Money Market Update

while the Fed hints at a QT pause to cure a money market blindspot, liquidity remains strong but has failed to offset selling pressure from bearish macro headlines

Welcome to another Conks edition. In case you missed it, or you’ve just joined us, the first part of The Fed’s Relief Valve went live recently.

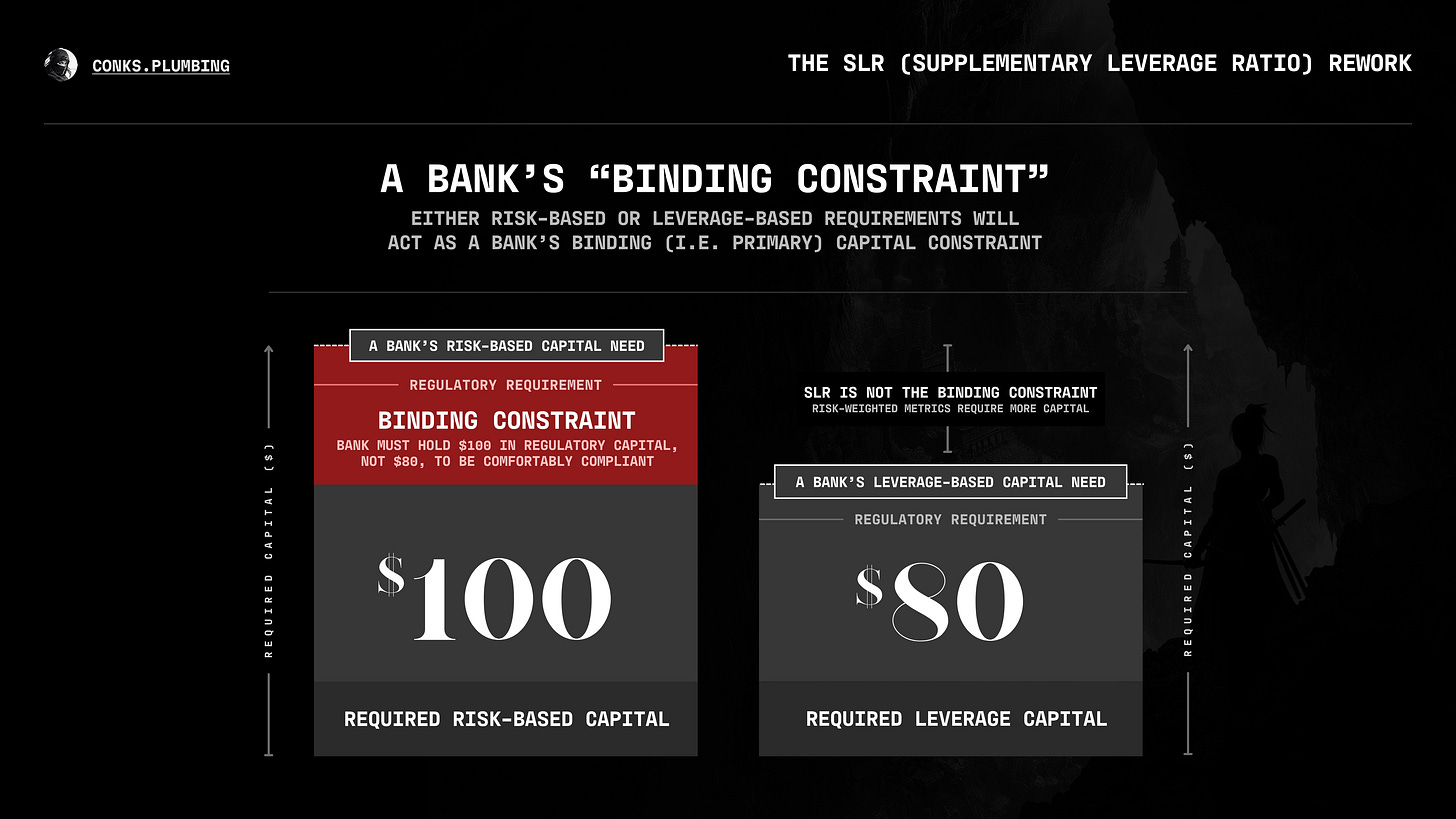

Part II will (further) demystify how Treasury market plumbing will be affected by potential changes to the Fed’s SLR and other regulations, and how to express this via actionable ideas — even without an ISDA. A small taster below…

