Don't Count On a Fed Pivot Just Yet

Money markets suggest the Federal Reserve won't execute a liquidity u-turn anytime soon

For the past few months, we’ve been told that the monetary system has experienced considerable financial tightening. But now, with risk assets rebounding, the dollar wrecking ball taking a breather, and volatility subsiding, markets ostensibly disagree, believing that a Federal Reserve Pivot™ is looming.

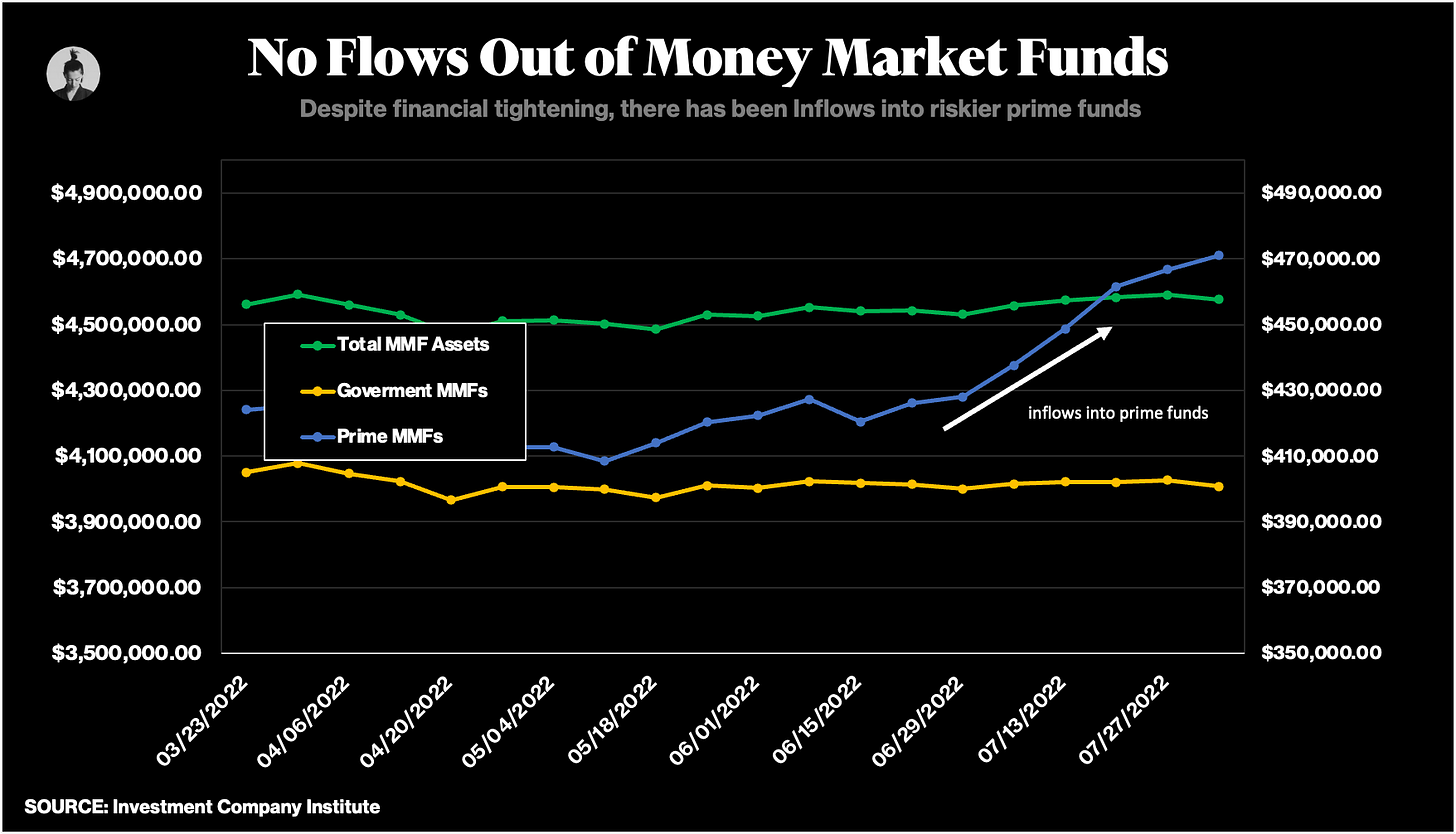

In reality, we could be miles away from a liquidity u-turn. For the Federal Reserve’s main policies, namely quantitative tightening (QT) and interest rate “hikes”, to have any chance of dampening risk sentiment, money must be yanked from the private sector. This in practice involves investors using bank deposits, which they would otherwise spend into the real economy, to purchase boring old Treasury bonds during the Fed’s QT operations. They must also avoid using the trillions of dollars of excess cash stored in money market funds (MMFs) — shadow banks that invest in short-term debt securities like U.S Treasury bills, reverse repos, and commercial paper — to pay for these, since this does not deliver any financial tightening. No bank deposits or bank reserves disappear in the latter scenario.

