Money Market Update

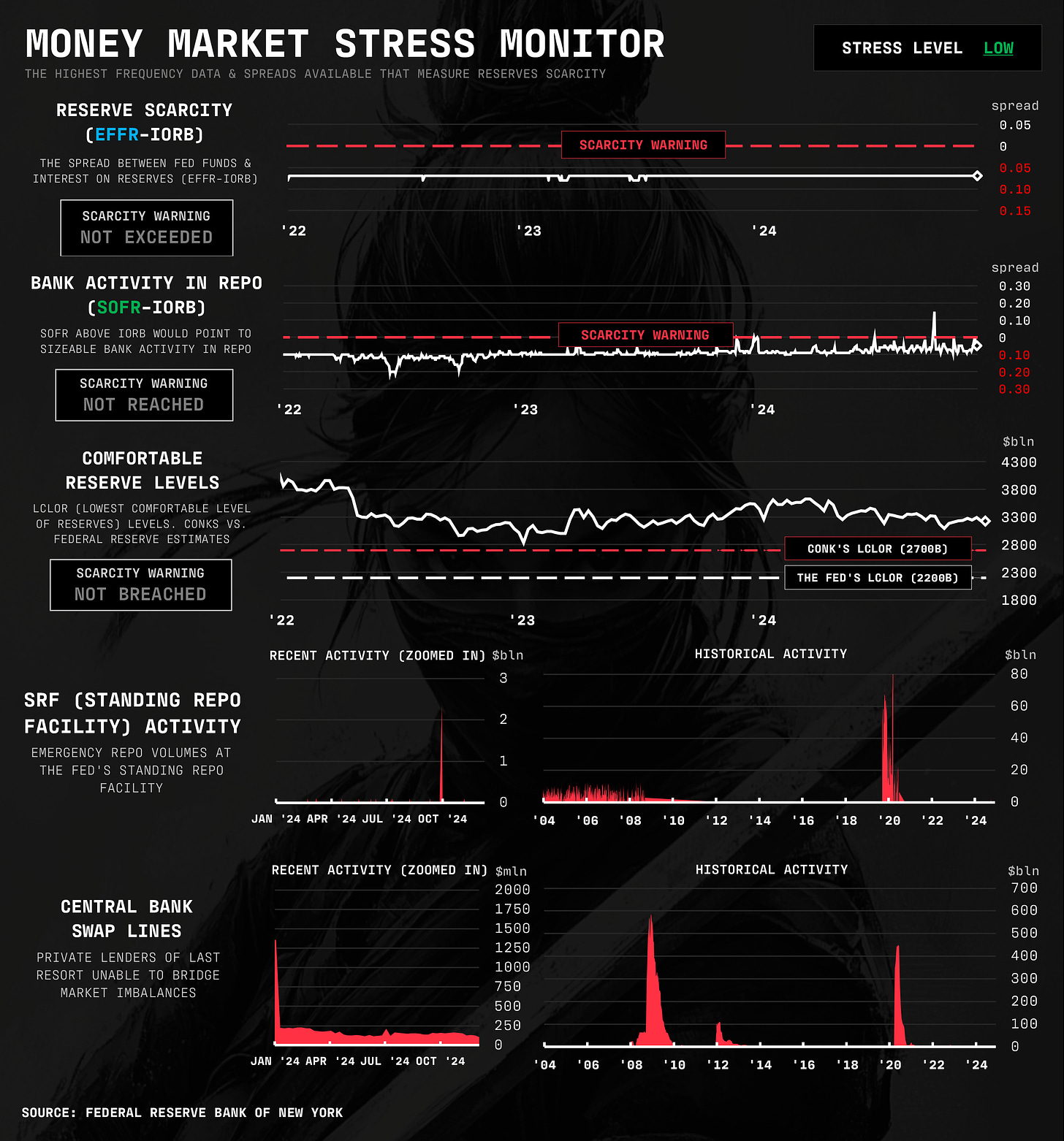

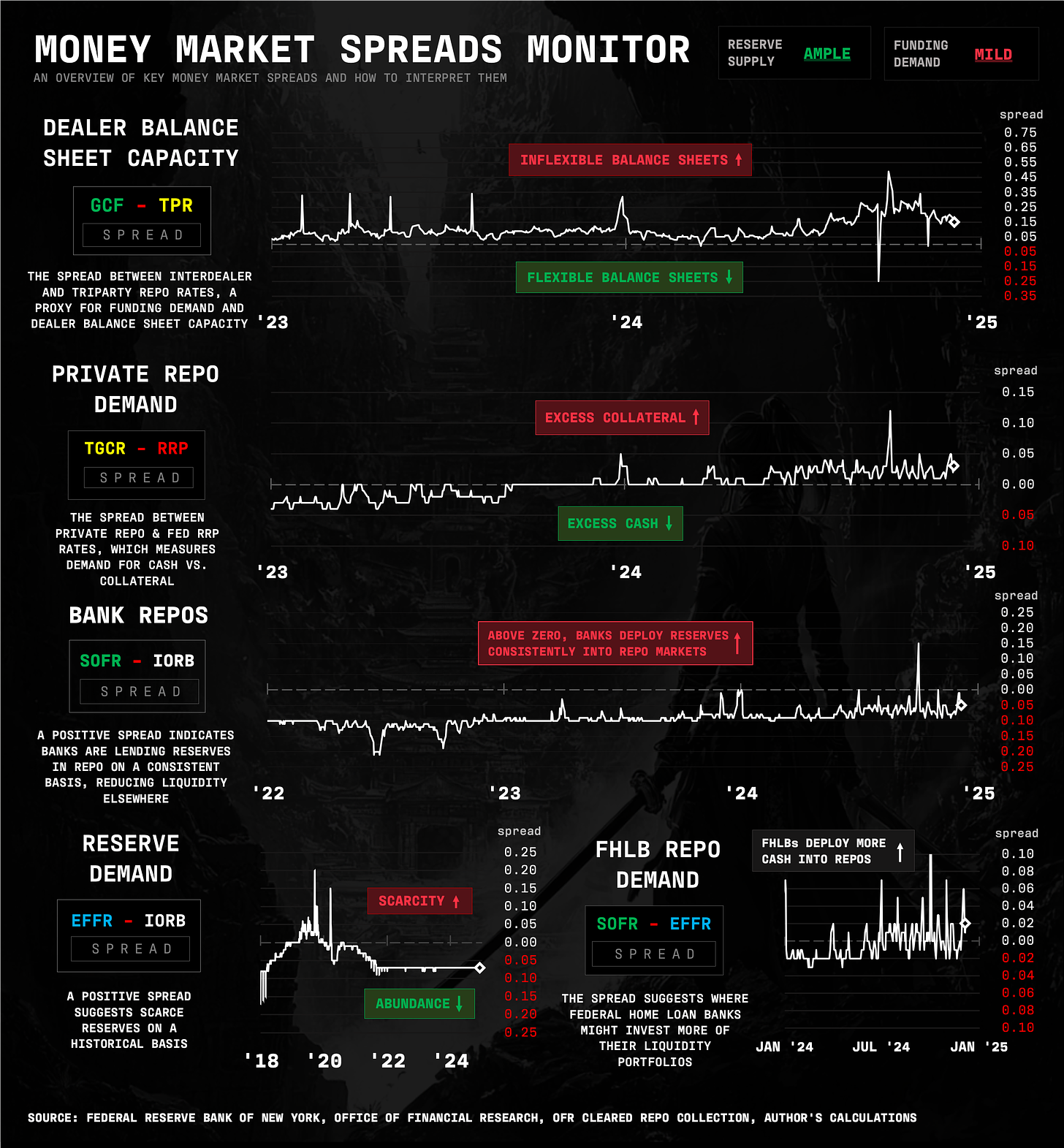

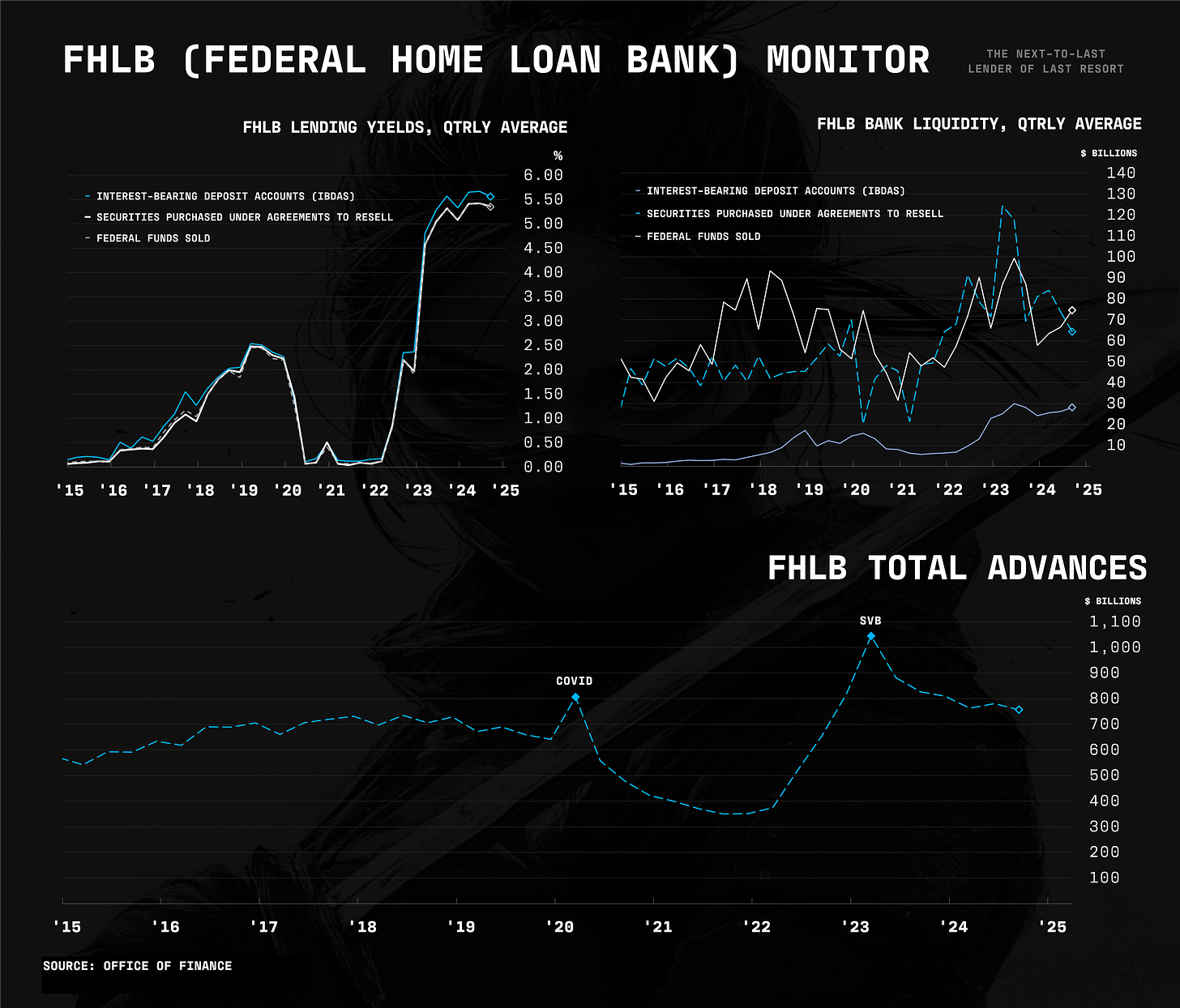

while the Fed dismisses the debt ceiling as a reason to stop reducing its balance sheet, funding pressures keep building in money markets. regardless, liquidity remains more than ample