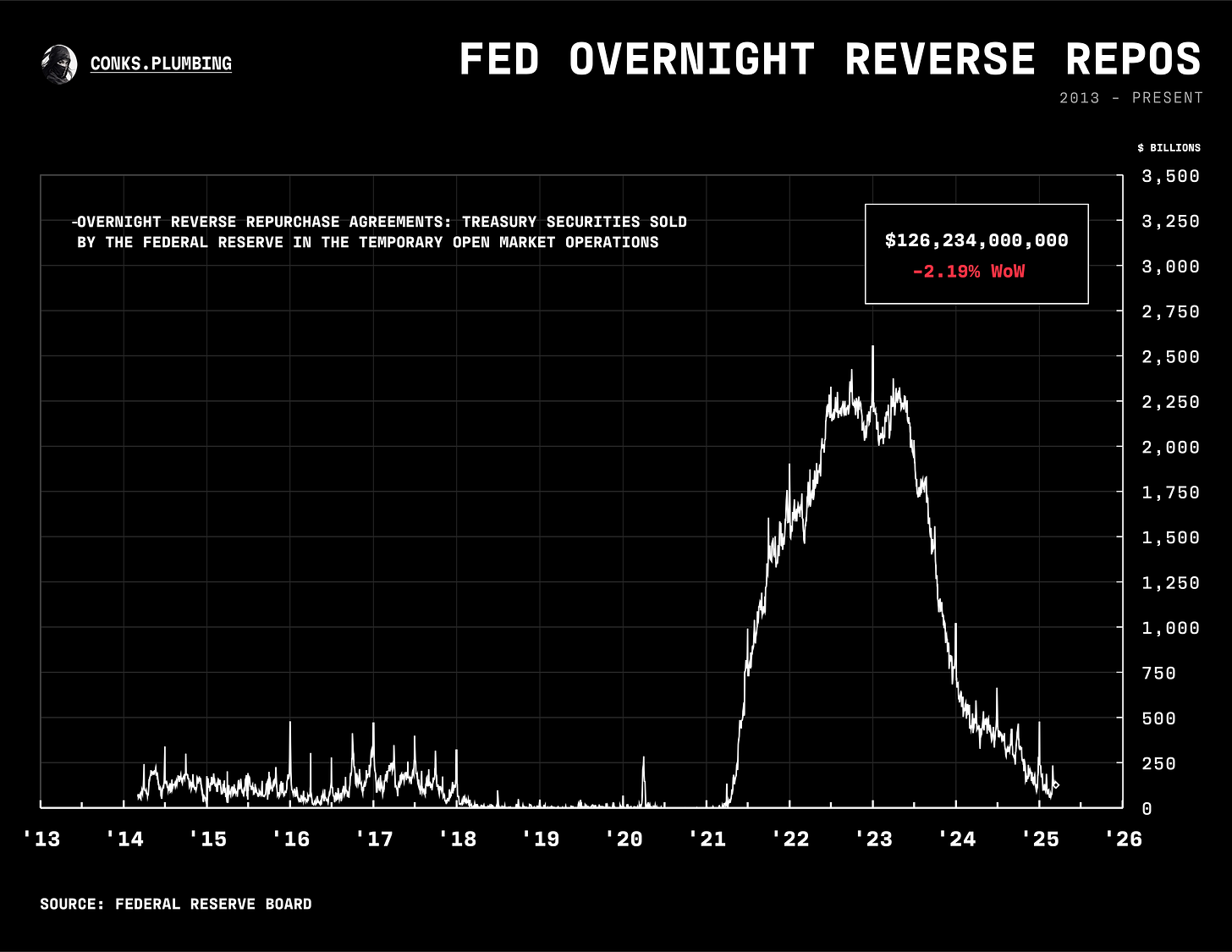

But first, a (gradually improving) money market update…

Summary & Brief Commentary

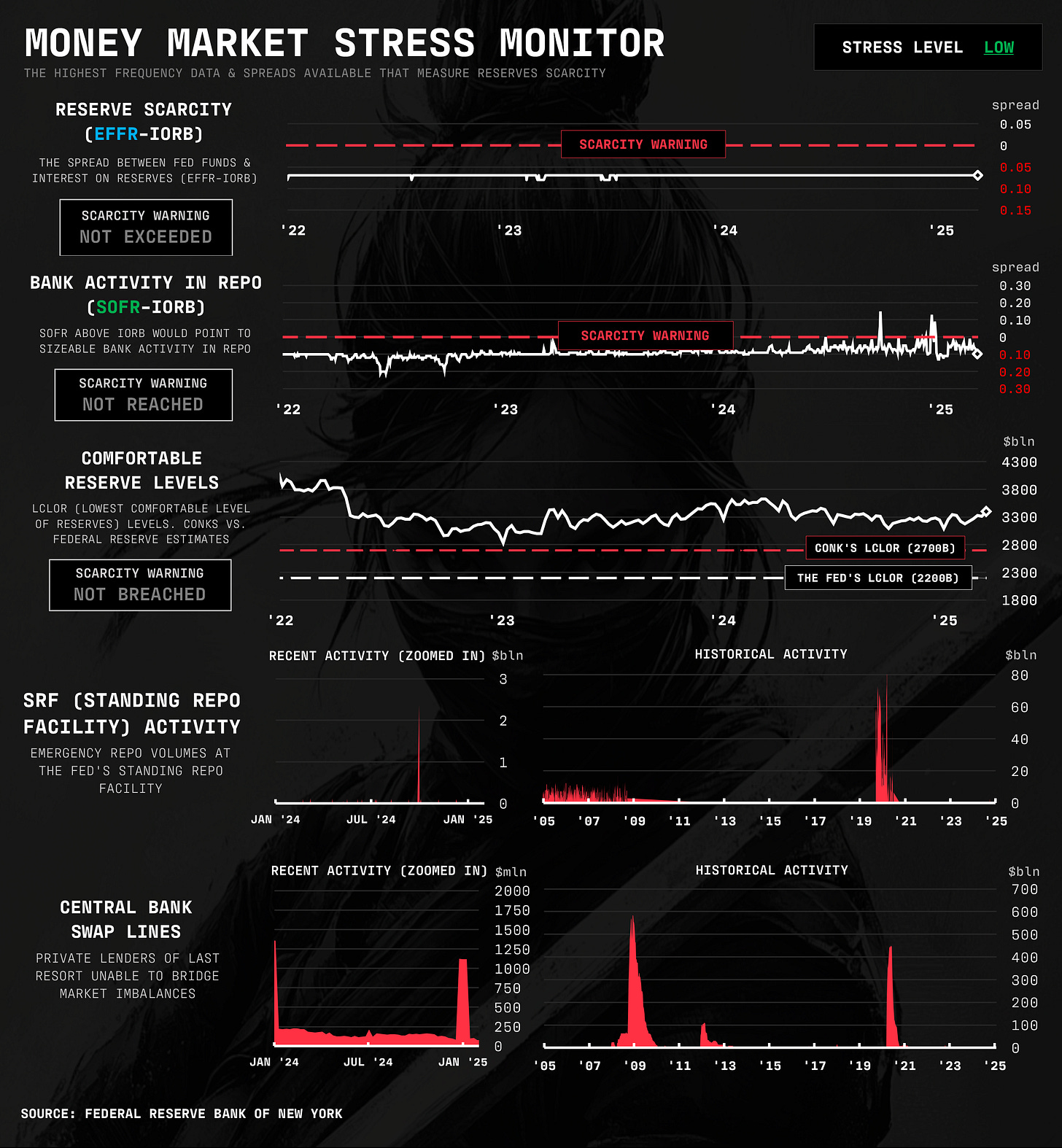

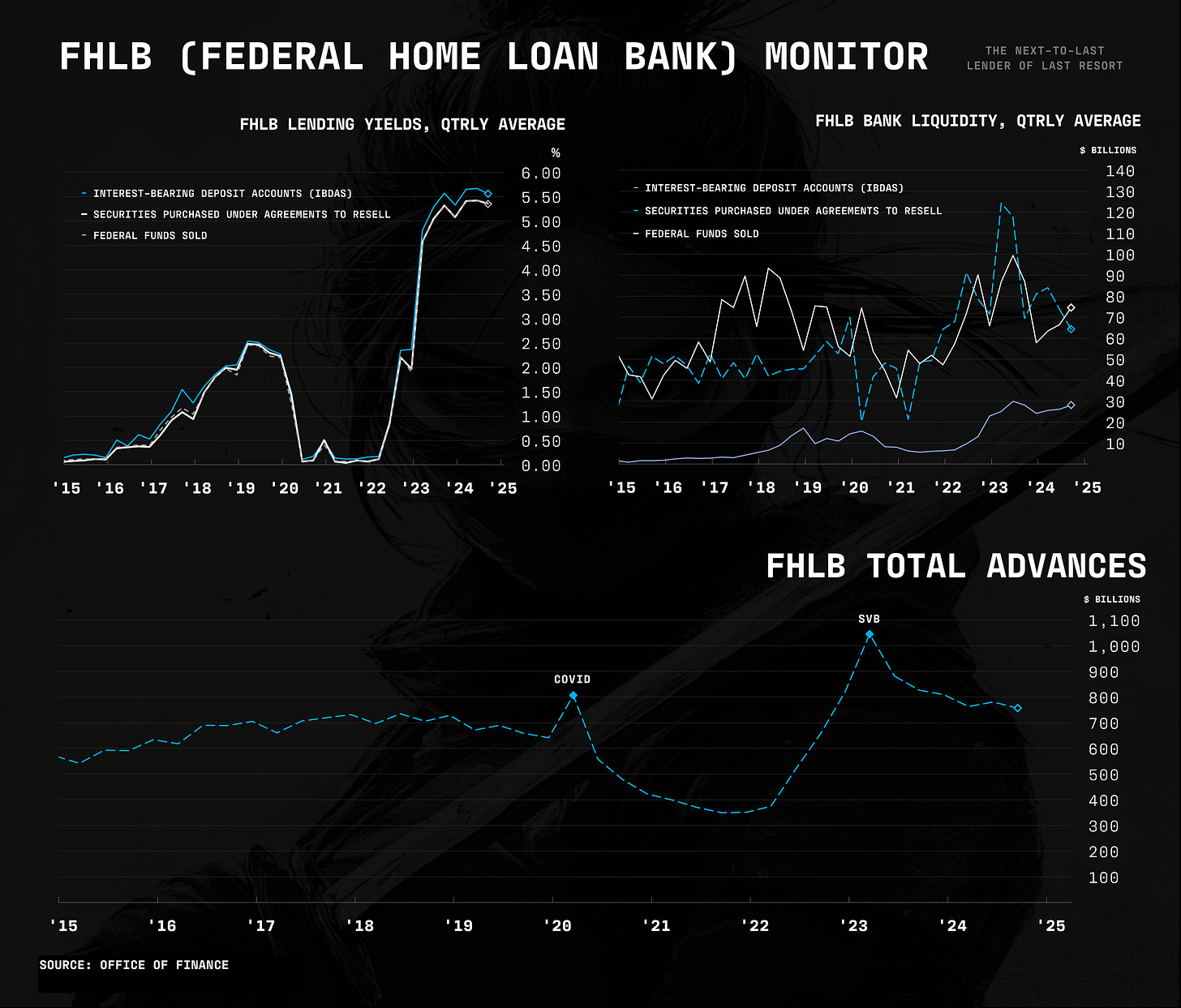

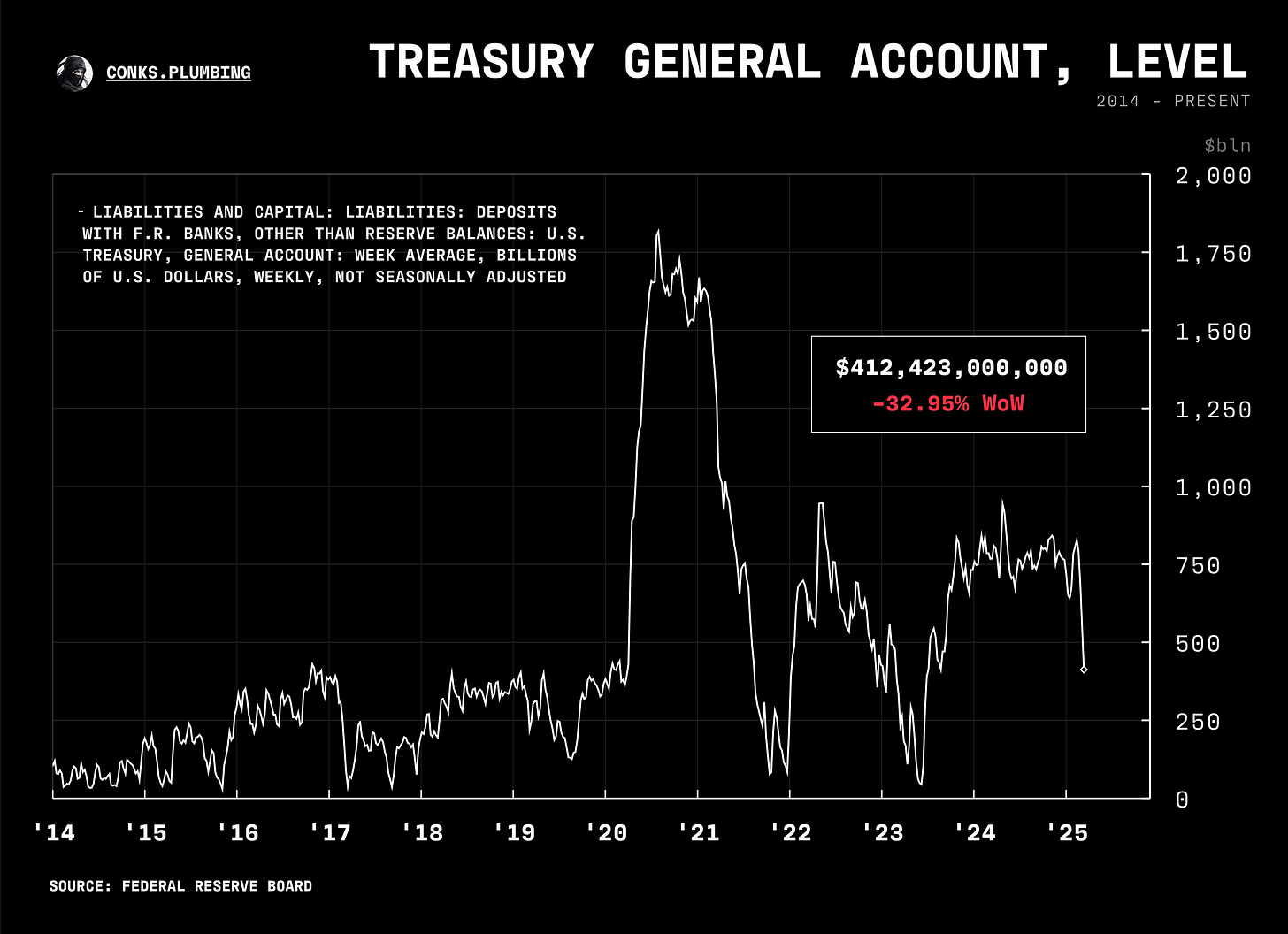

