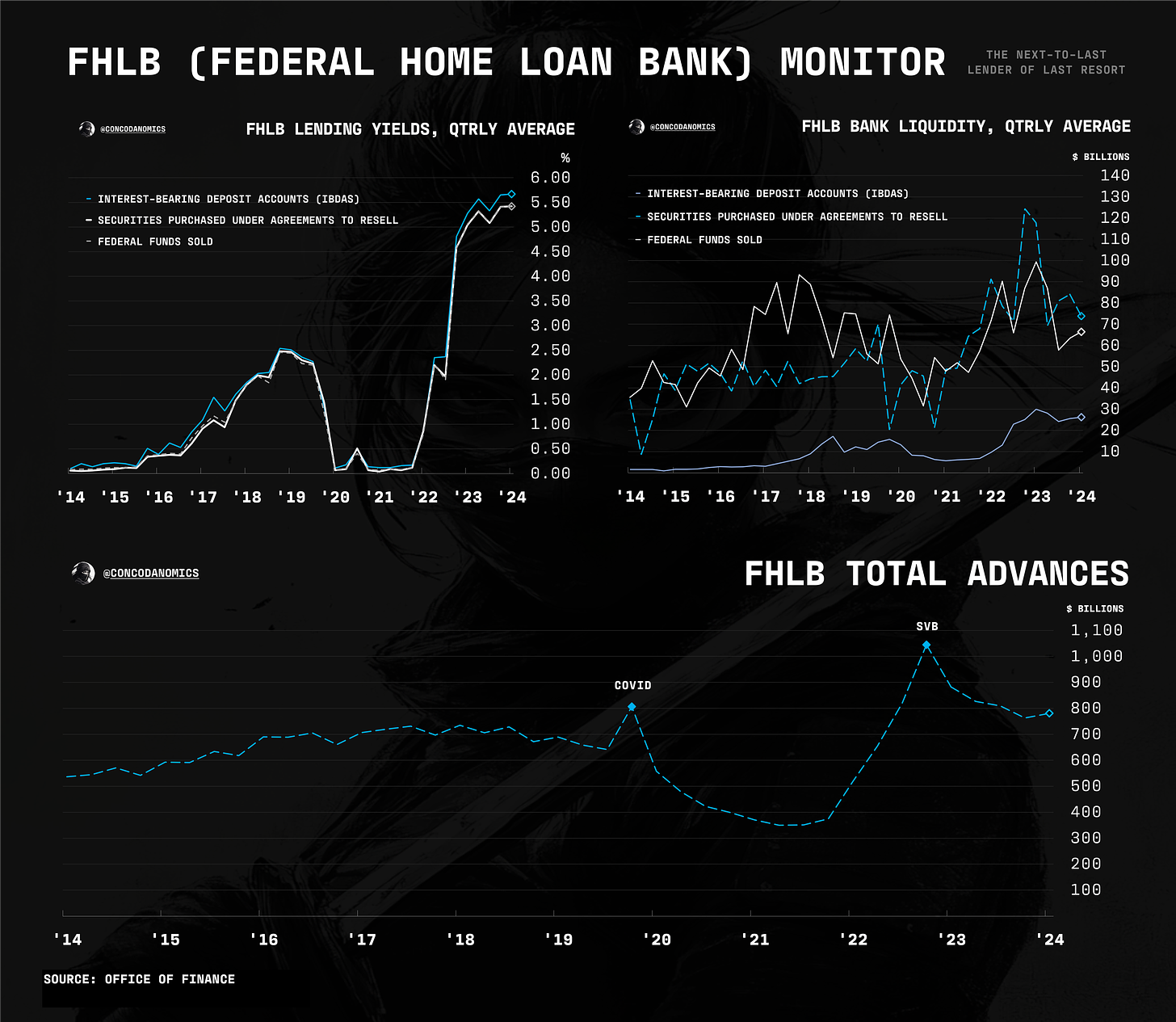

No shortage of interbank liquidity, with IBDAs offered by the Federal Home Loan Banks (FHLBs) remaining popular with large banks and FHLBs rotating out of repos and into Fed Funds lending. Moreover, the longstanding decline in advances has now bottomed.

Now, for the chartbook (more monitors coming soon)…

If you act on anything provided in this newsletter, you agree to the terms in this disclaimer. Everything in this newsletter is for educational and entertainment purposes only and NOT investment advice. Nothing in this newsletter is an offer to sell or to buy any security. The author is not responsible for any financial loss you may incur by acting on any information provided in this newsletter. Before making any investment decisions, talk to a financial advisor.