But right now as we speak, the Fed’s favored scenario is starting to play out. Total money market fund (MMF) assets have barely decreased, partly because investors are not withdrawing from MMFs to participate in quantitative tightening. We’ve even witnessed inflows into “riskier” prime money market funds and outflows from their “safer” government-backed counterparts. So much for risk-off. When tightening?

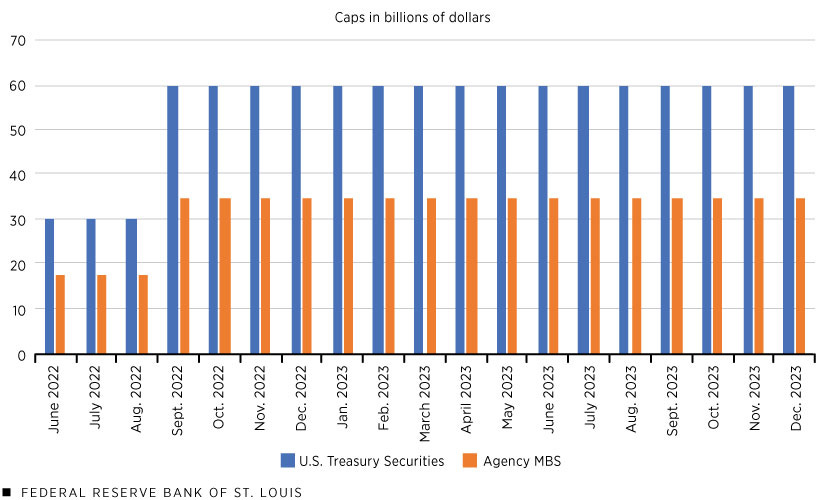

Instead, as the Fed had desired, investors have been using bank deposits to buy bonds in QT operations, thereby enabling the U.S central bank to implement monetary policy in the most effective way .i.e reducing the maximum amount of liquidity the Fed’s schedule permits:

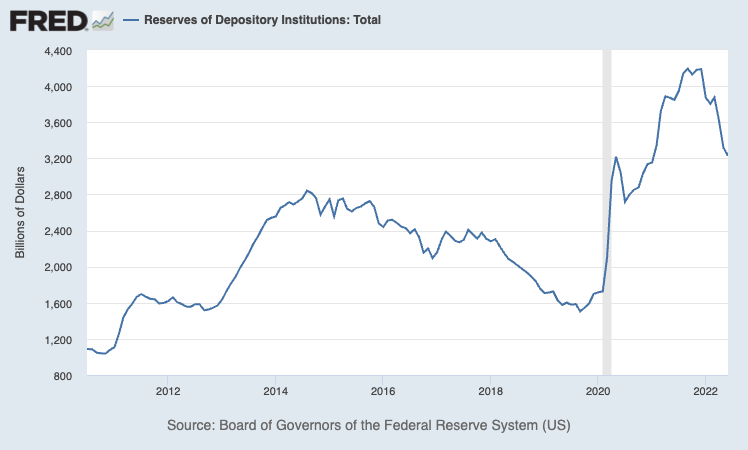

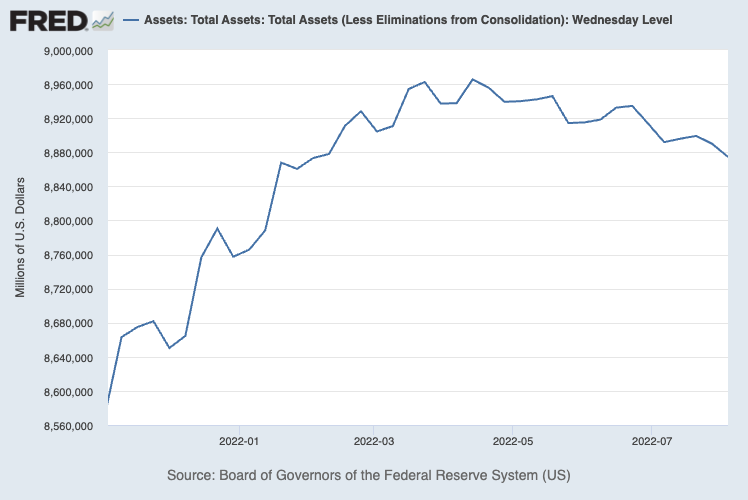

The resulting liquidity hoover has decreased the level of interbank reserves...