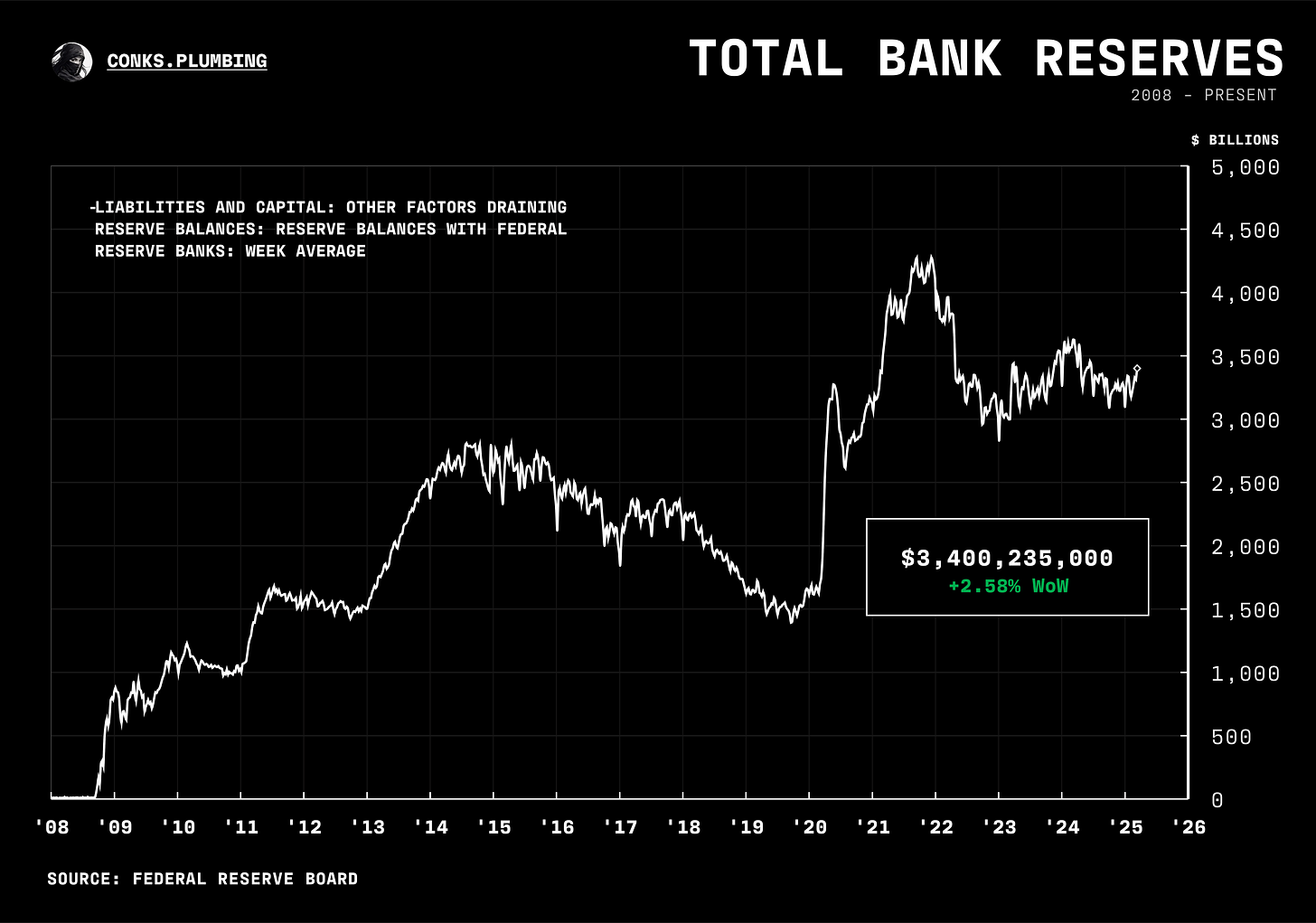

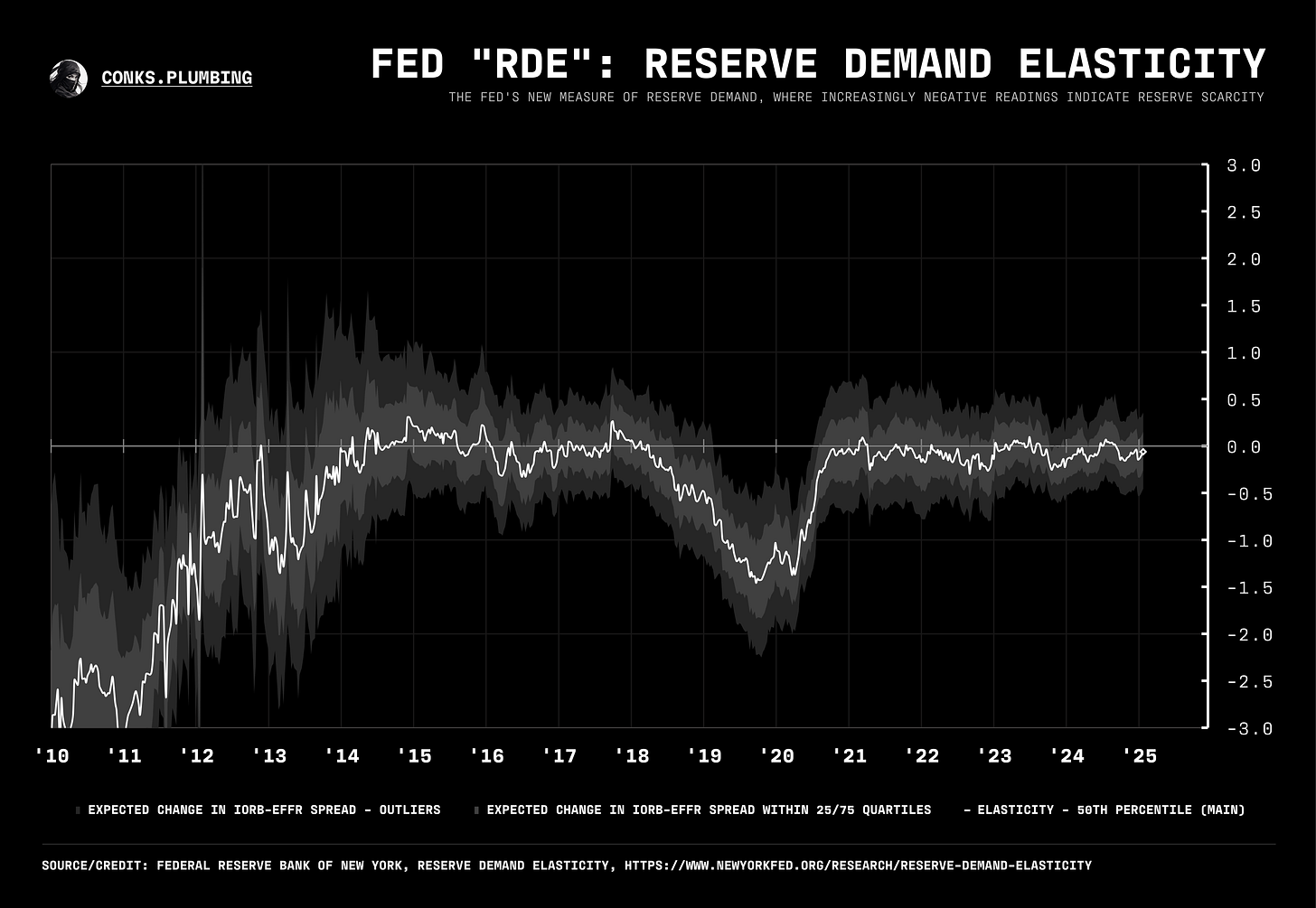

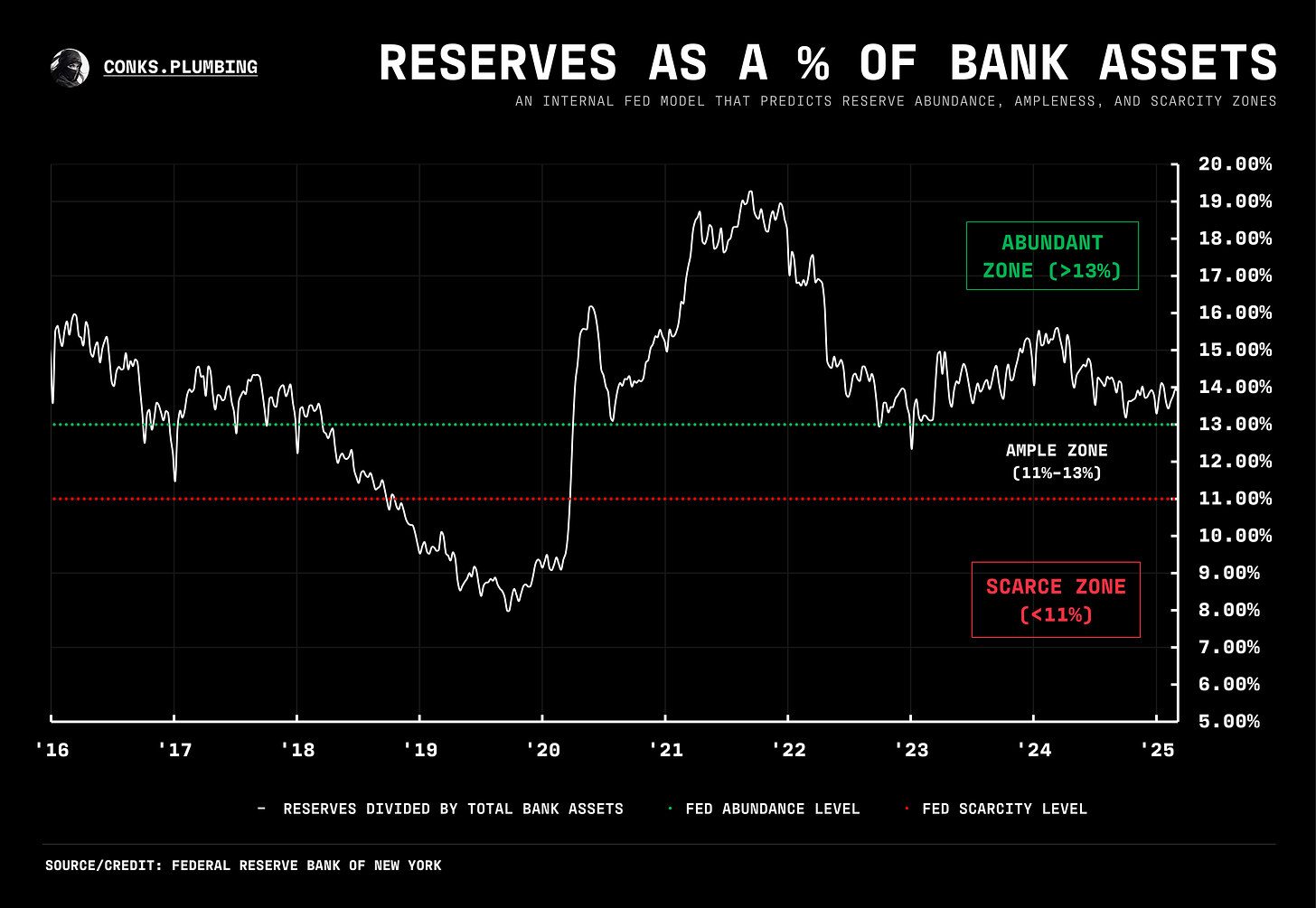

A lot has happened in STIRs since the last update. Yet, the most significant event was the latest FOMC minutes, in which multiple Fed officials (after possibly reading a Conks piece) finally suggested preventing a mirage in bank reserve levels arising from the latest debt limit drama — explained in the Money Market Blindspot series.