EFFR, OBFR, SOFR, TGCR, and BGCR are subject to the Terms of Use posted at newyorkfed.org. The New York Fed is not responsible for publication of tri-party data from the Bank of New York Mellon (BNYM) or GCF Repo/Delivery-versus-Payment (DVP) repo data via DTCC Solutions LLC (“Solutions”), an affiliate of The Depository Trust & Clearing Corporation, & OFR, does not sanction or endorse any particular republication, and has no liability for your use.

Could anyone please share done away sponsored repo workflows in detailed

Conks, two questions for you:

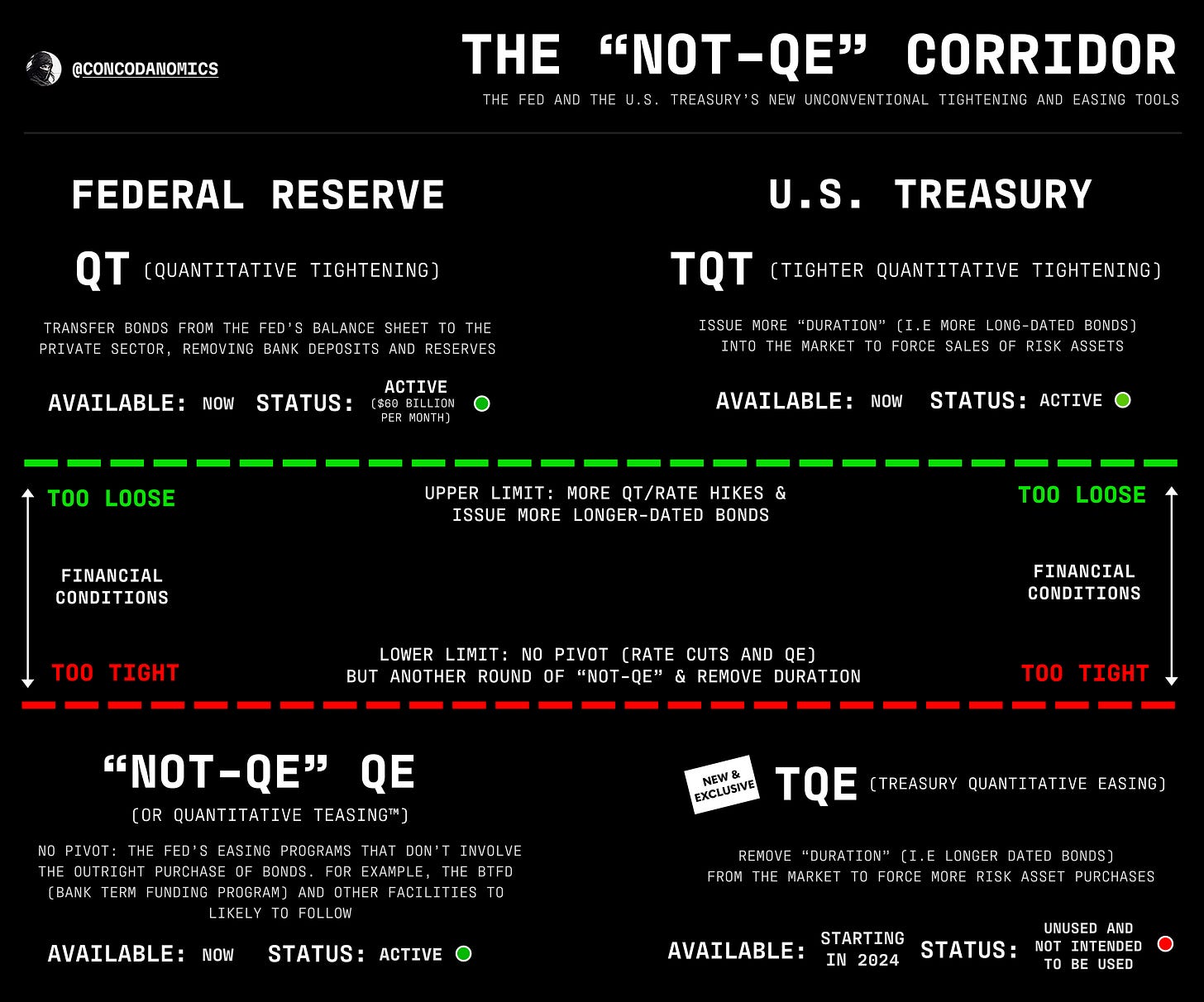

1. TQT: isn't the Treasury still tilting issuance towards bills? Seems like the 10-year <4% would logically be (partly) a function of reduced coupon issuance. After all, The Treasury's goal is to fund the gov't with as little interest expense as possible.

2. Any thoughts on rate cuts? I had been in the "no cuts all year" camp since December last year, but now I'm not so sure...

NB: asking for entertainment only, not seeking investment advice.