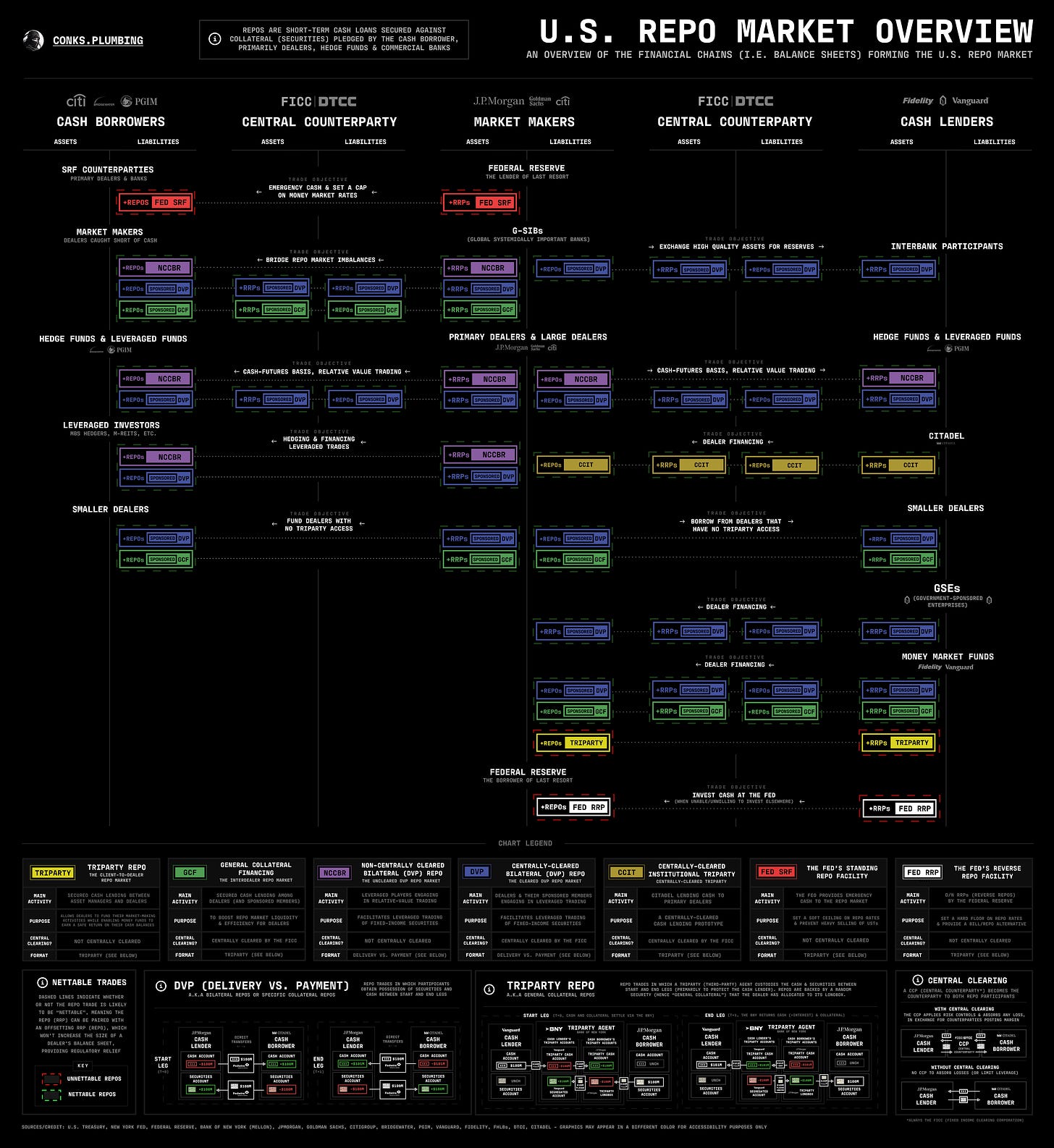

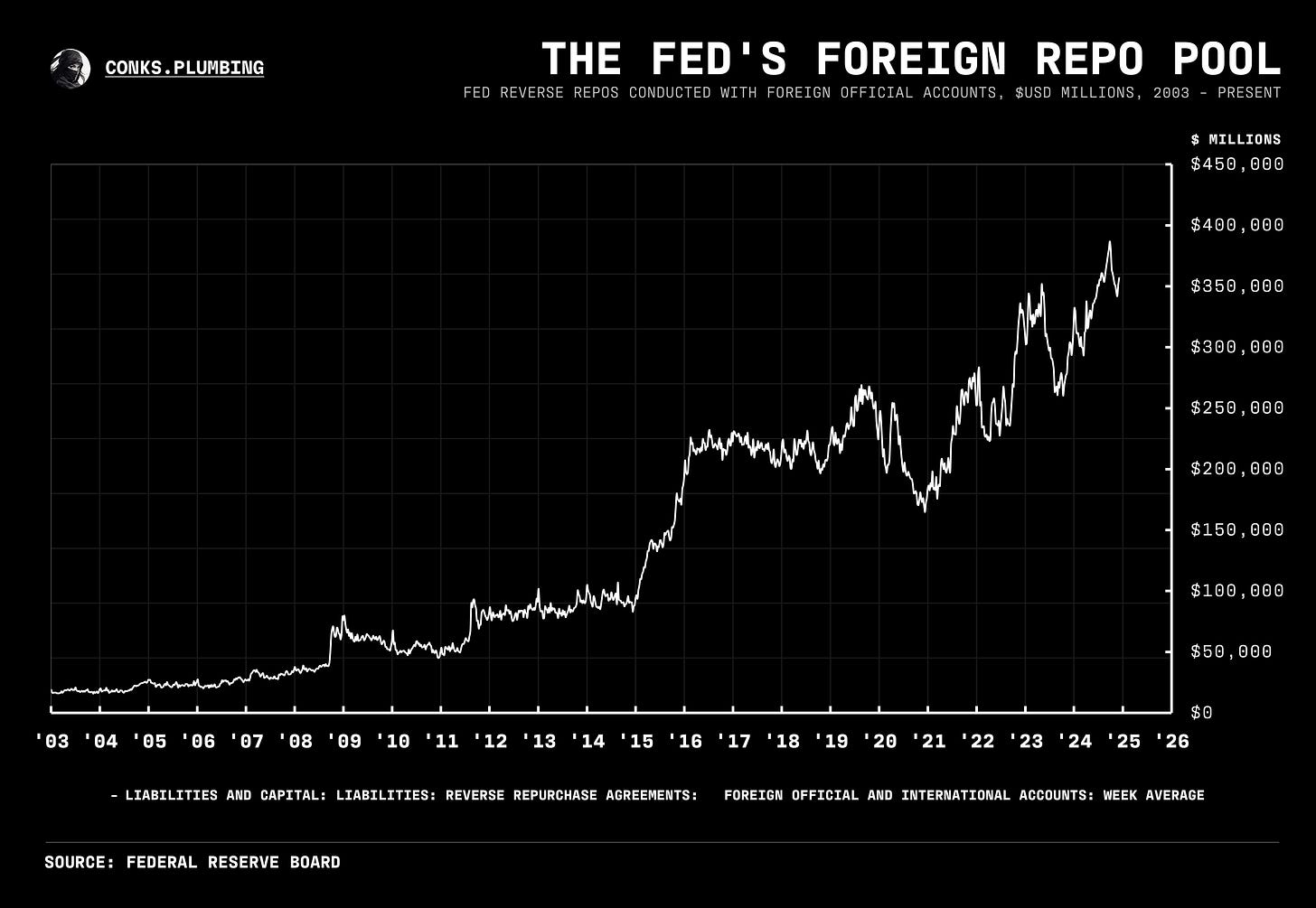

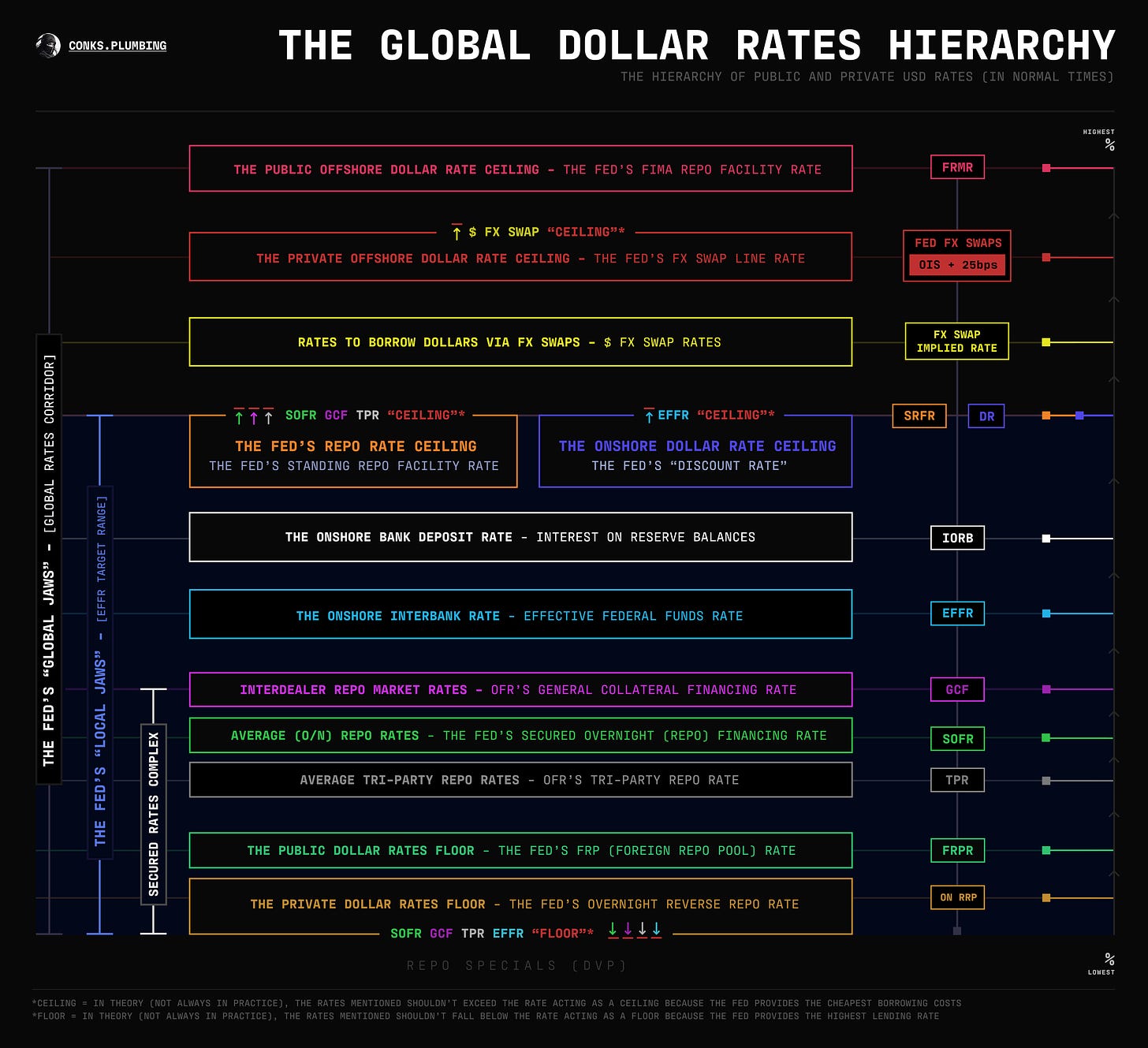

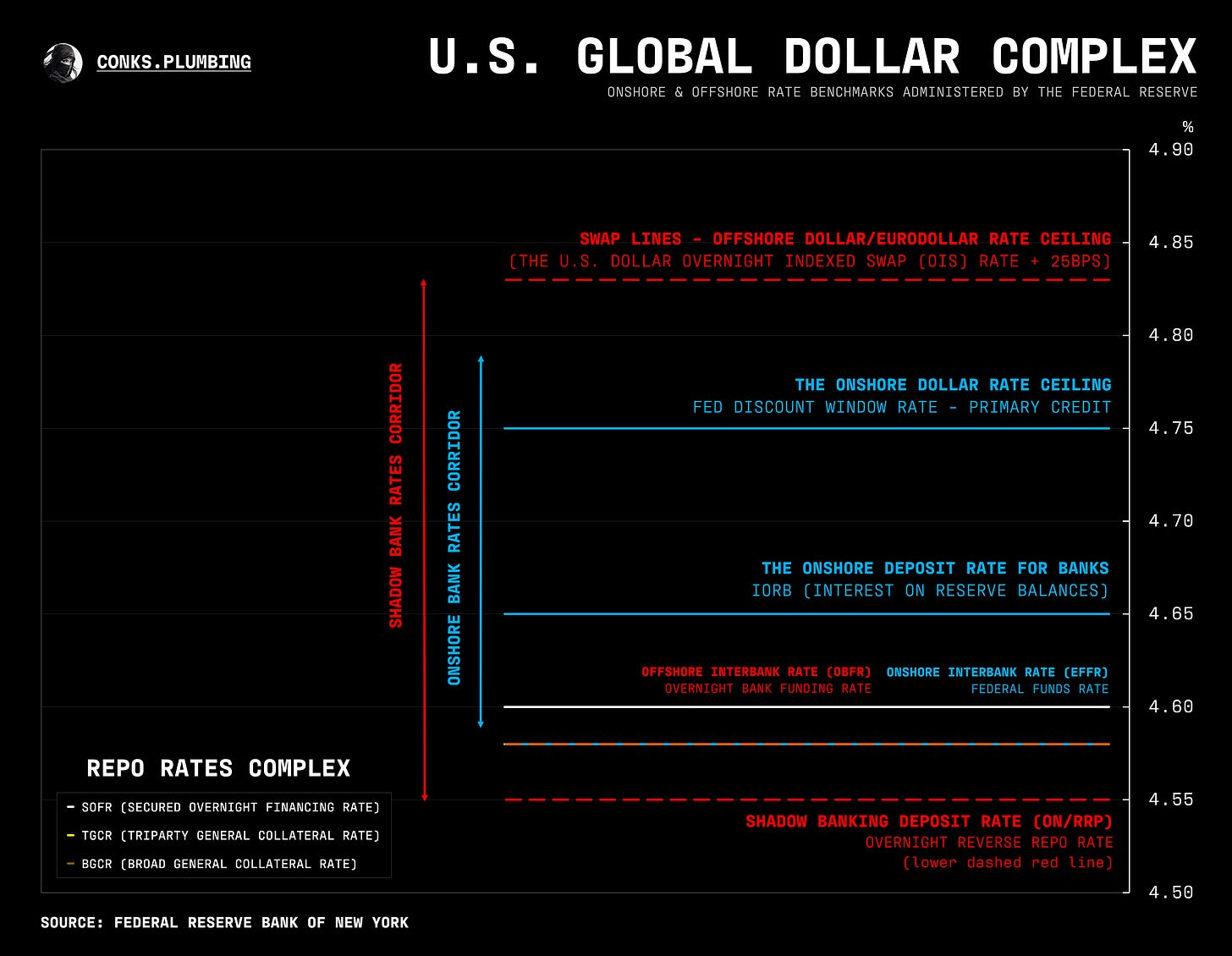

Welcome to the latest Conks edition. We’re almost 44,000 readers strong. Our upcoming piece, The Repo Market Fortification — featuring multiple new infographics, will hit your screens soon. A “small” taster below…