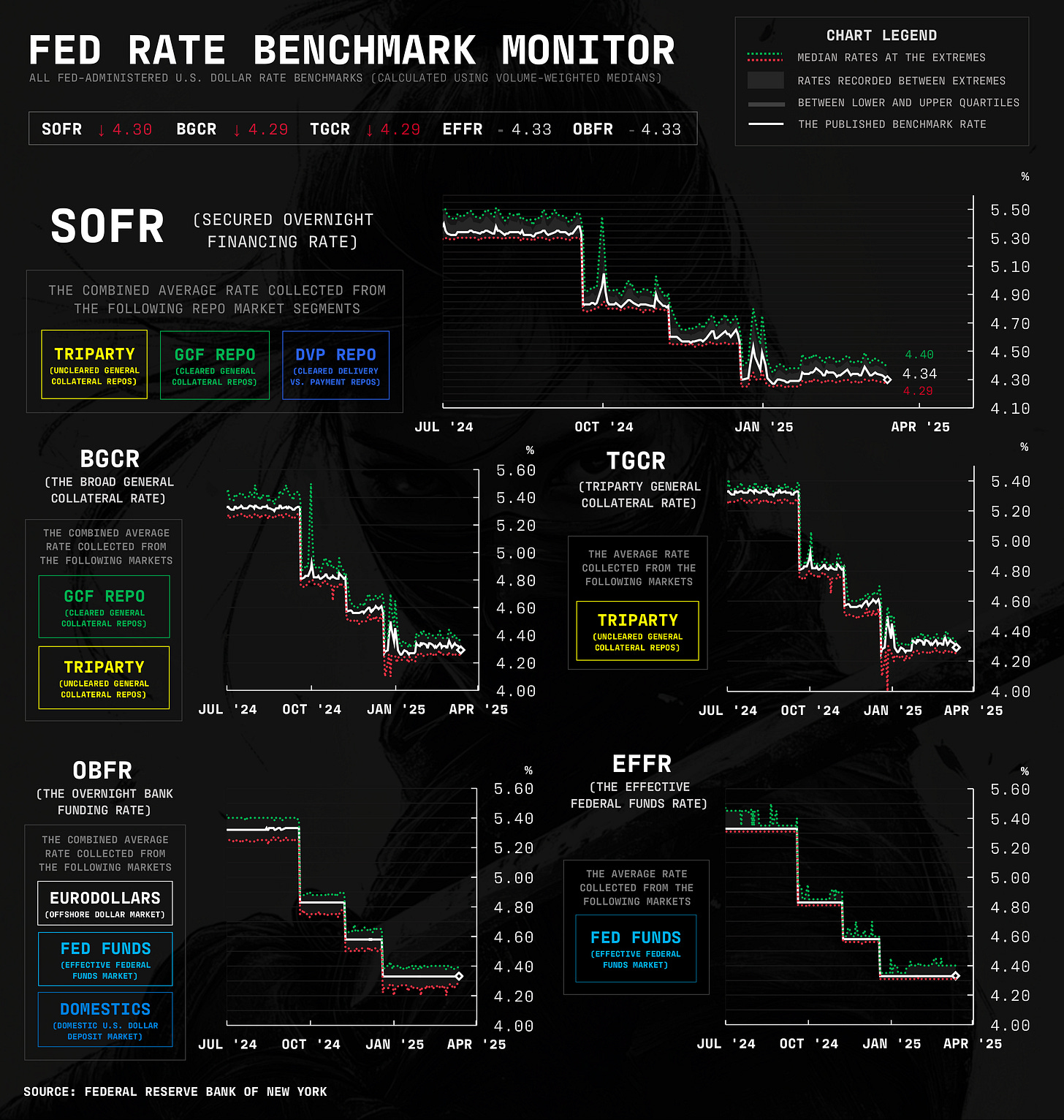

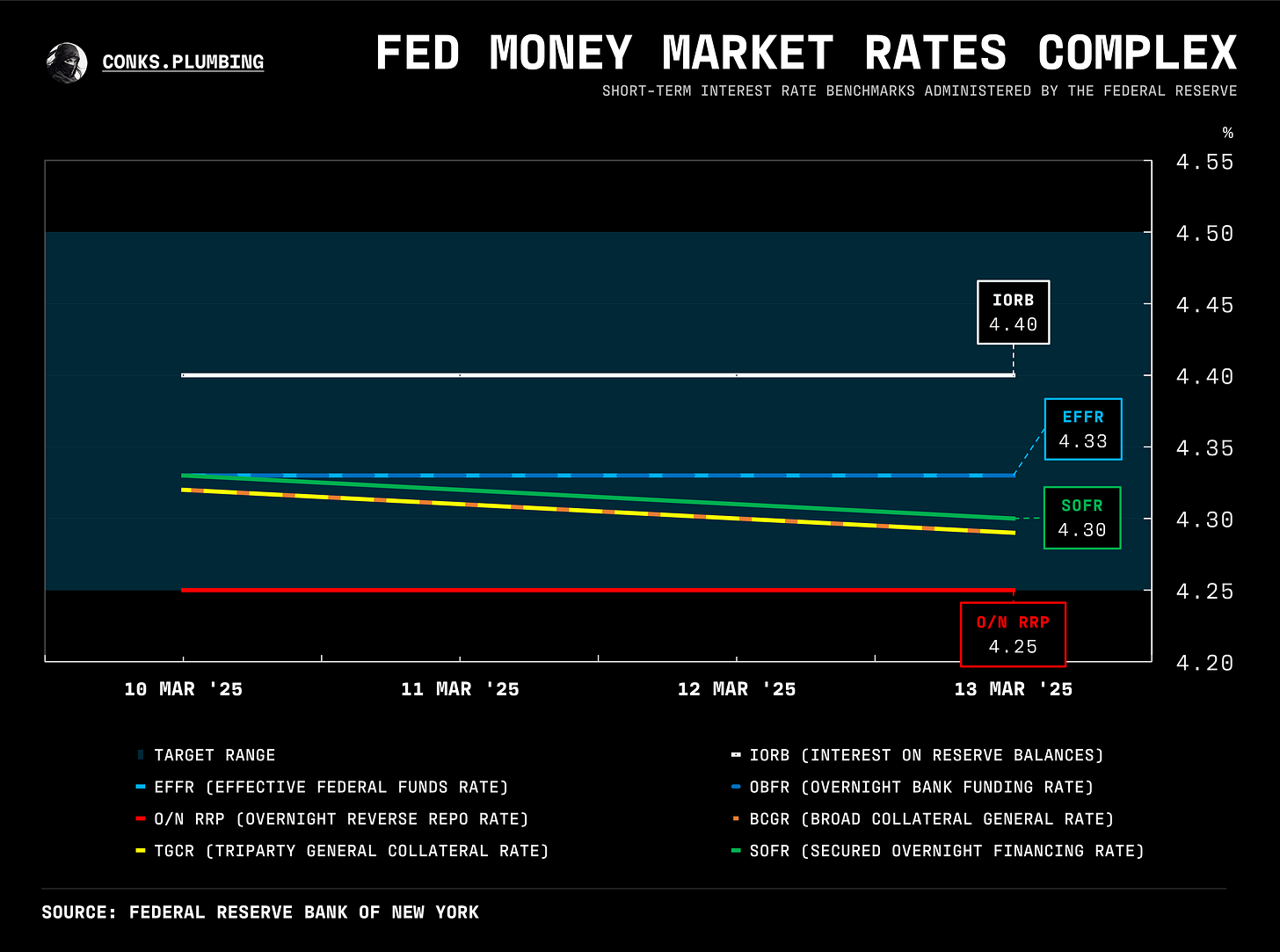

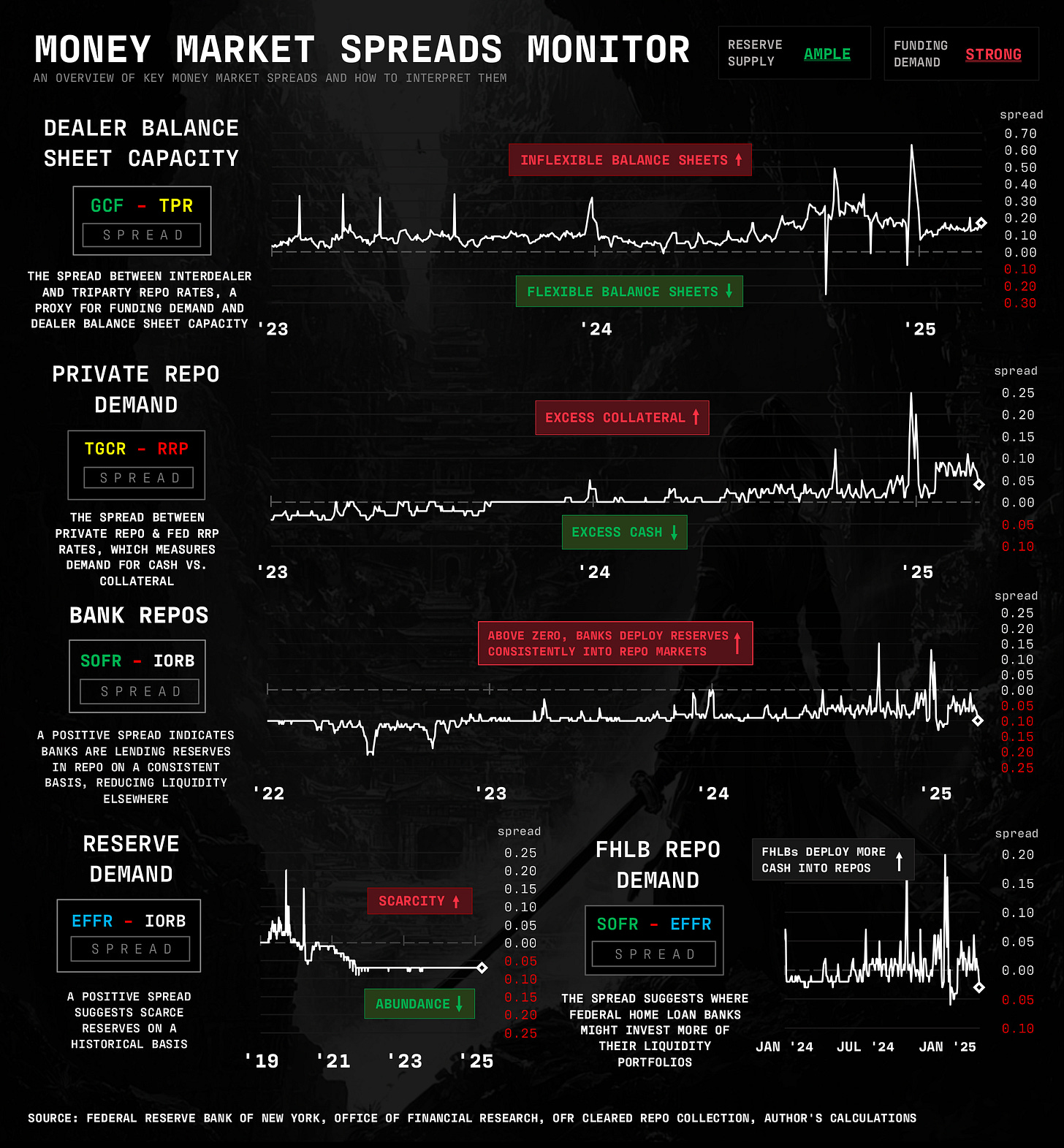

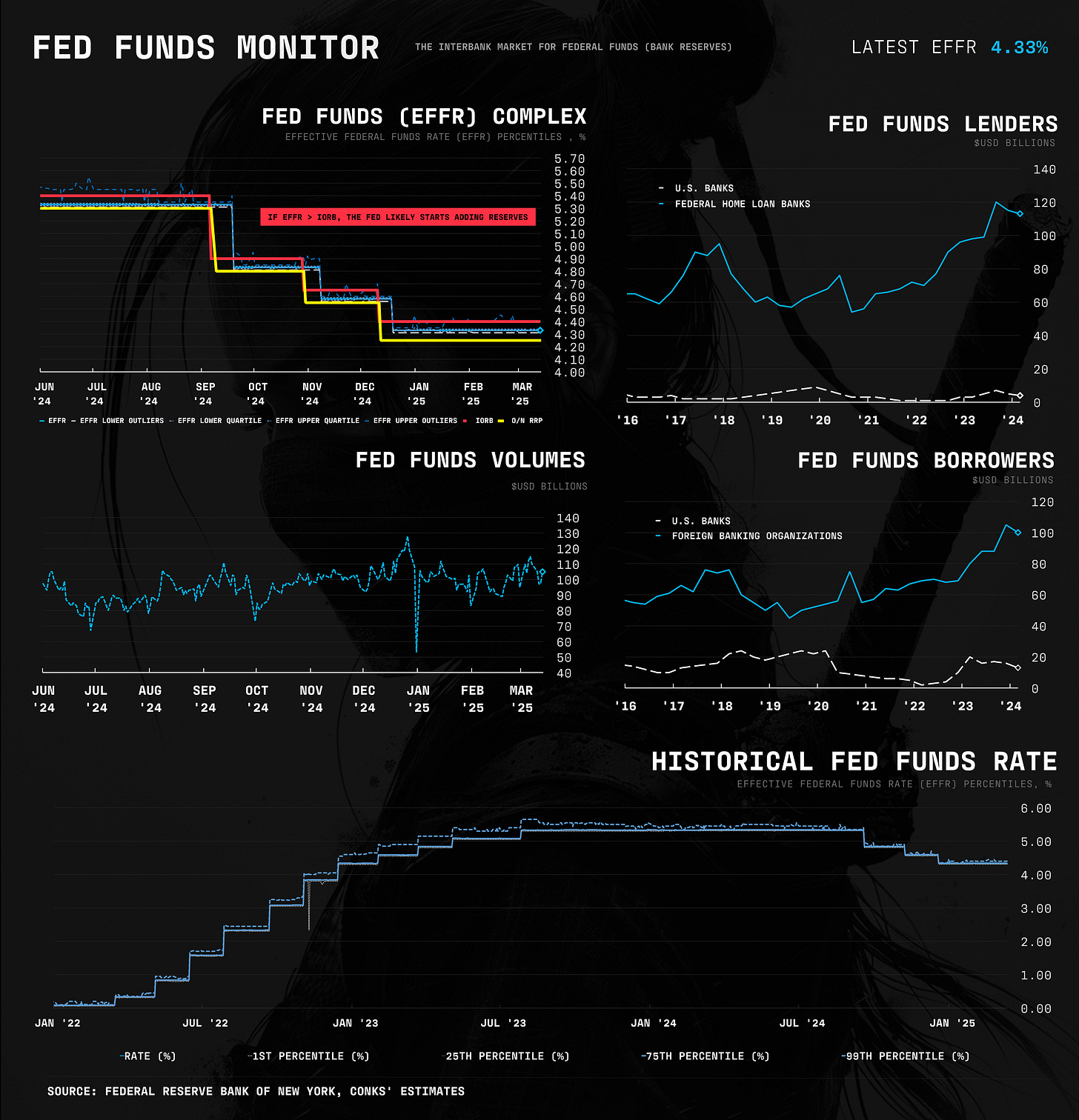

In response, the SOFR-FF basis didn’t move much, but it has recently been pricing in a QT pause announcement, with a halt likely to go into effect during April and/or May. A week or so ago, we went neutral on the idea that easing from a TGA drawdown and other drivers had been priced in, as the March SOFR-FF futures spread fell back to zero (i.e. when SOFR was expected to trade in line with the Fed Funds rate). The motivation to get out was any further talk of a QT pause.

Since then, markets seem to have suddenly priced in a halt to the Fed’s balance sheet runoff. We think no QT pause at the incoming FOMC meeting would again be bullish for April/May SOFR-FF (thus bearish for the SOFR-FF futures basis at the April/May expiries). We’ll find out early next week.