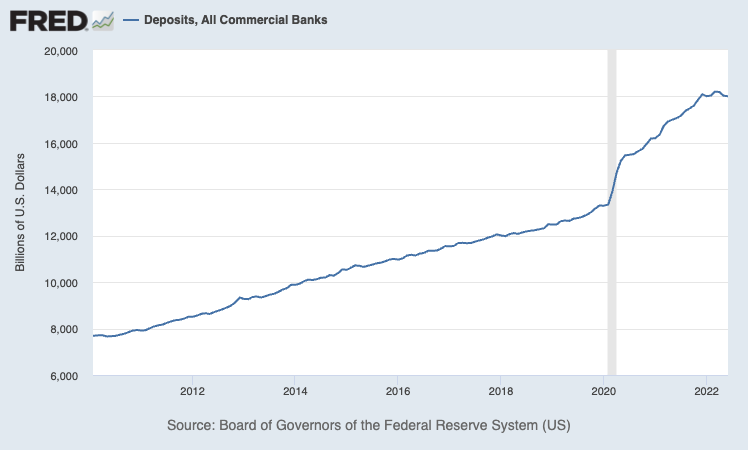

…and commercial bank deposits (albeit slightly, but more on that shortly)…

As a result, quantitative tightening has reduced the number of bonds on the Fed’s balance sheet, while the U.S Treasury has issued and sold more bonds to the private sector to pay off the “maturing principal” — a bond’s value at the time of maturity, which the Treasury pays to the Fed.

This process will have eventually transferred trillions of dollars in bonds from the Fed’s balance sheet to private investors and citizens. The Treasury market, during this process, will not shrink, only liquidity in the Federal Reserve’s interbank system and in the private sector. The end game of QT is fewer interbank reserves and fewer bank deposits, in order to rid the system of ample liquidity.

Since the start of this tightening cycle, however, quantitative tightening has hardly decreased liquidity enough to cause any significant fuss. A graph of the Federal Reserve’s balance sheet illustrates how “humps” have emerged, as its overall level has declined:

This is the result of the Fed reinvesting assets once it exceeds its self-imposed “redemption cap” for any given month. What’s more, recent mortgage-backed security “reinvests” could take a quarter to show up in the data. The result is a humpy, non-linear balance sheet reduction.

As you can see, after looking under the hood, it appears monetary tightening via QT does not seem to be that constrictive. The prevailing narrative cries impending doom, yet the mechanics of QT and the lush levels of liquidity it’s trying to eradicate say otherwise.