But first, a (gradually improving) money market update…

Summary & Brief Commentary

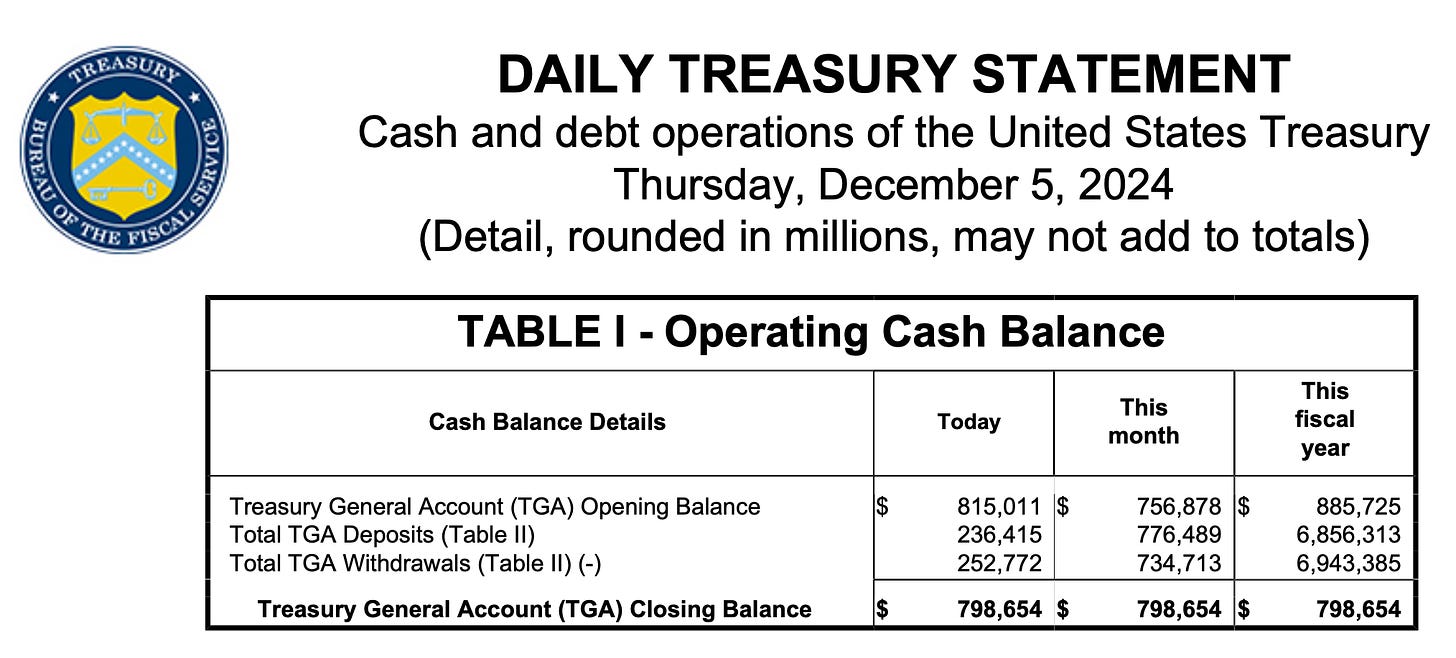

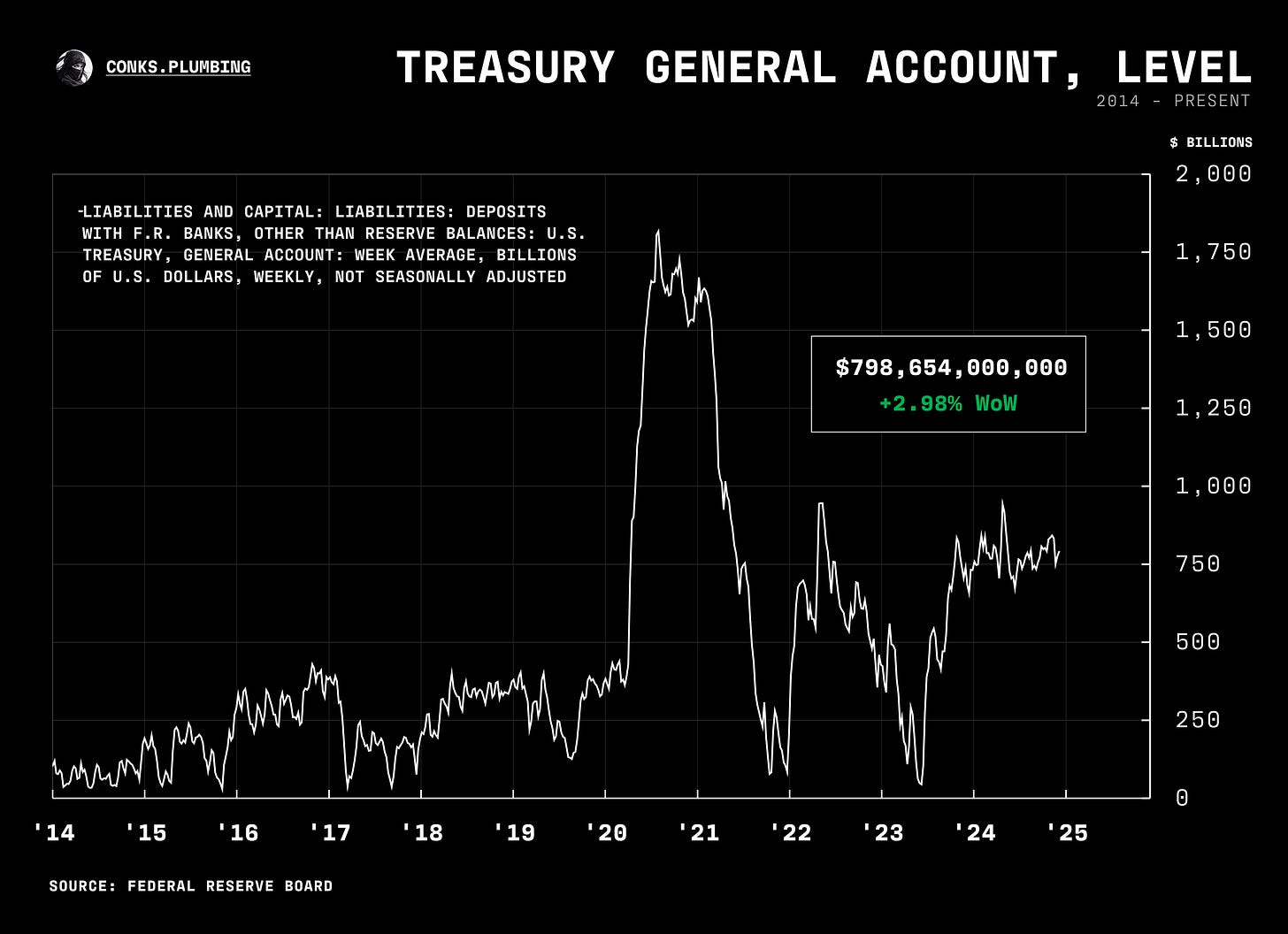

The next debt ceiling battle, which could prompt a liquidity blindspot described in The Fed’s Global Put, was mentioned in the latest FOMC minutes. This will act as a hurdle for the Fed to continue reducing its balance sheet, yet officials officially disregarded the debt ceiling as a motive to end QT.

If the debt ceiling battle is prolonged, Conks projects the U.S. Treasury has enough money plus extraordinary measures to last until Q3 2025 before the X-date — the day the Treasury runs out of money.