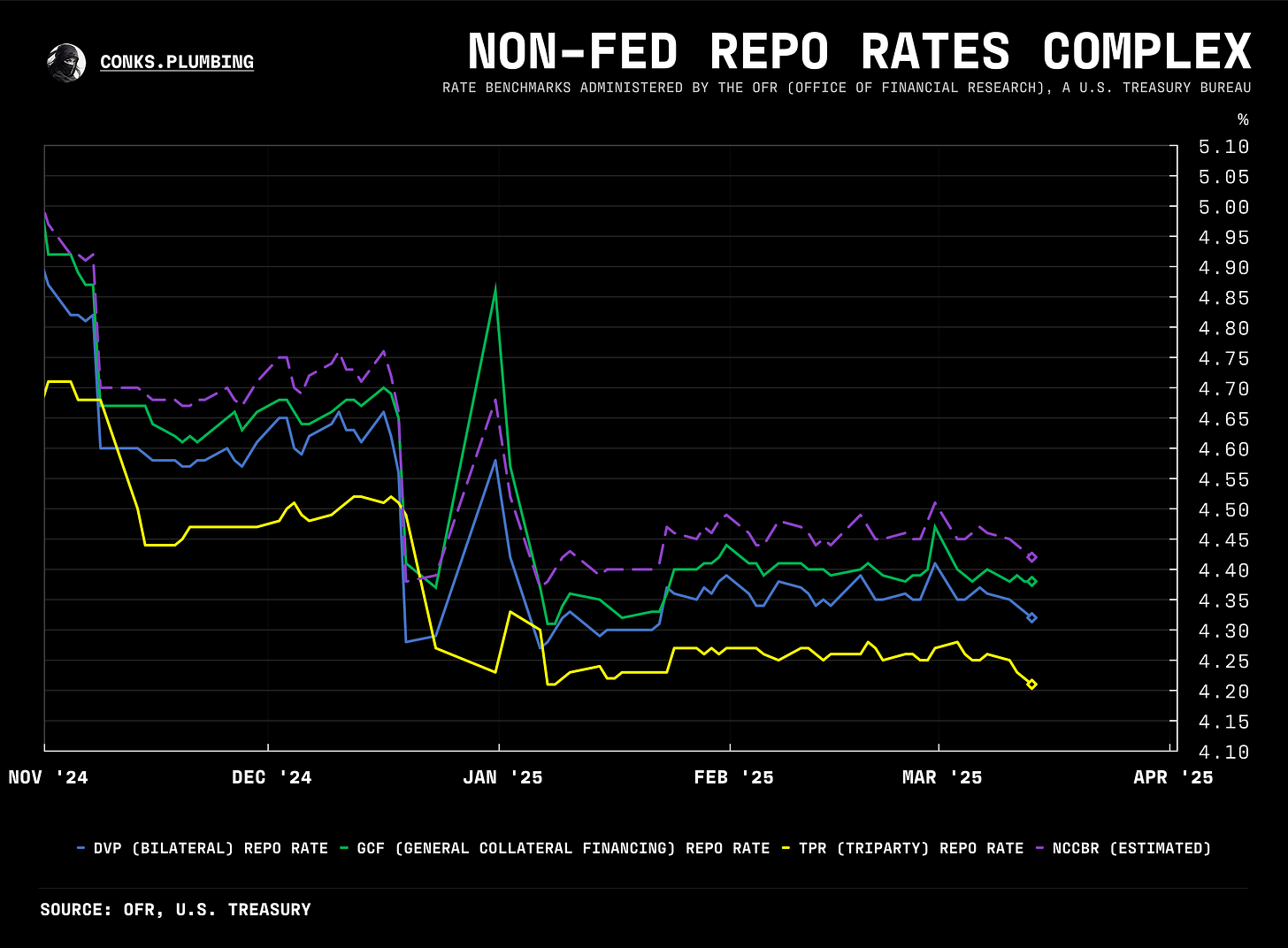

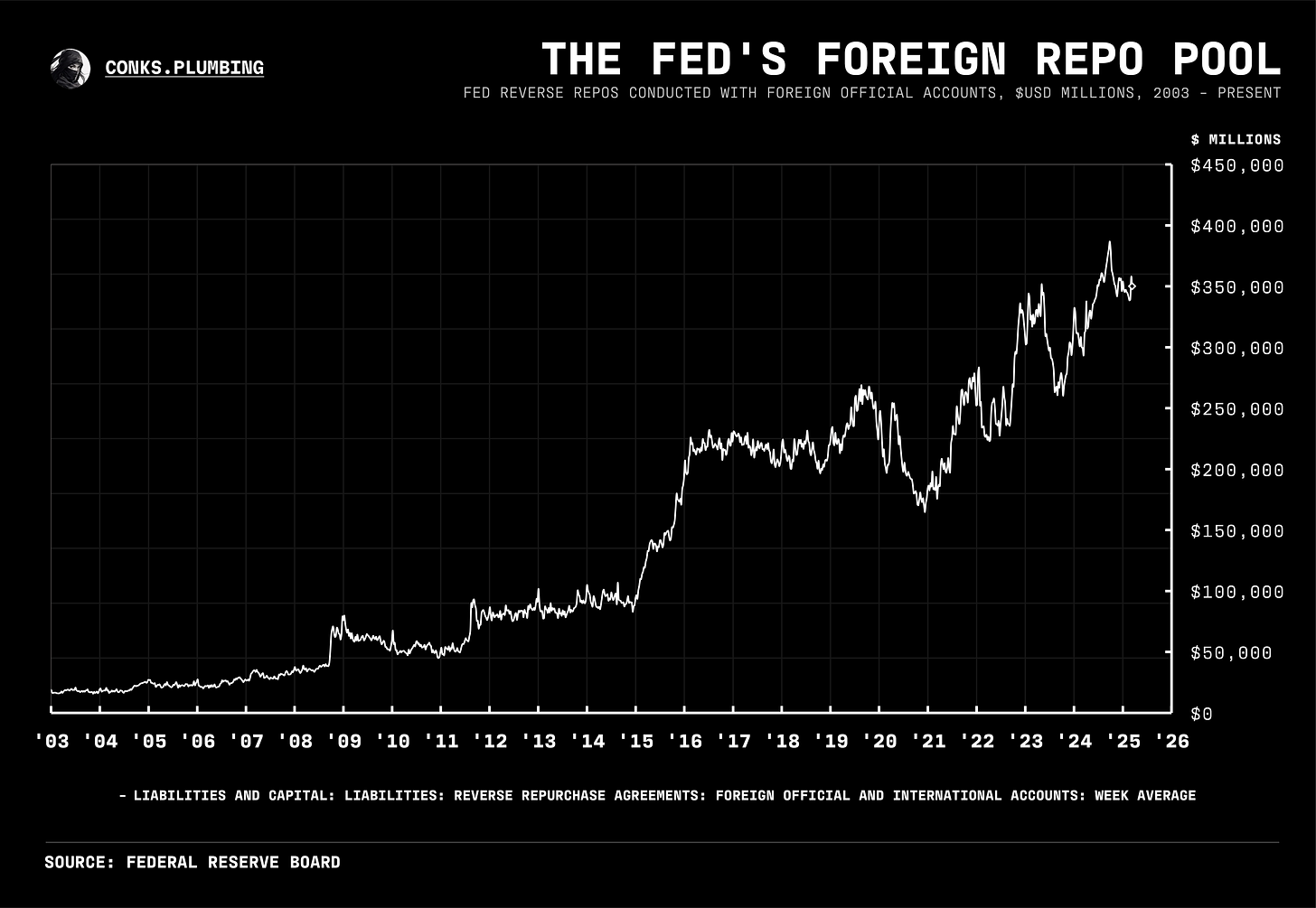

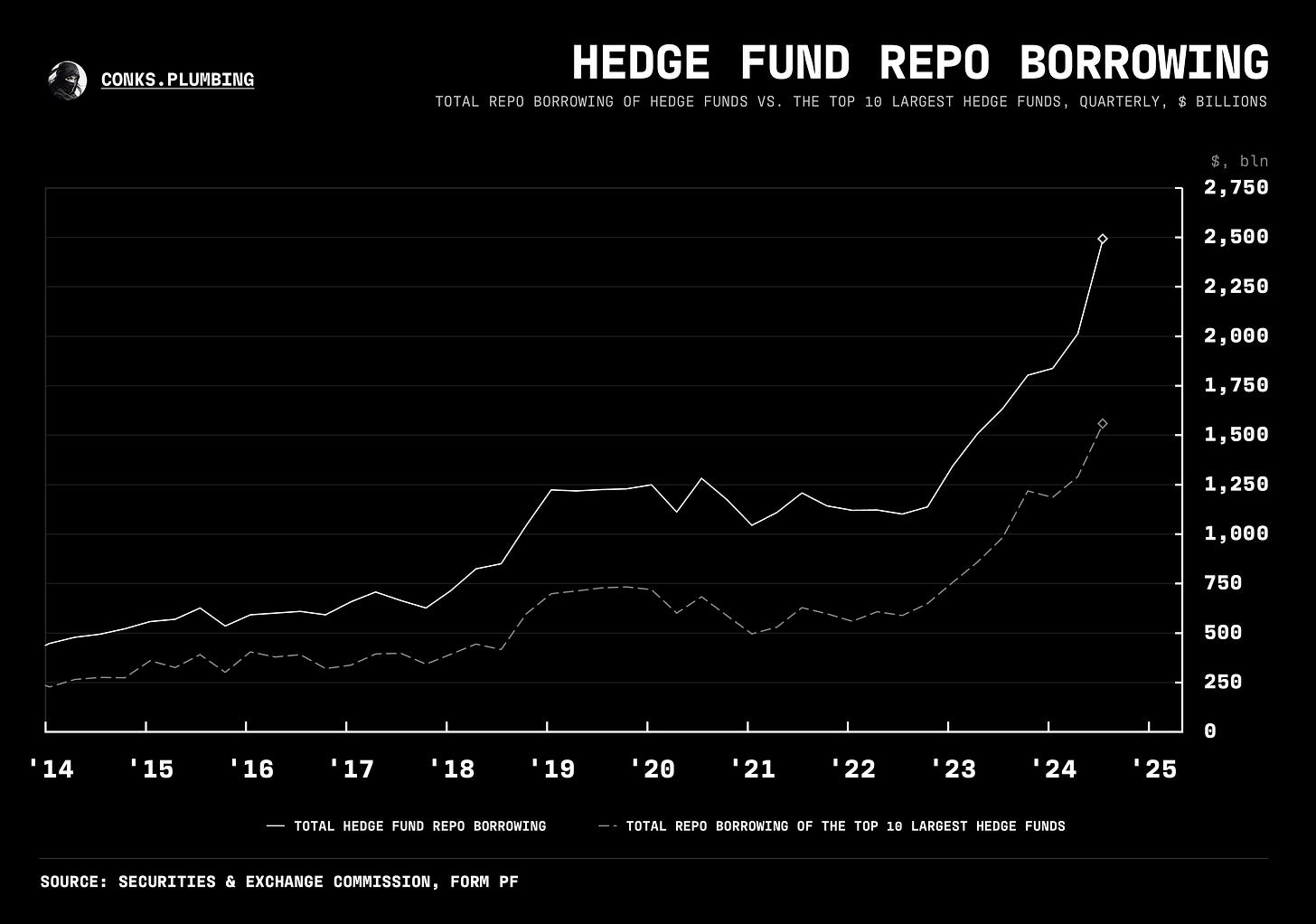

Meanwhile, in market structure, the Repo Market Exodus — a shift from “uncleared” to cleared repo markets — has been delayed. The SEC has deferred mandatory central clearing (where trades must be cleared and settled through a central counterparty) of U.S. Treasury repos and cash trades by one year.

The central clearing mandate also coincided with the Treasury Market Practices Group (TMPG) recommending mandatory minimum haircuts on repo trades, which could have reduced trade volumes that drive a more efficient Treasury market. But in late February, the TMPG changed its tone to suggest “prudent” haircuts instead. There’s now a bull market in UST liquidity concerns!