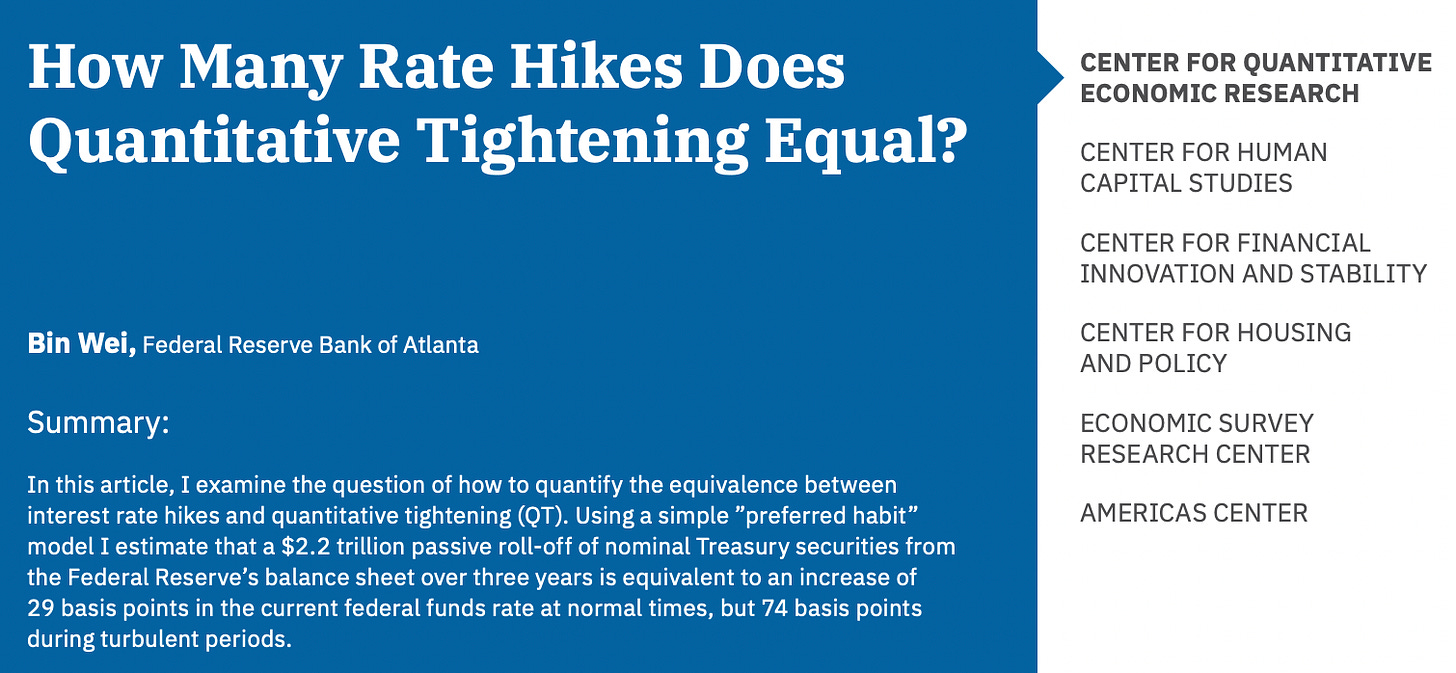

Even the Fed agrees. A recent study out from the Atlanta Fed shows that $2.2 trillion of QT amounts to raising rates by only 0.29% during a calm period and 0.74% during a volatile period over — wait for it — three years!

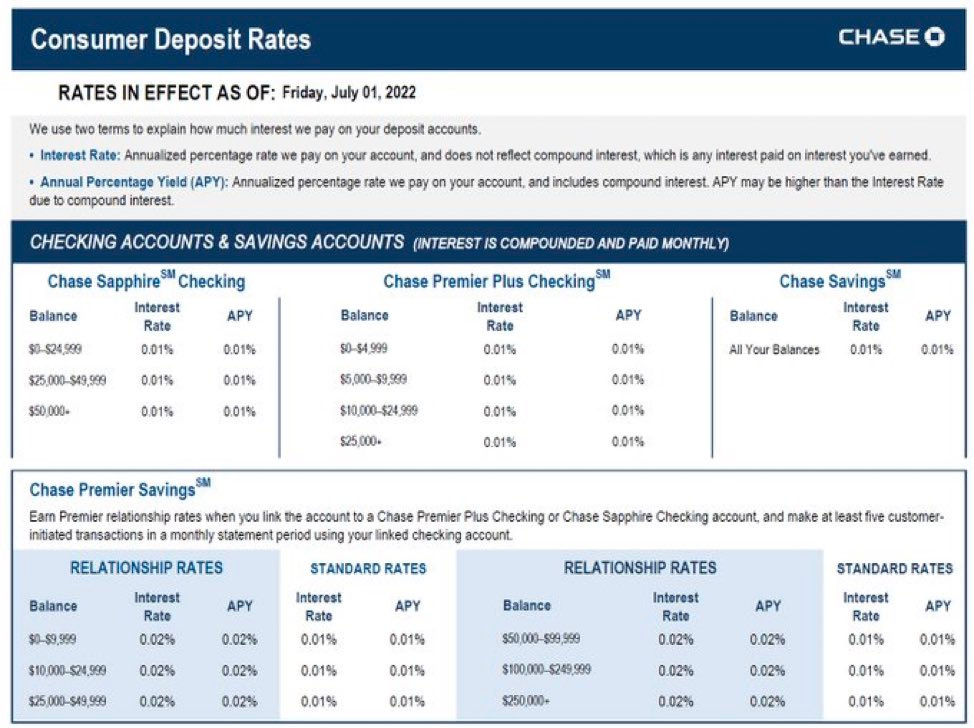

As for rising interest rates, banks now could be more willing to lend, not less. Since the Great Financial Crisis (GFC), banks have tried to keep deposit rates at near zero because they can now use the colossal amount of retail deposits created during QE to fund themselves. Without these, they’d have to borrow at exceedingly higher rates in unsecured money markets, such as the Federal Funds market.

This means any further rate hikes are now increasingly profitable for the Wall Street colossus. No wonder JPMorgan CEO Jamie Dimon was calling for “six or seven” rate hikes by the end of 2022. Rising profits from increased borrowing costs may not only boost banks’ willingness to lend but could also counter the now-diminishing level of bank deposits. In the modern banking system, loans create more deposits, resulting in more cash for consumers to spend into the real economy.