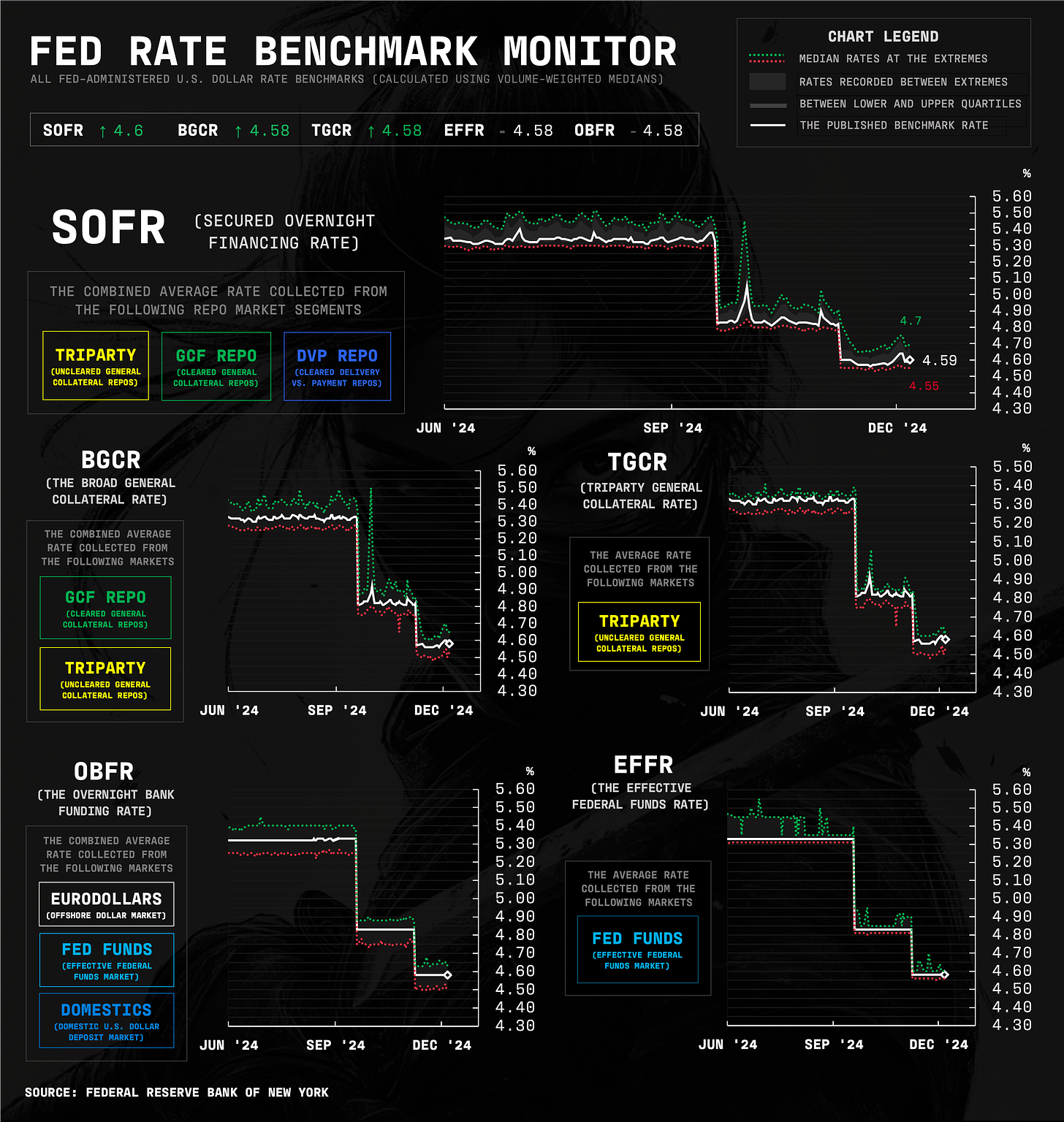

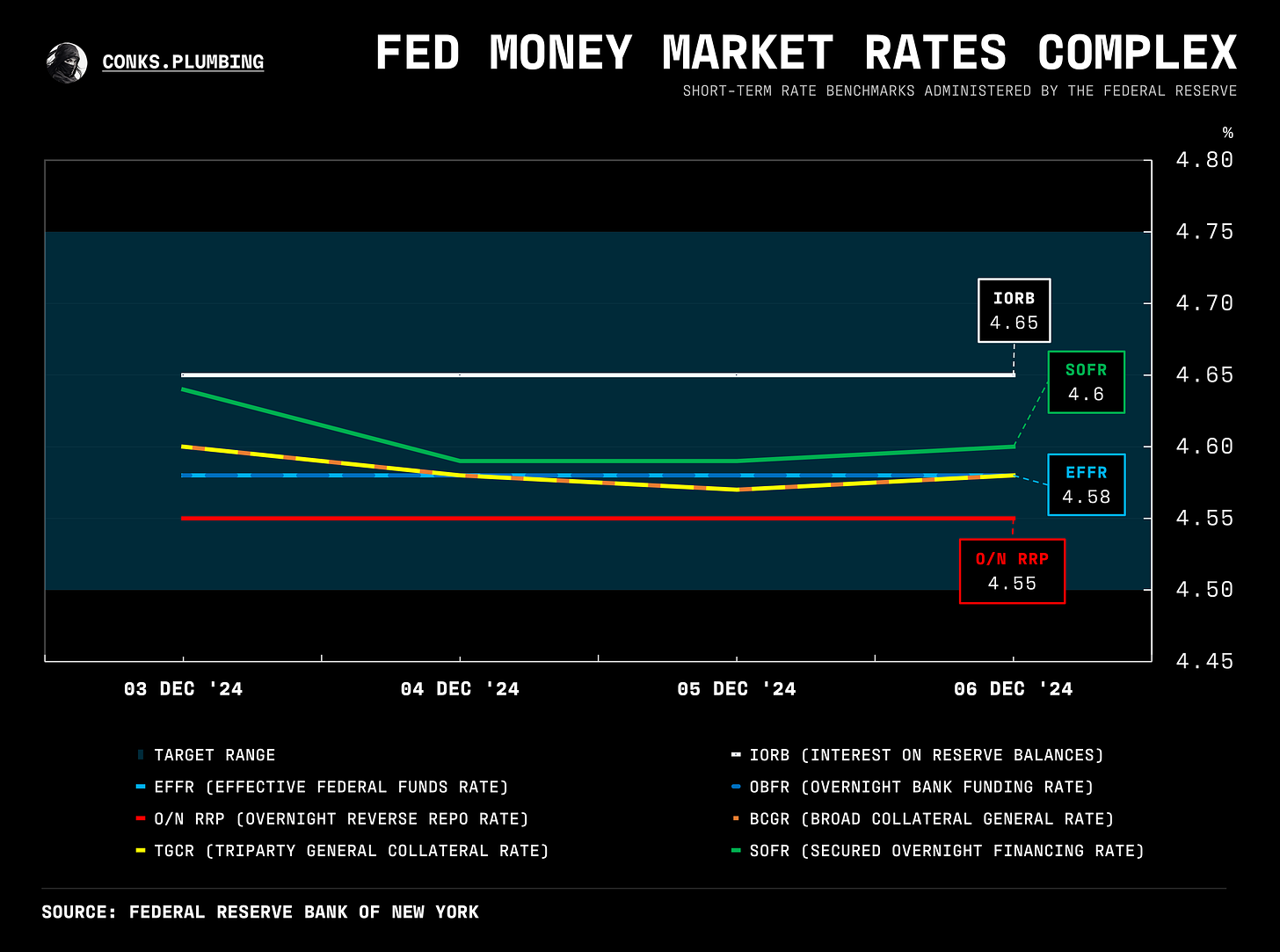

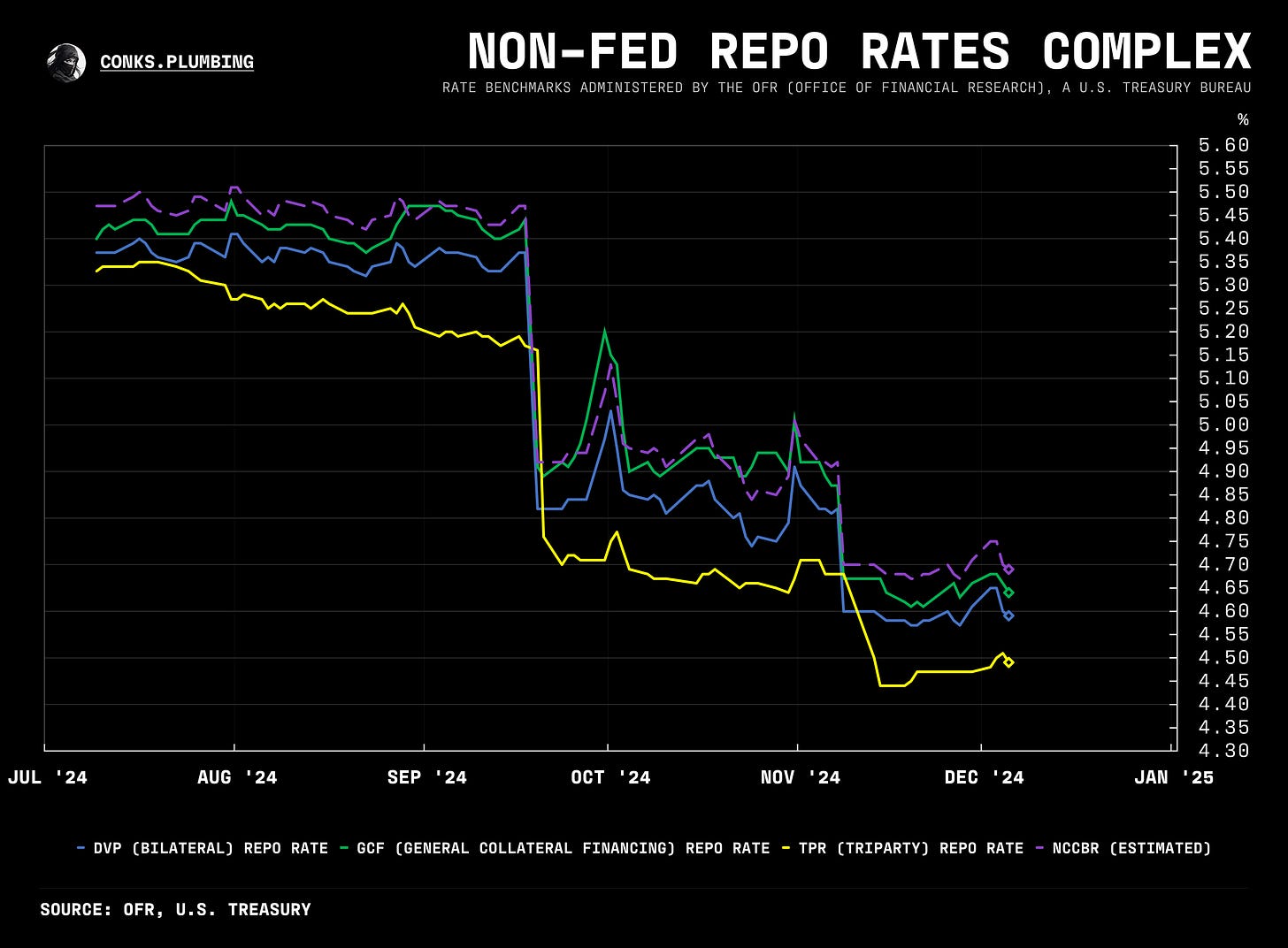

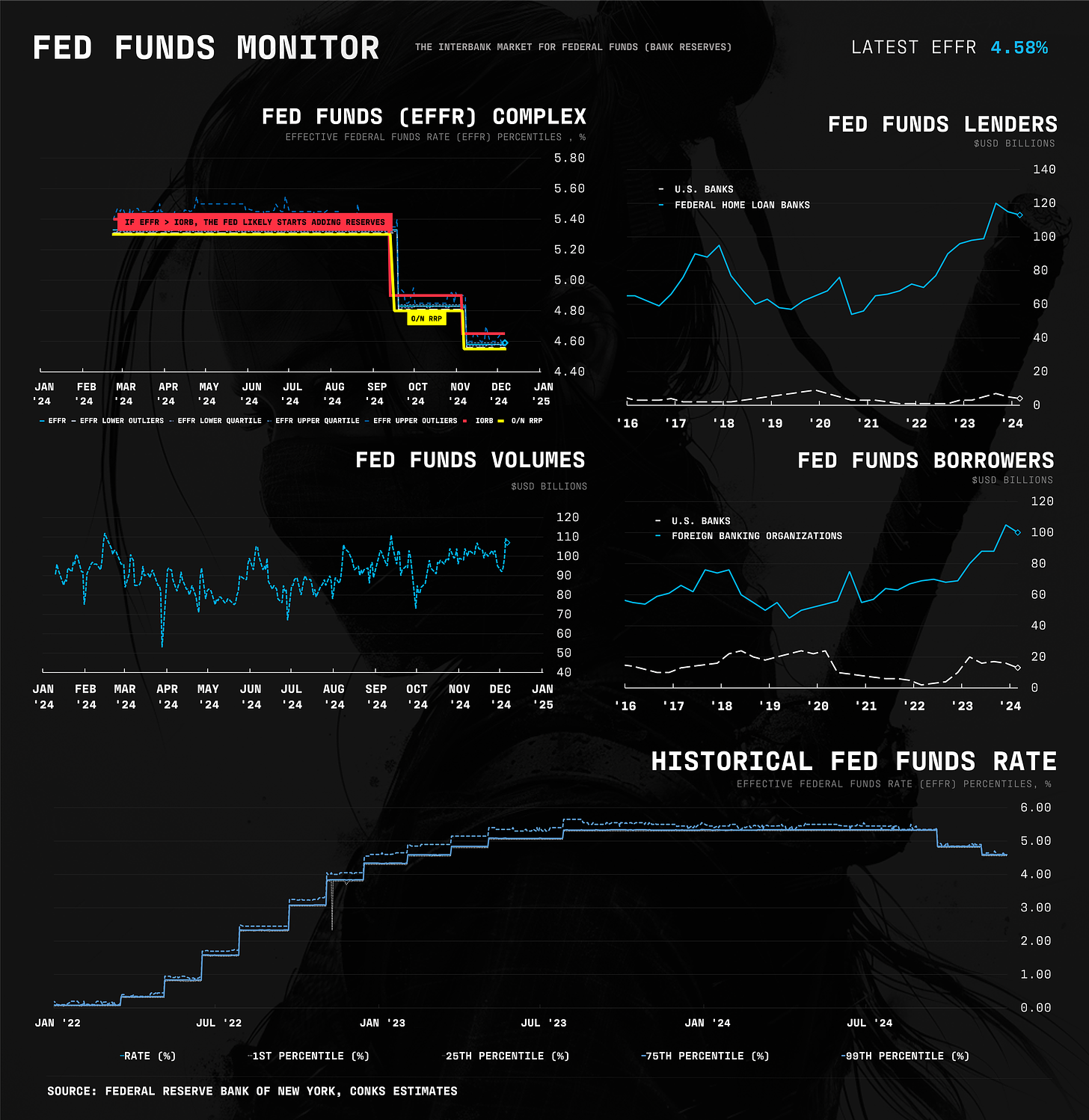

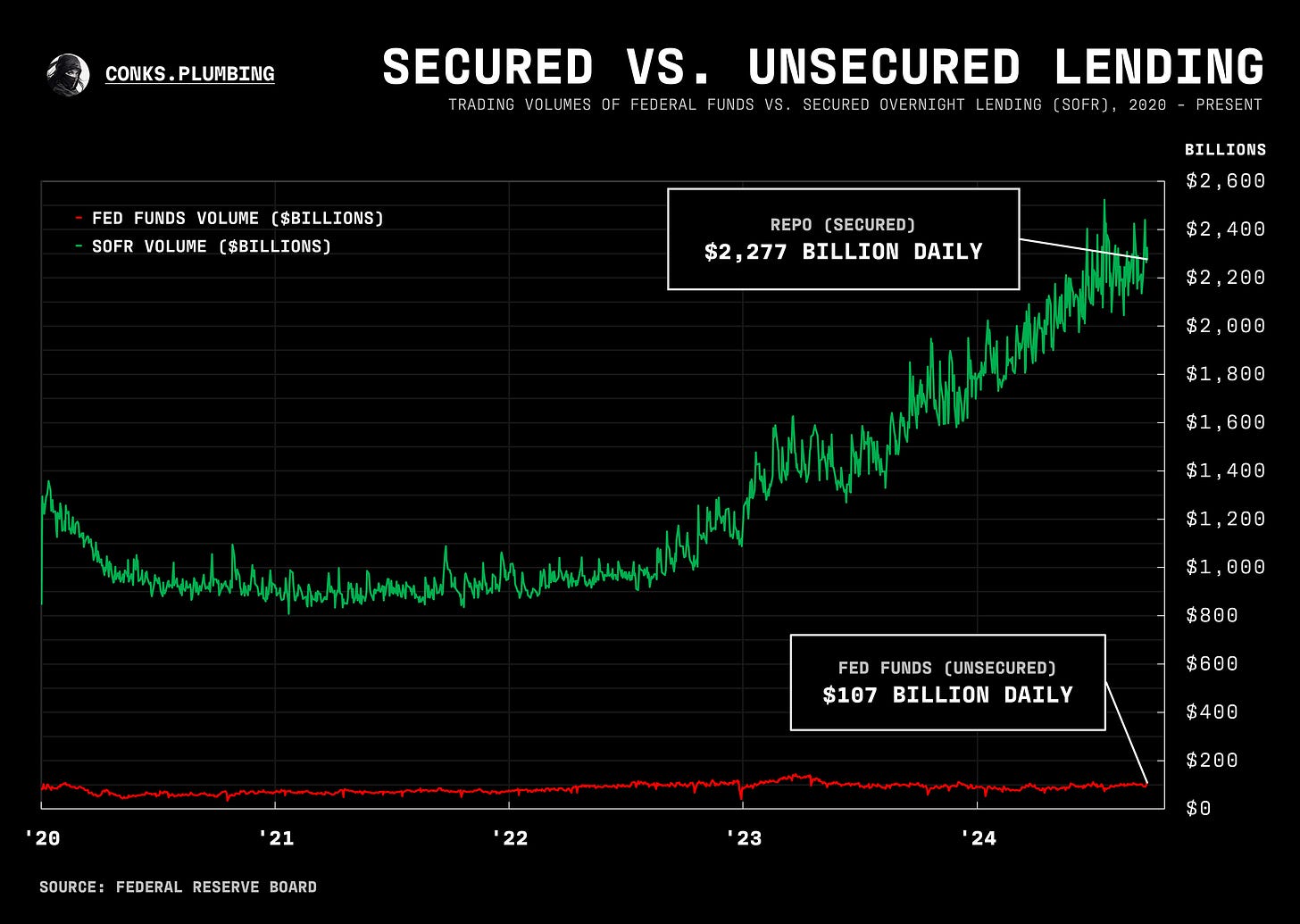

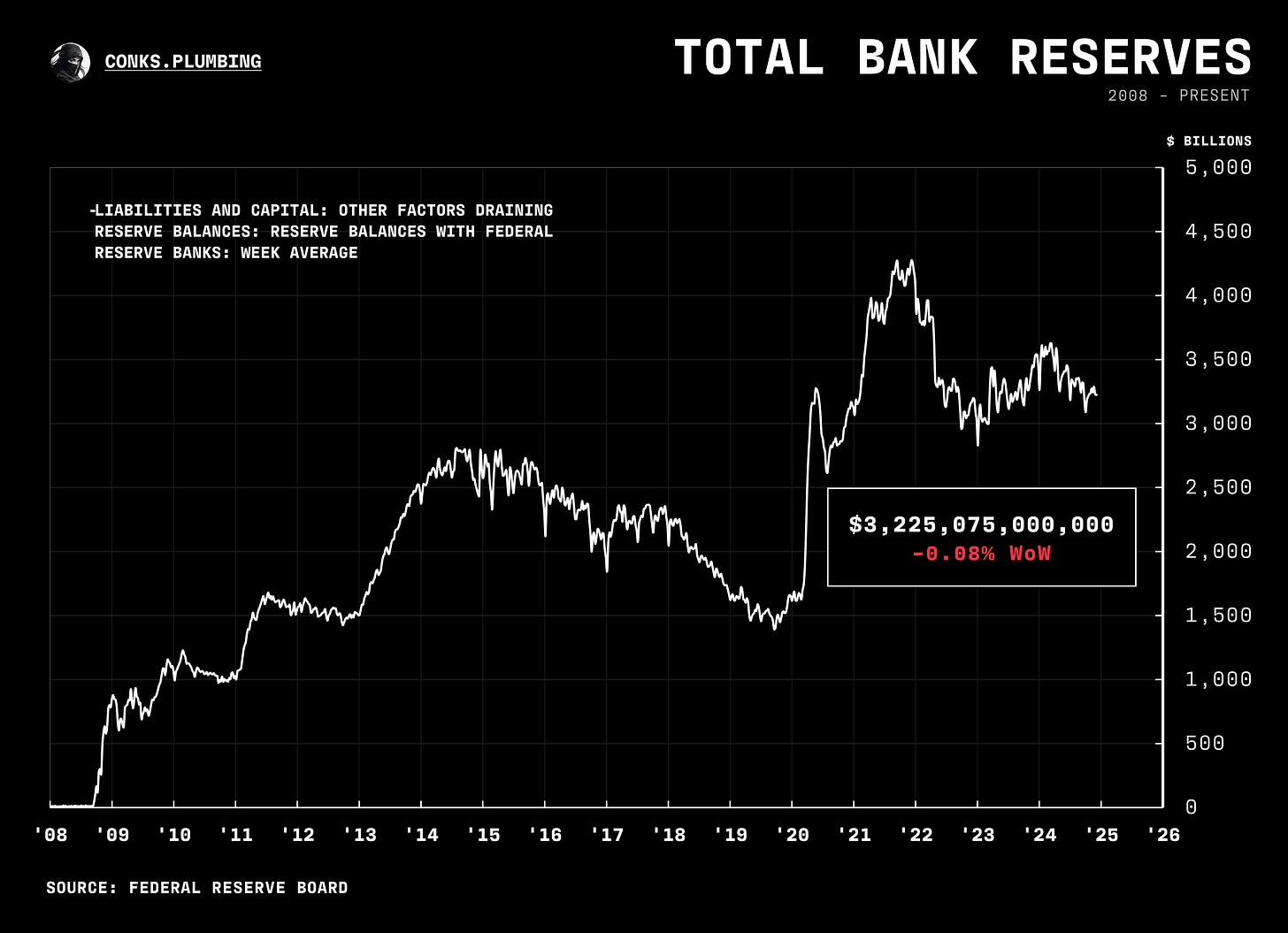

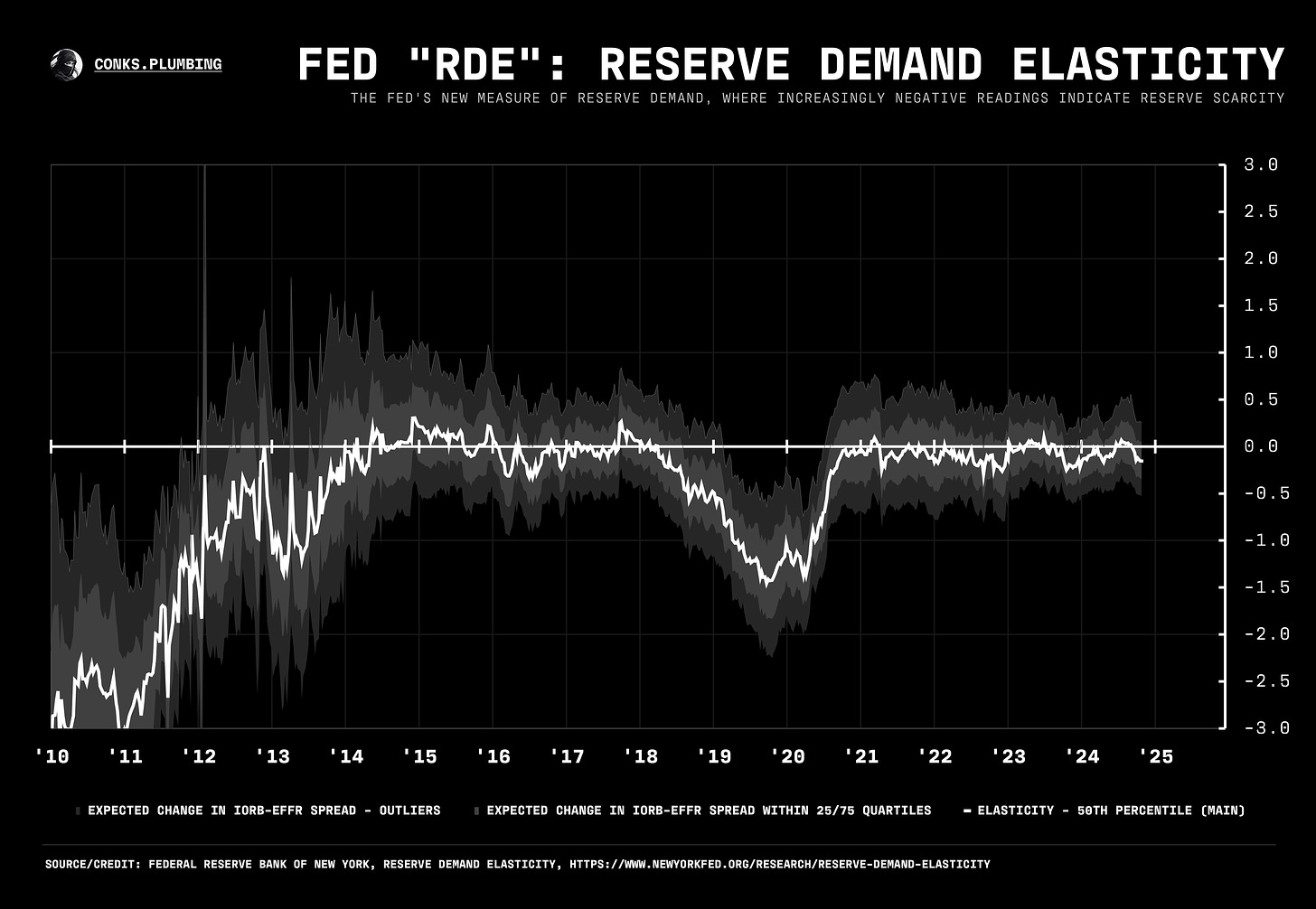

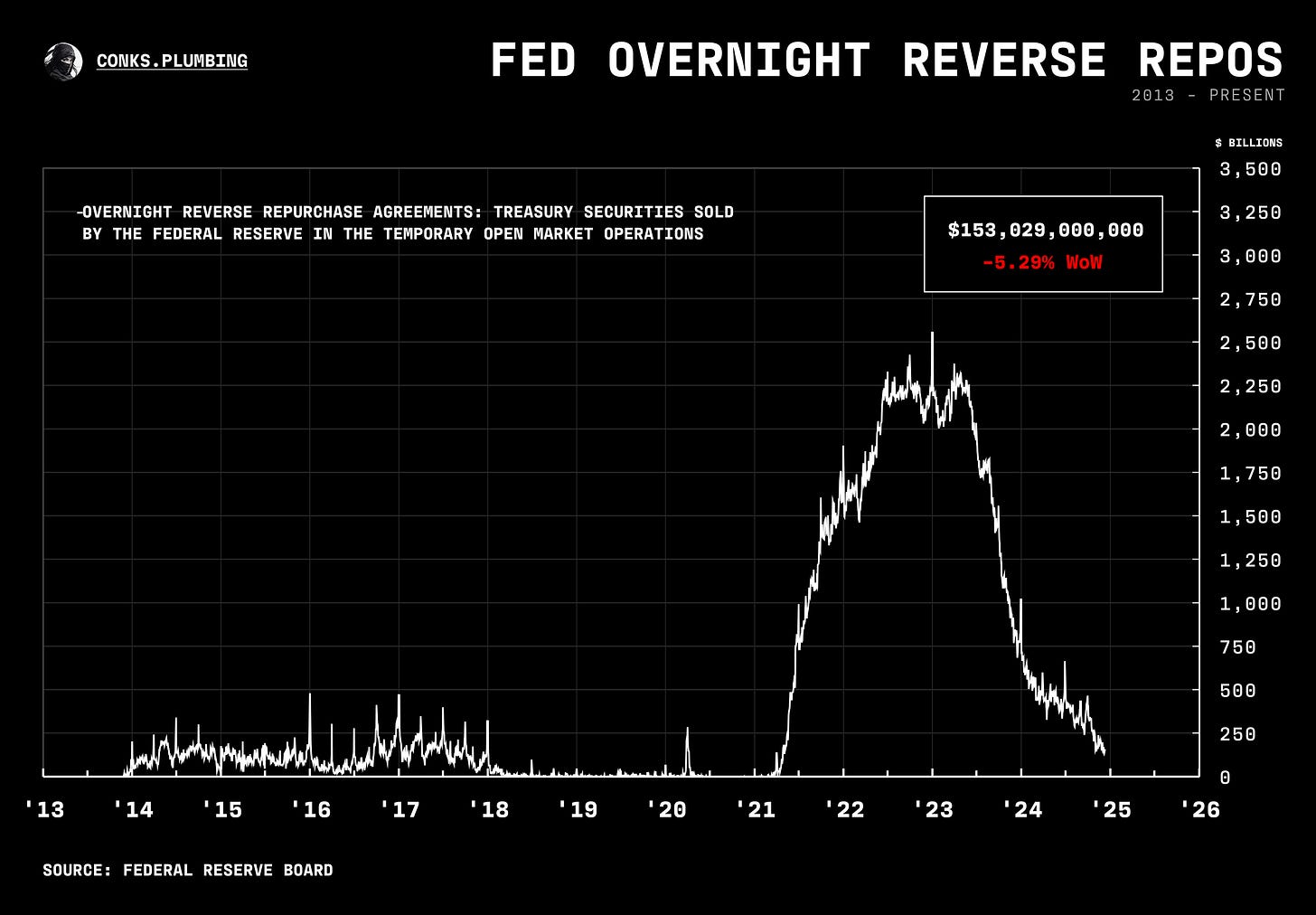

Meanwhile, the Fed Funds market has seen the largest spike in volume this year, while repo pressures have persisted. SOFR is printing above EFFR consistently. Nevertheless, Fed officials have stated they will only consider ending QT when EFFR starts moving up with SOFR. The Fed Funds rate, however, continues to print in a straight line. To quote a recent meme: nothing ever happens. Liquidity remains abundant.

Elsewhere in money markets, as anticipated, large inflows into U.S. MMFs have persisted despite semi-sharp rate cuts, preserving tighter (i.e. more positive) XCCY bases. Conks expects cross-currency bases to remain elevated until the second half of next year.