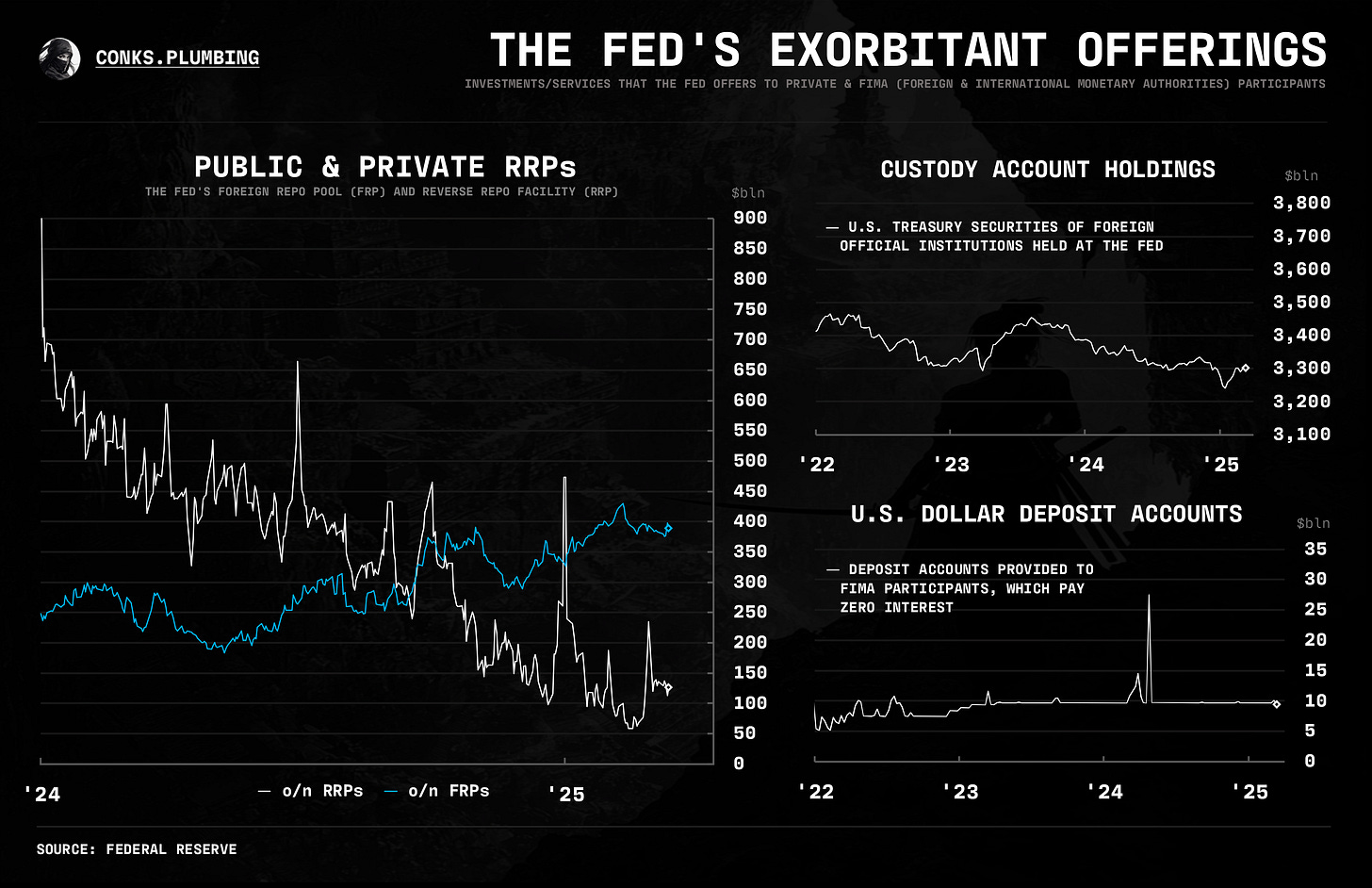

General macro liquidity, though, remains ample. Yet, this won’t suffice against U.S. heads of state prompting a selloff for the greater good — leading to price-insensitive selling (e.g. trading desks hitting internal risk limits).

Despite the U.S. admin’s latest actions, the Fed will likely stay on pause. SOFR futures are pricing one cut (-0.25) in the next quarter (viewable via SFRH5M5 on Bloomberg or CME:SR3H2025-CME:SR3M2025 on TradingView). Too much too soon, in our view.

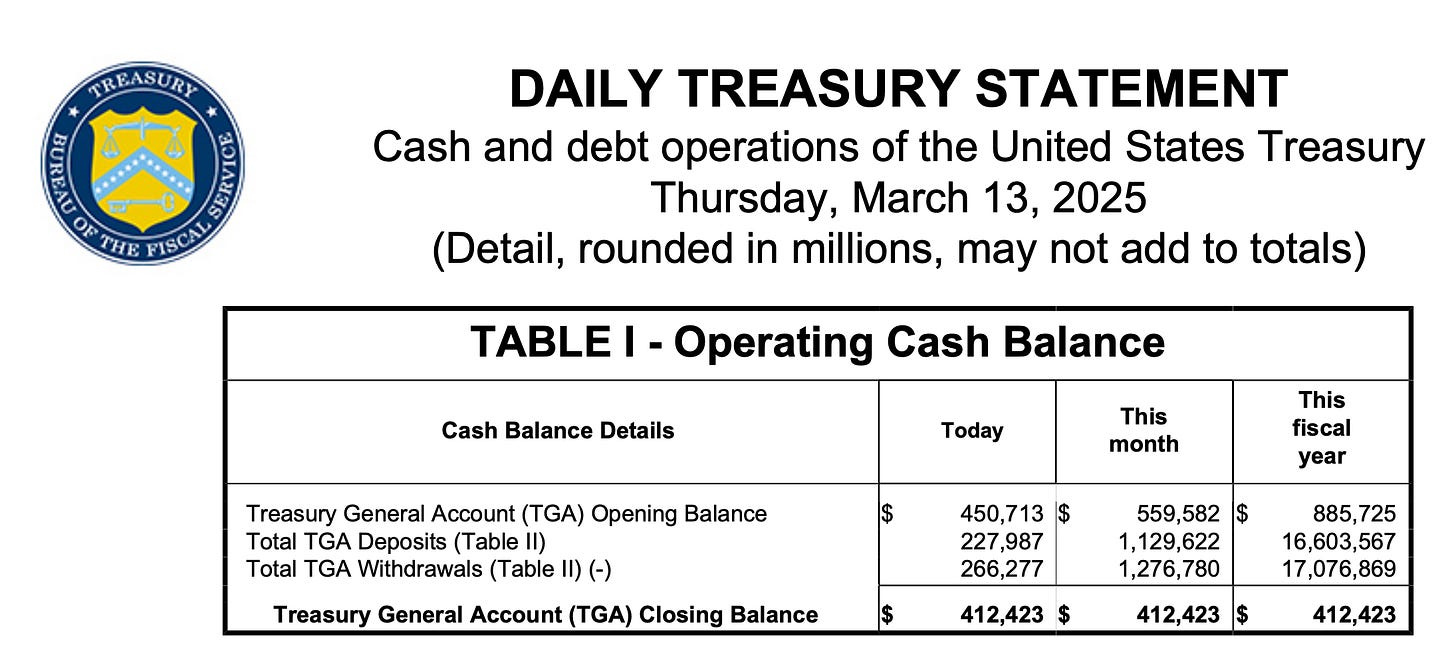

Lastly, so much for a TGA drawdown saving equities. It shouldn’t have had a meaningful effect anyway, since no strong causal connection or statistical significance exists between equity prices and reserve levels.

And with that, onto the chartbook…

If you act on anything provided in this newsletter, you agree to the terms in this disclaimer. Everything in this newsletter is for educational and entertainment purposes only and NOT investment advice. Nothing in this newsletter is an offer to sell or to buy any security. The author is not responsible for any financial loss you may incur by acting on any information provided in this newsletter. Before making any investment decisions, talk to a financial advisor.

EFFR, OBFR, SOFR, TGCR, and BGCR are subject to the Terms of Use posted at newyorkfed.org. The New York Fed is not responsible for publication of tri-party data from the Bank of New York Mellon (BNYM) or GCF Repo/Delivery-versus-Payment (DVP) repo data via DTCC Solutions LLC (“Solutions”), an affiliate of The Depository Trust & Clearing Corporation, & OFR, does not sanction or endorse any particular republication, and has no liability for your use.

Thx I was just wondering yesteday what happened to the updates lol

Thanks 😊