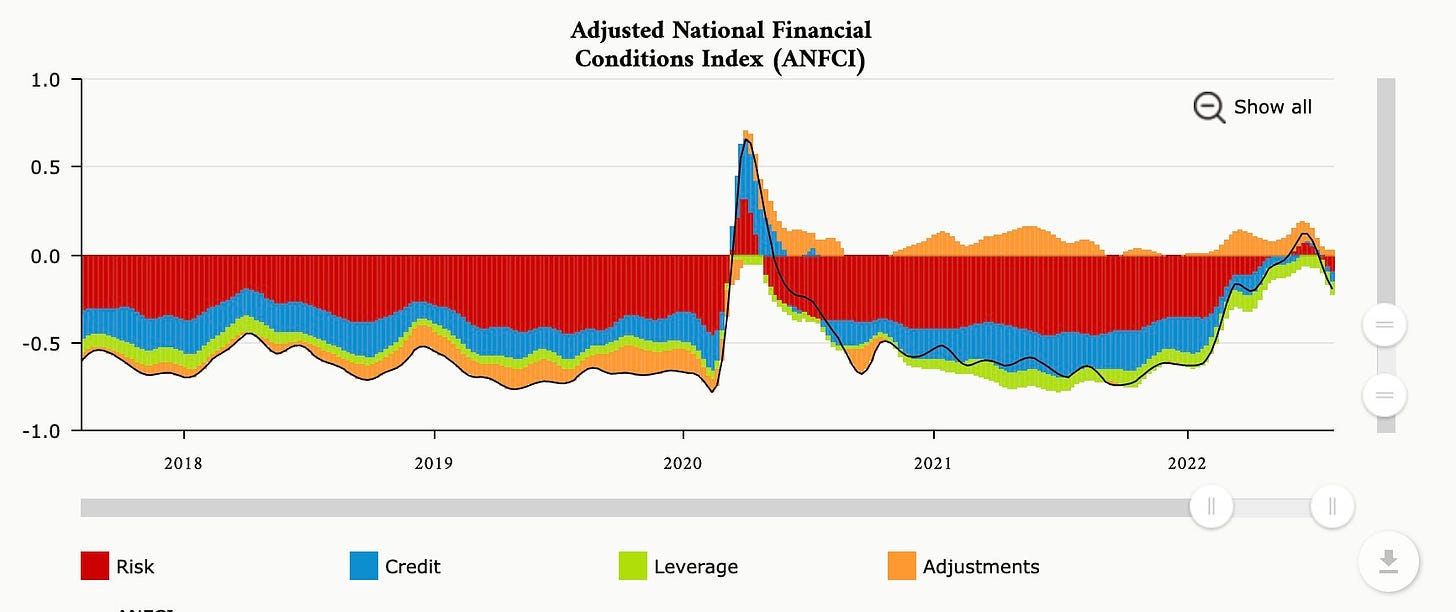

As is now evident, despite all the rage, it’s likely only a fraction of monetary tightening has occurred. At this moment, nothing is close to dramatically impeding the financial plumbing. Even the latest reading from the Chicago Fed’s FCI (Financial Conditions Index) has reversed course, with its latest reversal (which indicates looser financial conditions) implying that the central bank has much more room — and incentive — to continue its hiking cycle:

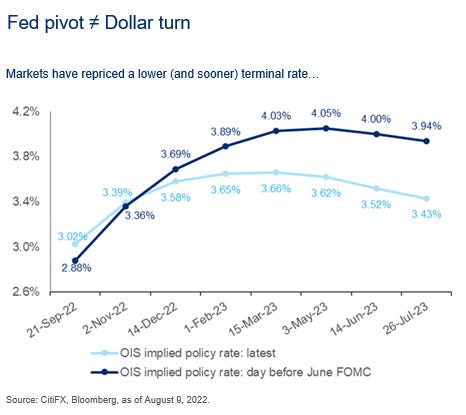

Ultimately, a financial plumbing emergency, even in this geopolitical climate, remains far-fetched, one that might cause a full Fed Pivot™. As of today, though, the OIS (Overnight Indexed Swap) market, the rate for overnight lending between banks, has signaled a rate reversal by July next year.

Between now and then, we’ll likely witness further efforts by the Federal Reserve to ratchet up monetary tightening. But how much damage will this incur to risk assets, if anything at all? Surely the market cannot pump to high heavens without economic growth and the Fed’s bazooka out of action? But in these crazy markets, you never know what might happen next.

If you enjoyed this, feel free to smash that like button or post/tweet a link via social media. We appreciate your support!

I still maintain that the FED will be very slow to kill off the Inflation that They have wanted for so long. Now that They have what they want, would They be in any hurry to curtail it? Me thinks not...Have a great weekend, All!

We are living in crazy times! As always thanks for the content.