We’ve also received tons of queries about the rise of “equity repos.” In an equity repo, a cash borrower pledges equities (i.e. stocks) from its inventory to receive short-term cash. Equity repos are uncommon because most stock lending occurs in the securities lending market, not the repo market. Triparty equity repo volumes have climbed primarily because of increased demand for equities, which have also risen in value, meaning dealers can obtain more cash against equity collateral.

The type of “equity repo” that has garnered significant media attention does not involve repos backed by equities. The phrase describes leveraged equity exposure, such as entering into a total return swap (TRS) with banks and dealers. These dealings are commonly priced at SOFR (a repo rate benchmark) plus a spread. So, the term “equity repo rate” may not refer to an actual equity repo, like those traded in the triparty repo market, which dealers use primarily to boost their cash balances. In short, “equity repo” is not usually a phrase to describe a repo but leveraged equity exposure obtained outside the repo market.

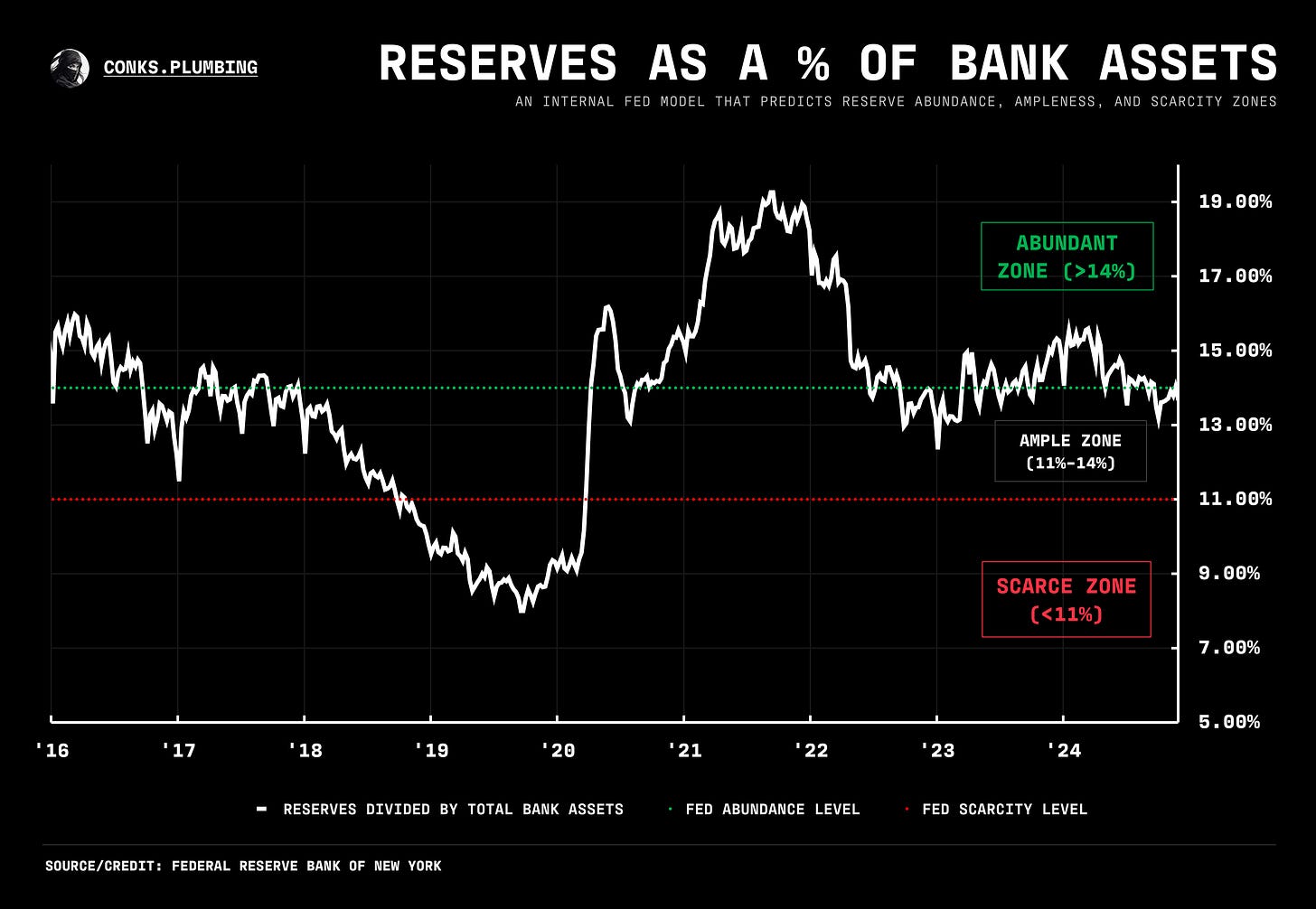

Lastly, we’ve included another useful Fed liquidity gauge by comparing bank assets to reserves. As is evident with other measures included in our monitors (below), we’re nowhere close to a scarce reserve regime.

Now, onto the chartbook (more monitors on the way)…

Give the gift of financial plumbing this holiday season…

If you act on anything provided in this newsletter, you agree to the terms in this disclaimer. Everything in this newsletter is for educational and entertainment purposes only and NOT investment advice. Nothing in this newsletter is an offer to sell or to buy any security. The author is not responsible for any financial loss you may incur by acting on any information provided in this newsletter. Before making any investment decisions, talk to a financial advisor.

EFFR, OBFR, SOFR, TGCR, and BGCR are subject to the Terms of Use posted at newyorkfed.org. The New York Fed is not responsible for publication of tri-party data from the Bank of New York Mellon (BNYM) or GCF Repo/Delivery-versus-Payment (DVP) repo data via DTCC Solutions LLC (“Solutions”), an affiliate of The Depository Trust & Clearing Corporation, & OFR, does not sanction or endorse any particular republication, and has no liability for your use.

I like the fact that you link explainers because I keep forgetting what each thing means🤣🤣

Suggest using a more layman way of saying things like "...bases become tighter ie more positive" ... and why is xccy bases more "tighter" when more usd flows into US and what this means in terms for banks?